Lumber Weekly

Last Week:

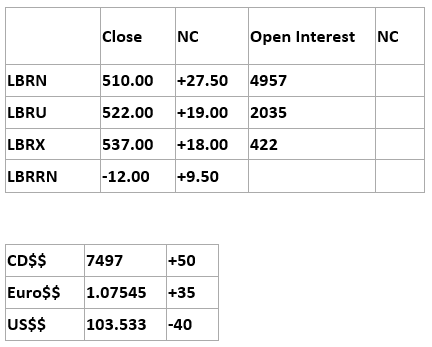

The week was mixed as the futures market gave back half of its rally while cash continued higher. The futures market is in the middle of a rebalancing for the month’s end, so their dynamics are different. What is troublesome in this environment is that while the spread works, the second month gets clobbered. The risk management selling is in the next month. Also, the futures correctly projected a slowing cash market. Today, a slowing cash market doesn’t indicate lower prices. The futures will be the one making the new lows if all remains the same.

Factors:

The current trade is all about economic outlooks. No one is complaining about sales. The problem lies in the fact that there is no follow-through. The industry will not add to inventories and that is based on their projects. That won’t change anytime soon. The buy side will only step in when forced. The sell side is always $20 too high. There are bands established, but that isn’t anyone’s focus at this time.

Thought:

As we finish the third quarter many are starting to realize that covid aberration is behind us and we are back to a grind market fighting for dollars. The difference, I believe, is the ability for the market to go up. Just last 8 months ago the futures were trading at $627 mill. A complacent marketplace will cause strong rallies. My fear today is that we have to make a new low to make a new high…

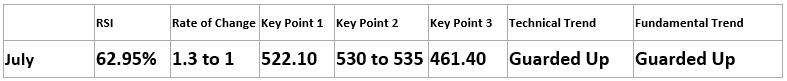

Technical:

Where did the bull market go? Now that we are back in the $35/$70 mode again the 100-day moving average is the focal point. It traded back and forth on it only to fall apart by Friday. Thursday, the stochastics started to turn, as did the longs wishful thinking. The psychology of the market is not to get caught long and last week’s trade highlights that concept. Exiting and rolling could weigh on November next week.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636