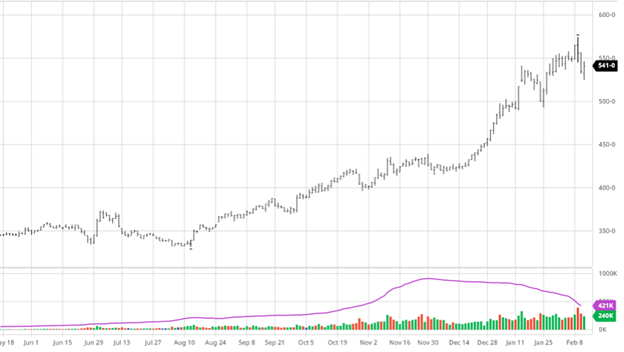

Corn lost on the week following dissapointing numbers in the February USDA WASDE Report. Despite the big losses on Tuesday and Wednesday following the report a modest bounce was seen Thursday to give the bulls a little sigh of relief. As we have seen with previous dips there has been buying after the dips that help support the market. The big surprise in the report was US corn ending stocks number being over 100 million bushels higher than trade expectations at 1.502 billion bushels. They did lower them from the January report of 1.552 BBU but not near as much as expected. The world carryout was was also bearish with the USDA raising world carryout to 286.53 million metric tonnes, a raise of 2.7 mmt, and well above trade estimates. The bullish news was that Chinese imoprt expectations increased by 256 million bushels but the US export total was only increased 50 million bushels. With this bearish news funds also began to offload some of their long positions adding fuel to the fire. You should also not expect any news to come out of China as they head into their Lunar New Year so buying from China will be slow. Parts of Argentina that have gotten needed rain may have received more help than expected on their crops as some predict it helped more than anticipated. The positive day on Thursday to stop the bleeding was important for the bulls but how the week ends will be important.

Via Barchart.com

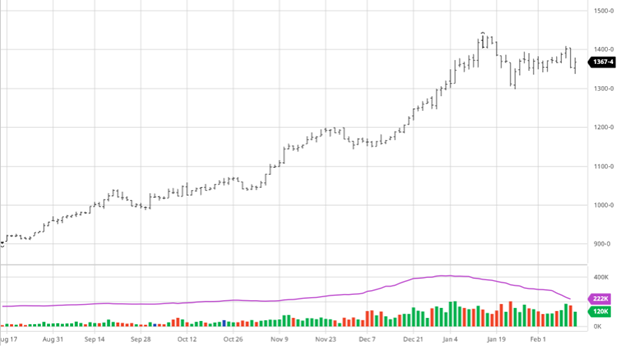

Soybeans were lower this week as the bearish news in the report for corn moved triggered a broad based sell off at the Board of Trade. Beans took it on the chin Wednesday as fund selling led the way. Despite a neutral report on the beans side, when funds decide to take profit they are the market mover. New export offers from Brazil were part of drawback as they were 40 cents below the US market and that collapse brought the US to about even. The USDA report showed that the US cannot export any more than about 250 million bushels the rest of the marketing year before bins are empty. CONAB released supportive bean crop estimates on Thursday coming in just above 133 million metric tonnes. The tightness of world stocks is on every traders mind and likely what has caused the markets to jump around – While 100 million additional bushels is only 1% of the 10 billion bushels produced any and all changes to production are being watched. The volatility of the past few weeks is best displayed on the visual daily ranges in the chart below.

Via Barchart.com

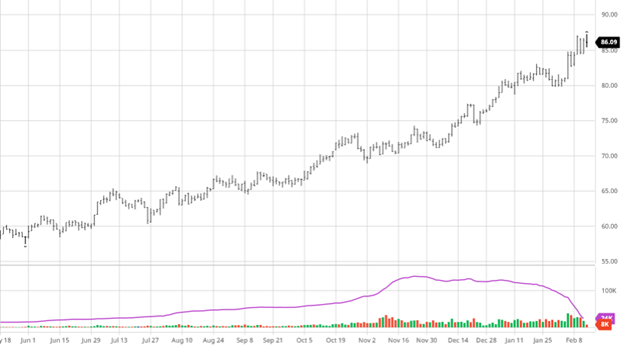

Cotton once again saw a big week of gains as demand around the world continues. Exports were strong this week with Vietnam, Turkey and China being the biggest buyers. The National Cotton Council’s planted acreage estimates came out this week with the following:

The NCC sees Upland acreage down 4.9% Y-O-Y, at 11.3mm acres. Pima acreage is seen down 20.7%, to 161,000. Overall, this imputes a 5.2% decline to 11.5mm acres. (CottonGrower.com)

With only 4 trading days next week, On-Call sales basis the March contract, will have to be fixed (bought) by the Mills before Friday, ahead of First Notice Day on Monday, Feb 22. The loss of acres was expected with soybeans and corn being very attractive in price vs cotton currently. If cotton can continue its run up it may be able to gain some acres back but this recent run will need to continue. West Texas continues to be extremely dry and will need some moisture heading into the spring.

Via Barchart.com

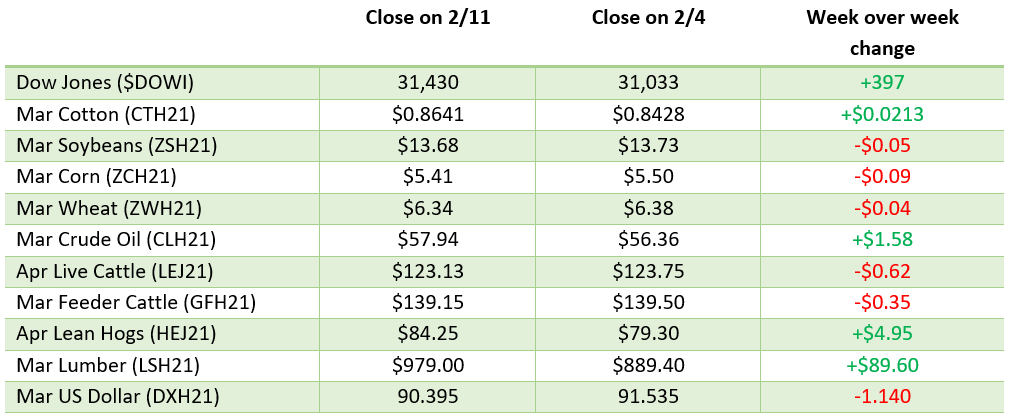

Dow Jones

The Dow gained this week as supportive news from vaccines and the continued drop in Covid cases around the US. As many investors remain bullish looking at 2021 it is important to note that we still have a long way to get out of the storm that has been the last year.

Wheat

Wheat has been in a sideways trade the last few weeks and looks to continue. There was no big news in the report that caused any knee jerk reaction in the market as it followed beans and corn lower on the week.

Insurance

Remember that this month is important for revenue-based insurance averages so it will be important to keep an eye on the markets even if you do not plan on making any sales. As of the close on 2/11 the price for corn is $4.5141 and soybeans are $11.645.

Via Barchart.com