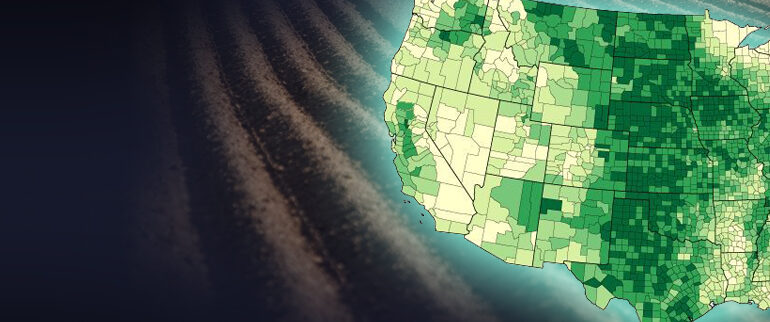

Corn had a choppy week only to end $0.09 lower after last week’s shockingly bullish USDA report. The main price mover this week was the uncertainty in the weather outlook. The weather post July 15th has been in limbo of hot and dry or cooler with some rain. Hot and dry would hurt the crop for the long run lowering yield, which is when we saw the prices rise on certain days. The post July 15th to August 1st period is very important to keep an eye on moving forward as the weather will be the key mover and the August 10th USDA report is worth keeping an eye on. The eastern corn belt looks to have extreme heat and dryness over the next week after a round of rain earlier this week…but let’s be honest, the weather man is only right 10% of the time = changes to the forecast are expected and prices will react.

“Supply side for corn ad beans adjusted due to the changes in planted area, so nothing too exciting there. But corn demand got cut quite a bit. Even so, the ending stocks are below trade expectations,” Scoville says (agriculture.com)

Soybeans had a similar week to corn with some up and down price movement after the rally last week. The hotter and drier outlook in parts of the Midwest will have an adverse effect on the crop like it will for corn. The lack of sales to China is are still holding back the market as Phase 1 continues to trail behind trade goals. Like corn, keep an eye on weather moving forward but as mentioned before. And big purchases from China would be a promising sign, but it doesn’t seem like that’s bound to happen any time soon:

Meanwhile, trade relations between the U.S. and China remain relatively frosty. President Donald Trump noted earlier today that relations are “severely damaged” after each has accused the other of mishandling the coronavirus pandemic. Trump indicated a planned phase-two trade agreement is still on the table but is not a priority right now. (farmprogress.com)

Wheat got a boost this week (+$0.42) as Russia and Europe’s wheat crops look to come in well below pre-harvest estimates. Low harvest numbers from the rest of the world is bullish for U.S. wheat prices as our growing season continues. This boost is very welcome following the last few months of declining prices. The markets will keep an eye on Russia and Europe as they progress through harvest.

Via Barchart

Dow Jones

The Dow continues to move on any news related to COVID-19. A lot of uncertainty hangs over the U.S. and the markets as spikes in cases continues around the country. An important thing to keep an eye on for the markets will be what schools decide to do in the fall, as going back to school is being used as a tool to also try and continue to reopen the economy.

Lumber

September lumber futures reached a multi-year high this week and are now up +82% from their April multi-year low. The best way to sum up the market place is by watching it print. It was up $48 – $498 since Wednesday. There isn’t enough wood to supply the needs, and mills are raising prices at will. It is a market squeeze that only ends once the pipeline is filling or prices shut down purchase order books.