AG MARKET UPDATE: SEPTEMBER 30 – OCTOBER 7

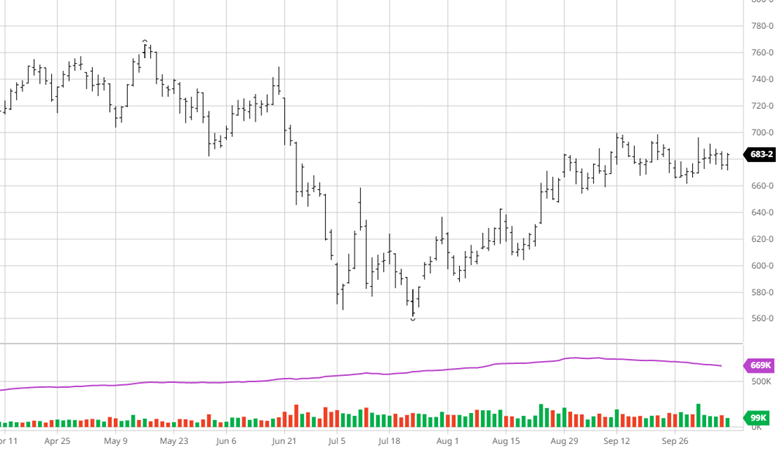

As you can see in the chart below the relatively sideways trade continued this week. Harvest is rolling along, about 20% done at the start of the week, with no issues across much of the country as most areas are experiencing drought conditions. The upcoming USDA report on Wednesday will update US and South American estimated yields. The low river levels from lack of rain are starting to cause bottlenecks and problems for exports. Elevators may ask farmers to delay delivery until they know they will be able to ship it out of their facility. A continued strong US Dollar will continue to weigh on export demand.

Beans were relatively flat this week but are still much lower than the highs from last month. Beans have struggled on lack of exports and relatively strong yields. The strong USD and barge situation is hurting bean export demand same as corn. China will be coming out of their week long market shut down on Sunday and hopefully we will see them as buyers more regularly in larger quantities. Harvest was 22% complete this week, off to a great start. The bean market is more vulnerable than corn at this point with less supportive news and poor technical.

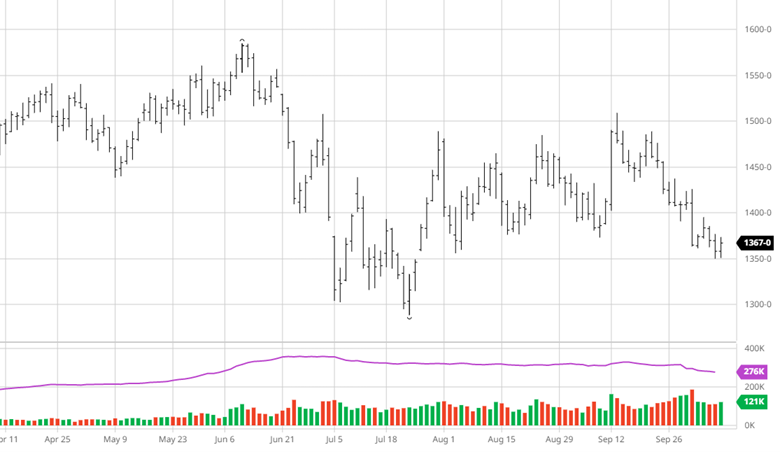

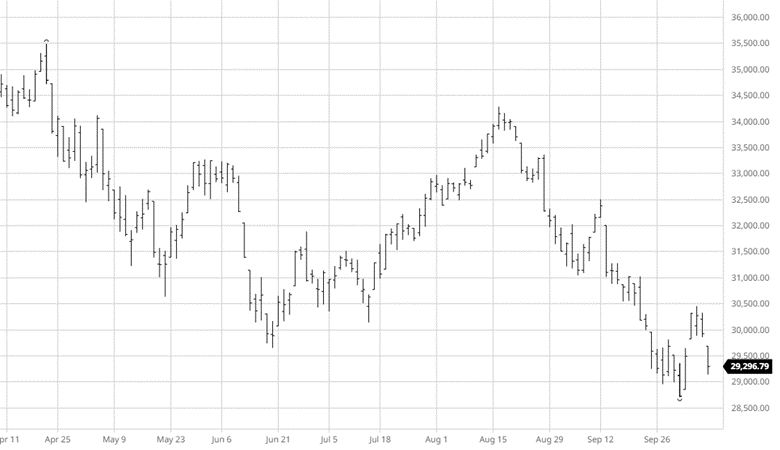

Equity Markets

The markets had a nice two-day rally before losing a solid chunk of those gains heading into the weekend. The hard sell off on Friday was fueled by the strong jobs report. While a strong job report sounds like a good thing, it is one of the indicators the Fed has been using when deciding to raise rates and this would incline them to raise again instead of slowing down. There is not a lot of good news in the market right now with many analysts seeing more downside, while a few thinks this most recent bounce may have put in a good floor.

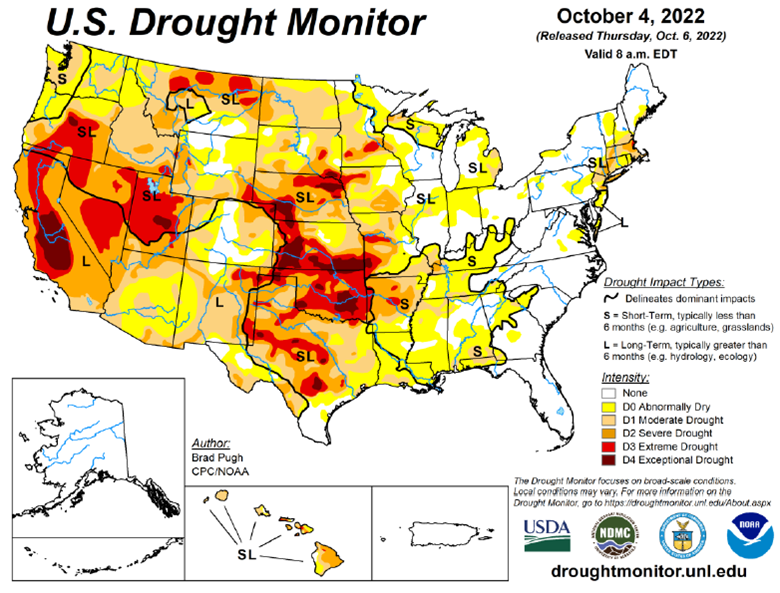

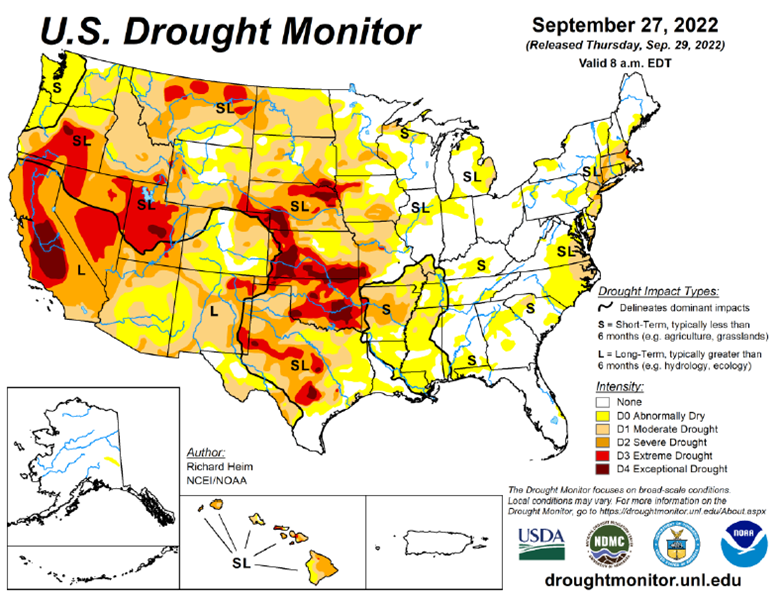

Drought Monitor

The drought monitor below shows where we stand week to week.

Podcast

Are the Fed’s hikes starting to dampen inflation? Oil, grains, and metals have all fallen from their highs. But the rarely spoken of Cotton market was one of the first to crack…falling from 1.58/lb to 0.95/lb in just a few short days. We’re digging into this sharp drop and just why and how Cotton is involved in seemingly everything with RCM’s very own cotton king, LOGIC advisors Ron Lawson.

In this episode, Ron is giving us the low down on how and why he believes it’s not Dr. Copper which acts as the global economic barometer, but how Cotton is the real Canary and leading indicator on global demand. In between those talks, we’re covering all things Cotton including crop insurance, irrigated vs dry land, the scam that was Pima and Egyptian Cotton, the process of cotton – which countries have it, which want it, ginning it, spinning it, dyeing it, global commodity merchant co’s pushing it around, and even micro-plastics, climate change, and how Cotton always flows to the cheapest labor source. Finally, we’re walking in some high Cotton putting Ron in the hot seat. Will we ever get the growth back? Tune in to get these critical hot takes — SEND IT!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].