The Lumber Market:

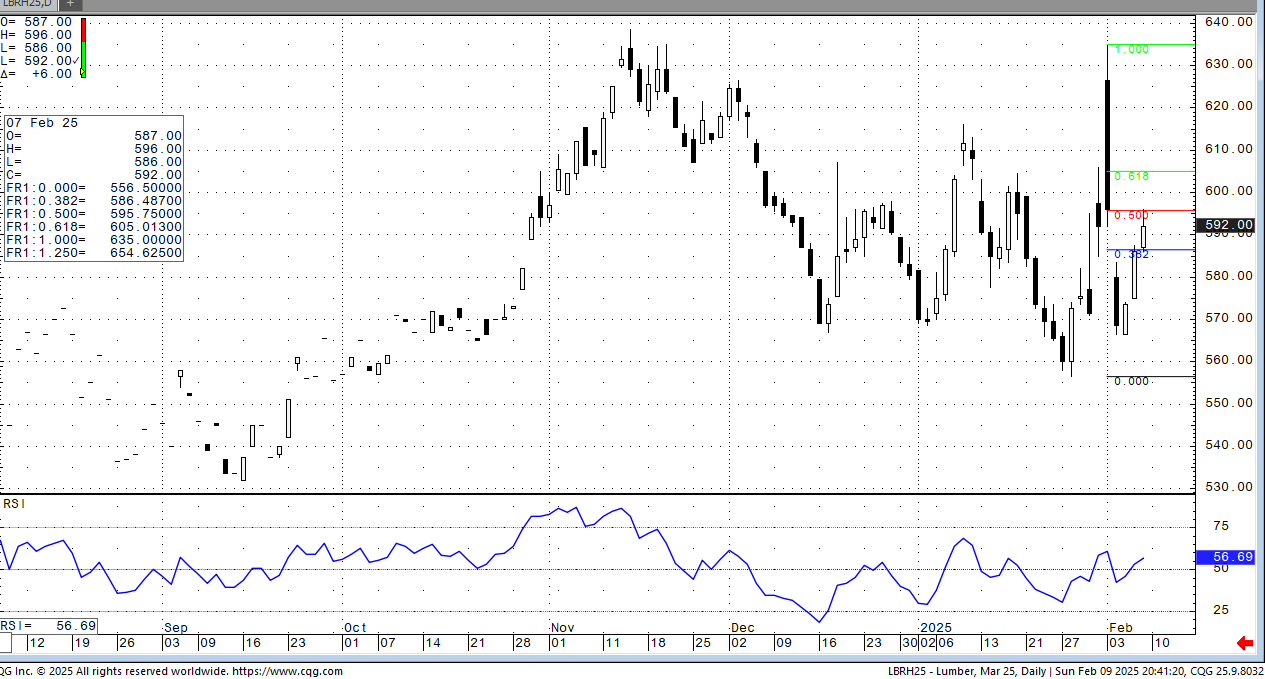

It was a good week for July futures as the cash attempt to bottom helped support it. July’s struggle today is its premium to cash. While there is a good amount of time left, the month can only get so far away from it. Futures tend to carry about a $30 premium to cash early in the cycle. It has been much greater in the recent past, but today’s appetite for risk is limited. The producer side of the industry will again try to rein in supply. Over the years they have not been able to limit supply to slow a bear market. Only when demand picked up where they able to gain back control. It is the same today. It wasn’t a week ago that the wholesalers were playing hot potato with cars of lumber. Like it or not, that is our real time view of the market. As I said before, one distressed widget looks like a thousand when you can’t get rid of it.

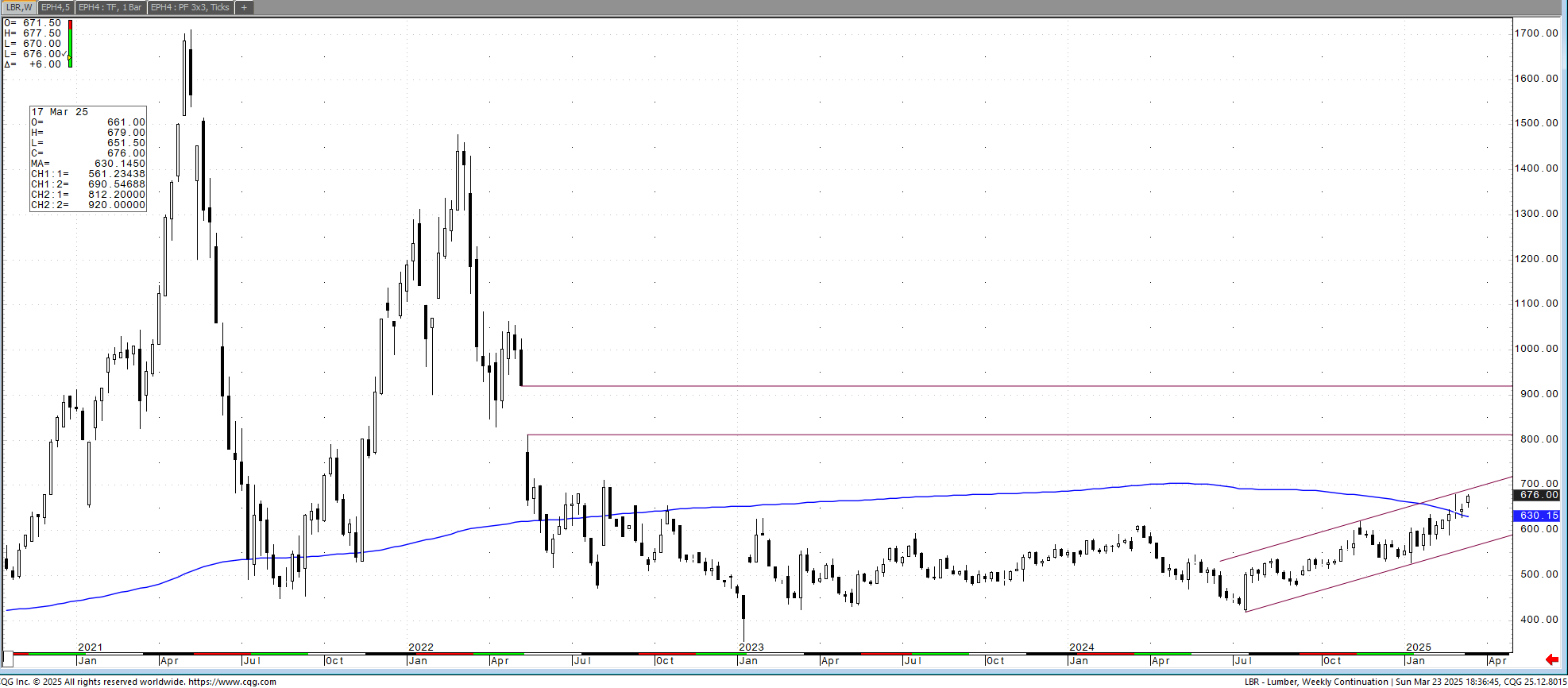

Monday, we come in no longer worried about the May expiration and more confidence that the lone widget is gone. We also come in with both the industry and the funds building their positions. The industry jumped their long position to 4575 up 504. The funds increased their short position to 3863 up1103. Now that was as of Tuesday, but the total open interest didn’t move much during our drama filled May expiration. With the industry longs, are those forward buys or speculative? Forward buys mean a better future. Speculation means a lot of selling at some point. The funds, well it is more defined. They will roll their longs at the end of the month and then roll their shorts two weeks later. It is like clockwork. The other thing that now comes into play is the trigger to force the short funds out. Yes, that is a thing. The 200-day moving average is 617.10. That sometimes is the point to start exiting, but it is so early to see them exit on this one.

Futures are not a perfect scientific data set, but it is the best source of price discovery. The May $93 spike is a good example of issues. The guy who sold it has to be a great trader.

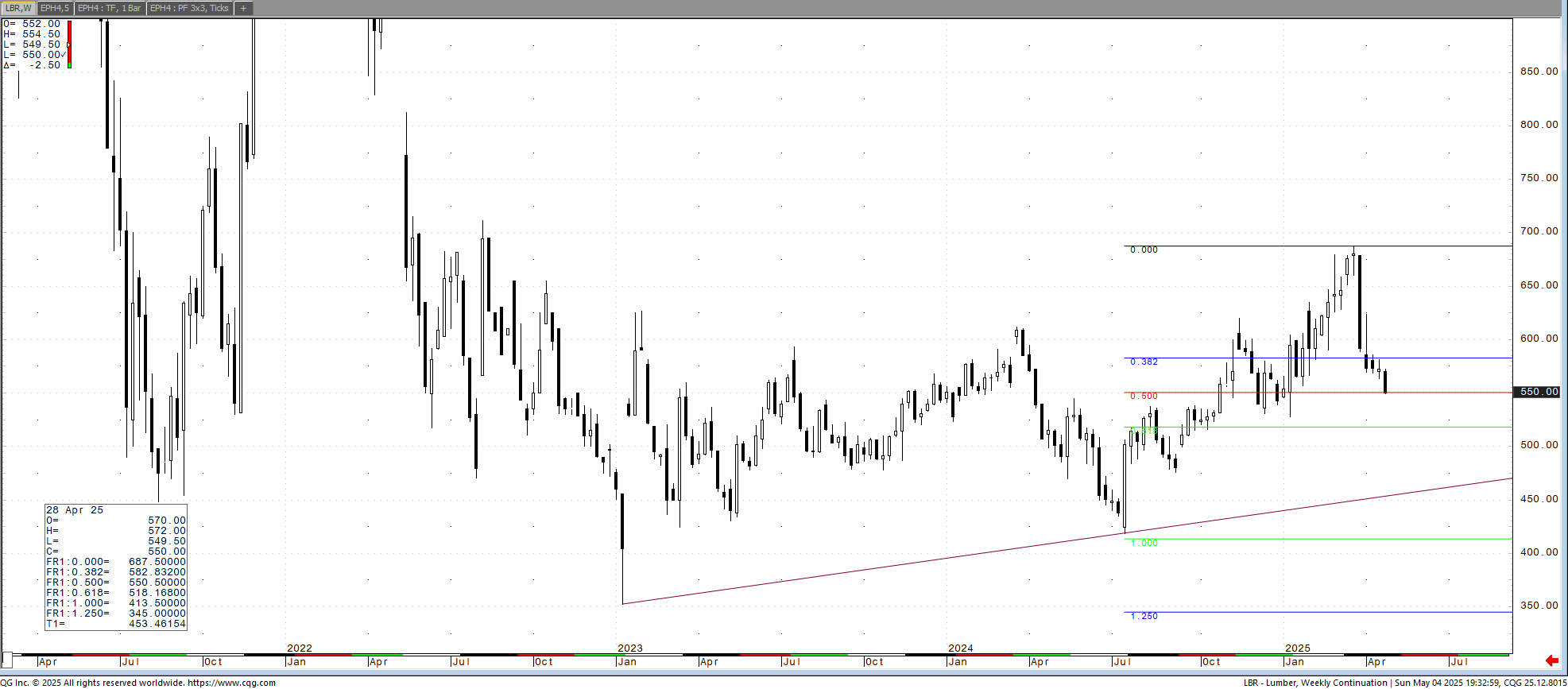

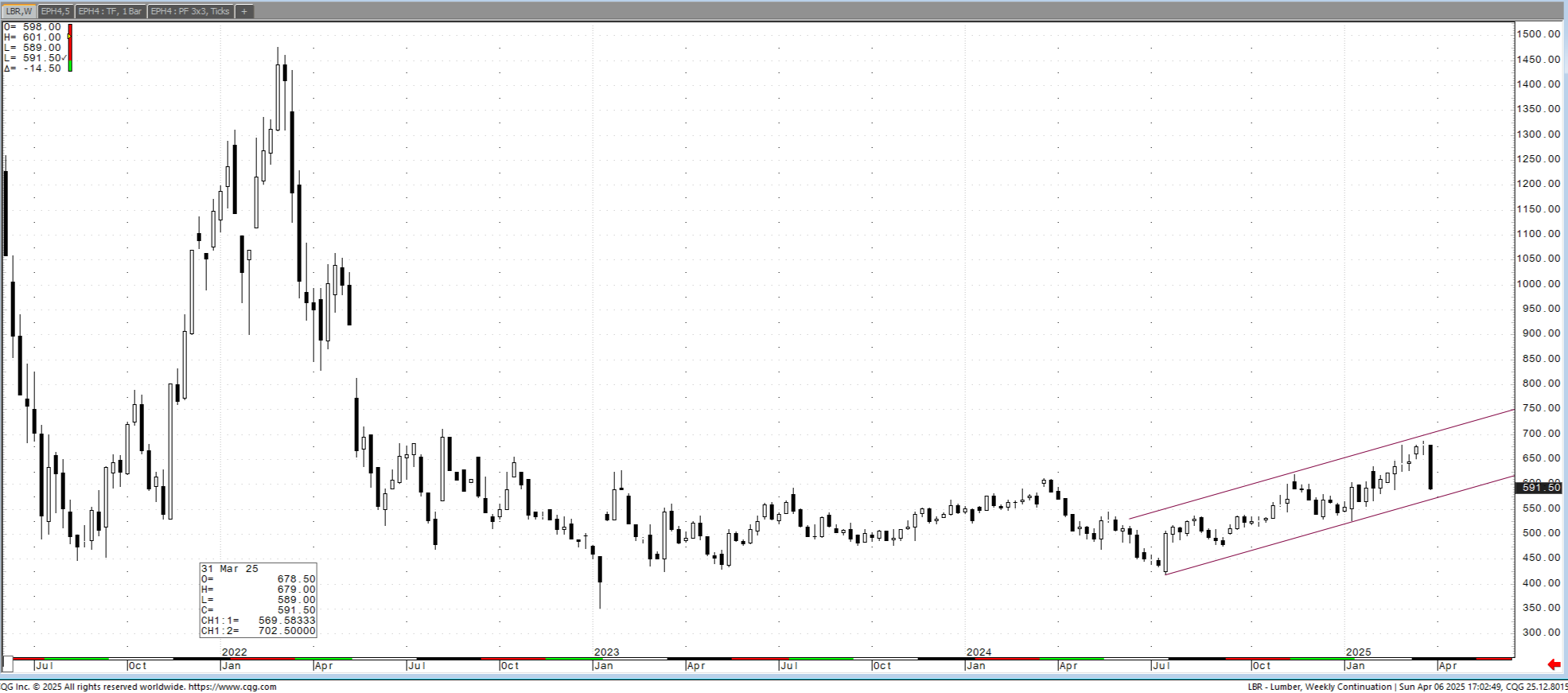

Technical:

Looking at the upside, the large gap in July is in play. May’s spike went into its gap. The 655.00 to 675.00 will be looked at. It will need a lot of help but will get near it. The major issues are 1. the funds are selling and 2. the industry is very long. The market needs another sideways build up here over $600. This week will define the futures trade going further out.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

Southern Yellow Pine:

https://www.cmegroup.com/markets/agriculture/lumber-and-softs/southern-yellow-pine.volume.html

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636