Corn continues its run up and briefly traded over $5 this week. Corn and beans charts look very similar as you can see below as corn has followed beans. What I mean is bean news moves the markets more so than corn right now as exports for both to China (and others) have been steady for a while now with some surprises from time to time. China announced this week their intention to plant more corn acres this year and expand ethanol production, but with Chinese corn still at around $10 it will be hard for them to make any major waves quickly. With South American weather continuing to be dry in the big picture this should keep SA from producing a huge crop. Old crop corn prices are strong but new crop Dec ’21 continues to lag and will ultimately depend on the South American crop and planted acres before we see any big movement. Keep an eye on the Jan USDA report that comes out the 12th for any change in news.

Soybeans have had a great last couple months as they continue to run up and get over $13.50. As South America continues their dry outlook into the summer in the southern hemisphere. Argentina has a really good chance for wide sweeping rain next week but returns to dry after that. As South American weather still looks to be problem it will continue to be supportive of beans. With good exports again this week and weather issues in SA the underlying fundamentals remain supportive. Brazil has now started importing soybeans from the US as well as China and will continue to do so until harvest. With this runup we still see down days and even sizeable downward movements, this usually will stem from profit taking until we see fundamentals change. With soybean prices where they are this will lead to farmers switching over some acres which will be an important talking point heading into the spring. We continue the view of selling all of your ’20 crop and not paying for storage to take advantage of these prices. If you do not want to miss out on any further movement higher we suggest at looking at re-ownership on board if it fits your risk level.

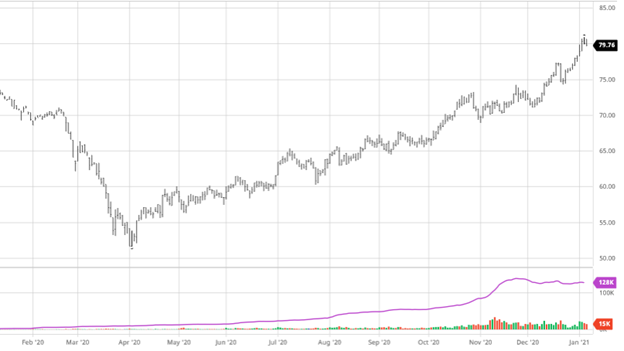

Cotton has seen a nice bump higher as we have gotten into the 80s for several trading days. Cotton may benefit the most from the weaker dollar more so than grains. US cotton is still cheaper than cotton in China (even with cost of delivery) so this should keep the US product competitive and sought after. With the outlook of 2021 moving out of the pandemic with vaccines, demand will rise for all textiles but cotton mills will ramp back up in India and China the most. March cotton chart is below.

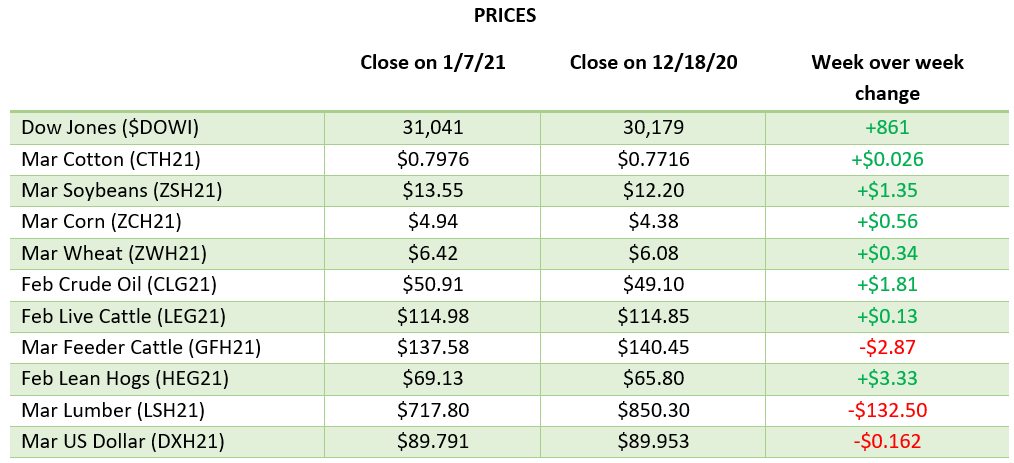

Dow Jones

The Dow has gained over the last few weeks as investors have gotten a better look as to what the next 4 year will look like as both Georgia senate seats went to the Democrats. Many experts think that moderate Dems will be the most important over the next 4 years as they will not vote completely on party lines and prevent any drastic changes. However, it will be important to keep an eye on the markets as we get closer to the Biden administration taking over as investors look to avoid new taxes.

US Dollar

The dollar has continued to stay low and may head lower. This is supportive of US commodities in the world market and would help exports in the big picture.

Via Barchart.com