Corn planting has accelerated in the last week with planted acres now at 27% complete. This is 7% ahead of the normal pace and well ahead of where we were at this time in 2019. Still ahead of last year’s pace, the acres planted in the Eastern Corn Belt is lagging behind the rest of the country as they are stuck in a wet and cool weather pattern slowing their efforts to get in the field. As you can see from RJO’Brien’s U.S. Corn Planting Progress, the leading corn planted states are:

-

-

- MN at 40%

- IA at 39%

- IL at 37%

- NE at 20%

-

With parts of the country set to reopen this week, it will be important to keep your eye on what happens in the oil markets. If consumers start buying more gas and getting back to normal travel, look for ethanol demand to crawl back. There is no quick fix to these markets, any positive COVID-19 news remains the biggest boosts for these markets.

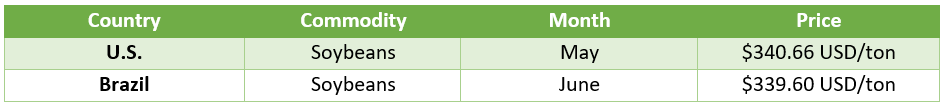

The biggest news in beans is that there is little to no news. Outside of some sales to China and Mexico, beans have been at the mercy of COVID-19 and Brazil. Soybean planting progress came in at 8% this week (average is 4%) as weather in a lot of areas was good over the weekend. U.S. bean prices continue to be competitive with South America, however SA beans are higher quality, leading them to be the preferred option:

U.S. soybean sales last week of 1.078 MMT (39.6 million bushels) fell in line with market expectations of 700k-1.2 MMT, but were the highest in 19 weeks. This comes with the return of Chinese buying with purchases of 618k tonnes for the week giving beans a much welcome price boost.

Crude Oil is still feeling the effects of last week’s historic day. While it has rebounded from the lows and is now trading in the $15 range, the outlook is still grim. As U.S. and World stocks are getting close to capacity, there are oil tankers anchored in place around the world’s oceans as they await instructions on where to deliver. The best case for oil prices comes with the world economy opening and consumers reverting back to normal means of consumption and any positive COVID-19 treatment news would be bullish for crude moving forward.

The COVID-19 pandemic has wreaked havoc on a number of critical U.S. industries, but none more strategically important than food production. In the livestock industry, the biggest concern is keeping processing plants staffed. Line speeds have slowed considerably, and in some cases, plants shuttered completely. U.S. beef production fell from 565 million pounds the week of March 23rd to 414 million pounds last week, down -27% from a month ago. Pork production is also dropping sharply with hog slaughter down nearly 650,000 head on a weekly basis. The backlog is forcing producers to destroy millions of market ready animals, break eggs, abort sows, and euthanize piglets. Meat supplies are contracting, pushing wholesale beef prices to record highs. Pork bellies that were being rendered a few weeks ago have tripled in price. Shortages in meat cases are imminent unless something changes quickly.

On April 28th, President Trump attempted to address this situation by invoking the Defense Production Act, which will require meat packing plants to remain open. A key component of the ACT releases packing plant owners (Tyson, Cargill, Smithfield, JBS et al) from liability if workers fall ill from COVID-19. The announcement got immediate pushback from workers and labor unions representing 80% of the packing industry workforce.

Relief Package

The $19 Billion farm relief package that was announced a couple of weeks ago will touch most sectors of agriculture. Of the $19 Billion, $3.9 Billion will be direct payments for grain and soy growers, while the largest chunk of the money will be $9.6 Billion ($5.1 Billion for beef, $2.9 Billion for dairy and $1.6 Billion for hogs) to livestock producers that have been undercut by processing plant closures and logistic problems. Distribution of these funds will be made quickly according to various Senate sources.

“This aid will help keep food on Americans’ tables by providing a lifeline to farm families already hit by trade wars and severe weather.” – Zippy Duvall, President of the American Farm Bureau (USA Today)

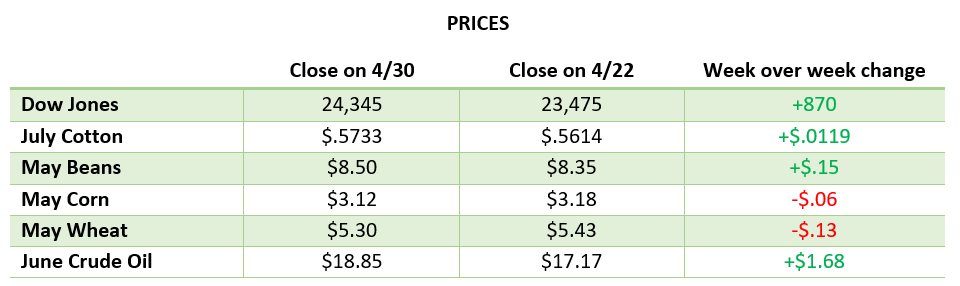

Dow Jones

The Dow is up again this week on news from the Fed promising support for the economy, while also pledging to keep interest rates near zero and possible treatments for COVID-19. After a miserable February and March, April has been a good month for the market as continued hope of a light at the end of the tunnel along with strong responses by the Fed have pushed markets higher.