AG MARKET UPDATE: AUGUST 26 – SEPTEMBER 15

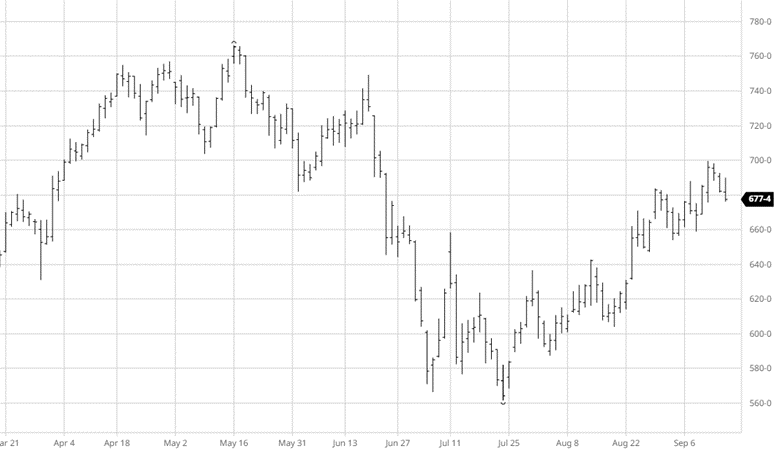

Corn has been moving higher since late July with yields being lowered in many areas and supply concern. The USDA report from Monday lowered the estimated US yield forecast to 172.5 bu/ac from the 175.4 bu/ac in August. Most private estimates are in the low 170 range, so it was nice to see the USDA start to agree with everyone that the crop just is not there this year. US and world ending stocks for 22/23 were both lowered as well but the world ending stocks were at the higher end of estimates. The prediction is that South America will have another record crop to take pressure off the disappointing US year. If South America has issues however, world balance sheets could get tight. Ethanol demand/production dodged a bullet this week as rail workers are likely to avert a strike (the large majority of ethanol is moved via rail). Energy markets have also pulled back as recession fears and global slowdown remains in the headlines.

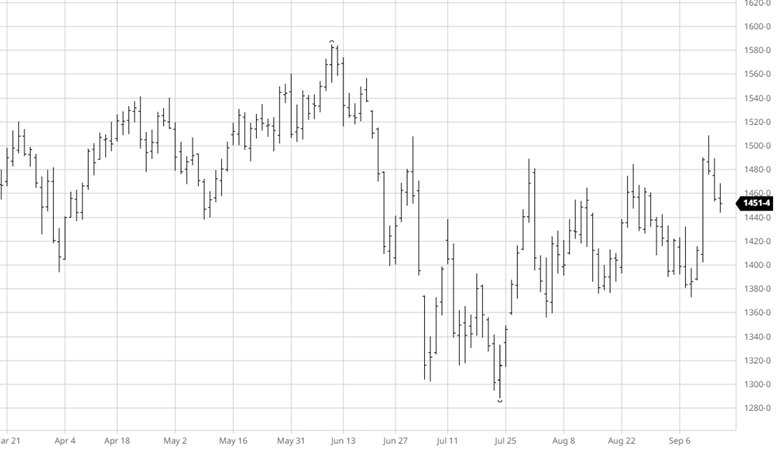

Beans had the surprise of the report with the USDA lowering the US bean yield estimates to 50.5 bu/ac from 51.9 bu/ac in August. Many estimates believe this to be a great US crop to this point. Seeing the USDA lower the estimates was a shock and beans shot up +76 cents on Monday as a result. The lower bushel estimate lowered the US and world ending stocks for 22/23 as well. The trading days following the report have lacked additional bullish news and remain under pressure on Friday as exports remain lackluster. Soybeans need to find buyers, looking at you China!, for the bull case to have more ground to stand on. US prices are still expensive in the world marketplace suggesting we could see a pullback met with some buying. The late heat across the Midwest expected in the next couple weeks will put pressure on beans finish; however is helping with drying corn.

Beans had the surprise of the report with the USDA lowering the US bean yield estimates to 50.5 bu/ac from 51.9 bu/ac in August. Many estimates believe this to be a great US crop to this point. Seeing the USDA lower the estimates was a shock and beans shot up +76 cents on Monday as a result. The lower bushel estimate lowered the US and world ending stocks for 22/23 as well. The trading days following the report have lacked additional bullish news and remain under pressure on Friday as exports remain lackluster. Soybeans need to find buyers, looking at you China!, for the bull case to have more ground to stand on. US prices are still expensive in the world marketplace suggesting we could see a pullback met with some buying. The late heat across the Midwest expected in the next couple weeks will put pressure on beans finish; however is helping with drying corn.

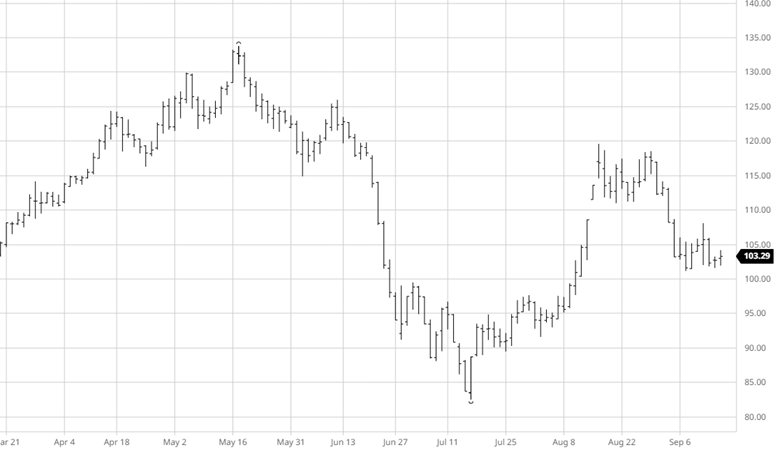

Cotton has been an interesting commodity to watch over the past few months with of the widest trading ranges in recent memory (51 cents!!). The US production will be low as most dryland in Texas has been zeroed out and will produce 0 (ZERO) bales. For the supply side this is bad news and adds to the already tight global supply. The demand side is littered with it’s own pressures – world recession fears loom, a strong USD (difficult for exports), and continues supply chain issue… the main Demand Theme = “It doesn’t matter how small the crop is is no one wants it”. When a tight supply market meets a low demand market, the next question is “what gives first?” a recession would lead to the demand market winning the race to the bottom.

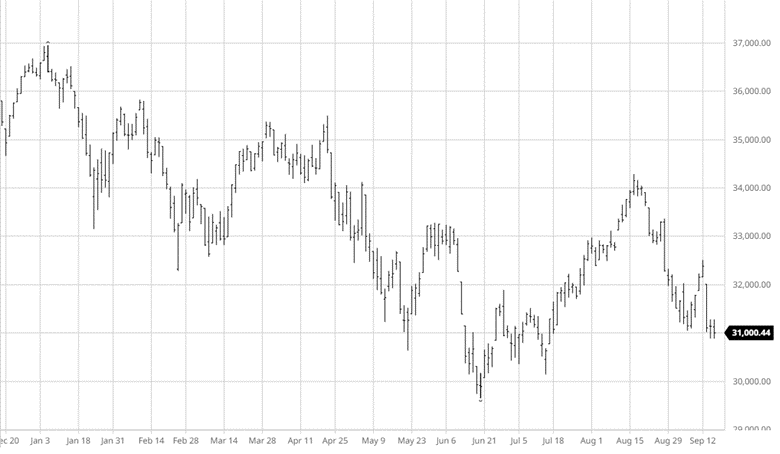

Equity Markets

This time last week, the equity markets were bounding higher and all appeard to be clear for the bulls to win the race to the end of the year. Fast forward 7 days and equities are struggling on the heals of poor consumer data and higher than expected inflation (wait…this is not new!). Tuesday was one of the worst days since 2020 with the markets down sharply across the board leaving investors gasping for air. Historically, September and October are two of the most volatile months of the year…the first few trading days in September have not disappointed… button down the hatches for the days and weeks ahead…managing risk will be paramount.

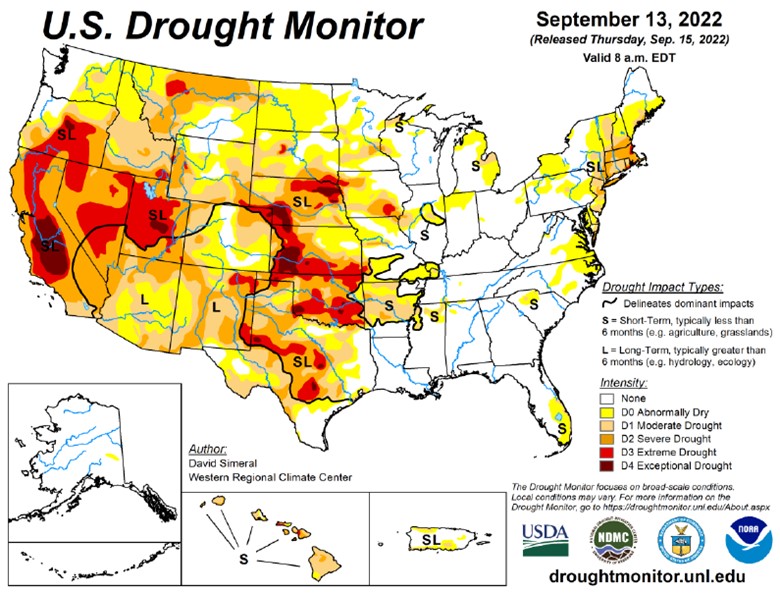

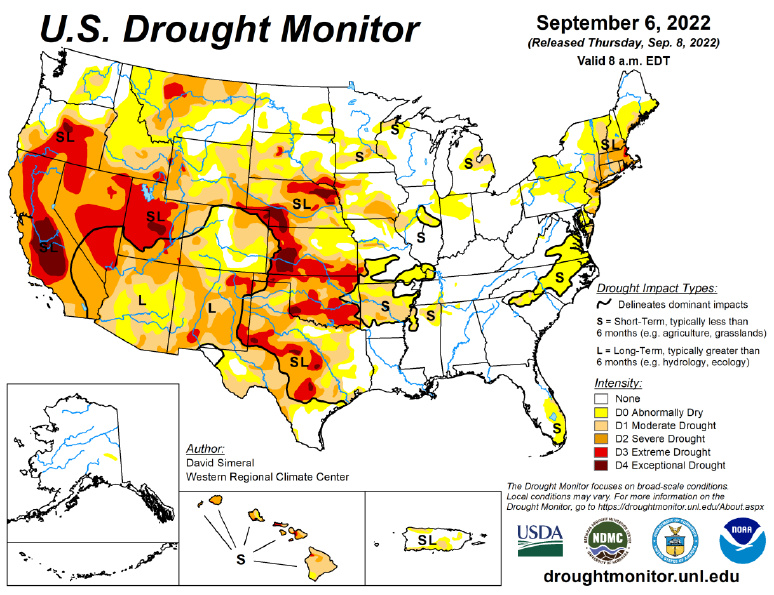

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].