The grains have started to separate themselves from each other as they begin to have their own trades tied to the US growing season coming into view. After last week’s plantings intention report, corn had a couple down days but has climbed back to the post report level heading into Friday’s USDA April report. Corn’s exports this week were better than expected along with news that China may buy up to 80 million bushels into late summer (bullish news for old crop corn). Basis is showing us that supplies are tightening despite the lagging data from the USDA stocks report. Even if Friday’s report does not show this expected change, will the market believe the USDA or the cash market? Brazil’s safrinha crop is under stress as it continues to be dry with no immediate relief which is expected to cause even more damage to a crop that has had its issues coming down the home stretch. Brazil’s corn production according to this week’s CONAB report is still expected to be a record 4.29 billion bushels despite the stress. The US forecast is dry in many areas as early planting looks to be available across multiple regions.

Soybeans had a tough week following last week’s rally post acreage announcement. World vegetable oil prices have been falling and have pulled beans down with it. The markets are trying to figure out how to price beans. ASF in China is still a problem while world demand continues to rise outside of hog feed. US consumer demand coming out of Covid-19 lockdowns has been supportive to bean prices, despite the reopening issues in other parts of the world. Looking at new crop beans, they continue the slow climb higher, as the US crop is expected to play a major role in meeting the post lockdown demand towards the end of 2021. The USDA report on Friday will show the updated stocks and, like corn, soybean demand should be higher than the last report based off continued exports since the last report.

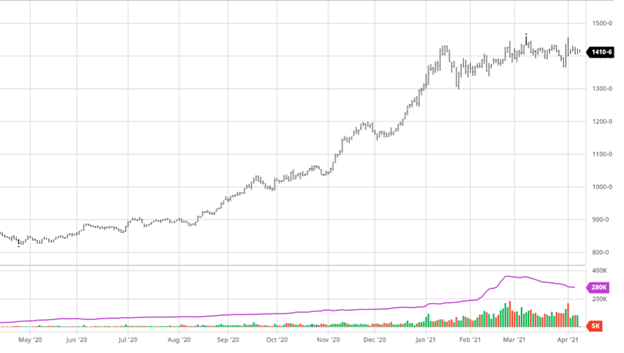

Dow Jones

The Dow gained on the week as interest rate anxiety is calming down and funds reposition themselves away from tech and into more cyclical sectors following tech’s run to end 2020. The Biden administration announced their plan for a $2+ trillion-dollar infrastructure plan this week that covers many different areas. Investors will keep their eye on the implementation of the plan and what sectors will be the best benefactors.

Basis

Cash basis levels in many areas continue to move higher even on days when futures prices rally. The cash market is reminding us that demand is still strong and many farmers have sold most of their old crop, so finding corn and beans is not as easy since farmers have sold with the rally of the last several months.

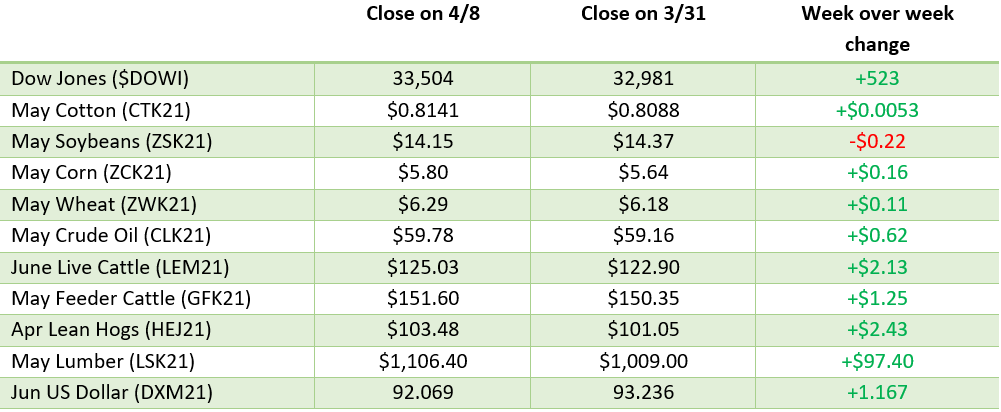

Weekly Prices

Via Barchart.com