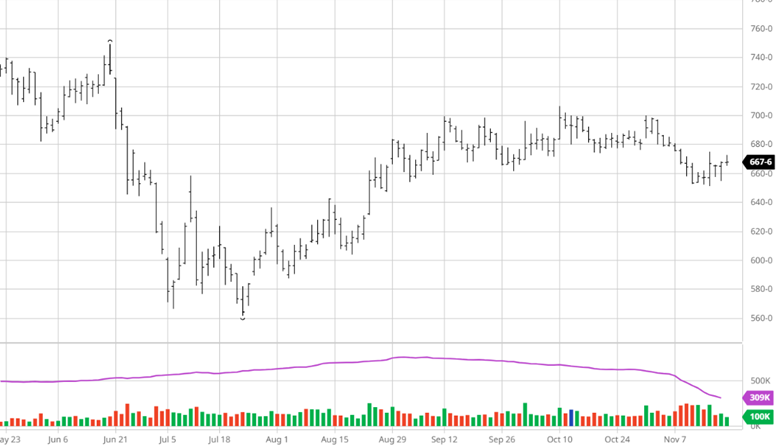

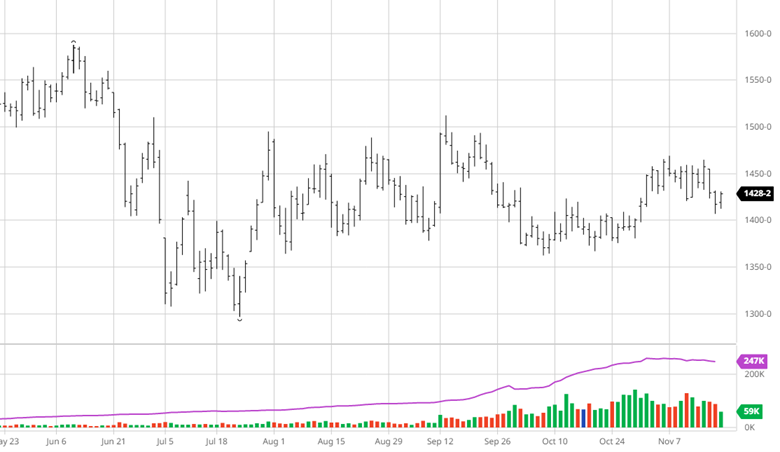

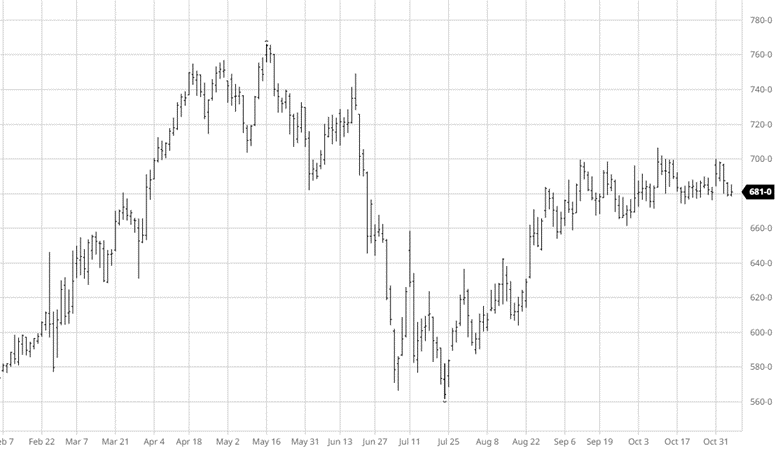

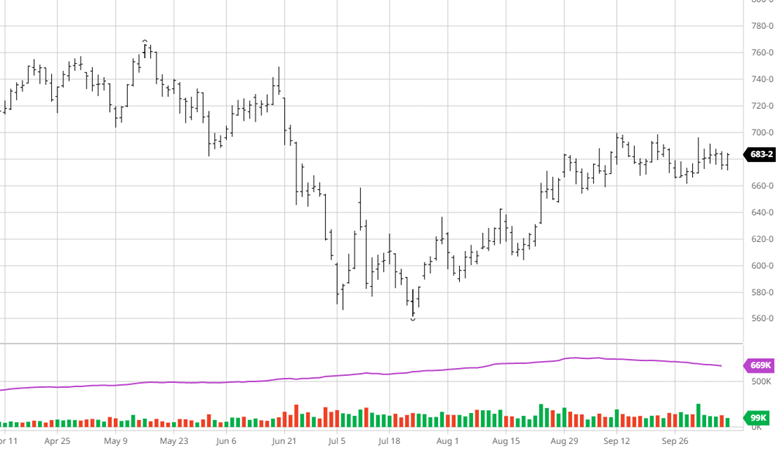

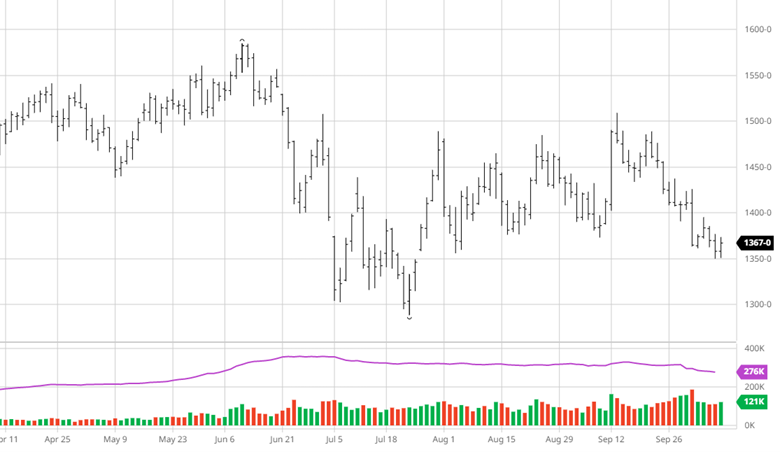

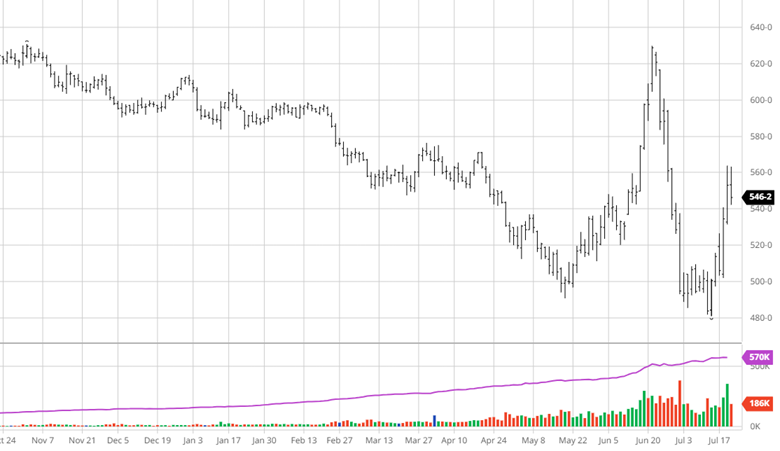

Corn has seen a strong rally after falling following the USDA Report last Wednesday. The USDA estimated the US crop to have a 177.6 bu/ac yield this year following the rough start to growing season with drought conditions over most growing areas. While the rains have been beneficial in providing relief, this crop needs a lot more rain in the form of soaking rains and not storms with straight line winds. If the hot and dry pattern returns expect to see prices move higher. Russia has threatened that they will treat any ship entering the now closed grain corridor as a military vessel has tensions in the Black Sea region high again. The longer this new standoff drags out the more support it will provide grains. The collapse of the USD and inconsistent weather can help support this move higher after a bearish USDA report depending on the future forecasts and technical trading.

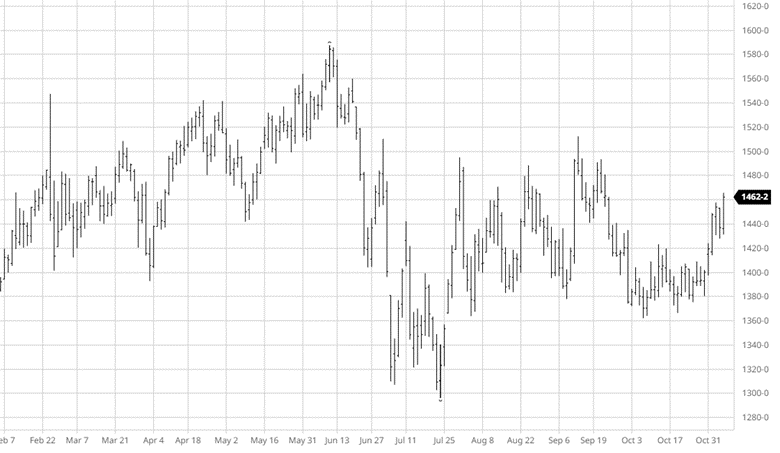

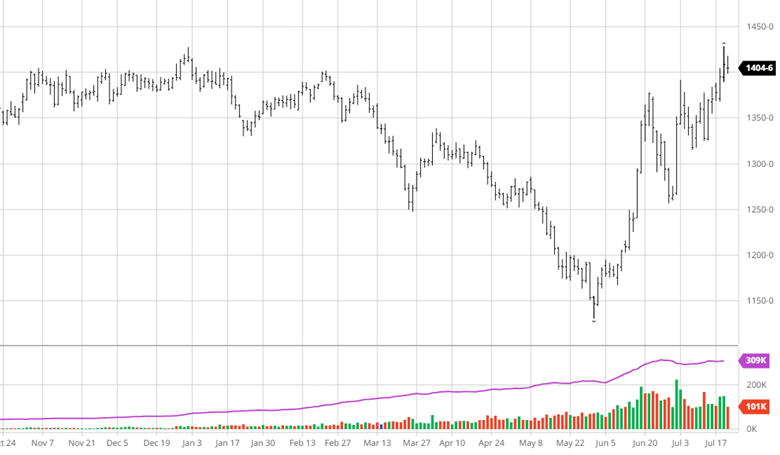

Soybeans have enjoyed a great run over the last month and half as soybeans got back over $14 this week. After a low acreage number and not an ideal start to the summer beans have had a great last 2 months. The forecast hot dry stretch coming up is expected to put more stress on this crop as we head into the end of July and start of August. With tightening world balance sheets it will be hard for funds to get over extended short but every weekend provides the opportunity for surprise rains and new market surprises.

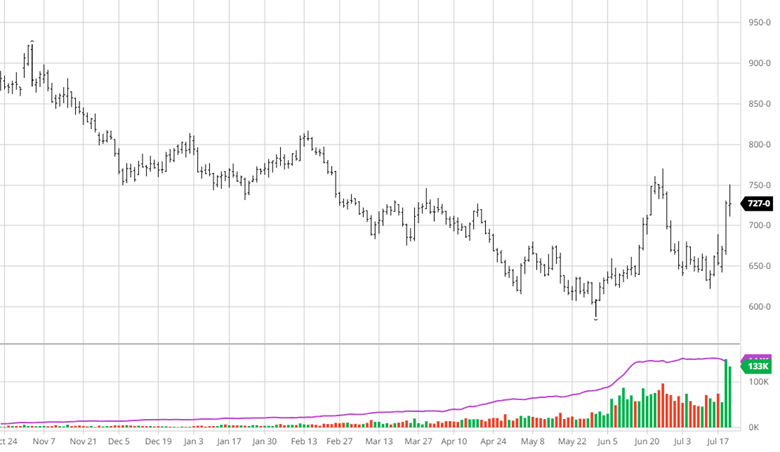

The big news of the week was Russia threatening all vessels that enter the region as military vessels, escalating the tensions and ending the grain corridor for the time being. Russia keeps attacking Odessa which will damage the remaining infrastructure and could present even more challenges if/when the grain deal resumes. The Russian ambassador to the US has said that Russia is not preparing to attack civilian ships in the Black Sea, though previously the Russian Defense Ministry announced that all ships traveling to Ukrainian Black Sea ports would be considered potential carriers of military cargo, and the southeastern and northwestern parts of the Black Sea’s international waters should be considered unsafe for navigation.

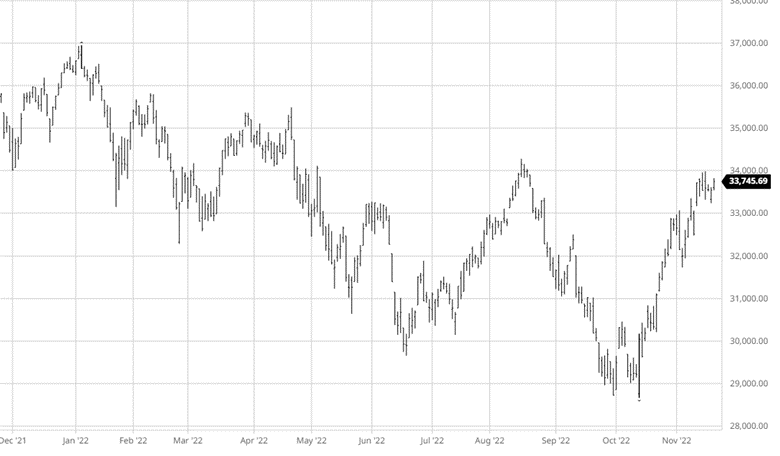

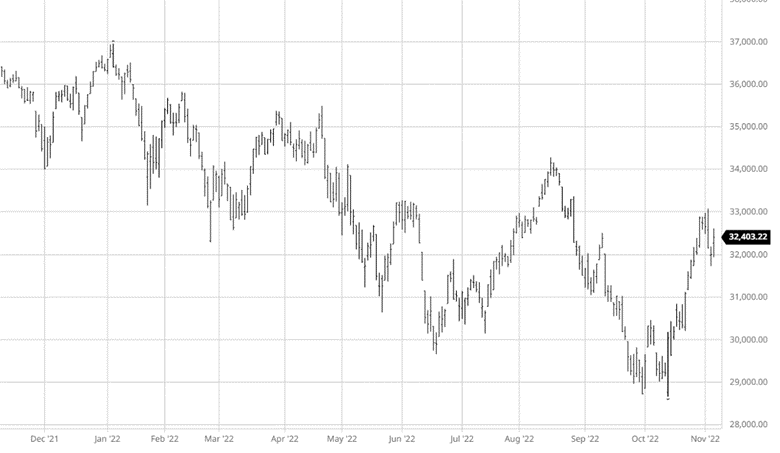

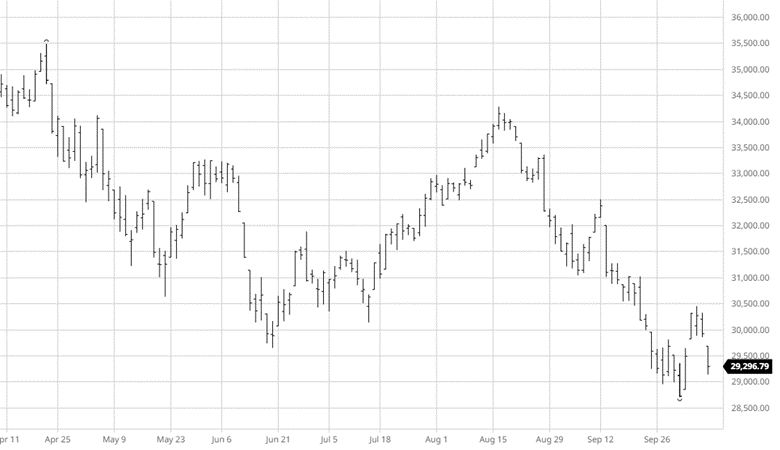

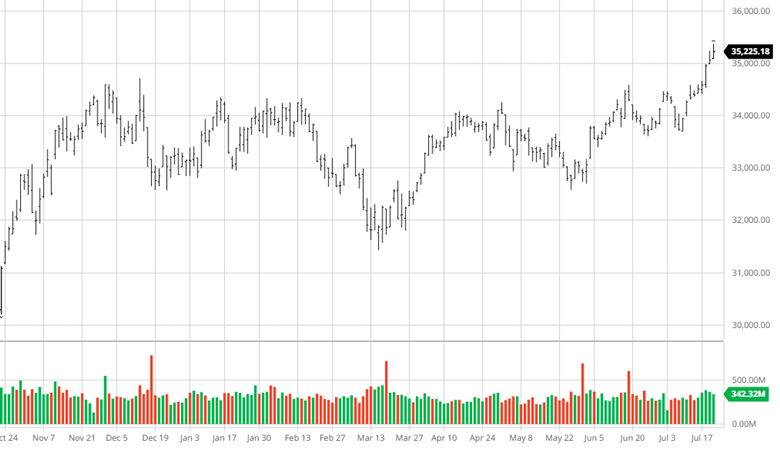

Equity Markets

The equity markets continued their strength the past couple of weeks with CPI coming in slightly lower than expected (by 0.1%) at 3%. While inflation is still above the target of 2% the slow decrease over time is helping it come down while core inflation, 4.8%, follows the same pattern. The Fed decision at the end of the month is likely to result in a ¼ point rate hike as we head into earnings season next week. Tech stocks took their largest losses that we have seen recently on Wednesday as earnings have begun being posted.

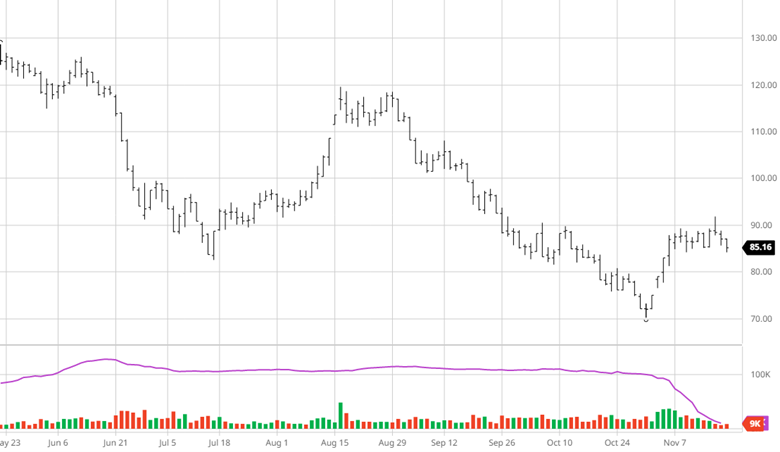

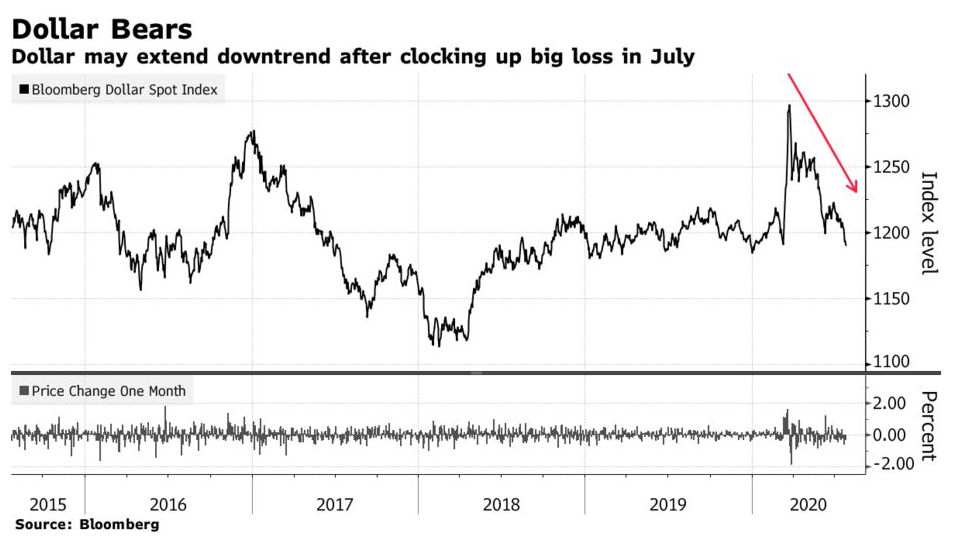

US Dollar

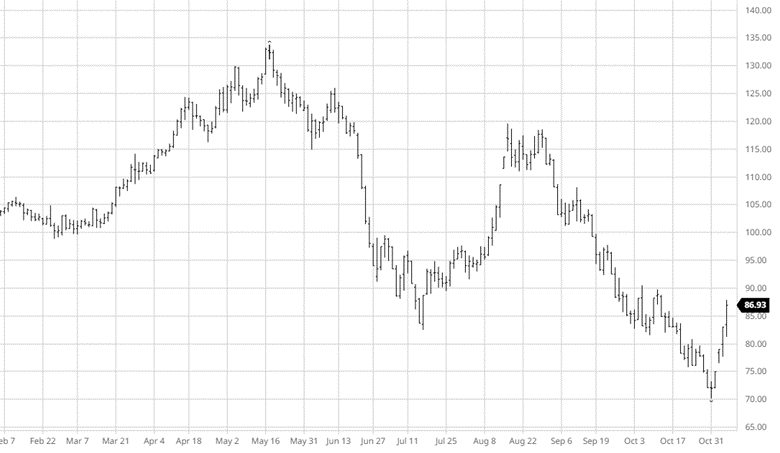

The US Dollar hit its lowest level in a year this week as the greenback fell below the 100 level. This should help ag exports be competitive on the world stage but the sharp decline from the 103-level last week was surprising.

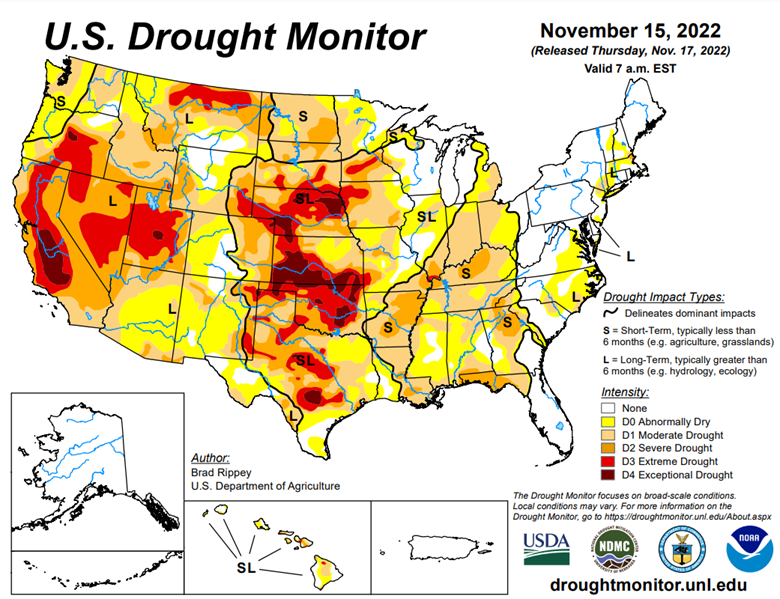

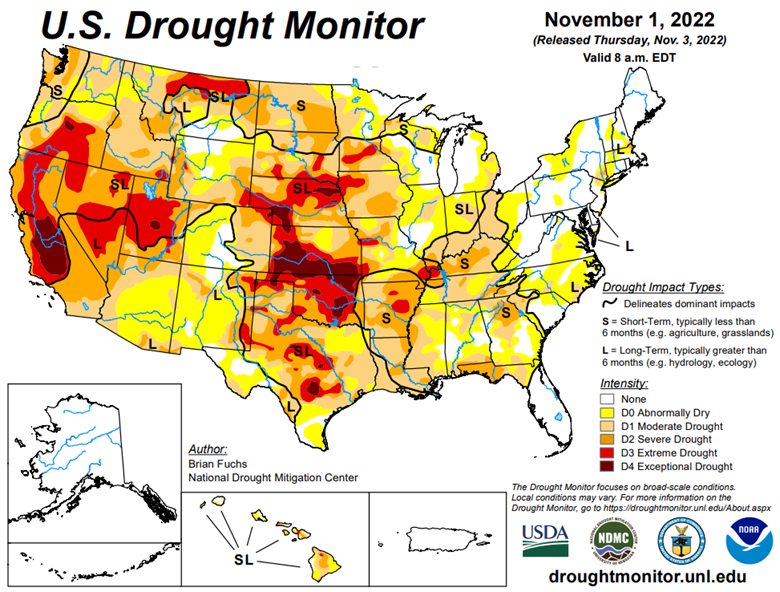

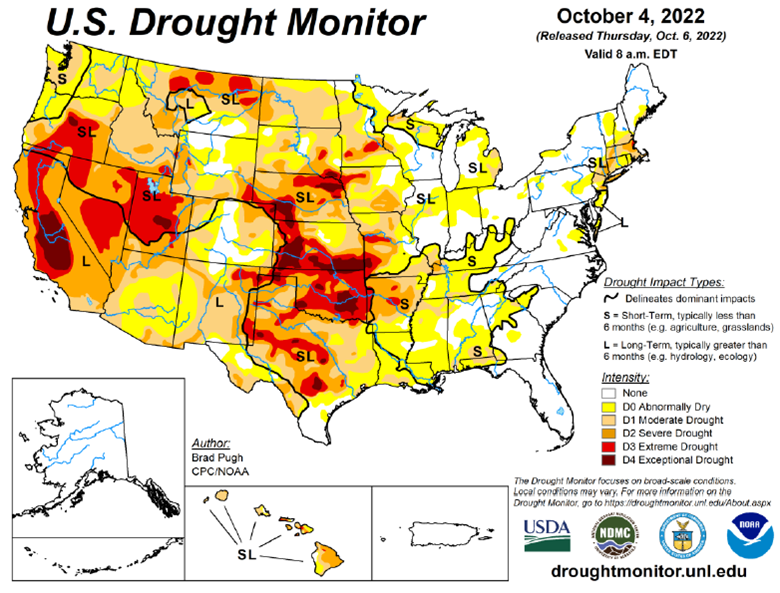

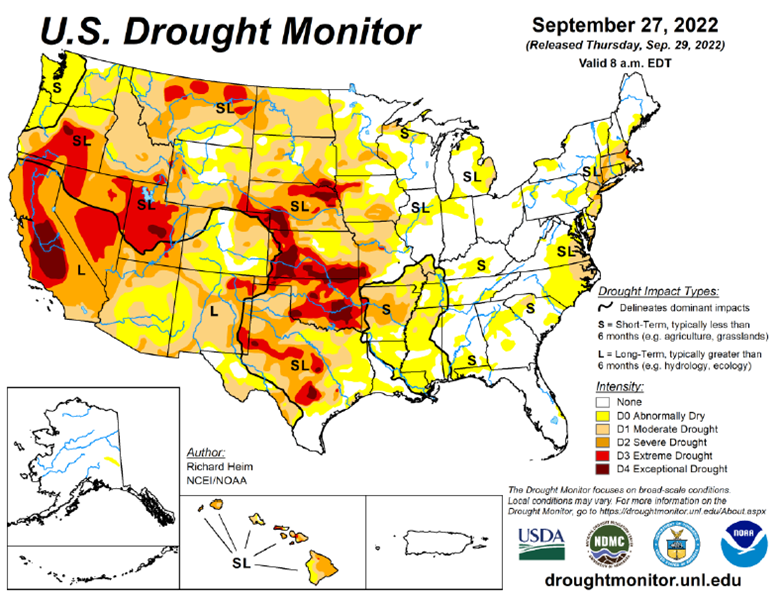

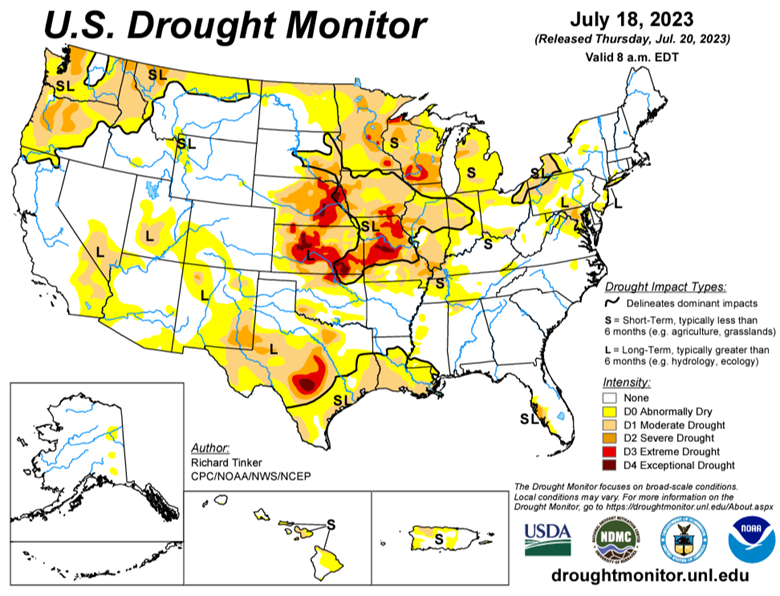

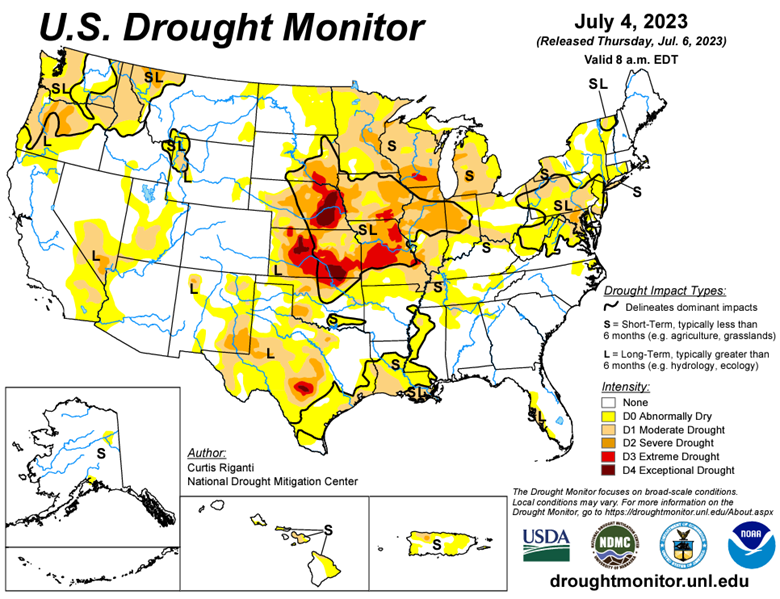

Drought Monitor

The drought monitors below show the change in drought conditions over the last 2 weeks.

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].