HARVEST MARKET UPDATES: JANUARY 16-22

Corn was pretty flat on the week dropping only 1 cent in the March contract. As the weather in South America had no surprises and exports continued at a good pace there was not much to move the market overall despite a couple volatile days mixed in there. The underlying fundamentals did not change and the swings were brought on moslty from the managed money side. There was some rain over last week and some added to Argentina looking out a couple weeks but as we know weather that far out is hard to predict. IHS Markit updated their projected acres for 2021 to 94.2 million which is 3.4 million above the 2020 acreage. This would definitely be bearish new crop corn (Dec ’21) prices but there is a long way to go to be able to actually plant that many acres. After corn’s run up it is hard to tell if this week was a needed pause to asses where we are or a top. If you have not thought about marketing your ’21 crop yet we highly suggest coming up with a plan now as this run up in prices may not last forever and you do not want to miss out on profitable selling opportunities (see where we were this time in 2020 vs where we were May-Aug). The pullback may continue as funds begin offloading contracts but exports this week were strong so the fundamentals remain supportive.

Soybeans took it on the chin this week for their first sizeable pullback since early December. The underlying fundamentals, like corn, have not changed in the last week. Most of the pullback came from follow through selling by speculative funds. The loses were greater this week before bouncing back as the intraday low on Wednesday was $13.52. IHS Markit projected US soybean acreage for 2021 to be 90.1 million which would be 7 million more than 2020. This is a bearish number if it is realized but is also not surprising when bean prices right now make them very attractive. Brazil’s crop keeps shrinking but they also planted the most acres ever this year, so they are still on track for a near record crop. Everyone will keep a close eye on South American production as the influence on our prices continues. If you still have beans and have not sold during the rally thinking they are going higher we suggest selling the physical and consider a re-ownership on paper strategy if you want to be long. Prices kept falling on Friday as funds continue to liquidate despite strong exports. When funds are as long as they have been we expected them to take profit at some point but it will need to slow down for the bullish fundamental news to direct the market again.

Cotton had a solid boost this week as the bullish trend keeps on rolling. A weak dollar, as mentioned before, has been very supportive of commodities in general but especially cotton. As demand around the world ramps back up cotton has benefited from international demand, from countries like China, as they are coming out of the pandemic. With this world demand there are shipping concerns as Covid continues to be a problem in the US as ports struggle to contain breakouts. Ultimately when there are bottlenecks in the supply chain it frustrates everyone but will pinch balance sheets for end users when they pay more to get the cotton delivered.

Dow Jones

The Dow gained on the week with Joe Biden’s inauguration coming and going without incident. As investors start to get a better idea of what the Biden administration will look like and what they look to do with regulation and taxes the next month will be important for investors. Most analysts are bullish looking at 2021 as vaccine distribution continues to roll out and we begin to look at the world after lockdowns from Covid are no longer needed. One thing that Biden has made apparent is he wants to switch towards cleaner energy throughout the country and already halted the Keystone Pipeline construction on day 1.

USDA Report

The RCM Ag team had a roundtable discussion following last week’s USDA report on our new podcast, The Hedged Edge. Here are the links to view/listen to it on your platform of choice.

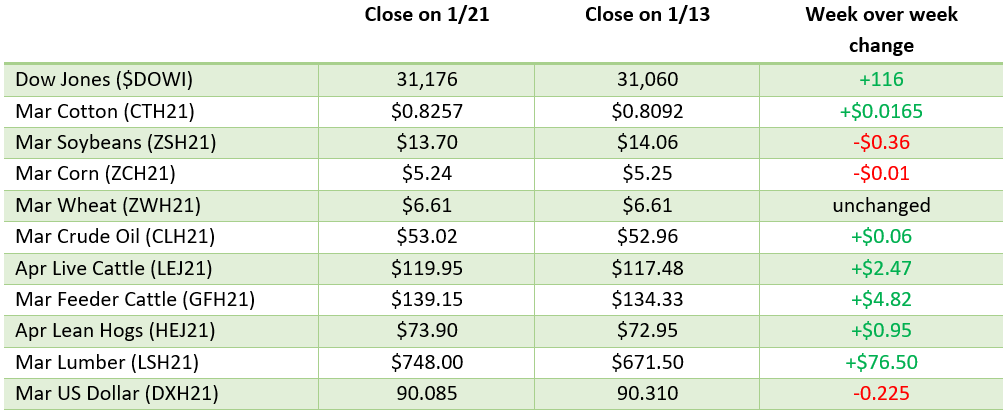

Weekly Prices

Via Barchart