It’s been raining a lot here in the Midwest this spring. Like, only 5 little league games have actually been played instead of 15 scheduled, a lot. For most of us, that means some severe weather, tornado threats, and flooding. But for those who plant the world’s Corn and Soybean crops in the Midwest, that means problems getting that crop in the ground. How bad? The USDA is reporting that the Corn crop is only about half as planted as it typically is for this time of year, with Corn about 58% planted versus 90% at this time last year. Here’s the state by state breakdown showing just how much Corn has been planted via Agweb.

And a big reason for that is because of this:

30 day rainfall footprint (1st map) is insane. 300-600% above average (2nd map). 84 river gauges are in MAJOR FLOOD this morning (3rd graphic). The MS River in IL/IA has been in major flood for months. Heavy rainfall & above average snow set the stage in March. pic.twitter.com/VRIysWSOwz

— Jim Cantore (@JimCantore) May 30, 2019

We touched on this planting issue as it related to the China trade war and tarrifs, but Corn in particular has been on a tear the past few weeks as fears of supply issues and the inability of farmers to get the crop planted has mounted. If you can’t get it planted, you can’t grow it, and you can’t harvest it – meaning there will be less Corn. Here’s the hourly chart showing Corn advancing by about 15% over the past month.

Now, you may be thinking who cares – they’ll just plant the Corn a little later and everything will work out OK. But as one of RCM’s AG specialists, Jody Lawrence, points out – the farmers are running up against time here. One, you can’t just plant the Corn as late as you want, as it takes pretty much a set time to grow and the later you start, the later you’ll finish – meaning you’ll have potential frost issues and problems getting the crop out of the ground the later into the fall you go. Second, there are deadlines that have to be met in order for farmer’s to qualify for prevented-plant insurance -which pays out when farmers are unable to sow crops at all. Here’s Jody:

Over the weekend we passed the first set of prevent plant dates for corn in the WCB on Saturday the 25th with another round this Friday the 31st and then the last date next Wednesday June 5th. With unfriendly forecasts into late next week and 42% of the forecast corn acres (39 MA) and 71% of the bean acres (61 MA) still needing to be planted and most soybean PP dates around June 15th, the outlook is not good. Growers have about a week to decide whether to plant their Corn or lose the ability to claim the insurance.

Who cares?

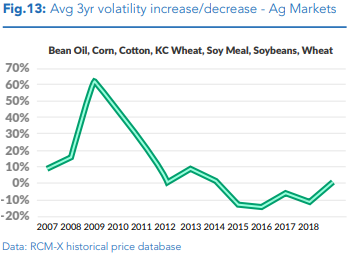

Well, the farmers for one. And the grain companies and ethanol plants and anyone who needs to feed some livestock, secondly. But bringing it back to the alternative investment world – there’s a few 100 billion of dollars in Ag Trading CTAs and quant hedge funds which track things like Corn prices that have been waiting a long time for a move like this. We highlighted the lack of such volatility in the past few years in the Ag space in our 2019 managed futures outlook, and even predicted an increase in AG volatility being one of the potential drivers of managed futures and alternative investment performance in 2019.

It sure seems like we’re seeing an increase in volatility in the weather, which is one of the biggest price drivers of Ag prices. Record forest fires. Bigger and costlier hurricanes. Hotter and longer droughts, and so forth surely must cause… [some sort of reversal of] the declining volatility environment of the past several years.….it wouldn’t surprise us at all to see the smaller Ag markets awake out of their long slumber to add to the equation in 2019.

Which all leads us to commodities markets non-correlation with the stock market. Things like a freak blizzard causing an up trend in cattle prices, a swine virus breaking out in China, and record rains in the Midwest simply aren’t part of the stock, bond, interest rate world. Prices aren’t rising because of a good consumer confidence number, earnings report, or interest rate decision. Prices are rising because there are millions of acres of Corn yet to be planted and at threat of never getting planted (economics 101 = supply down, price up). In more sophisticated vernacular – the two markets have different price drivers, and the price driver for Corn is about as far away from the price drivers for the stock market as you can get.