We utilize our independent standing, national producer reach, and tech partnerships to bring our commercial agriculture customers best in class tools and resources to improve efficiency, increase revenues, and generate more customer volume.

What is Commercial Agriculture?

Commercial agriculture is the large-scale production of crops for widespread distribution to wholesalers or retail outlets.

There are two primary types of commercial agriculture: subsistence and commercial. When a farmer produces food primarily for personal consumption, that is referred to as subsistence agriculture.

Commercial agriculture is when the crops such as livestock, dairy, grain, plantation, and fruit are farmed and produced for sale to others. This food is eventually distributed through wholesale distributors to restaurants, supermarkets, or local produce stands.

Because their production often contributes to the gross domestic product of a country, many governments offer financial support to commercial farms to help increase production. Investments in commercial agriculture can focus on technology to improve farming efficiency and sustainability. An example of this would be soil-less indoor farms, which can produce more yields per unit of area than traditional commercial farms.

Why RCM Ag For Your Commercial Agriculture Process

As a commercial agriculture business, your focus should be on growing your enterprise while provide the tools to improve your operations, make more money, make your life easier, and modernize your business.

Get Onboard With Technology

Easily manage basis contracts, HTA’s, and standard OTC contracts

Only your customers get to see your prices

Let your farmer customers transact with you online with zero slippage risk

They don’t get notified that they’ve sold you grain until you’re filled on the hedge

Easily manage smaller quantities of grain with our hedge parameters

You decide when to hedge – at 2,500 bushels, 5,000 bushels, etc. You set the limits

Manage your cash bids and your futures all in one system

No need to pay multiple platform fees – included in RCM clearing(*volume dependent)

Are your farmers using apps like Bushel or QT Nova?

Farmer facing commercial agriculture platform integrates with other mobile apps, so you don’t have to manage multiple interfaces

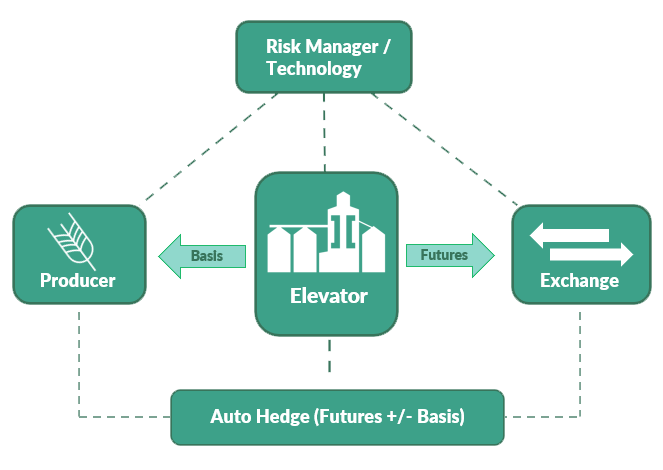

- Elevator and Producer connected to each other on Basis via technology

- All directly connected to each other via the Exchange (CME Group)

- Elevator Risk Manager in control of all the above

Our Technology Platform

Commercial Agriculture FAQ

Basis

The difference between the spot or cash price and the futures price of the same or a related commodity. Basis is usually computed to the near future, and may represent different time periods, product forms, qualities and locations. The local cash market price minus the price of the nearby futures contract is equal to the basis.

Local cash price – futures price = Basis

Cash Market

Cash Commodity

The actual physical commodity or financial instrument as distinguished from the futures contract that is based on the physical commodity or financial instrument. Also referred to as “spot.”

Cash Market

A place where people buy and sell the actual commodities, i.e., grain elevator, bank, etc. Spot usually refers to a cash market price for a physical commodity that is available for immediate delivery. A forward contract is a cash contract in which a seller agrees to deliver a specific cash commodity to a buyer sometime in the future. Forward contracts, in contrast to futures contracts, are privately negotiated and are not standardized.

Cash Price

Current market price of the actual or physical commodity. Also called the spot price.

Cash Sales

The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets.

Forward Contract

A private, cash-market agreement between a buyer and seller for the future delivery of a commodity at an agreed price. In contrast to futures contracts, forward contracts are not standardized and not transferable.

Spot Price

The price at which a physical commodity for immediate delivery is selling at a given time and place. The cash price.

Futures

Futures

Standardized contracts for the purchase and sale of financial instruments or physical commodities for future delivery on a regulated commodity futures exchange.

Futures Commission Merchant (FCM)

An individual or organization which solicits or accepts orders to buy or sell futures or options on futures contracts and accepts money or other assets from customer in connection with such orders. An FCM must be registered with the National Futures Association (NFA).

Trading Vernacular

Ask Price

Also called the “offer.” Indicates a willingness to sell a futures or options on futures contract at a given price.

At-The-Money

The option with a strike (or exercise) price closest to the underlying futures price.

Bear

One who believes prices will move lower.

Bear Market

A market in which prices are declining.

Bear Spread (Futures)

In most commodities and financial instruments, the term refers to selling the nearby contract month, and buying the deferred contract, to profit from a change in the price relationship.

Bear Spread (Options)

A vertical spread involving the sale of the lower strike call and the purchase of the higher strike call, called a bear call spread. Also, a vertical spread involving the sale of the lower strike put and the purchase of the higher strike put, called a bear put spread.

Bid Price

An offer to buy a specific quantity of a commodity at a stated price or the price that the market participants are willing to pay.

Bid/Ask Spread

The price difference between the bid and offer price.

Bull

One who expects prices to rise.

Bull Market

A market in which prices are rising.

Bull Spread (Futures)

In most commodities and financial instruments, the term refers to buying the nearby month, and selling the deferred month, to profit from the change in the price relationship.

Bull Spread (Options)

A vertical spread involving the purchase of the lower strike call and the sale of the higher strike call, called a bull call spread. Also, a vertical spread involving the purchase of the lower strike put and the sale of the higher strike put, called a bull put spread.

Contract

Depending on the context in which it is used, a term of reference describing either a unit of trading in a particular futures, options, or cleared product or a product approved and designated for trading or clearing pursuant to the rules of an exchange.

Contract Month/Year

The month and year in which a given contract is delivered in accordance with the Rules (for physically delivered contracts) or the month and year in which a given contract is finally settled in accordance with the Rules (for cash settled contracts). Synonymous with DELIVERY MONTH/YEAR.

Contract Size

The actual amount of a commodity represented in a futures or options contract as specified in the contract specifications.

Day Order

An order to buy or sell a contract during that trading day only. Session/Day orders that have been placed but not executed during regular trading hours (RTH) do not carry over to the next trade date. Similarly, Session/Day orders placed during electronic trading hours (ETH) are only executed for that trade date

Exercise

To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. The option holder (long) is the one who exercises the option. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. The short option holder is assigned a position opposite to that of the option buyer. CME Clearing removes the option and creates the futures positions on the firms’ books on the day of exercise.

Exercise Or Strike Price

The price at which the buyer of a call can purchase the commodity during the life of the option, and the price at which the buyer of a put can sell the commodity during the life of the option.

Expiration Date

The term “expiration date” shall mean the last day on which an options contract may be exercised.

Implied Volatility

The volatility implied by the market price of the option based on an option pricing model. In other words, it is the volatility that, given a particular pricing model, yields a theoretical value for the option equal to the current market price.

In-the-Money

A call option with a strike price lower (or a put option with a strike price higher) than the current market value of the underlying futures commodity. Therefore someone who exercised their option on a future would receive a futures position that was already “in the money”.

Initial Margin

The minimum deposit a clearing firm must require from customers for each contract, when an account is new or when the account’s equity falls below minimum maintenance requirements required by the Exchange.

In-The-Money

A call option with a strike price lower (or a put option with a strike price higher) than the current market value of the underlying futures commodity. Therefore someone who exercised their option on a future would receive a futures position that was already “in the money”.

Limit Move

A contract’s maximum price advance or decline from the previous day’s settlement price permitted in one trading session, as determined by the exchange. See Price Limit.

Limit Order (LMT)

A Limit order allows the buyer to define the maximum price to pay and the seller the minimum price to accept (the limit price). A Limit order remains on the book until the order is either executed, canceled or expires. Any portion of the order that can be matched is immediately executed.

Maturity

Period within which a futures contract can be settled by delivery of the actual commodity; the period between the first notice day and the last trading day of a commodity futures contract.

Offer (Ask Or Sell)

An offer to sell a specific quantity of a commodity at a stated price. (Opposite of a bid.)

Offset

To remove an open position from an account by establishing a position equal to or opposite the existing position, making or taking delivery, or exercising an option (i.e., selling if one has bought, or buying if one has sold.

Out-Of-The-Money

A term used to describe an option that has no intrinsic value. A call option with a strike price higher (or a put with a strike price lower) than the current market value of the underlying futures commodity. Since it depends on current prices, an option can vary from in the money to out of the money with market price movements during the life of the options contract.

Premium

(1) The price paid by the purchaser of an option to the grantor (seller);(2) The amount by which a cash commodity price trades over a futures price or another cash commodity price.

Time Decay

Decline in the theoretical value of an option position based solely on the passage of time.

Time Value

The amount by which an option’s premium exceeds its intrinsic value. Usually relative to the time remaining before the option expires.

Options

Call Option

A contract between a buyer and seller in which the buyer pays a premium and acquires the right, but not the obligation, to purchase a specified futures contract at the strike price on or prior to expiration. The seller receives a premium and is obligated to deliver, or sell, the futures contract at the specified strike price should a buyer elect to exercise the option. Also see American Style Option and European Style Option.

Put Option

A contract that provides the purchaser the right (but not the obligation) to sell a futures contract at an agreed price (the strike price) at any time during the life of the option. A put option is purchased in the expectation of a decline in price.

Option Premium

The price a buyer pays for an option. Premiums are arrived at through open competition between buyers and sellers on the trading floor of the exchange.

Strike Price

The terms “exercise price”, “strike price” and “striking price” shall be synonymous and mean the price at which the futures contract underlying the options contract will be assigned upon exercise of the option. For options contracts which are exercised into multiple futures contracts, the exercise price represents the spread price differential between the futures contracts.

Synthetic Option

A combination of a futures contract and an option, in which one is bullish and one is bearish.

Synthetic Call Option

A combination of a long futures contract and a long put, called a synthetic long call. Also, a combination of a short futures contract and a short put, called a synthetic short call.

Synthetic Put Option

A combination of a short futures contract and a long call, called a synthetic long put. Also, a combination of a long futures contract and a short call, called a synthetic short put.

Hedging

Hedge

The purchase or sale of a futures contract as a temporary substitute for a cash market transaction to be made at a later date. Usually involves simultaneous, opposite positions in the cash market and futures market.

Long Hedge

The purchase of a futures contract in anticipation of an actual purchase in the cash commodity market. Used by processors or exporters as protection against an advance in the cash price. See hedge.

Selling Hedge Or Short Hedge

Selling futures contracts to protect against possible declining prices of commodities that will be sold in the future. At the time the cash commodities are sold, the open futures position is closed by purchasing an equal number and type of futures contracts as those that were initially sold. The practice of offsetting the price risk inherent in any cash market position by taking an equal but opposite position in the futures market. Hedgers use the futures markets to protect their business from adverse price changes.

Short Hedge

The sale of a futures contract in anticipation of a later cash market sale. Used to eliminate or minimize the possible decline in value of ownership of an approximately equal amount of the cash financial instrument or physical commodity.

Margin

Margin (Performance Bond)

The minimum amount of funds that must be deposited as a performance bond by a customer with his broker, by a broker with a clearing member or by a clearing member with the Clearing House. This is one of the financial safeguards that help to ensure that clearing members (usually companies or corporations) perform on their customers’ open futures and options contracts.

Margin Call (Performance Bond Call)

A request from a brokerage firm to a customer to bring performance bond deposits up to minimum levels or a request by CME Clearing to a clearing firm to bring clearing performance bonds back to levels required by the Exchange Rules. Most exchanges refer to this as a “margin call.”

Swaps/OTC

A custom-tailored, individually negotiated transaction designed to manage financial risk, usually over a period of one to 12 years. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house. The writer of the swap, such as a bank or brokerage house, may elect to assume the risk itself, or manage its own market exposure on an exchange. Swap transactions include interest rate swaps, currency swaps, and price swaps for commodities, including energy and metals. In a typical commodity or price swap, parties exchange payments based on changes in the price of a commodity or a market index, while fixing the price they effectively pay for the physical commodity. The transaction enables each party to manage exposure to commodity prices or index values. Settlements are usually made in cash.

Commercial Agriculture Glossary

Account Equity

The net worth of a futures account as determined by combining the ledger balance with any unrealized gain or loss in open positions as marked to the market.

Adjusted Futures Price

The cash-price equivalent reflected in the current futures price. This is calculated by taking the futures price times the conversion factor for the particular financial instrument (e.g., bond or note) being delivered.

Ask Price

Also called the “offer.” Indicates a willingness to sell a futures or options on futures contract at a given price.

At-The-Money

The option with a strike (or exercise) price closest to the underlying futures price.

Basis

The difference between the spot or cash price and the futures price of the same or a related commodity. Basis is usually computed to the near future, and may represent different time periods, product forms, qualities and locations. The local cash market price minus the price of the nearby futures contract is equal to the basis.

Bear

One who believes prices will move lower.

Bear Market

A market in which prices are declining.

Bear Spread (Futures)

In most commodities and financial instruments, the term refers to selling the nearby contract month, and buying the deferred contract, to profit from a change in the price relationship.

Bear Spread (Options)

A vertical spread involving the sale of the lower strike call and the purchase of the higher strike call, called a bear call spread. Also, a vertical spread involving the sale of the lower strike put and the purchase of the higher strike put, called a bear put spread.

Bid Price

An offer to buy a specific quantity of a commodity at a stated price or the price that the market participants are willing to pay.

Bid/Ask Spread

The price difference between the bid and offer price.

Brokerage House

A firm that handles orders to buy and sell futures and options contracts for customers.

Bull

One who expects prices to rise.

Bull Market

A market in which prices are rising.

Bull Spread (Futures)

In most commodities and financial instruments, the term refers to buying the nearby month, and selling the deferred month, to profit from the change in the price relationship.

Bull Spread (Options)

A vertical spread involving the purchase of the lower strike call and the sale of the higher strike call, called a bull call spread. Also, a vertical spread involving the purchase of the lower strike put and the sale of the higher strike put, called a bull put spread.

Call Option

A contract between a buyer and seller in which the buyer pays a premium and acquires the right, but not the obligation, to purchase a specified futures contract at the strike price on or prior to expiration. The seller receives a premium and is obligated to deliver, or sell, the futures contract at the specified strike price should a buyer elect to exercise the option. Also see American Style Option and European Style Option.

Cash Commodity

The actual physical commodity or financial instrument as distinguished from the futures contract that is based on the physical commodity or financial instrument. Also referred to as “spot.”

Cash Market

A place where people buy and sell the actual commodities, i.e., grain elevator, bank, etc. Spot usually refers to a cash market price for a physical commodity that is available for immediate delivery. A forward contract is a cash contract in which a seller agrees to deliver a specific cash commodity to a buyer sometime in the future. Forward contracts, in contrast to futures contracts, are privately negotiated and are not standardized.

Cash Price

Current market price of the actual or physical commodity. Also called the spot price.

Cash Sales

The sale of commodities in local cash markets such as elevators, terminals, packing houses and auction markets.

Cash Settlement

A settlement method used in certain future and option contracts where, upon expiration or exercise, the buyer does not receive the underlying commodity but the associated cash position. For buyers not wishing to take actual possession of the underlying physical commodity, cash settlement is sometimes a more convenient method of transacting business. For example, the purchaser of an E-mini S&P future is unable to take ownership of the index at expiration. Therefore he simply pays or receives the difference between the purchase price and the price of S&P futures contract at settlement.

Clearing Fee

A fee charged by the exchange for each contract cleared. There are also clearing fees associated with deliveries, creation of a futures position resulting from an option exercise or assignment, Exchange for Physicals (EFP), block trades, transfer trades and adjustments.

Clearing Firm

A company that works directly through an exchange’s clearing house to execute trades on behalf of futures market participants.

Clearing House

The division of a futures exchange that confirms, clears and settles all trades through an exchange.

Contract

Depending on the context in which it is used, a term of reference describing either a unit of trading in a particular futures, options, or cleared product or a product approved and designated for trading or clearing pursuant to the rules of an exchange.

Contract Month/Year

The month and year in which a given contract is delivered in accordance with the Rules (for physically delivered contracts) or the month and year in which a given contract is finally settled in accordance with the Rules (for cash settled contracts). Synonymous with DELIVERY MONTH/YEAR.

Contract Size

The actual amount of a commodity represented in a futures or options contract as specified in the contract specifications.

Day Order

An order to buy or sell a contract during that trading day only. Session/Day orders that have been placed but not executed during regular trading hours (RTH) do not carry over to the next trade date. Similarly, Session/Day orders placed during electronic trading hours (ETH) are only executed for that trade date.

Delivery

The term has distinct meaning when used in connection with futures contracts. Delivery generally refers to the changing of ownership or control of a commodity under specific terms and procedures established by the exchange upon which the contract is traded.

Typically, except for energy, the commodity must be placed in an approved warehouse, precious metals depository, or other storage facility, and be inspected by approved personnel, after which the facility issues a warehouse receipt, shipping certificate, demand certificate, or due bill, which becomes a transferable delivery instrument.

Delivery of the instrument usually is preceded by a notice of intention to deliver. After receipt of the delivery instrument, the new owner typically can take possession of the physical commodity, can deliver the delivery instrument into the futures market in satisfaction of a short position, or can sell the delivery instrument to another market participant who can use it for delivery into the futures market in satisfaction of his short position or for cash, or can take delivery of the physical himself.

The procedure differs for energy contracts. Bona fide buyers or sellers of the underlying energy commodity can stand for delivery. If a buyer or seller stands for delivery, the contract is held through the termination of trading. The buyer and seller each file a notice of intent to make or take delivery with their respective clearing members who file them with the Exchange.

Buyers and sellers are randomly matched by the Exchange. The delivery payment is based on the contract’s final settlement price. Some futures contracts, such as stock index futures, are cash settled.

Delta

The measure of the price-change relationship between an option and the underlying futures price. Equal to the change in premium divided by the change in futures price.

Execution

The completion of an order to buy or sell a futures contract.

Exercise

To invoke the right granted under the terms of an options contract to buy or sell the underlying futures contract. The option holder (long) is the one who exercises the option. Call holders exercise the right to buy the underlying future, while put holders exercise the right to sell the underlying future. The short option holder is assigned a position opposite to that of the option buyer. CME Clearing removes the option and creates the futures positions on the firms’ books on the day of exercise.

Exercise Or Strike Price

The price at which the buyer of a call can purchase the commodity during the life of the option, and the price at which the buyer of a put can sell the commodity during the life of the option.

Expiration Date

The term “expiration date” shall mean the last day on which an options contract may be exercised.

Forward Contract

A private, cash-market agreement between a buyer and seller for the future delivery of a commodity at an agreed price. In contrast to futures contracts, forward contracts are not standardized and not transferable.

Futures

Standardized contracts for the purchase and sale of financial instruments or physical commodities for future delivery on a regulated commodity futures exchange.

Futures Commission Merchant (FCM)

An individual or organization which solicits or accepts orders to buy or sell futures or options on futures contracts and accepts money or other assets from customer in connection with such orders. An FCM must be registered with the National Futures Association (NFA).

Hedge

The purchase or sale of a futures contract as a temporary substitute for a cash market transaction to be made at a later date. Usually involves simultaneous, opposite positions in the cash market and futures market.

Implied Volatility

The volatility implied by the market price of the option based on an option pricing model. In other words, it is the volatility that, given a particular pricing model, yields a theoretical value for the option equal to the current market price.

In-the-Money

A call option with a strike price lower (or a put option with a strike price higher) than the current market value of the underlying futures commodity. Therefore someone who exercised their option on a future would receive a futures position that was already “in the money”.

Initial Margin

The minimum deposit a clearing firm must require from customers for each contract, when an account is new or when the account’s equity falls below minimum maintenance requirements required by the Exchange.

In-The-Money

A call option with a strike price lower (or a put option with a strike price higher) than the current market value of the underlying futures commodity. Therefore someone who exercised their option on a future would receive a futures position that was already “in the money”.

Introducing Broker (IB)

A firm or individual that solicits and accepts orders to buy or sell futures or options on futures contracts from customers but does not accept money or other assets from such customers. An IB must be registered with the National Futures Association (NFA).

Limit Move

A contract’s maximum price advance or decline from the previous day’s settlement price permitted in one trading session, as determined by the exchange. See Price Limit.

Limit Order (LMT)

A Limit order allows the buyer to define the maximum price to pay and the seller the minimum price to accept (the limit price). A Limit order remains on the book until the order is either executed, canceled or expires. Any portion of the order that can be matched is immediately executed.

Long Hedge

The purchase of a futures contract in anticipation of an actual purchase in the cash commodity market. Used by processors or exporters as protection against an advance in the cash price.

Maintenance Margin

The minimum equity that must be maintained for each contract in a customer’s account subsequent to deposit of the initial performance bond. If the equity drops below this level, a deposit must be made to bring the account back to the initial performance bond level.

Managed Futures

The term managed futures describes an industry comprised of professional money managers know as commodity trading advisors (CTAs). These trading advisors manage client assets on a discretionary basis using global futures markets as an investment medium.

Trading advisors take positions based on expected profit potential. All CTAs involved must be registered with the Commodity Futures Trading Commission (CFTC), a US government regulatory agency. While many casual observers most closely associate managed futures and Commodity Trading Advisors with trend following, the reality is that the strategies and approaches within managed futures vary tremendously, and that the one common unifying these is that these managers trade highly liquid, exchange-traded instruments and deep foreign exchange markets.

As a result, the terms many fund managers choose to implement, including lock-ups, gates, side pockets, and penalties for early redemptions, rarely apply to investments in managed futures. Liquidity and transparency also simplify risk management, and investing via separately managed accounts, a common practice among managed futures investors, mitigates the risk of fraud since investors retain custody of assets.

Margin (Performance Bond)

The minimum amount of funds that must be deposited as a performance bond by a customer with his broker, by a broker with a clearing member or by a clearing member with the Clearing House. This is one of the financial safeguards that help to ensure that clearing members (usually companies or corporations) perform on their customers’ open futures and options contracts.

Margin Call (Performance Bond Call)

A request from a brokerage firm to a customer to bring performance bond deposits up to minimum levels or a request by CME Clearing to a clearing firm to bring clearing performance bonds back to levels required by the Exchange Rules. Most exchanges refer to this as a “margin call.”

Maturity

Period within which a futures contract can be settled by delivery of the actual commodity; the period between the first notice day and the last trading day of a commodity futures contract.

Offer (Ask Or Sell)

An offer to sell a specific quantity of a commodity at a stated price. (Opposite of a bid.)

Offset

To remove an open position from an account by establishing a position equal to or opposite the existing position, making or taking delivery, or exercising an option (i.e., selling if one has bought, or buying if one has sold.

Option Premium

The price a buyer pays for an option. Premiums are arrived at through open competition between buyers and sellers on the trading floor of the exchange.

Order

A request by a trader to buy or sell a given futures instrument with specified conditions such as price, quantity, type of order.

Out-Of-The-Money

A term used to describe an option that has no intrinsic value. A call option with a strike price higher (or a put with a strike price lower) than the current market value of the underlying futures commodity. Since it depends on current prices, an option can vary from in the money to out of the money with market price movements during the life of the options contract.

Prime Rate

Interest rate charged by institutional banks to their larger most creditworthy customers.

Premium

(1) The price paid by the purchaser of an option to the grantor (seller);(2) The amount by which a cash commodity price trades over a futures price or another cash commodity price.

Put Option

A contract that provides the purchaser the right (but not the obligation) to sell a futures contract at an agreed price (the strike price) at any time during the life of the option. A put option is purchased in the expectation of a decline in price.

Range

The difference between the highest and lowest prices recorded during a given time period, trend, or trading session.

Risk

(1) The possibility of losing some or all profits or investment return due to external market factors. (2) The dollar difference between the current price and the price at which the liquidation of open positions would occur. (3) The portion of the performance bond requirement associated with the likely worst case change in value from one day to the next.

Selling Hedge Or Short Hedge

Selling futures contracts to protect against possible declining prices of commodities that will be sold in the future. At the time the cash commodities are sold, the open futures position is closed by purchasing an equal number and type of futures contracts as those that were initially sold.

The practice of offsetting the price risk inherent in any cash market position by taking an equal but opposite position in the futures market. Hedgers use the futures markets to protect their business from adverse price changes.

Short Hedge

The sale of a futures contract in anticipation of a later cash market sale. Used to eliminate or minimize the possible decline in value of ownership of an approximately equal amount of the cash financial instrument or physical commodity.

Spot Price

The price at which a physical commodity for immediate delivery is selling at a given time and place. The cash price.

Strike Price

The terms “exercise price”, “strike price” and “striking price” shall be synonymous and mean the price at which the futures contract underlying the options contract will be assigned upon exercise of the option. For options contracts which are exercised into multiple futures contracts, the exercise price represents the spread price differential between the futures contracts.

Swap (OTC)

A custom-tailored, individually negotiated transaction designed to manage financial risk, usually over a period of one to 12 years. Swaps can be conducted directly by two counterparties, or through a third party such as a bank or brokerage house. The writer of the swap, such as a bank or brokerage house, may elect to assume the risk itself, or manage its own market exposure on an exchange.

Swap transactions include interest rate swaps, currency swaps, and price swaps for commodities, including energy and metals. In a typical commodity or price swap, parties exchange payments based on changes in the price of a commodity or a market index, while fixing the price they effectively pay for the physical commodity.

The transaction enables each party to manage exposure to commodity prices or index values. Settlements are usually made in cash.

Synthetic Call Option

A combination of a long futures contract and a long put, called a synthetic long call. Also, a combination of a short futures contract and a short put, called a synthetic short call.

Synthetic Futures

A combination of a put and a call with the same strike price, in which both are bullish, called synthetic long futures. Also, a combination of a put and a call with the same strike price, in which both are bearish, called synthetic short futures.

Synthetic Option

A combination of a futures contract and an option, in which one is bullish and one is bearish.

Synthetic Put Option

A combination of a short futures contract and a long call, called a synthetic long put. Also, a combination of a long futures contract and a short call, called a synthetic short put.

Time Decay

Decline in the theoretical value of an option position based solely on the passage of time.

Time Value

The amount by which an option’s premium exceeds its intrinsic value. Usually relative to the time remaining before the option expires.