Commentary:

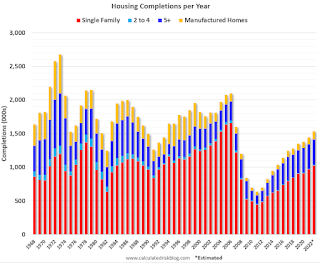

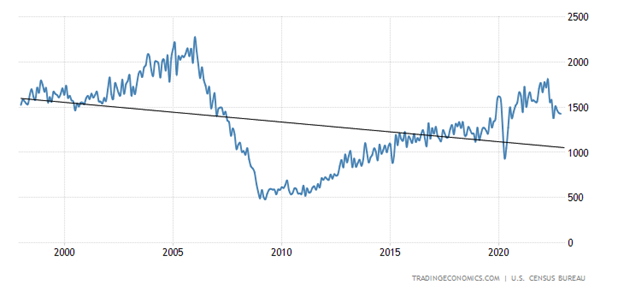

The futures market lost momentum last week but still remained near its 3-month highs. The indifference trade was caused by a flat cash market. It is hard to tell if the resilience shown in futures was from a better outlook or from funds covering shorts. We have been flying blind the last few sessions as an outage in statement reporting at many firms has stopped the CME from being able to report open interest accurately. It has also prevented the CFTC from issuing the commitment of trader’s report for last week. What we do know is that the housing market, like equities, has support. Mortgage rates are back down to 6.09% which equates to another 3 million buyers who now qualify. Traffic is reported to be better than expected. While it is down sharply from the Dec 2021 highs, it still shows potential. After Friday’s jobs data we can be confident that there are buyers out there and they have jobs. All past housing downturns remained negative because of job losses. This isn’t the case this time. The key takeaway from last week was that once the froth is off the market and when homes become affordable again there is a market waiting. Let’s take a broader look at the economics.

Economic:

The Economic downturns have a timeline from when it reaches recession, pushes capital into the system and then recovers. This process tends to take time. Milton Friedman called it “the long and variable lag.” Today, unlike ever before, there is enough capital in the system to move the economy out of a recession. Since we have never been here before no one can tell us what it will look like. That said, the consensus seems to be leaning to a longer timeline for things to turn. The typical move would be to cut rates and boost confidence. Without that type of stimulus, money will only trickle into the economy. The markets are acting less nervous and more confident. If this economy has its way the market will move from point A to point B instead of heading to Z from A.

Technical:

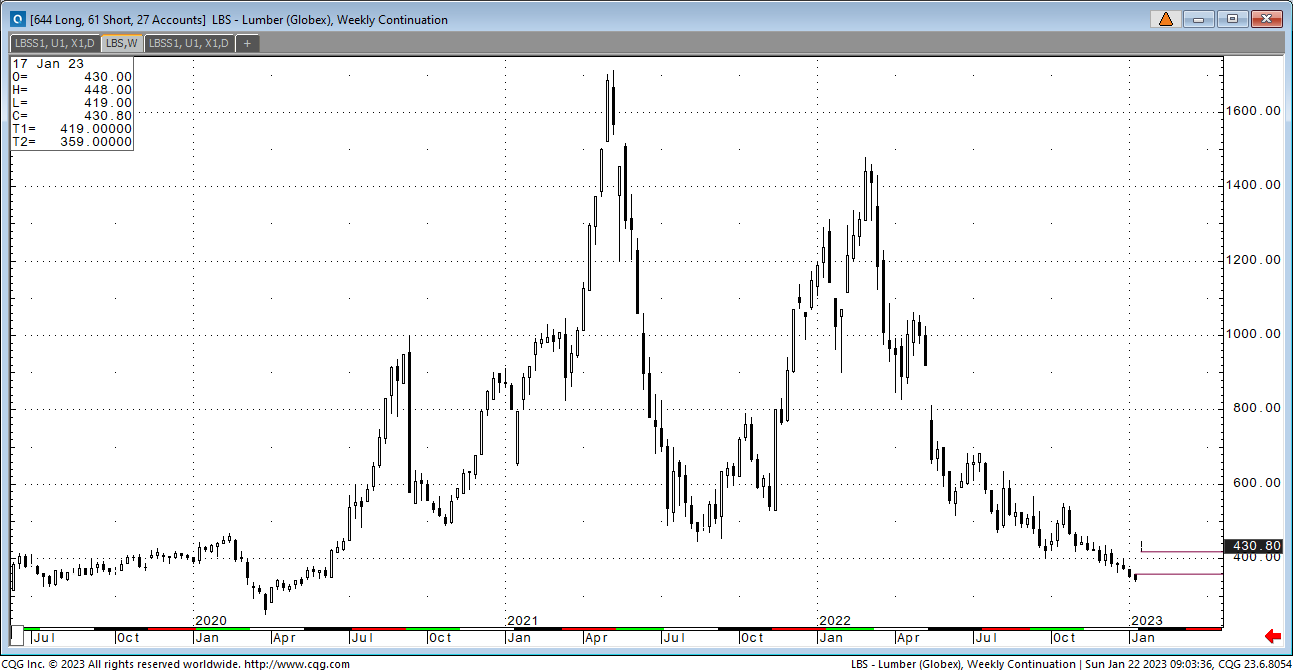

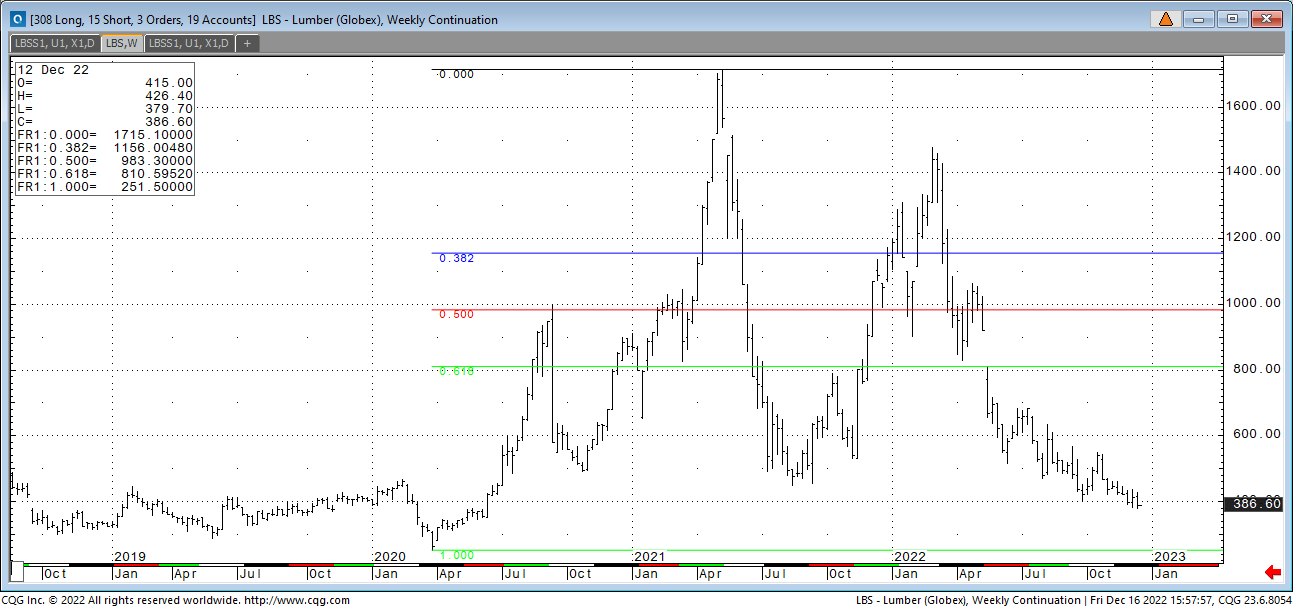

Things are as not bad as we thought they would be at this point, and the rally in the lumber market just confirmed it. The upside focus is on the 200-day moving average. It is sitting at 564.75. That’s a $200 futures run in a short period of time. The market got caught short. The slight sell off last week allowed a few of the momentum indicators to correct. That’s mildly friendly and consistent with reports from the field. Builders were projecting cutting production by 40%. It turns out that they only cut 20% so far. A 20% reduction from lofty highs isn’t a reason for $335 cash but it also isn’t a reason for $600 cash. The technical read is right.

Notes:

There is a lot of confusion about the commodity funds in general and especially those in lumber. The funds that participate in the lumber futures market are generally ones with either a focus on a basket of products or purely momentum. The long fund that is getting all the press recently is a fund that carries a basket of commodities on the long side. This Rogers fund has been around since the early 2000’s. We haven’t seen it for a while during the big run up but seems to be back. The last commitment of traders report two weeks ago had the long fund count at 393. We have no way of knowing if that is all Rogers or if it is made up of a few funds. I have heard that smaller funds were looking at lumber futures when it was in the $300’s so it could be spread out some. On the other side are the short funds. Those looked to be mostly momentum funds that add to a winning position. They hit a high of 1955 open interest a few weeks ago. The last report had them down to 954. These types of funds carry defined positions based on equity. They are designed to add as the market goes lower and exit when it rallies a certain distance. There is no opinion of market direction. When the futures market was breaking $400, they were adding. When the market failed to continue lower and turned, they began to exit. The question today is of how much they will liquidate instead of rolling because of the switch of the contract. These funds are designed with strict liquidity rules. They will not accumulate open interest in an illiquid market. That said, if this is one fund or a big fund with tags attached, it has been making a windfall in this market. Their design has worked extremely well so I would expect them to stay around but the downside momentum model could be less profitable from here on out.

NEW CONTRACT:

Lumber Futures Volume & Open Interest

CFTC Commitments of Traders Long Report

https://www.cftc.gov/dea/futures/other_lf.htm

Lumber & Wood Pulp Options

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636