AG MARKET UPDATE: APRIL 8 – 21

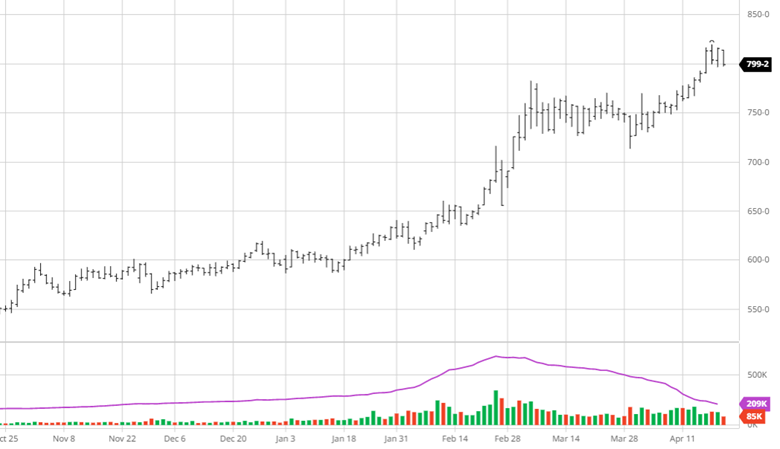

Corn has had a good past couple of weeks despite the pullback on Thursday. Planting has gotten underway across the country; while some areas are not quite ready, the next month will be as important as the last few years for weather. The western corn belt needs some rain, and the plains need warmer temperatures to begin planting. The uncertainty with Ukraine remains, but there have been reports that farmers have already planted 20% of their spring crops despite the ongoing war. While this is bearish for prices, it is important to note that there will almost definitely be a drop in total acres. China’s lockdowns in Shanghai continue as they remain a big question mark in the short run as to how their covid restrictions will play out. For now, keep an eye on US planting weather as a delayed crop will lead to yield loss, the current prices for new crop would move higher, and supplies would get tighter. Ethanol production last week was the lowest since September, with some plants down for maintenance and rail transportation prices higher; this is not surprising but will be something to keep an eye on with gas prices still elevated.

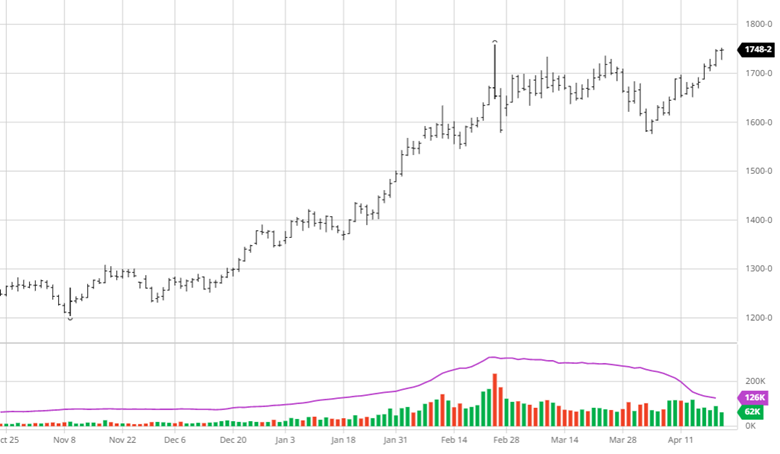

Soybeans have had a good couple of weeks after a short period of movement lower. Exports this week were on the low end of expectations outside of new crop bean sales, seeing a decent number. Bean oil prices continue higher supporting beans to move higher. After trading sideways for a bit, then lowering this move upward looks to continue and possibly test the highs we saw in late February in a wildly volatile trading day. China’s ag ministry said they intend to produce 20.63 million tonnes of beans this year, up from the 16.4 million last year. Like corn, the weather needs to improve across much of the US to feel better about this crop’s potential.

Soybeans have had a good couple of weeks after a short period of movement lower. Exports this week were on the low end of expectations outside of new crop bean sales, seeing a decent number. Bean oil prices continue higher supporting beans to move higher. After trading sideways for a bit, then lowering this move upward looks to continue and possibly test the highs we saw in late February in a wildly volatile trading day. China’s ag ministry said they intend to produce 20.63 million tonnes of beans this year, up from the 16.4 million last year. Like corn, the weather needs to improve across much of the US to feel better about this crop’s potential.

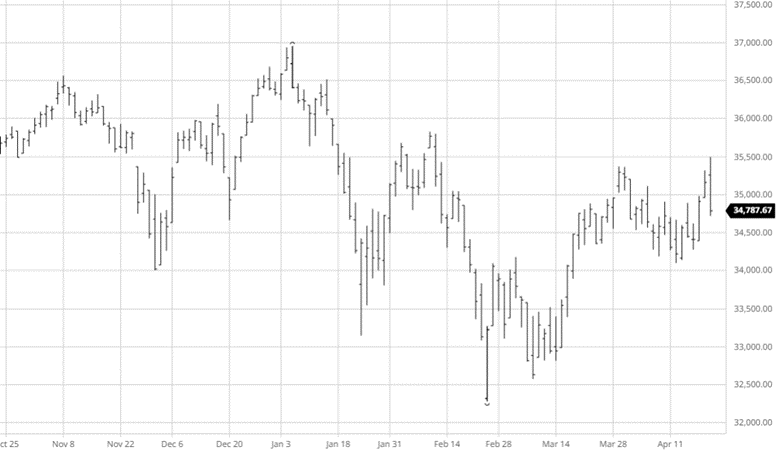

Dow Jones

The Dow was up slightly on the week and reached its highest point in over two months before falling lower on Thursday. There has been a lot going on with earnings, but Netflix posted the most headline-worthy while losing a billion in market cap, and Tesla posted a solid quarter to provide some support. Inflation and interest rates continue to be the talking points as everyone looks to point fingers at noncontrollable factors. The next quarter will be important to see if inflation can get under control or if more warning signs come to the market. The “growth trade” will be challenged with rates rising and some valuations coming back down to earth.

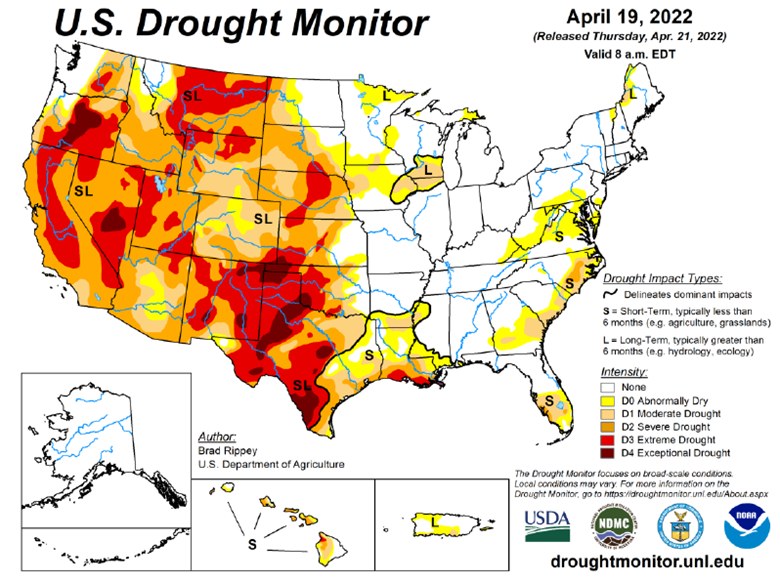

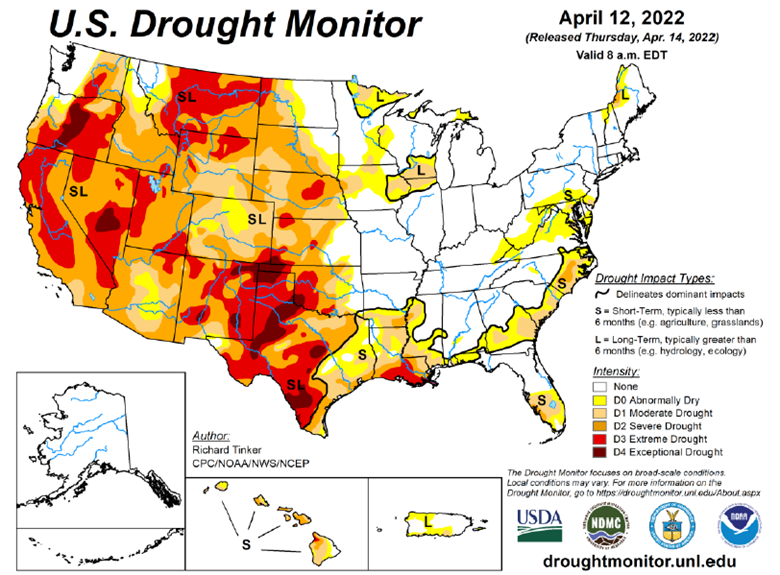

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

RCM Ag Services put a unique spin on National Agriculture Day by going international. That’s right, we jumped right into international waters with Maria Dorsett from USDA’s Foreign Agriculture Services for an interesting discussion about linking U.S. agriculture to the rest of the world.

Each year, March 22 represents a special day to increase public awareness of the U.S.’s agricultural role in society, so why not take it one step further by bringing in a global component? As the world population soars, there’s an even greater demand for producing food, fiber, and renewable resources. That’s why we’re taking a deeper dive into the USDA’s trade finance programs, like the GSM-102, which supports sales of U.S. agricultural products in overseas markets and supports export growth in areas of the world that are seeing some of the fastest population growth.

So, jump aboard (no passport needed), as Maria discusses how U.S. companies use GSM-102, what the program features, and the benefits that it offers!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].