Recap:

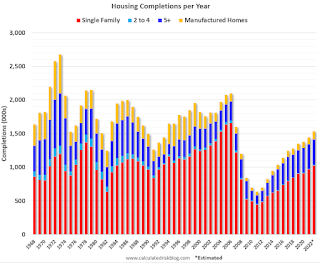

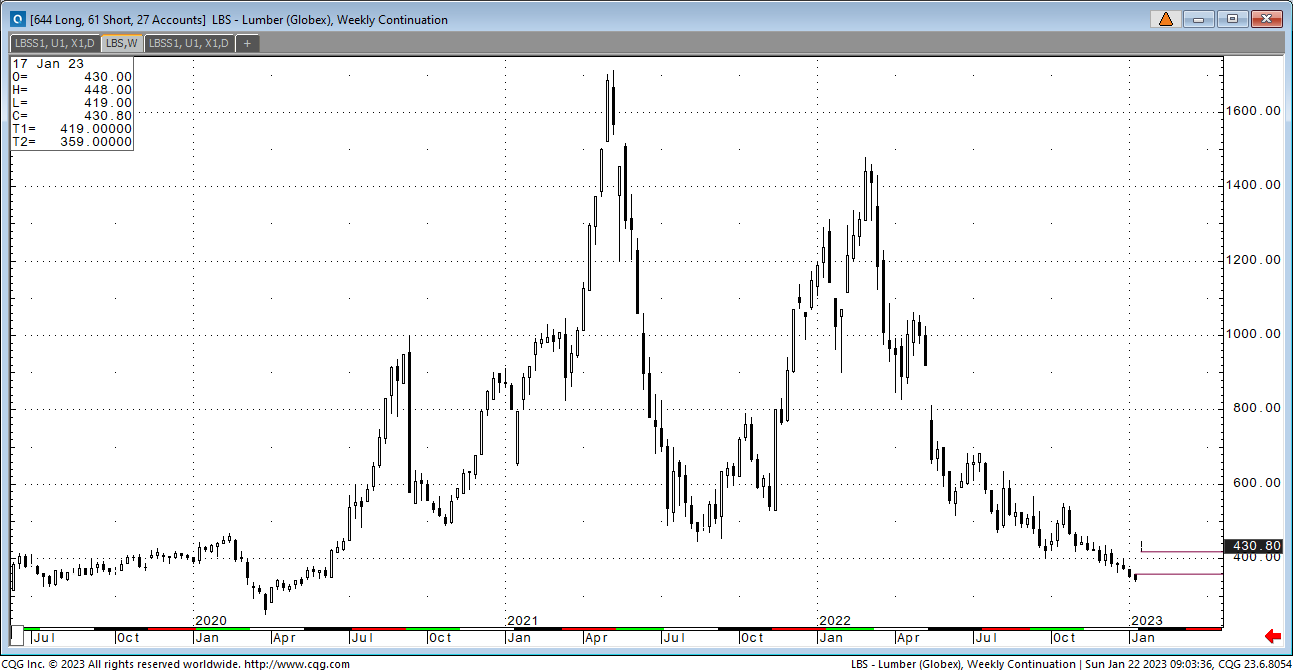

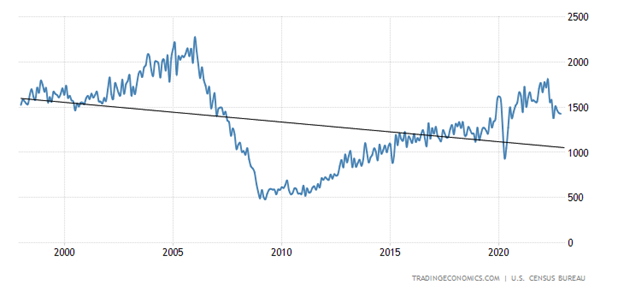

How bad should bad look? We are coming up on one year since the Fed began to raise rates and slow the economy. The effects on the housing industry have been drastic. Starts topped at 1805 last April and dropped to 1309 by last month. The price of the commodity has dropped from the $1000 level to $370 during the same period. The Fed has done its job in this sector. I go back to my question of is this bad going to worse or bad to better? Looking at the futures trade so far in 23 I’m starting to see the possibility of the bad to worse scenario not because of lower prices or less construction but because of a flat market. The most pain would be caused by a $400 market for months on end. That is a no volatility environment at a below breakeven price. That is where the Fed would like us to be. There have been two rallies this year so far. The first was started and driven by fund liquidation. The cash market was underbought but took itself to overbought in days. It was a futures driven rally not an uptick in demand. This last rally of $50 was more of the same in futures as the final group of short funds liquidated. This has become a stagnant market. The housing market has correctly reacted to the Fed’s policies. It has stopped the bubble. The Fed will keep it that way.

The lumber market is commodity driven and that gives it two dynamics demand (which is being controlled) and supply. The panic we saw in January was the supply siders buying up the market. There is too much recent history not to create a panic. The producer side is trying to curb excess supply. That is a very difficult maneuver when mill operations have multifunctional reaches and cash flow. What I do know is that production control leads to a hard bottom. It doesn’t slow down before demand picks up. The supply question is and will cause volatility.

Another point that was brought to my attention last week was industry makeup. We talk about the covid effect on the housing industry as being a “one of a kind event.” While I do agree with that fact, I have to add that on September 12th, 2001, things were looking very bad and in 2009 worse. What I realized last week was that a high percentage of the decision makers in our industry today where not in the business in 2009 or 2001. The movement today is what has been successful over the last 5 years or so. Do we overreact or under react?

I’ll finish with the funds. As of February 7th, the funds had a little over 600 longs and 200 shorts. For a two-week period in January the short fund took their 1950 contracts and a ton of money and went home. That was expected, but not over such a short period of time. As we are trying to establish a trading range in futures, I don’t think the January run is one to look at since it was driven by the funds. Better defined bounces are needed.

Technical:

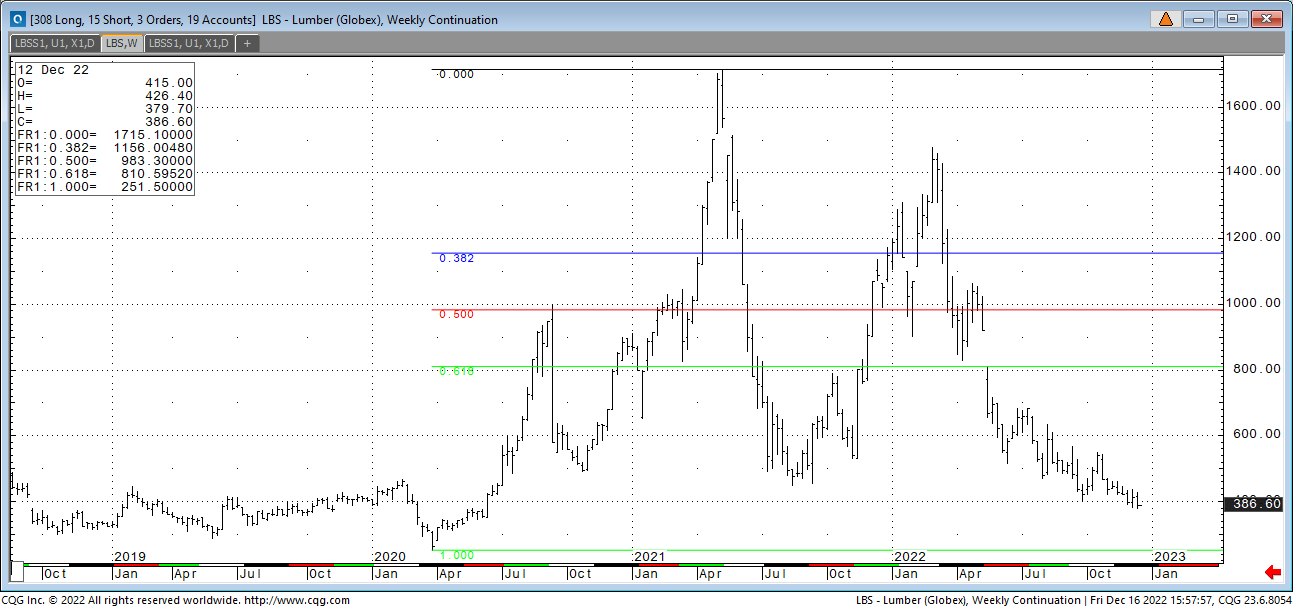

The technical picture is in the process of developing a fan like model. If we keep it simple the midpoint of the fan sits at 356.55 on the weekly chart. That line goes back to the beginning of the Fed action. This week it is support. If the market can hold that trend line the next measurements will be higher ectara. It spreads out in a fan pattern. If this is a correct model, it shows the timeline between steps as being very long. The next line comes in as resistance at $509. Again, this process would be long and drawn out. Most would rather the market just to blow through the points and spike higher. That really is the risk in today’s market. An unexpected and unwarranted run-up hurting those with jobs. Put a fence around your risk!!

NEW CONTRACT:

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636