THE LEONARD LUMBER REPORT: The liquidity issue in the marketplace seems to be getting worse not better

Weekly Lumber Recap

12/18/22

Happy Holidays!!

The liquidity issue in the marketplace seems to be getting worse not better. At this point in the cycle, we should start to see a few green shoots. None were to be found last week as futures hit a new low on Friday. The outside markets are having a bigger than normal effect on our trade. Mostly due to the lack of news here. I’m confident that overall production on January 1st. will be less than the amount produced December 1st. The market seems to agree but throws in the fact that there will also be less homes starting on January 1 than started on December 1. The question becomes of how long the drifting lower will remain in place.

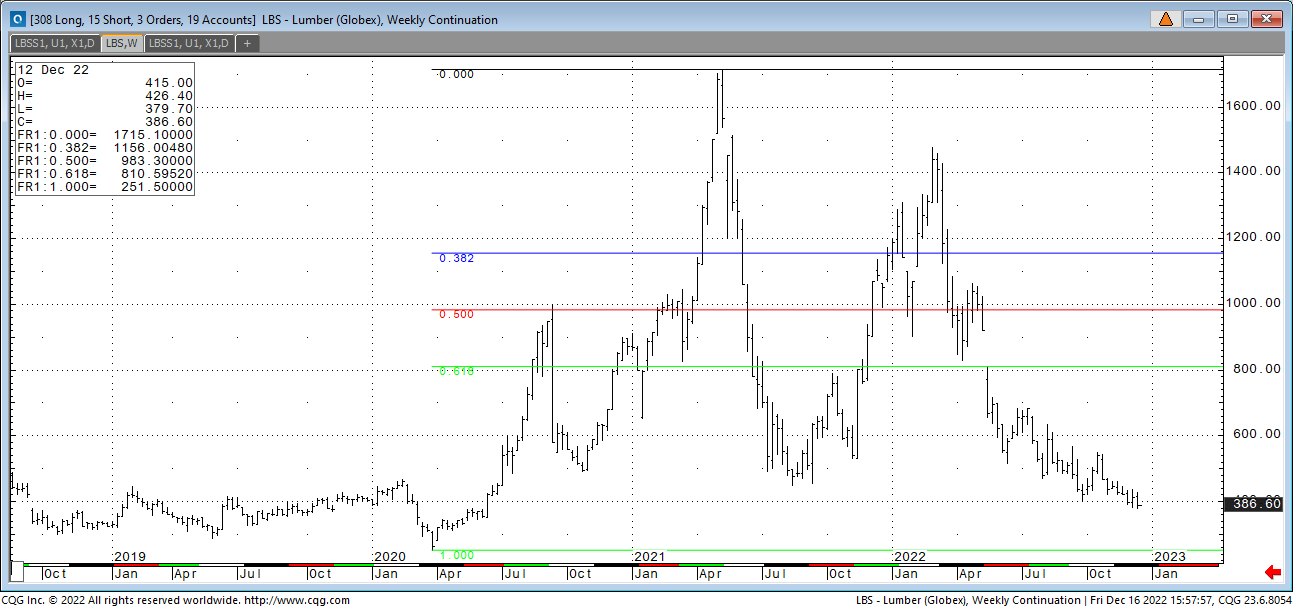

Look at the chart below. It has a Fibonacci measurement from the contract low during covid to the highs in 2021. Look to the left and 2019. The sideways price channel for the year was developed with an average of 1.29 starts. If that is the number, we are looking for 2023 then a sideways trade for a year could be expected. I’m not sure if that will develop but it does look like the current futures market wants to test that theory. I’m in the camp that next year will be somewhat subdued, but at a higher level. Next week will be more of the same unless the short funds start to cover. It hasn’t shown up yet so that is even a limited wish.

NEW CONTRACT:

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636