In 1984, Wendy’s debuted their iconic “Where’s the Beef?” commercial, starring Clara Peller as an old lady demanding more beef on her hamburger. Fast forward 36-years, and Wendy’s is once again asking, “Where’s the beef?”, but this time it’s about the literal beef…. Last week, a survey of online menus revealed 18% of the Wendy’s franchise listed beef items as out of stock – and if the largest fast food chains are being affected by lack of supply, what about your local stores?

The American meat industry is the envy of the world and has evolved over the past few decades into the most productive and efficient system in the world and because of that, consumers give little thought to how meat is produced until their abundant supplies of steaks, burgers and bacon are suddenly at risk. Unfortunately, the structure that delivers so much culinary and economic benefit to American consumers has proven vulnerable to a once in a life-time pandemic.

COVID-19 has infiltrated America’s meatpacking plants causing them to slow processing speeds, or close all-together, and logistically it makes sense. Converting livestock into the cuts that get to your plate requires massive facilities, intensive labor, and working in tight quarters which makes it difficult, if not impossible, to control the spread of a contagious disease. Without the ability to “socially distance”, thousands of plant workers have become ill, some have died, while many others are too afraid to go to work. The repercussions of the Covid-19-related plant disruptions will impact our food system for years to come. Once the smoke clears, owners of large meat packing plants may look to create smaller, regional facilities meaning consumers can expect higher prices, and fewer choices in the coming weeks and months.

Short-term Repercussions

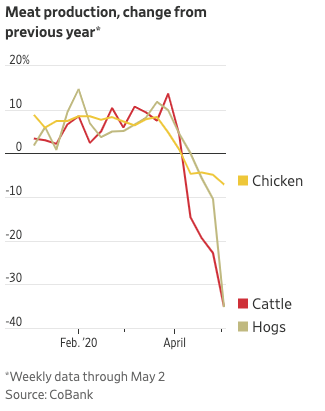

In the short-term, slaughter rates have plunged; the number of cattle and hogs slaughtered weekly fell by as much as 40% compared with the same period last year before recovering modestly. For the week ending May 9, hog slaughter was 1,775,000, down from 2,332,000 last year. (USDA)

(WSJ)

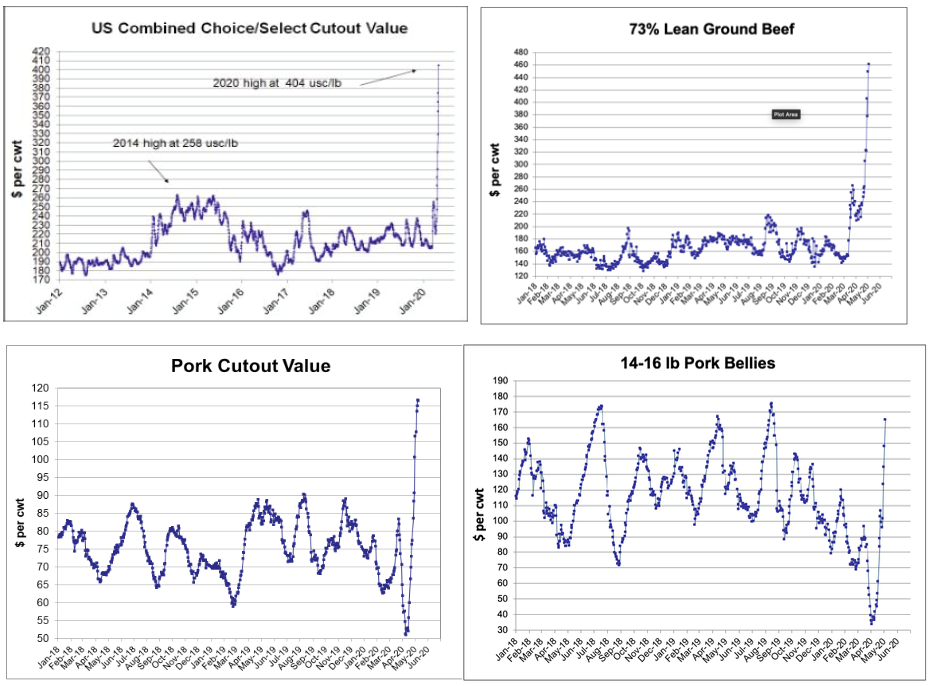

The sudden drop in slaughter punched a gaping hole in meat supplies which caught end-users off guard, as risk models could not have predicted the Covid-19 Black Swan event. Wholesale beef and pork prices skyrocketed as fast food chains and retailers scrambled to secure supplies: pork bellies priced near $30 cwt at the end of April, traded as much as 600% higher near $220 cwt, and 73% lean ground beef is up more than 330%. There’s no doubt substitution is occurring, but if you’re Wendy’s and your business is selling hamburgers, there is no substitution for ground beef – you either pay up or close your stores.

(USDA)

Long-Term Repercussions

The long-term impact on supplies is evolving. Plant disruptions are leaving a large number of producers without a destination for their livestock, leading to a steep drop in hog and cattle prices. Out of necessity, animals are being kept on feed longer, and fed slow-grow rations, but bottlenecks are backing up an extraordinary number of animals.

Out of sheer desperation, some farmers are being forced to destroy market-ready animals that have grown too large for modern slaughterhouses to manage. On-farm capacity is also a problem, because finished animals cannot be pushed through the processing system to make space for incoming feeder stock. In addition to putting down market ready animals, chaos in the supply chain is causing farmers to liquidate breeding stock, abort sows and euthanize piglets. The result of this activity will be a tightening supply of animals going forward. Expectations are for hog and cattle slaughter to remain in a pandemic driven slow-down, 15%-20% below kill capacity, for the remainder of 2020.

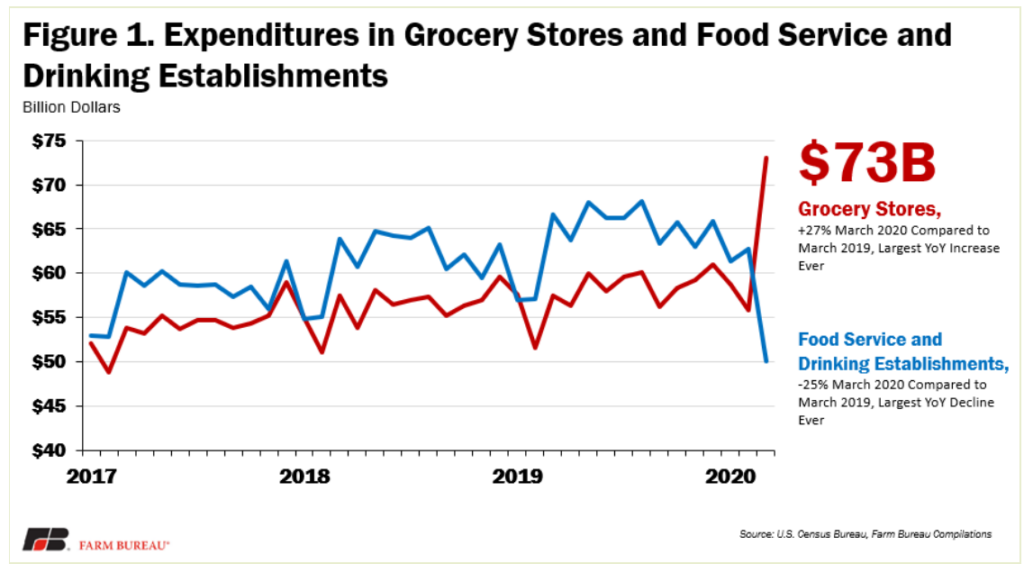

At the end of the day, we are moving from an oversupply of meat in the U.S. to a period of a persistent undersupply – and the severity of that will be determined by how well the Covid-19 situation is managed. The Covid-19 disruption to the food service industry will continue to be a drag on the meat markets, but thankfully, grocery and retail is picking up some of the slack.

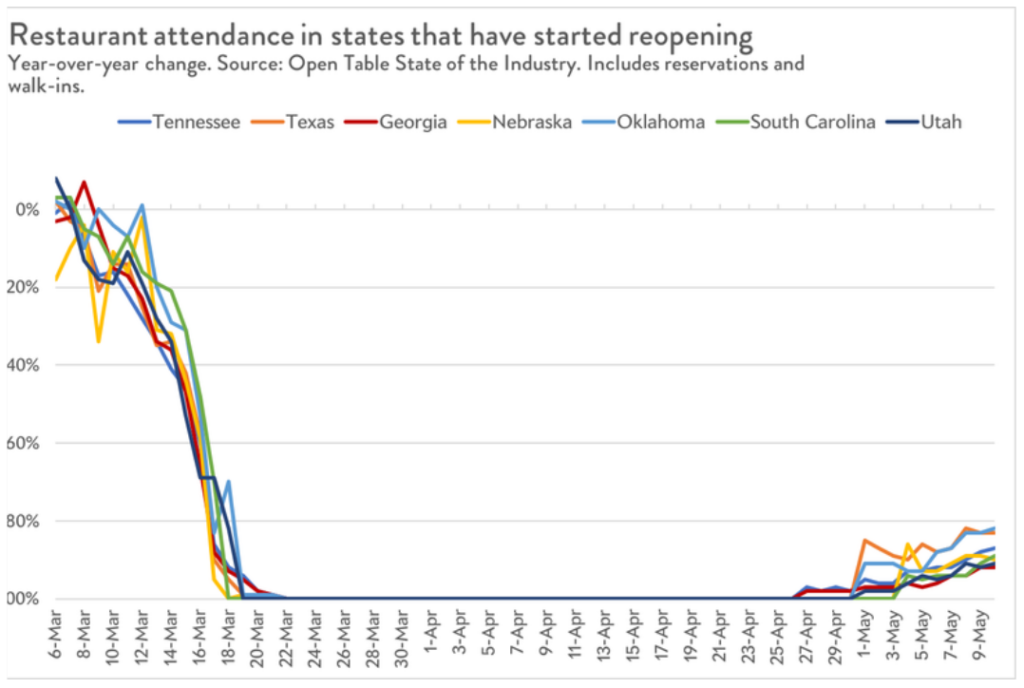

(Slate)

(Slate)

The Covid-19 threat to the food supply chain is a global phenomenon, and not isolated to the U.S. In the big picture, supplies globally are shrinking and there remains a historic global protein deficit as a result of African Swine Flu. With some states domestically and countries abroad opening back up, there is slight hope that the demand will come a little closer to meeting the production of meat, but how long it will take to fully recover is only a guessing game.

PS: don’t forget to check out RCM’s ‘What Moves Commodity Markets’ infographic.