Lumber Weekly

Last Week:

The futures market had a $39 trading range last week, all up. Once we crossed the halfway point in August, the short side had to start rolling or exiting. It is usually a two-week process that works well for the spread but does little for the out rights. The difference this time is that the futures market has been sitting near the bottom for a long time. The next move was up, and the exiting got it started. I have noticed the extreme level of scrutiny held by the industry. Few views this as a supply and demand rally. The focus is on the futures and the typical positioning volatility, me included. This reluctance could keep upward pressure on the market.

Factors:

The trade is reverting back to its historical norm. A $35 move is good, and a $70 move is great. This type of trade allows the industry to make money, or at least it should. Today we face a tremendous cost of doing business throughout the industry. In the past five years, small companies have morphed into significant players with all the costs associated with playing in the big leagues. They now either need higher prices to allow for better revenues, or they need to par costs. If the outlook for 2024 is of steady starts and steady supply, then the $35/$70 model is here for a while.

Thought:

I’m still in the camp that this commodity should trade higher. All commodities have run up and settled higher than their norm. Lumber trading sub $400 is too close to the norm. There have been steadily added costs to subscribe to a higher norm. There is an issue. The higher price of the finished product in most other commodities was due to the higher cost of production. None of the finished products faced a 30% Federal regulation charge. Salad dressing is not higher because of the Federal regulations put on soybeans. You cannot expect the commodity to carry that added cost. And that is most likely why the price is in the $400’s and not $600.

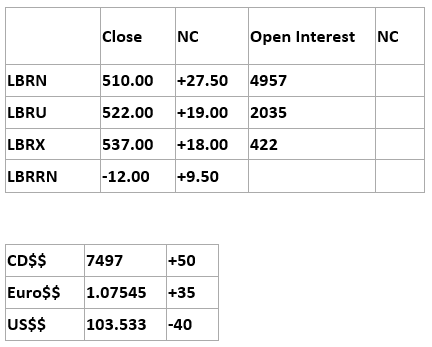

Makeup:

It looks like the industry is going for the Texas hedge while the funds continued to add. That should mean the spread goes $10 over to $20 under again.

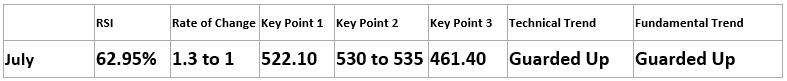

Technical:

The chart formation calls for trade through the $550 area. This is a grind and most likely will take work to get there. The wildcard is if the funds liquidate outright. For now, the points are:

- 542.80

- 547.20

- 555.30

RSI 65%

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636