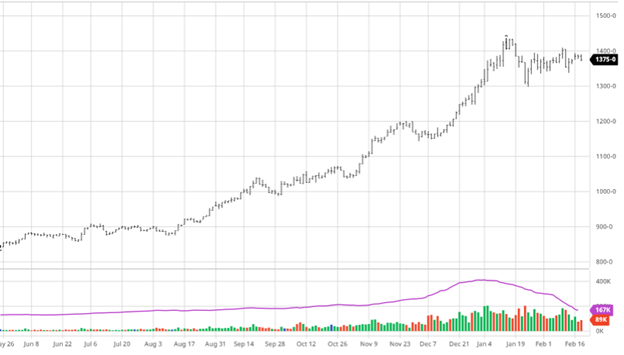

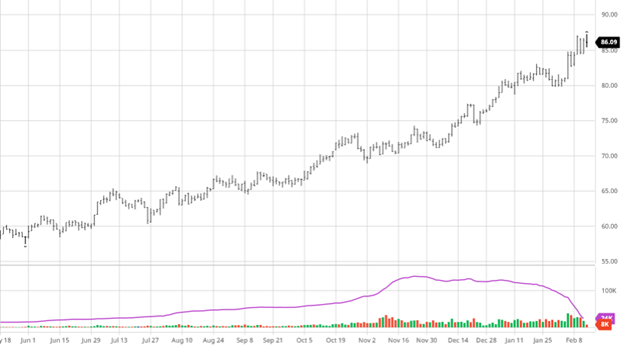

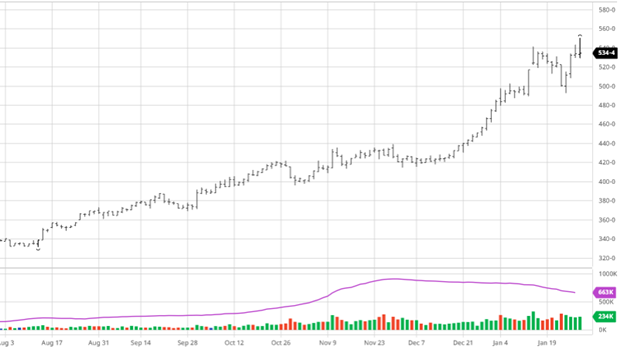

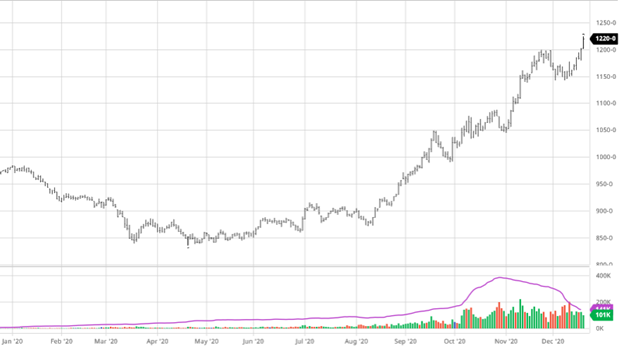

It’s been a slow week for Corn gains as China is celebrating the lunar new year. With the lack of Chinese buying the markets turned elsewhere for news. South America’s weather is still pretty consistent with wet conditions in northern Brazil and southern Brazil and Argentina remaining pretty dry. The next few weeks will be very important for Brazil/Argentina as soybean harvest is already behind pace. The Ag Forum has released the USDA expected planted acreage; Corn was pegged at 92 million acres, which was around most estimates, and not much of a surprise to the markets.

Chief Economist Seth Meyer: U.S. crop prices and expectations #AgOutlook #OATT pic.twitter.com/X1HQJHrM6c

— Dept. of Agriculture (@USDA) February 18, 2021

Friday’s supply and demand report is going to be the most important piece of news this week as it will be a reminder how tight the world and US supply are. The report, South American weather, and China being back from holiday will be where the focus shifts.

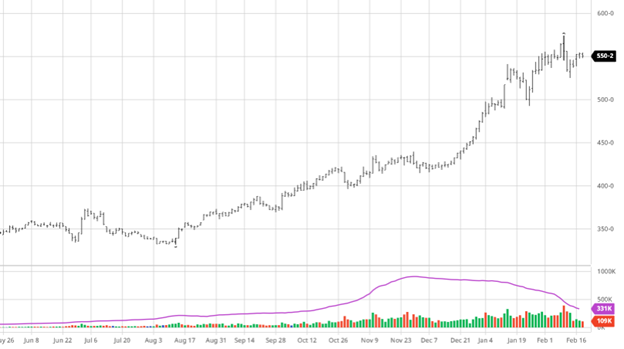

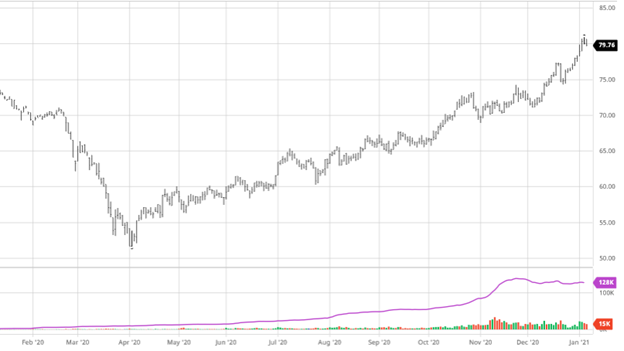

Via Barchart.com

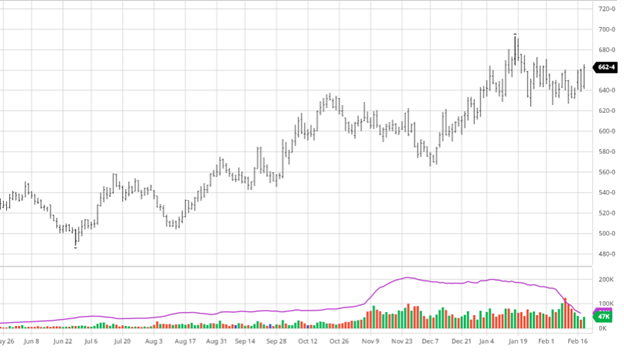

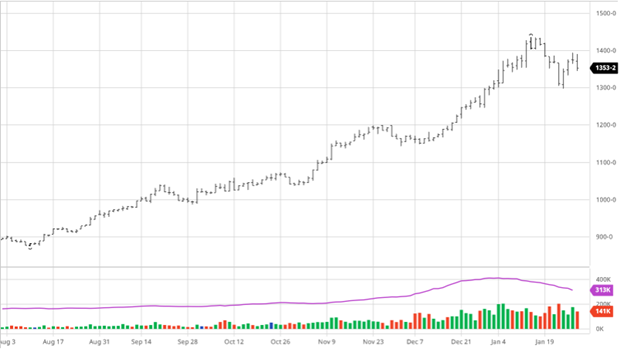

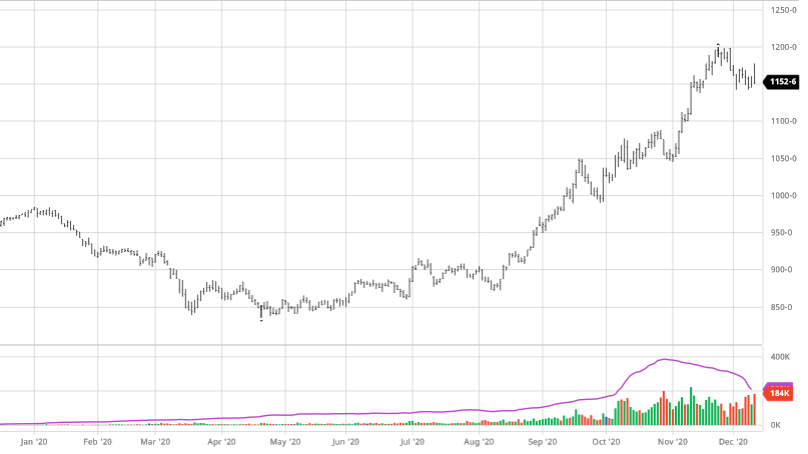

Like corn, Soybeans gained this week, despite a slow news cycle. Harvest delays continue in South America, to put it in perspective, the harvest is just reaching the halfway point of where they typically are at this point. The January crush report had another record month with bean crush coming in at 184.6 million bushels. The US will runout of beans this summer if this crush rate continues, and after 5 record weeks in a row it does not seem to be slowing down. The Ag Forum came out with an estimated 90 million acres of soybeans for this year which was right around estimates as well.

Chief Economist Seth Meyer: if one assumes we have normal planting weather, we would have an increase in total planted acres. But that’s entirely dependent on the weather #OATT #AgOutlook pic.twitter.com/NUIZjm5FtY

— Dept. of Agriculture (@USDA) February 18, 2021

It will be important to keep watching exports as China comes back from their holiday and will begin normal activity again. The news to end the week will be the supply and demand report so how China responds next week will give us an idea how accurate we think the report is.

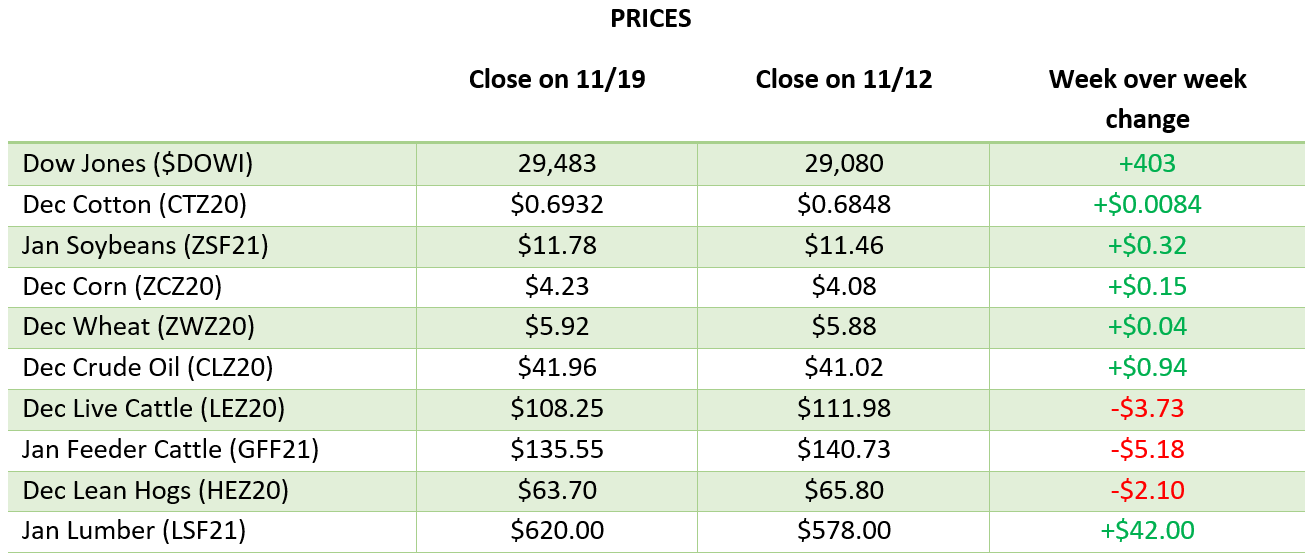

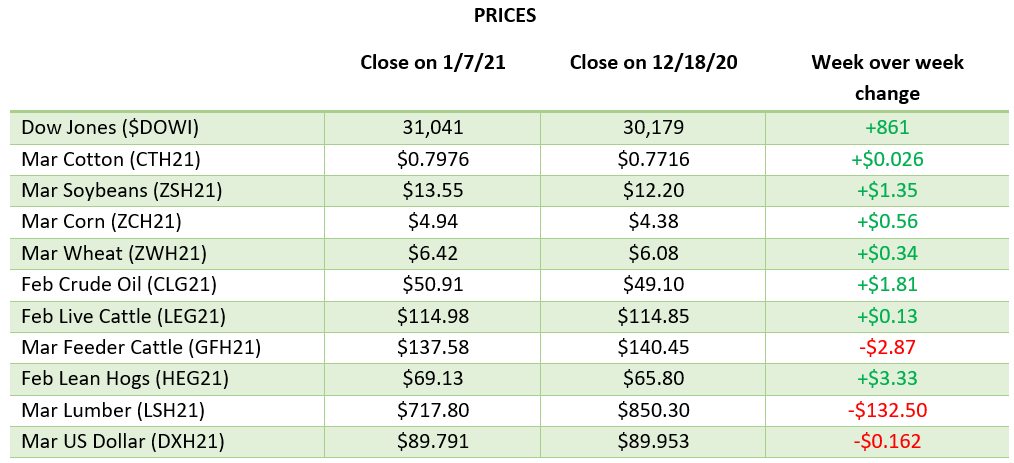

Via Barchart.com

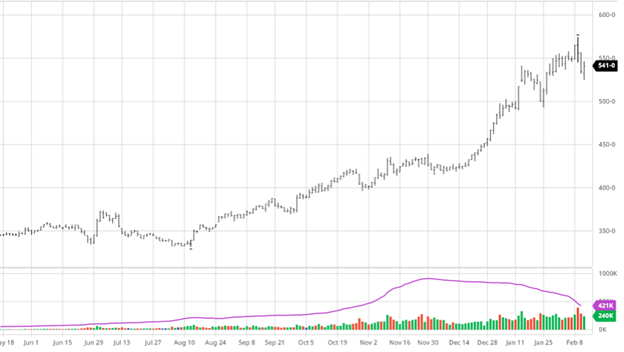

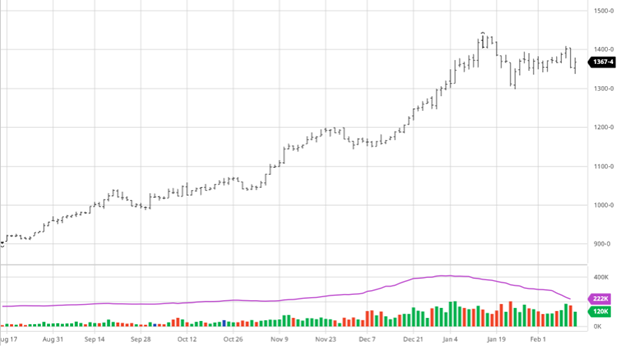

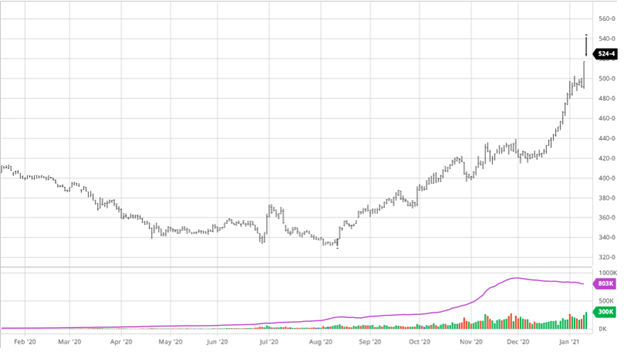

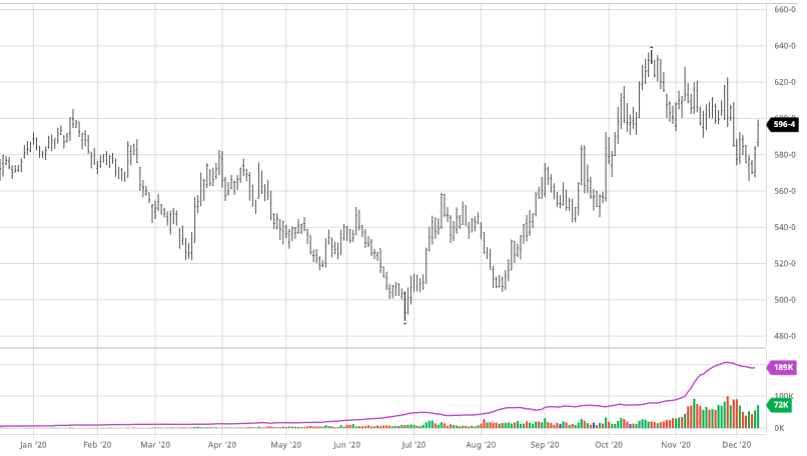

It’s been a strong week for Wheat as it bounced up from the lower end of the range it has been trading in. The cold weather throughout much of the country may have sparked the move this week as the possibility of damage to the crop comes in to play. It will be challenging to get a read on the extent of the damage until the spring making it more of a waiting game instead of a knee jerk reaction. Winterkill rallies are usually short-lived so we will see with this one. The USDA is estimating 45 million acres of wheat this year which is up by less than 1 million from last year. Even though we had a rally this week wheat appears to still be range bound as it has been.

Via Barchart.com

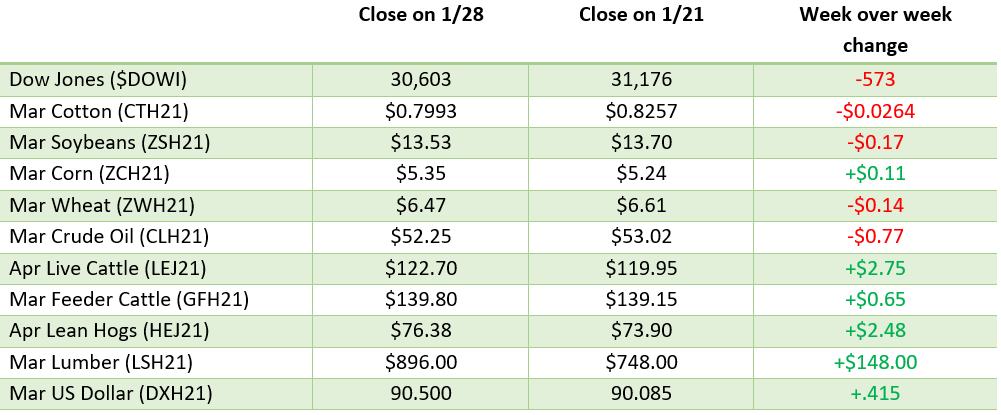

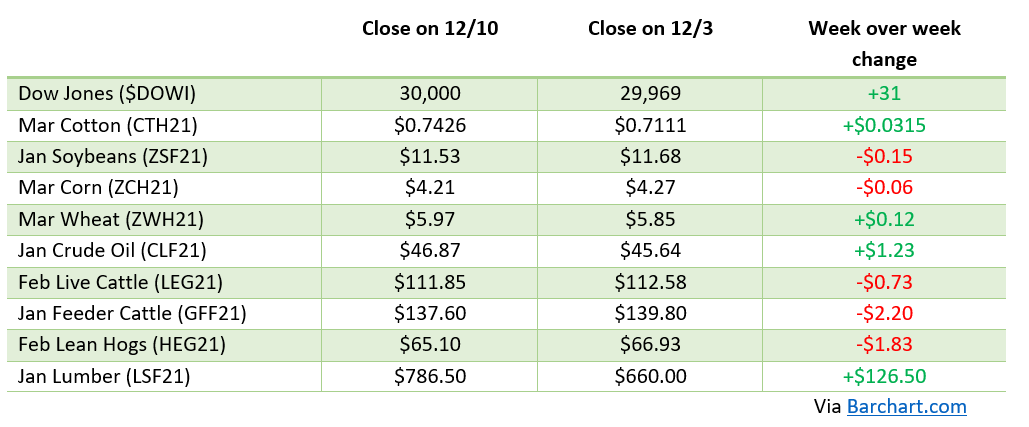

Dow Jones

The Dow has had an up and down week as market news has been quiet but the focus of the historic cold in parts of the country has caused energies to surge. The winter storm that ripped through the country has caused issues travelling in many areas slowing down the Covid-19 vaccine distribution and slowing down getting shots in arms as well. Cases have been on the decline the last few weeks and it will be important for this trend to continue.

Insurance

This month is important for revenue-based insurance averages so it will be important to keep an eye on the markets even if you do not plan on making any sales. As of the close on 2/18 the price for corn is $4.5304 and soybeans are $11.711.

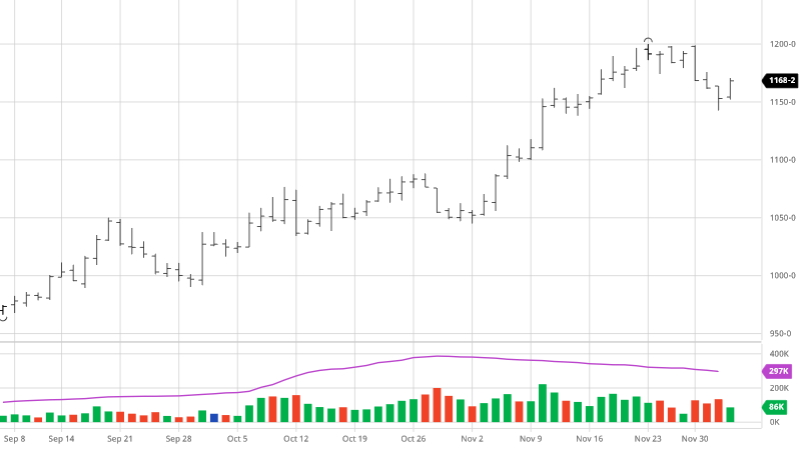

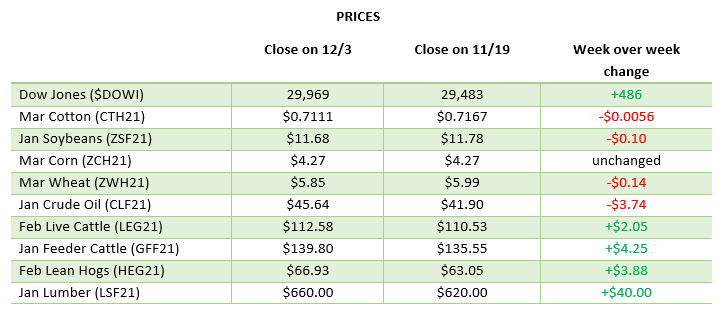

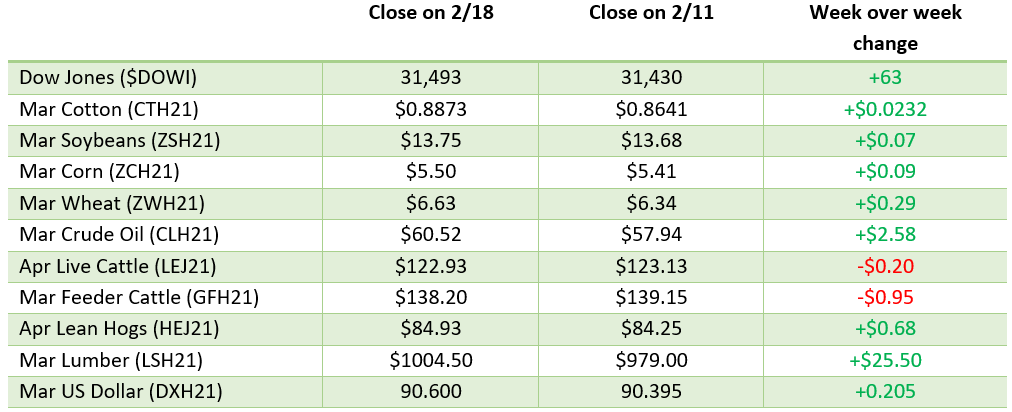

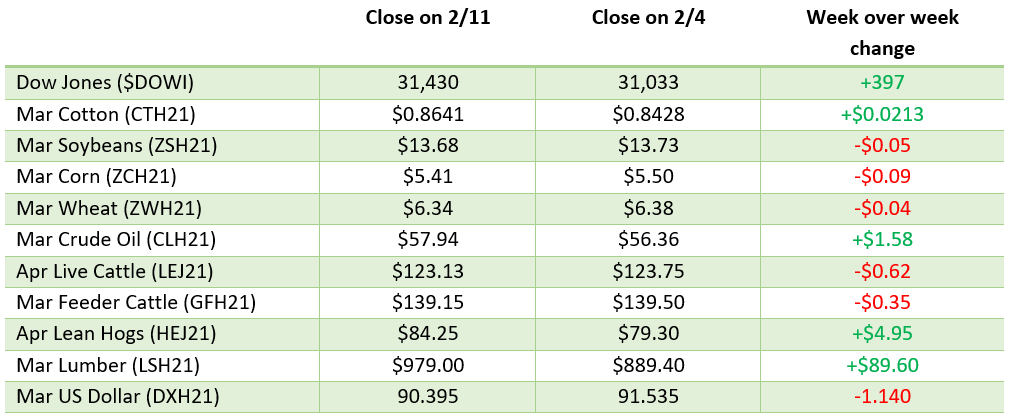

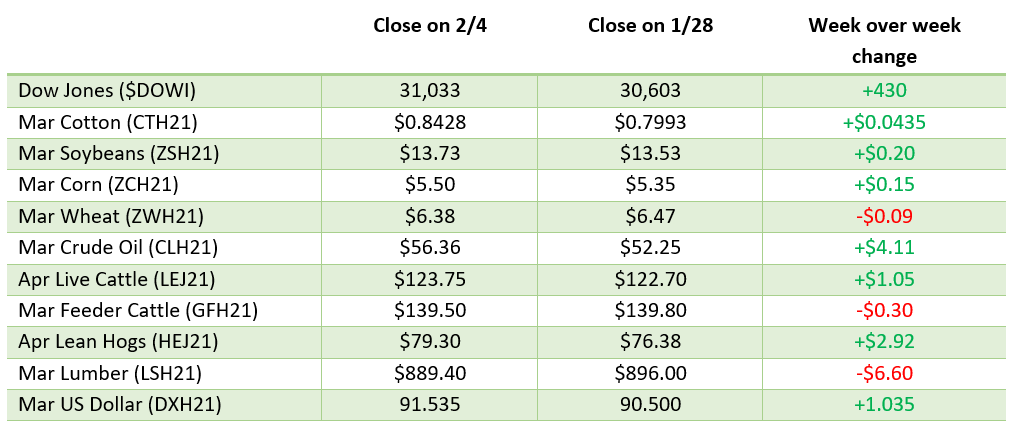

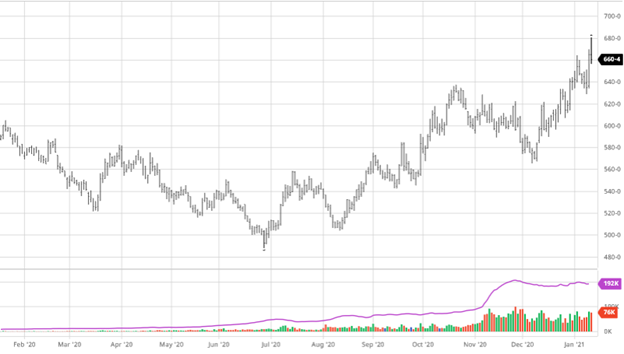

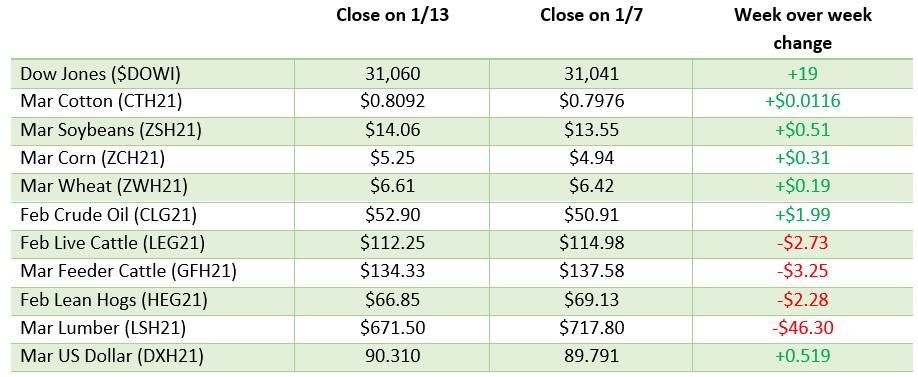

Weekly Prices

Via Barchart.com

,

,