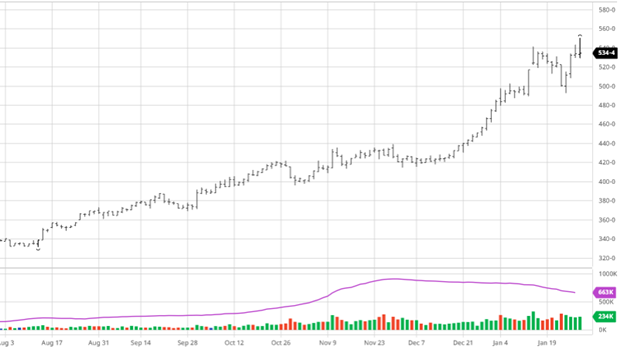

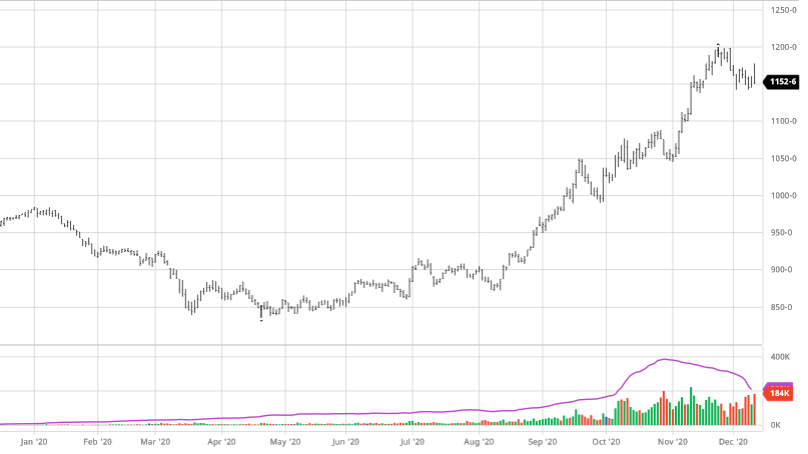

Corn gained on the week as South America has had issues with their first harvest and the continued wet conditions delaying it in north and central Brazil. Huge exports this week to China and other strong ones to accompany it were very welcome to see. A total of 293 million bushels, a weekly record, was the good news the bulls needed. It is easy to get in a lull where you expect these exports at this point with the past few months of demand but whenever they come in above or at the high end of expectations it is what is needed to keep the momentum. Funds continue to be long close to 2 billion bushels, so like beans the daily volatility may stick around. Continued exports and continued delay of Brazil’s harvest will be the bullish news under the market going into the USDA report on Tuesday that could throw some surprises at us – there is one thing we know for sure it is the USDA is full of surprises (both good and bad).

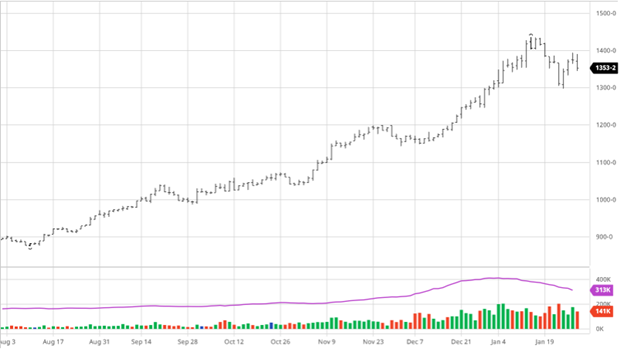

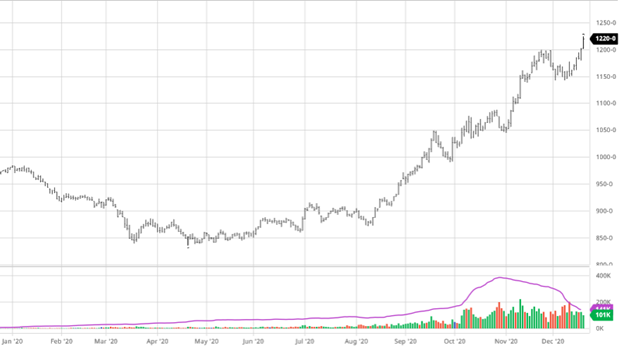

Soybeans rebounded this week as the markets were not as volatile as the previous couple of weeks. South America got some welcome rain in parts of Argentina and looks to remain hot and dry for the near future. The wetness in Brazil delaying their first corn harvest does not have much of an impact on soybeans, but as we know any big news for one of them will still have a ripple effect. Funds continue to be long as they entered the week long 820 MBU. As mentioned last week when funds decide to take profits, we may see price volatility in stretches. Good exports this week continued as we see consistent demand from China. As beans have been range bound the last 2 weeks relative to the past few months there has been end user buying dips below $13.50 to provide some support.

Cotton got a strong bounce on Thursday after trading relatively flat for the week. This week’s exports were strong with cotton going to 18 destinations. Overseas mills demand has stayed consistent and will continue to be the driving force behind cotton. With all the cotton that has been sold it is not hard to imagine that there will be a supply squeeze here in the US that will continue to drive prices higher as well. The supply squeeze will come as demand remains high; however, at some point we will begin to run out of cotton to export if current pace keeps up. Outside political pressure on China and their accused human rights abuses continue to cause them troubles exporting cotton which has helped the US. As great as cotton’s run has been it still is well below where it needs to be to be competitive with grains. For this reason, cotton acres are expected to fall over 500,000 acres to 11.5MA which would be supportive for new crop cotton as we head into the spring, but will we get a rally before then to keep those acres? The demand is there so it may be a last-minute decision for some farmers.

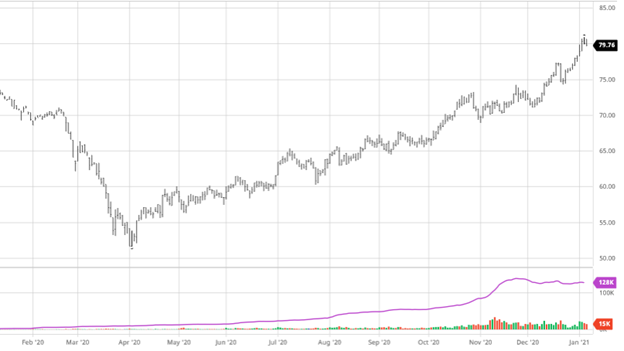

Dow Jones

The Dow gained this week and traded to new contract highs as market volatility has slowed down following the short squeeze drama of the last week. Covid-19 cases in the US have been trending lower for new daily cases along with vaccines continuing to roll are both great news. It is also earnings season so there has been lots of news both supportive and negative for many companies as any positive COVID-19 news seems to be the biggest overall market mover.

Insurance

Remember that this month is important for revenue-based insurance averages so it will be important to keep an eye on the markets even if you do not plan on making any sales. As of the close on 2/4 the price for corn is $4.4937 and soybeans are $11.5525.

February USDA Report

Reminder to keep an eye on the USDA report on Tuesday the 9th. This report historically has not contained as many surprises but with the recent Chinese demand we may see another update of the expected ending stocks and exports. We are expecting Tuesday’s report to be a market mover.

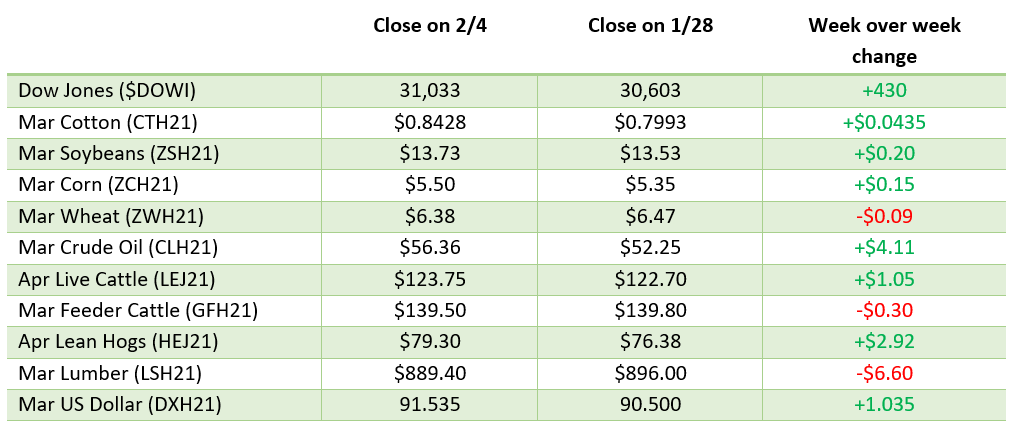

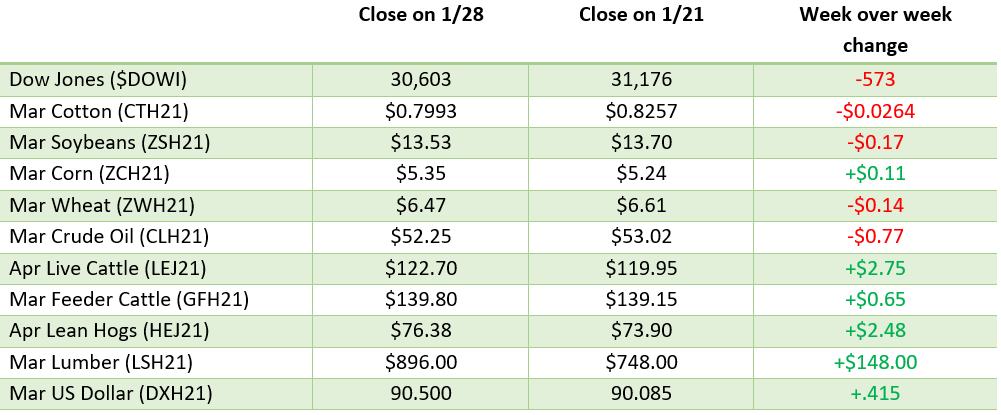

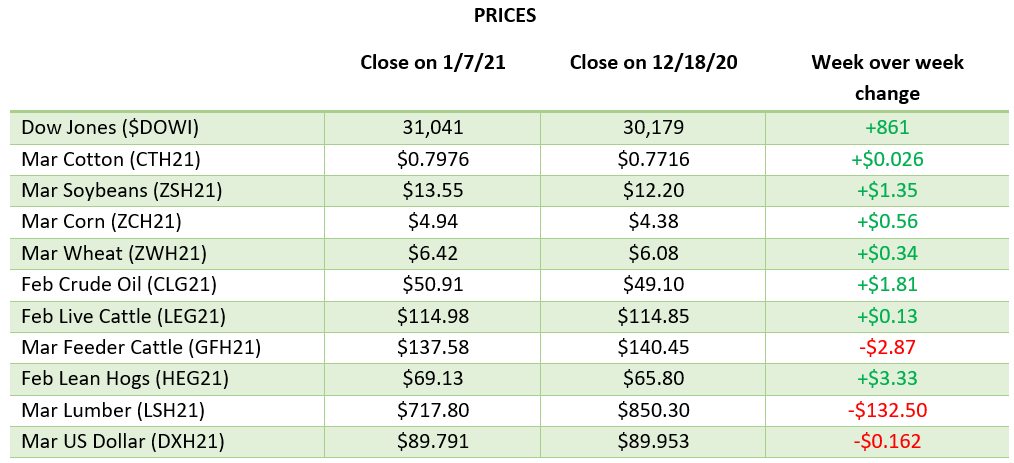

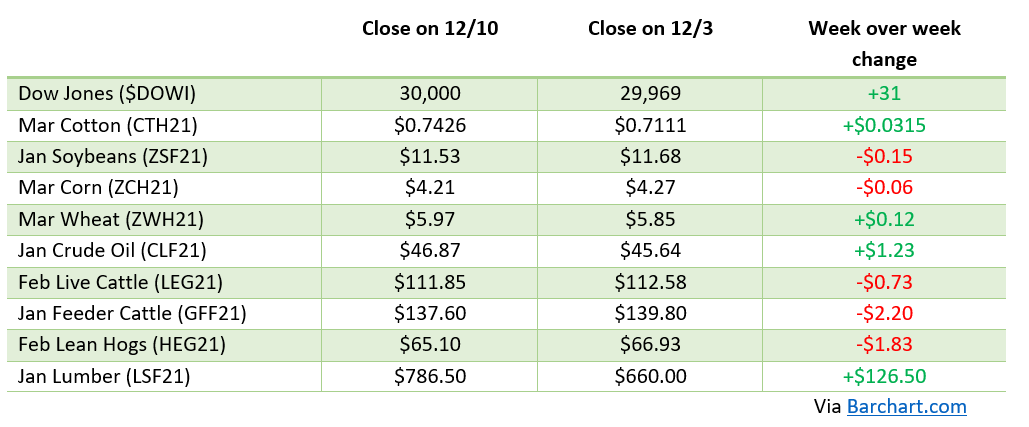

Weekly Prices

Via Barchart.com

,

,