The Correction Has Begun

Typically, a corrective move is easy to project, but there will always be tension in making that call after last year. There is always the fear of an implosion. Last week, we saw the slowness in the cash market carrying over to the futures market. Numerous factors are weighing on the market today, as mentioned before:

- The high concentration of bulls out there.

- The makeup of the home buyers is getting too speculative.

- The fact that mortgages are up a half-point already and going higher.

All this must be managed when ship times are weeks out and late. Most of the trade took a step back last, allowing the algo to press the futures market.

I hate to repeat it, but we are “all in or all out” regardless of any inventory management model. Today it is all out. The change will come with a futures market showing value or the buying cycle starting up again. There is a lot of pressure today in the futures, but none in cash. With another buy coming, the mills will probably trade around this area for a while. That will illuminate the futures discount at some point. Until then, the algo is in charge.

Let’s Get Technical:

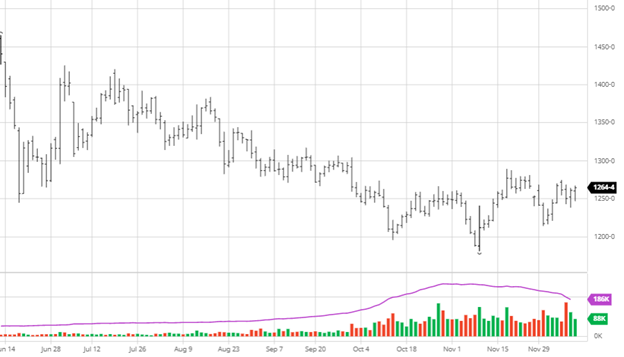

The key focus area is 1,059.95. The 38% retracement of this last move started on November 1. In March, the technical picture took a negative turn this week, breaking out of a channel that began November 1. The bottom of the channel came in at 1,226 last week. The channel is 1,421 to 1,226. The market should rebound to that area on the following buy round, but the significance is that the $1,500 measurements could be out of the game now. A failure of a long-term channel in lumber has indicated a topping market. The technical read is NOT calling a top but has been a good indicator of upside limits.

There is a good pocket of noise in the $1,125 area. Between the discount and that support area, we will see if it slows the algo.

Weekly Round-Up:

The put premiums have exploded; this is where you start to lift 20% of your hedges. That quick increase in premiums also indicates a market that could be blowing off to the downside. The initial read is a market correcting, and with the algo trading, it could end lower than it should be. It also shows that overall volatility is working itself back towards a lumber norm. We’ve been defining a “marketplace” or what we previously called a trading range once the market finds an actual value. Anything over $1,000 is unsustainable but real with the lack of supply. Transportation will continue as a driver for a few months. A off the radar support mechanism is the spread. There is a growing crowd into the March-May spread on the short side. Without a fund roll, that could lead to a buy round in futures.

It is a long way back from a $1338 high. Let’s see how the market acts by midweek.

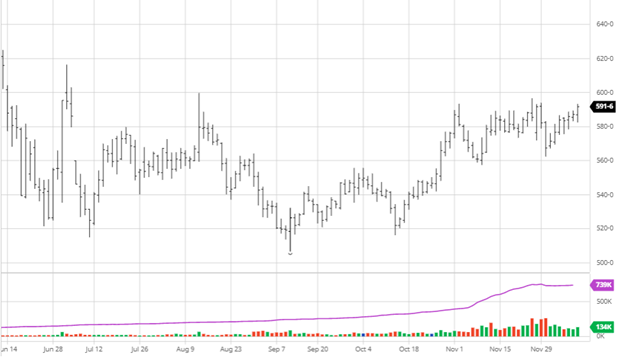

Open Interest and Commitment of Traders

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

23 LUMBER & WOOD PULP OPTIONS 23 Side 01 2022 DAILY INFORMATION BULLETIN – CME Group, Inc.

LUMBER & WOOD PULP OPTIONS 2022 DAILY INFORMATION BULLETIN – http://www.cmegroup.com/dailybulletin

https://www.cftc.gov/dea/futures/other_lf.htm

CFTC Commitments of Traders Long Report – Other (Combined)

This is the viewable version of the most recent release of the Other disaggregated long form futures only commitments report.

About The Leonard Report

The Leonard Lumber Report is a new column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Before You Go…

What’s Driving the Grain Markets Heading into 2022? The 2021 U.S. grain crop has the potential to be one of the largest on record. Where did all the yield come from, what areas were the hardest hit, and why on God’s green earth are grain prices still so high? Watch here or click the video icon below: