There is malaise over almost every market out there, whether it is corn or equities. Lumber is no different. The futures market has traded between 538 and 515 for 14 straight sessions. There is no energy and no real direction. The lumber market is flat, as is housing. The upcoming election may be a factor, but even that has gone flat. Economic uncertainty has put us all back into the weeds. That is friendly. Lumber gets bought in the fall. The longer one waits, the higher it will go. Today, the lumber futures are not showing signs of going higher. It shows signs of fatigue at the higher levels. The premium gets no help from the cash market each time it is up. That creates fatigue and the continued cycle of tight highs and lows.

Patience is key as we navigate these market conditions. The upcoming start reports on Friday could be the trigger we’re waiting for. Remember, hibernating till spring only works for bears.

Technical:

The technical read has been challenging in a flat market. Today, there is a flag pattern channel with $500 as support and $539 as resistance. The rules for flag patterns tell us that a close over $539.00 calls for a run to $578.00. We have had patterns in the past that call for a higher trade. The problem is the market can’t close over those areas. Maybe we are closer on this one. In any case, it is a buy lower market.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636

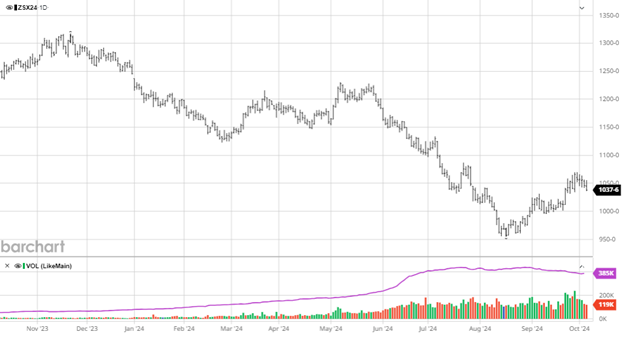

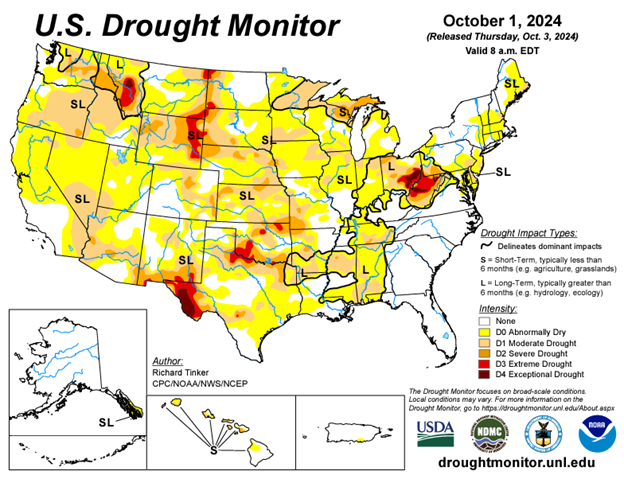

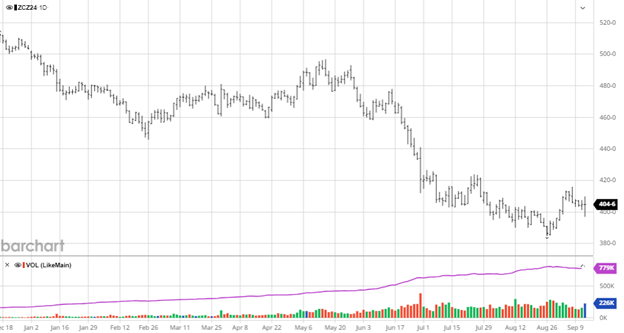

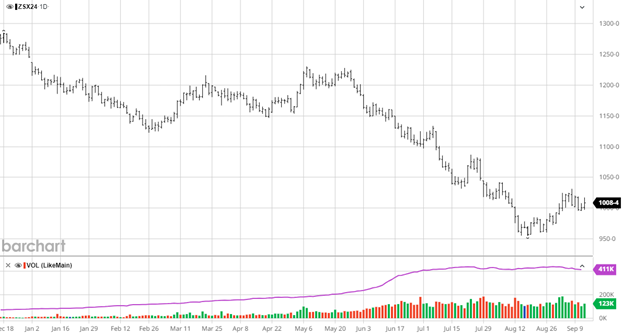

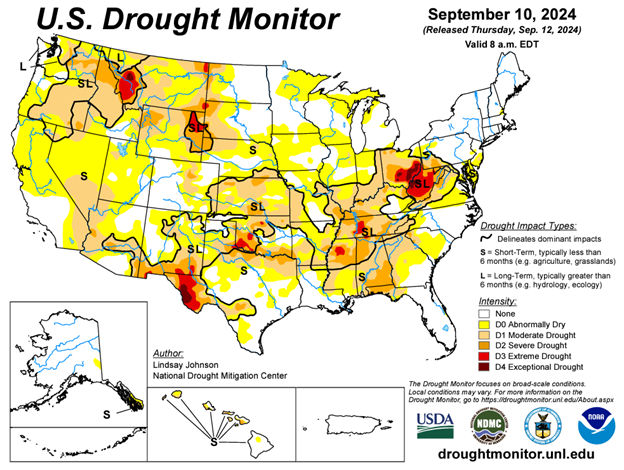

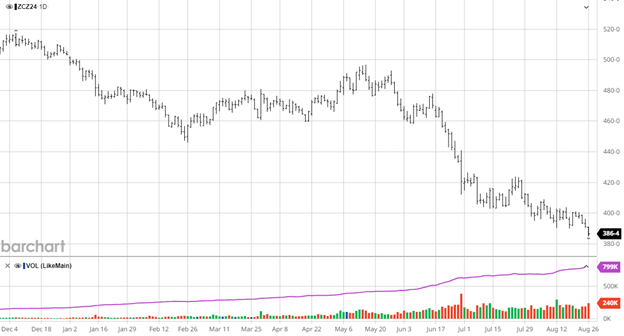

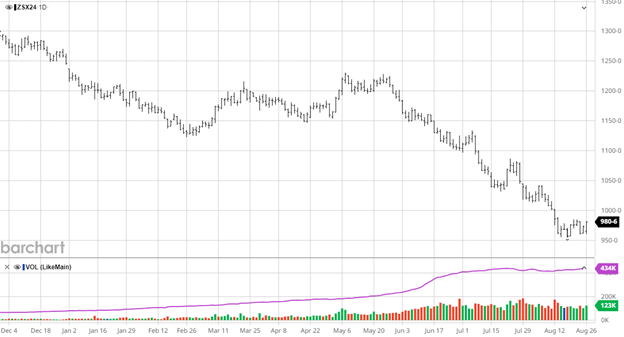

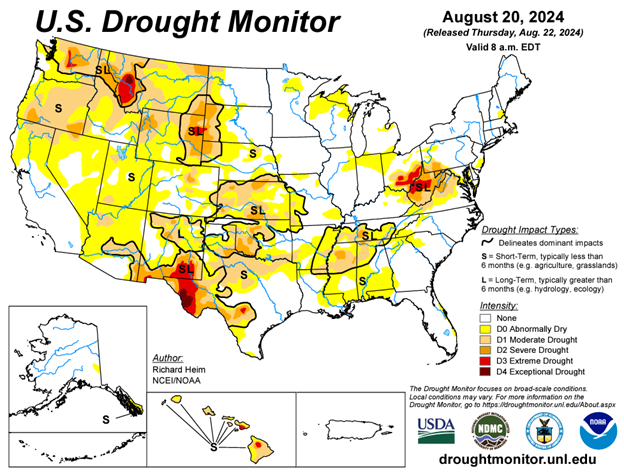

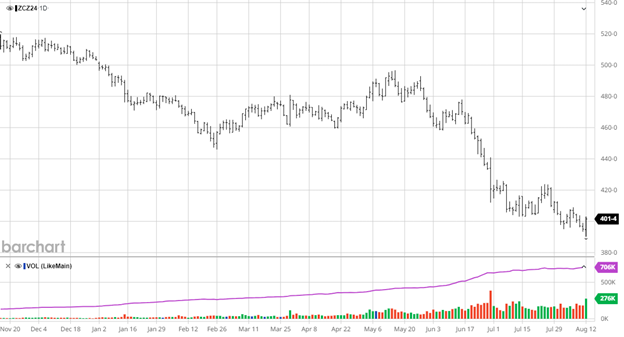

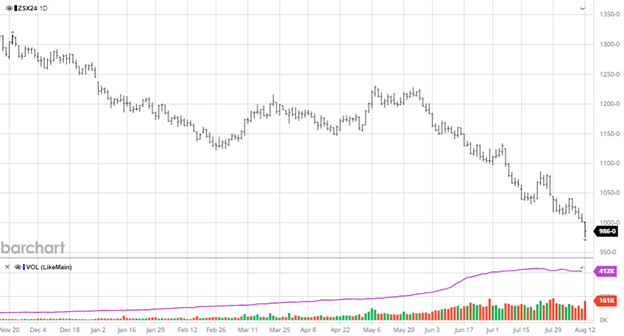

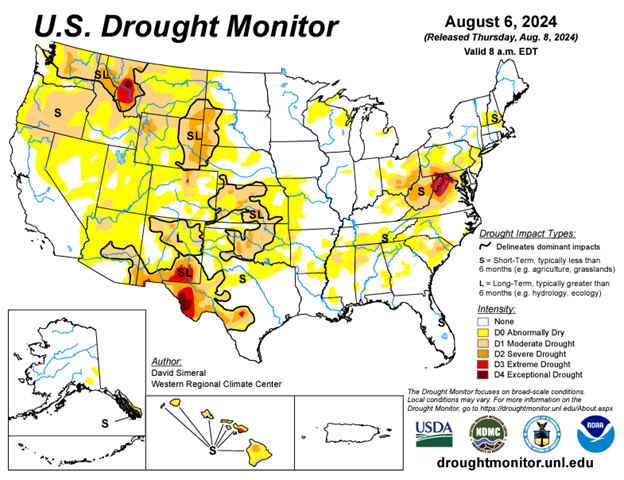

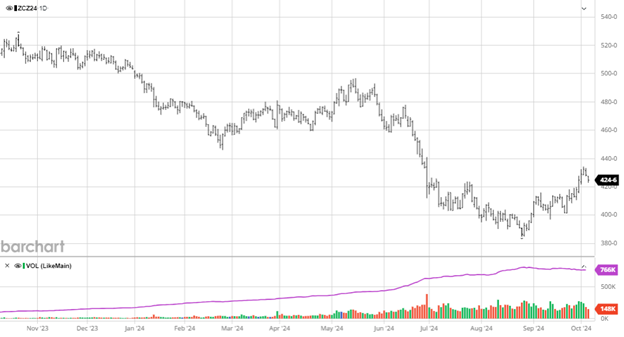

Soybeans faded to end the week as harvest progress and pressure lead to profit taking after the recent rally. The biggest news related to soybeans, non harvest related, is that congress seems to be working on bipartisan legislature to address the importing of used cooking oil while still collecting tax credits. The American farmer wants this loophole closed to force biofuel producers in the US to use domestic production. This will lead to millions of more bushels used at crush facilities in the US throughout the year with a major question of, what happens to the bean meal? The longer congress and the lobbying associations take on this legislature will lead to more frustration among farmers across the country so with it being an election year I would be careful with what gets “leaked” by parties involved. The end of year drought across much of the US likely led to a smaller crop as pods did not get the moisture needed for max fill. Bean harvest is slightly ahead of expectations at 26% to start the week of Sept 30.

Soybeans faded to end the week as harvest progress and pressure lead to profit taking after the recent rally. The biggest news related to soybeans, non harvest related, is that congress seems to be working on bipartisan legislature to address the importing of used cooking oil while still collecting tax credits. The American farmer wants this loophole closed to force biofuel producers in the US to use domestic production. This will lead to millions of more bushels used at crush facilities in the US throughout the year with a major question of, what happens to the bean meal? The longer congress and the lobbying associations take on this legislature will lead to more frustration among farmers across the country so with it being an election year I would be careful with what gets “leaked” by parties involved. The end of year drought across much of the US likely led to a smaller crop as pods did not get the moisture needed for max fill. Bean harvest is slightly ahead of expectations at 26% to start the week of Sept 30.