Ag Markets Update: May 1-7

Corn planting continued at a great pace around the country in the last week as weather has stayed favorable in some of the largest corn growing states. Weather looks good into the end of May for planting in most areas which would be bearish for the market. The next USDA report comes out on May 12th which will give some more insight into the supply and demand for the rest of the year. If you’re looking for any positive corn news in the short term, keep an eye out for updates on ethanol production, crude oil demand, and unexpected weather issues.

U.S. Soybean markets are keeping their eyes on Brazil and China as the U.S. continues to battle it out against Brazil for Chinese Soybean purchases. With increased political tensions, record Brazilian exports, and lagging demand, it’s looking like China will struggle to meet the Phase 1 agreement. Soybean planting continued over the week and is off to a great start at 23% planted and with a good weather outlook for the week should continue.

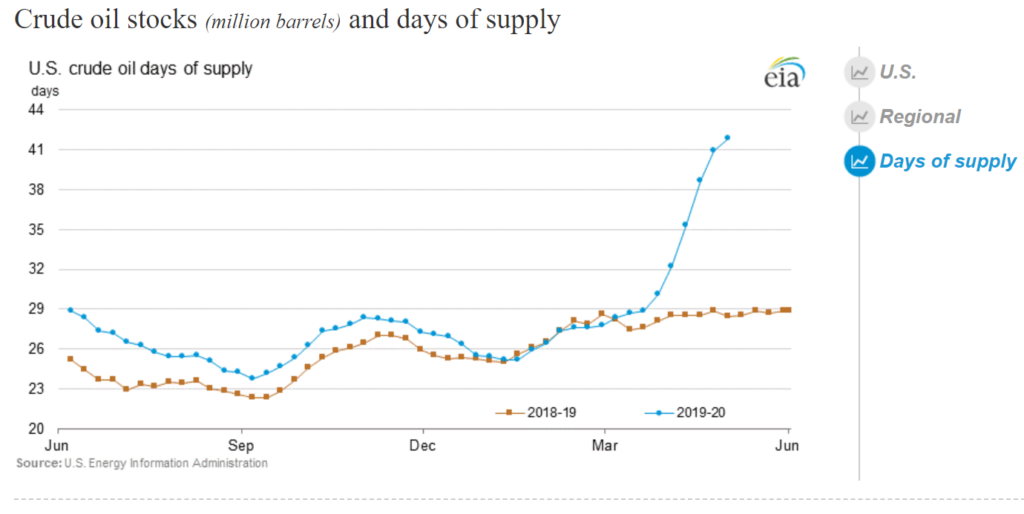

Crude oil storage & oversupply continues to make the market unstable; to help offset that risk, FCM’s have begun to add precautionary measures to reduce and eliminate speculative risk to customers in the front month by restricting to high net worth investors. June crude oil has rallied 269% since its low on April 21 at $6.50, while December crude has rallied 20.4% since its low on April 22nd. This shows that the major risk for prices is in the short run while further off markets have stayed calm. In addition the largest oil ETF, USO had a reverse stock split 1:8 and has diversified the funds exposure out across the curve. USO represents roughly 6% of the oil market with open interest of over 2 million as of May 7.

(eia)

The government is looking at intervening in the meat packing industry as struggles continue. Foreign interests in both ends of the process has the U.S. government looking to make sure we have control of the process and it is fair. The biggest focus in the meats industry is the plant closures and disruptions in the supply line from COVID-19.

Some U.S. meatpacking plants shut down because so many people were out sick they couldn’t function, or were ordered to close so public health investigators could make sure the workplace was safe…. The meat industry must balance consumer demand with worker safety, when historically the industry’s concern — from the design of plants to employee protocols — prioritizes mass production.” – Green Bay Gazette

Relief Package

The House will be debating a bill to add another $38 billion to the Commodity Credit Corporation (CCC), brining available funds to $68 billion. The USDA allocate this money to fund MFP3, direct commodity purchases, and other programs like WHIP+. Both sides are arguing about oversight of the distribution of the funds, but the bill is expected to pass later this spring.

DOW

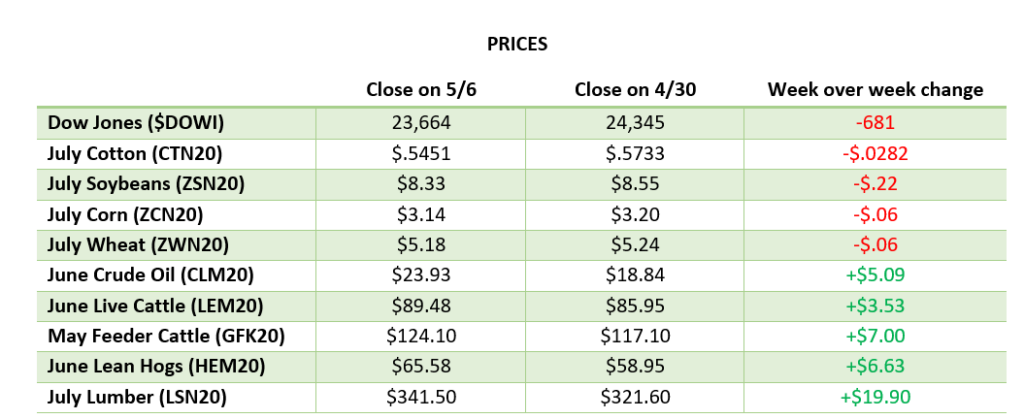

After a historic rebound in the month of April, the Dow seemed to come back to earth to start May as we saw a 680-point drop last week. There is a lot of uncertainty about a possible second wave of shutdowns as the country begins to open back up, along with concerns about how China will respond to U.S. politicians calling for accountability in their transparency, or lack thereof, in the early stages of the COVID-19 crisis.

Via Barchart.com