Introduction

While producing crops and other commodities is essential, the transportation industry behind the scenes plays a critical role in getting it where it needs to go on time. Whether by truck, railroad, barges, or large over sea vessels, the transport of raw commodities is how the world is fed. Several commodities must be transported in a timely manner relying on a complex supply chain environment. This blog discusses the main areas listed above and their role in feeding the world.

Trucking

According to a report by the USDA titled “The Importance of Highways to U.S. Agriculture,” published in December 2020, the trucking industry plays a pivotal role in the agriculture sector of the United States. Trucks are the primary means of transporting commodities by weight, accounting for 83% of agriculture freight by weight and over 50% of agricultural freight ton-miles.

Although they are typically used for short distances, trucks are essential in the movement of commodities. In fact, even for grains commonly transported by rail and barge over long distances, over 70% of cargo is moved by trucks. This highlights the significant contribution of trucks to the transportation of agricultural goods, particularly for meat, poultry, fish, and seafood, where the truck mode share is greater than 95%. https://www.ttnews.com/articles/trucks-key-movement-agricultural-products-usda-report-finds

While railroads, barges, and other vessels are the preferred method for long-distance transport, almost every commodity touches a truck at some point in the transportation process. The US roads and highways are important in making trucking efficient; as the world progresses, so must the trucking process. As electric trucks and autonomous vehicles gain market share, this will be one way the trucking industry will change in the years to come, as efficiency will be important in feeding the growing world.

Railroad

Railroads cover millions of miles across the US and the world and transport both people and goods to where they need to be. Most agriculture production is done away from the coasts but needs to get there to be exported; this is where rail becomes an important player.

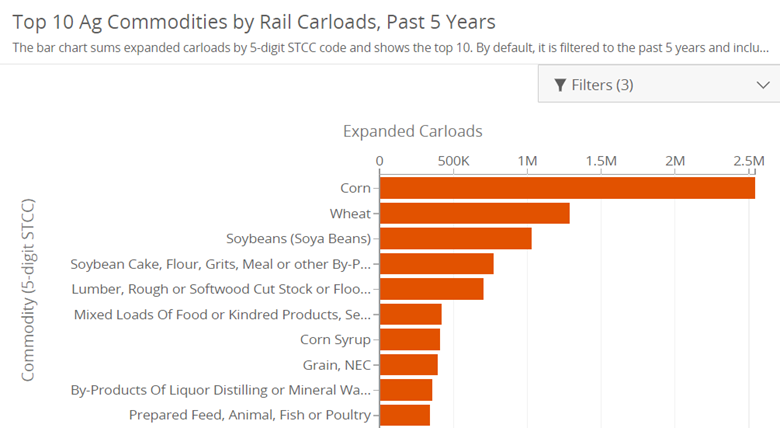

Corn, wheat, and soybeans are the most common farm products shipped via rail. The chart below shows the dispersion of amounts on the rails from 2015-2020.

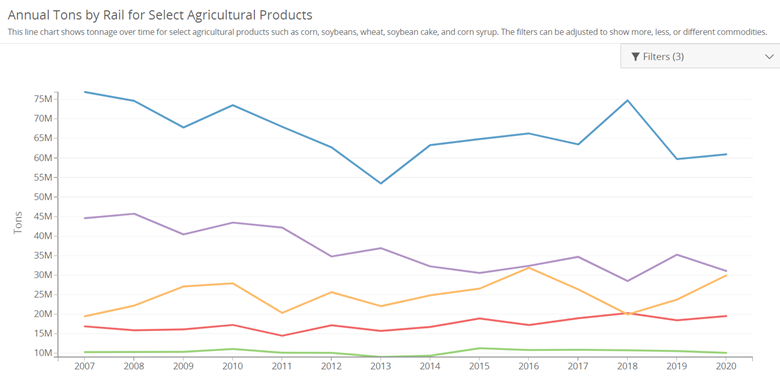

The following chart shows the total tonnage shipped via rail of specific commodities. Clearly, rail freight for corn is monumental in its distribution across the country and world. Corn is used in so many goods, from the gas we put in our car to the food we eat, that getting it where it needs to go in a timely manner is crucial.

While railroads play a significant role in transporting raw farm commodities, it is also a major form of transport for materials used in the energy sector, such as coal and oil. In contrast, the U.S. has an extensive rail system, and part of the infrastructure upgrades over the next couple of decades must improve rail efficiency to handle the increase in production expected.

Barges

When discussing the role of barges, it is important to know the primary waterways that are used: the Mississippi, Illinois, Missouri, and Ohio Rivers. While other rivers below play their own role in the shipping of agricultural products, these rivers’ locations make them crucial to the supply chain.

The rivers and locks system can be complicated during flooding, drought, or maintenance and can disrupt these shipping lanes. While these rivers are not only used for agriculture shipping, but there are also elevators all along these rivers to make the distribution to ports easier. Cities like Los Angeles, New Orleans, Savannah, and New York play a major role in the US exporting grain worldwide.

Like with railroads, continued improvements in the barge infrastructure will be important as the U.S. continues to produce and export more grains as the world grows.

Oversea Vessels

In 2021, the U.S. exported over 60 million metric tons of grain and oilseeds, making it one of the top exporting countries in the world. Most of these exports were transported by sea vessels, with some of the largest ships capable of carrying over 200,000 metric tons of cargo at a time. These vessels provide a cost-effective means of transportation for large volumes of goods over long distances and play a vital role in connecting the U.S. to markets worldwide.

The movement of agricultural commodities via sea vessels has its challenges, however. Issues such as port congestion, container shortages, and weather disruptions can all impact the efficient movement of goods. Additionally, changes in global trade policies or economic conditions can lead to shifts in trade flows and impact the demand for shipping services. Despite these challenges, the use of overseas vessels remains a critical component of the global supply chain and will continue to play a vital role in the transportation of agricultural commodities for years to come.

Contact RCM Ag Services for Your Transportation and Logistics Needs

If you’re looking for reliable and efficient transportation and logistics services for your agricultural commodities, look no further than RCM Ag Services. Our team of experts is dedicated to providing the highest quality services to meet your specific needs and ensure your products are delivered on time and in optimal condition.

Contact us today at [email protected] to learn more about our transportation and logistics solutions and how we can help you streamline your supply chain and increase efficiency. We look forward to working with you and supporting your agricultural operations.