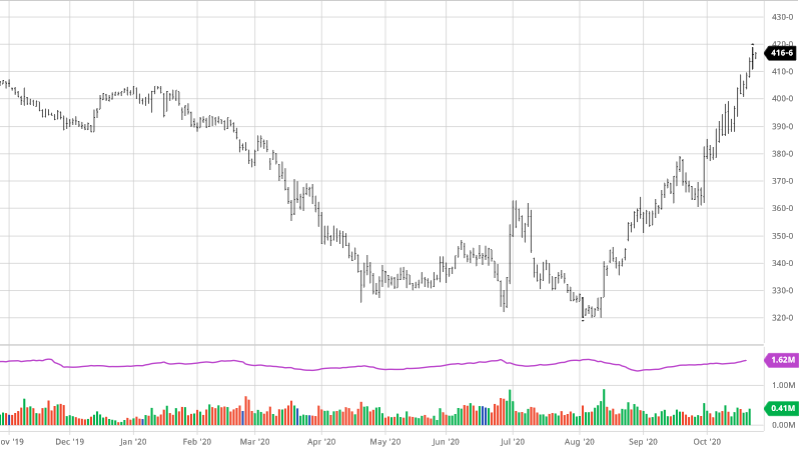

Corn’s recent run higher is impressive as you can see in the chart below. Strong export reports continue to come across, along with the feeling the USDA may still be over estimating the size of the crop. With South America’s weather problems to start the growing season, US corn prices continue to get the fundamental boost driven by supply and demand factors. Ethanol production remains well below pre pandemic numbers but will need more reopening and positive Covid-19 news before we see it ramp back up which could help drive corn demand even more. US harvest continues its hot start as corn was seen to be 57% complete on Monday and with favorable weather this week looks to continue rolling except in some areas who were surprised with an early snow.

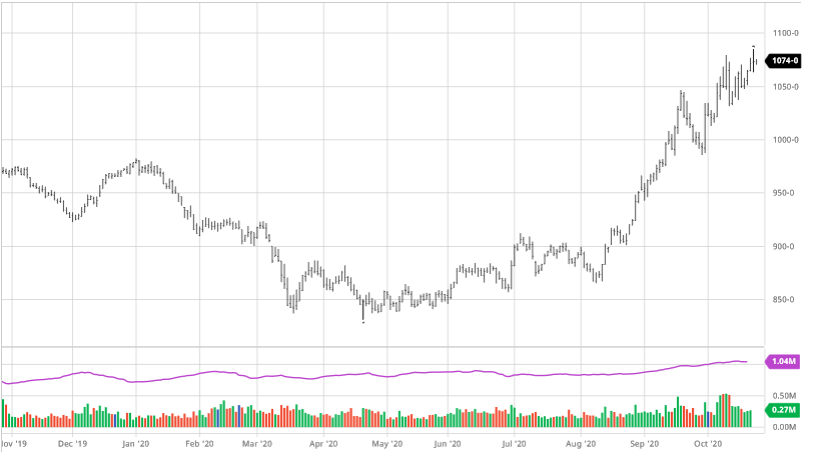

Soybeans continued their impressive climb this week. Huge exports numbers came in again this week as Chinese demand keeps coming. US bean harvest continued this week at its blistering pace and was 79% complete at the start of the week. Look for this to continue as weather continues to be favorable. The run up in prices has pushed through every point of resistance so far during this run. This week it struggled through the $10.83-85 window, if it can break through there look for this run to continue as we have not seen these price levels in a few years. As far as what to look at to continue to drive prices it is the same story, South American weather, and demand. As demand does not look to be slowing down that does not seem to be the factor to throw a wrench in prices. Keep an eye on SA weather as any favorable changes in weather over their large growing areas could be the kind of negative news to offset some of the favorable demand news. As mentioned last week we suggest taking advantage of this run up in prices and not store any beans and look at strategies of possible re-ownership on paper if you are worried about missing out on any upside movement.

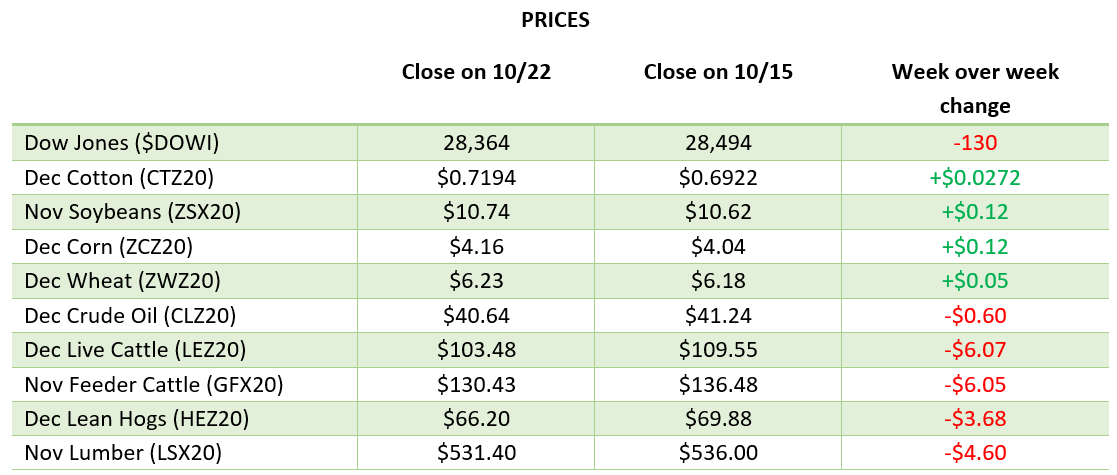

Cotton prices continued their rally this week on similar news to last week. Major flooding in parts of India have caused major damage to their crop that mills and gins depend on. The US looks to pick up some of this demand helping drive prices higher along with technical support inching higher as the market has taken a quick rise recently. Weekly exports were solid again this week as Pakistan and China were the biggest buyers. As you can see in the chart below we are now back above pre-COVID prices, traders will now look for that jump up to see if we can reach the $73.20+ gap.

Dow Jones

The Dow continues to bounce around as news on a new relief bill is all over the place. Until we get a final decision on a bill, which appears less and less likely to happen the closer we get to election day, expect this volatility to continue for the next couple of weeks. COVID cases around the world continue to spike so the market will continue to keep an eye on those as well as vaccine news.

Presidential Debate

President Trump and former Vice President Joe Biden traded blows in a much better “debate” on Thursday night. As the election draws near President Trump attacked Joe Biden by bringing up his past record and the argument of “why haven’t you done that in the last 47 years and when you were VP”. Joe Biden attacked Trump continuously with his handling of the nation’s Covid-19 response and spent time hitting the high points of his platform. There were no major bombshells that affected the futures market in the overnight trading as it was a fairly even debate that many pundits did not see swaying voters from one side to the other.

Via Barchart.com