Welcome to the 2022 lumber market. A place no one wants to be, but all keep showing up. Here’s a brief rundown:

The futures market was up over $100 again — The run has been relentless and unforgiving, and it’s hard to find the endpoint. Recently, 4 out of 5 of those in the lumber industry think the market is going higher. Half of those are not long. So why so bullish? The two key factors are transportation and demand. We will look at each side to see if that endpoint can be projected.

Many are looking for the typical first-quarter shipping issues where supplies are bought but can’t ship. That causes an artificial secondary market where the trader is forced to buy anything he can get his hands on from anyone. Here we see a jump in truck orders to “fill in.” This time, trucking availability has been restricted, creating general chaos throughout North America. The fill-in mechanism has broken down, forcing the trader to buy a car for further out shipment regardless of price. This has extended order files at the mills when they typically shrink. It also has pushed prices to the next level.

The bigger surprise coming into 2022 was the amount of demand that continues to create itself. Usually, we could foresee a push coming from the numerous jobs that get bid and rebid. Today most are surprised at the amount of new business that shows up daily. A lot of it is long-term and not close to starting, but it has changed the psyche of the trade and added another level to the already pressured trader. That same trader who can’t buy enough was only yesterday told not to buy a stick. That chase is also pushing prices to the next level.

Let’s Get Technical:

So, what is the next level? On the technical side, the key areas now are the gap left last year at $1,514.80 and an old Fib number of $1,518.30. There is room to get there with a weekly RSI at 75%. Each month is at a new high, and there aren’t any calcs from here up. We know that recently, a market spike has had a corrective pullback. I’m not that confident in a pullback with 3 out of 5 willing to “buy the pullback,” but that has been the trend.

Weekly Round-Up:

The market is back at unsustainable levels. And why do I say that? Because we can only build so many houses, and we do not have the labor to push actual starts to 1.7 or 1.8. At $1,200, there is enough wood flowing to keep a 1.6 pace at least. The market goes to $1,500 or more because there is a significant gap in the chain. Logistic problems have bottled up the flow of needed lumber, and those logistic issues are not going away anytime soon.

Open Interest and Commitment of Traders

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

https://www.cftc.gov/dea/futures/other_lf.htm

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

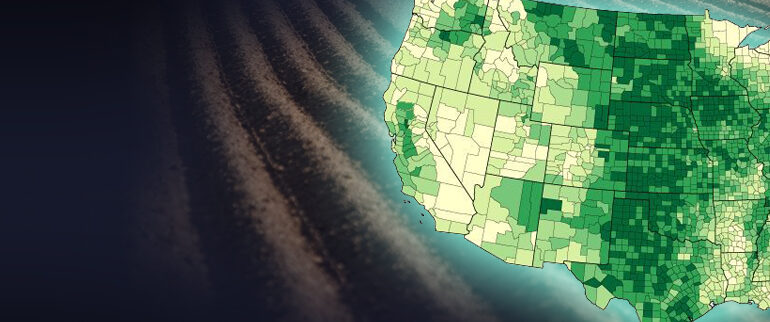

The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high?