As of 2022, there are 7.9 billion people in the world, which is anticipated to hit 10 billion by 2050

Did you know that by 2050, the world is expected to feed almost 2 billion more people than we do today? As the global population continuously rises, a significant amount of food will need to be produced over the next 30 years.

But before you get to overwhelmed with that thought, it’s imperative to know that the need for more production creates opportunities. In fact, in 2020 alone, 19.7 million jobs were related to the agriculture and food sectors. We cover these areas in this What It Takes To Feed the World infographic. So, let’s take a closer look into how each of these categories work together to help pave the way to feeding 25% more of the population over the next couple of years. Here’s everything you’ll need to know:

Download the Infographic

FINANCIAL INSTITUTIONS / INSURANCE

Due to inflation (we cover farm inflation here) and superior advancements in farming technology (seed, equipment, etc.), the cost of doing business is extraordinary.

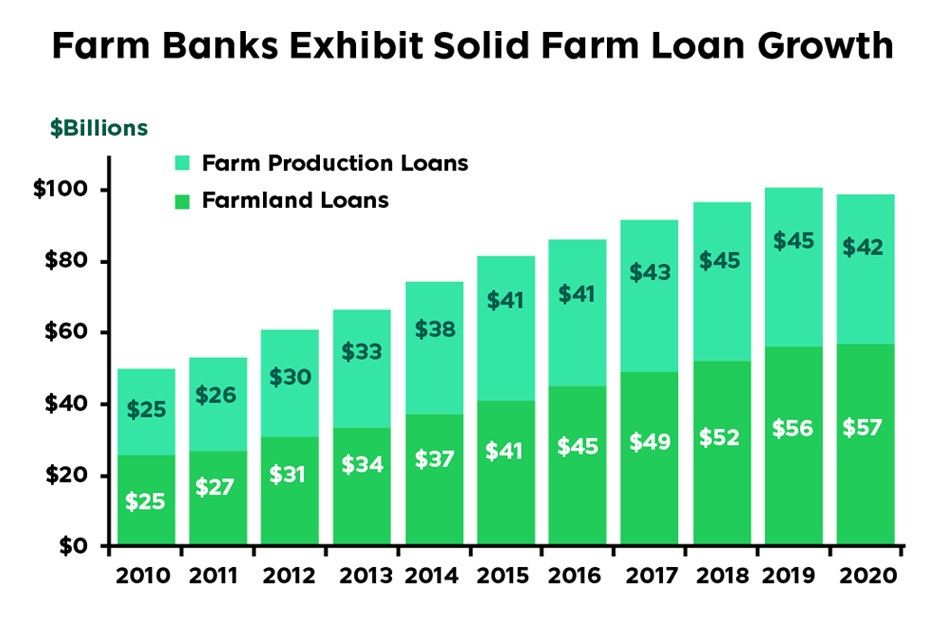

As a result, banks and other financial institutions have become the pillar of the agriculture community. From financing farmers, purchase of seeds and chemicals to providing insurance to protect the farmers on through to commercial lending and trade finance programs; without banks, agriculture, as we know it today, does not exist. As a standalone example, consider that in the U.S. alone, during 2020, farm bank’ lending was $98.6 billion despite the global economic slowdown. As the demand to produce continues to grow, there is minimal question that the need for capital will grow along with it.

Source: Federal Deposit Insurance Corporation & American Bankers Association Analysis

SEED / CHEMICAL:

Before the farmers can get to work, they need seeds and, subsequently, fertilizers (watch our fertilizer forecast here) to reach the full potential of every acre of land. From the genetics to the production to the distribution companies, one could argue that continued innovation of this industry is vital to the future of agriculture.

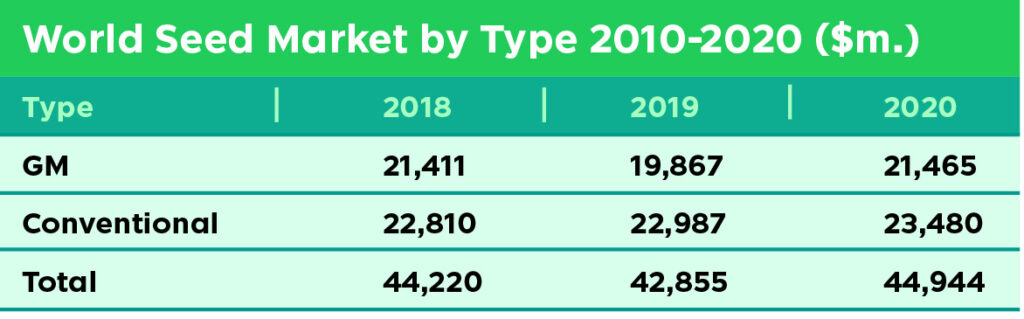

In 2020, the commercial seed market alone reached an estimated $44.9 billion in annual revenue. With the global pressure on to produce, the world can no longer afford to have underperforming years of production, placing even more pressure on this sub-sector of agriculture to continue to develop treatments on both the organic and GMO sides (watch The Future of Feeding the World Podcast here).

Source: IHS Markit – @2021 IHS Markit

EQUIPMENT

With the growing demand for food-producing land due to the world’s growing population, advances in technology have seamlessly made the farming process more efficient, profitable, and undoubtfully safer. Modern farms and agriculture equipment have significantly evolved by incorporating sophisticated technologies like sensors and GPS to driverless equipment with new autonomous machinery.

These enhancements to heavy equipment are essential to farmers, allowing them to no longer apply certain things uniformly, like fertilizing or watering the field. But instead, farmers can use minimal effort to target specific areas of their fields. Let’s look at some of these added benefits due to technology:

- Farmers have higher crop productivity.

- There is a reduction in the overuse of water, fertilizer, and pesticides.

- The price of food production is at a lower rate due to less manual labor.

- Improves the safety of farmworkers and machine operators due by incorporating the use of drones and various software. Check out this podcast with Dr. Steve Irwin on technical platforms here.

- Groundwater and rivers are experiencing less runoff of chemicals.

Undoubtedly, innovation of this business sector will continue to evolve and play a major role in the necessary production increases ahead.

GRAIN PRODUCERS

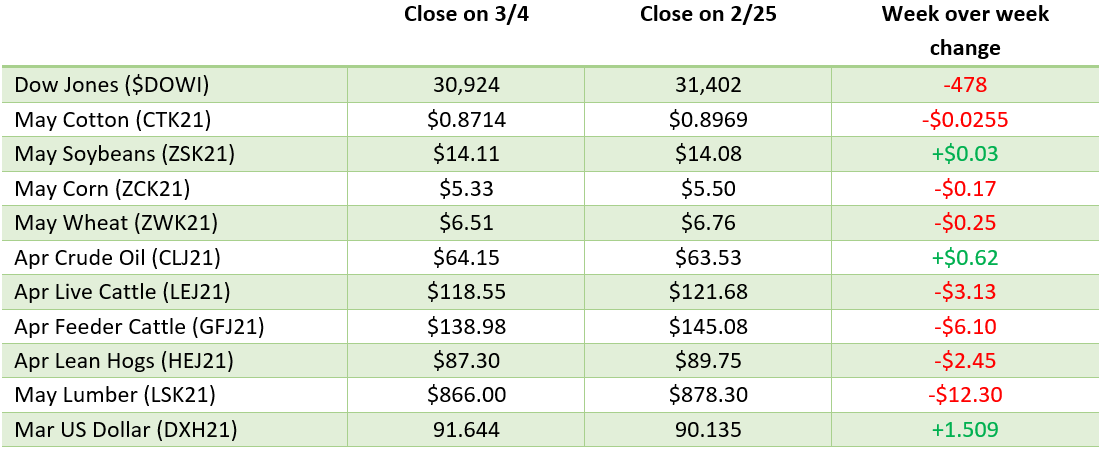

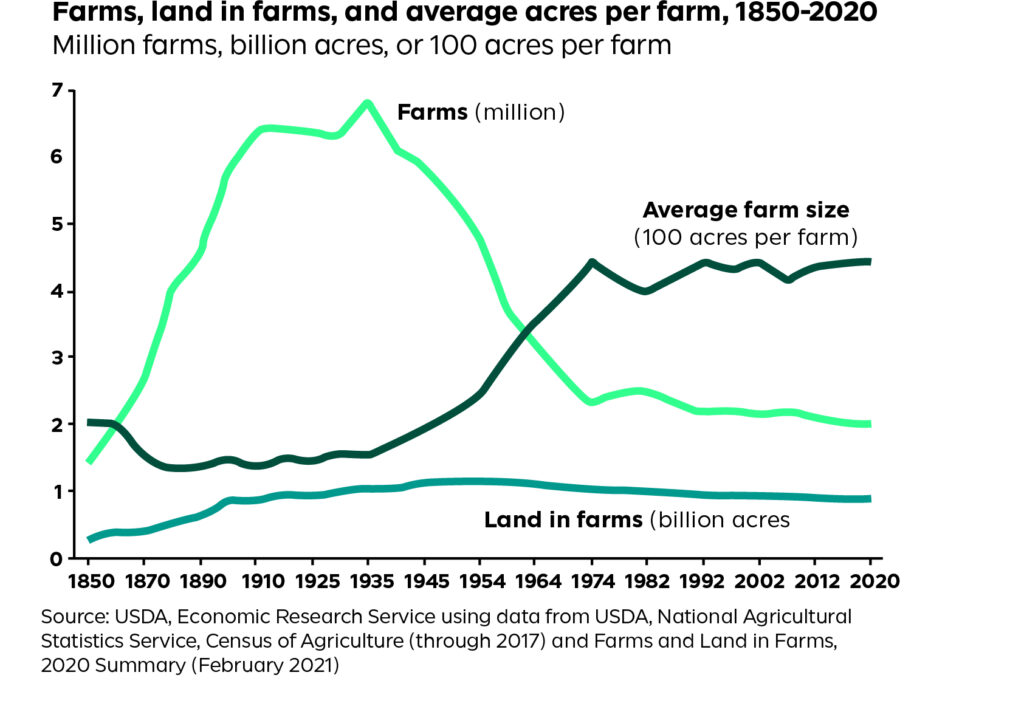

One hundred fifty years ago, work was hard for grain producers, but the job was simple – till the land, plant the seed and let mother nature do her job. As time passed and our global population grew and the demand for our arable land has grown exponentially; all of which, leads to the grain producers of today having the most important job in the world.

The work of the few is to feed the many. Since the post-WWII era, the number of farms has steadily been reducing, placing even greater pressure on those in production areas to continue managing their operations, focusing on profit margins, and working the inherently volatile world of commodity prices.

Imagine a 5,000-acre farm producing trendline yield corn of 180 bushels per acre. Quick raw math based on today’s price per bushel of $6.00 puts gross revenue at 5.4 Million dollars. Noting the rapidly rising costs of inputs (seed and chemical), labor and energy prices, a return to August 2020 prices of $3 would be a massive hit and likely take down such an operation.

All of this is to say that today’s job requires greater collaboration with others in the business than ever before (see section below on intermediaries and risk management).

INTERMEDIARIES/RISK MANAGEMENT

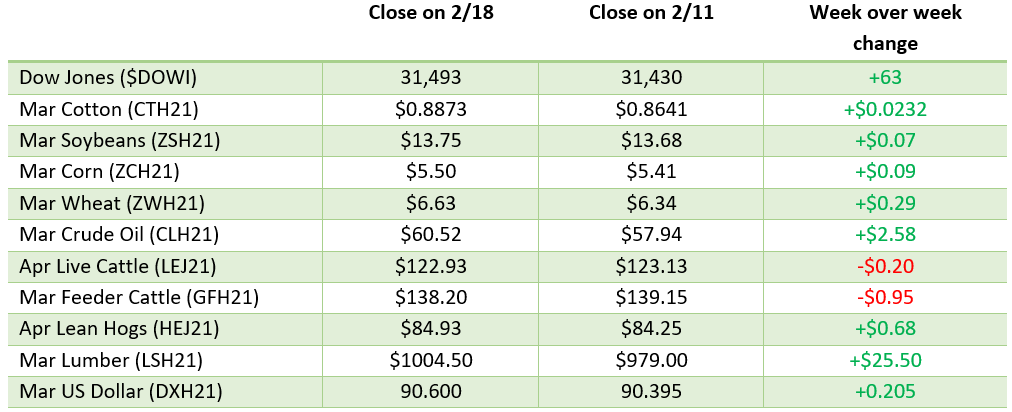

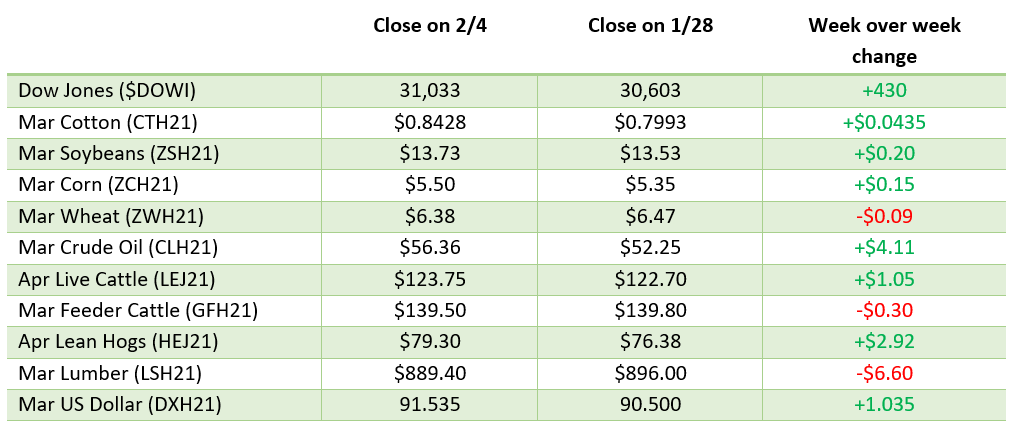

Commodity markets are highly unique in that both end-users and physical producers of a product can proactively buy and sell their input and or production in an open market before being produced via a forward contract or hedge.

To hedge is to manage risk and, in most cases, lock in or protect the profits margins. As discussed above, grain production is a highly volatile business, just like the purchase side (see end-users and commercials below).

Through intermediaries and risk management experts, farmers and end-users gain timely market information, access to markets, and ultimately execute the majority of their forward pricing. Whether through the use of futures, options, swaps, or even physical contracts developing and coordinating a risk management plan is essential to the long-term health of our global commodity infrastructure.

The CME Group is the world-leading commodity exchange, and their global branding says it best – “CME Group, where the world comes to manage risk.”

RCM Ag Services also falls into this category. We provide full-service risk management and advisory solutions to our local area producers and commercial agriculture operations around the globe.

TRANSPORTATION/LOGISTICS

COVID introduced unexpected stresses on global food systems, creating many immediate and rapid challenges to secure food availability. If a worldwide pandemic taught us anything, we know that supply chain management and transportation play a vital role within the agriculture industry. Agriculture logistics ensure that items like food, machinery, and livestock from all over the world are transported with a continuous, optimal flow from the manufacturers and suppliers to the producers and ultimately delivered to consumers.

Some of the most imperative agriculture supply chain and logistics management activities include production, acquisition, storage, handling, transportation, and distribution. Effective logistics is critical for guaranteeing customer satisfaction and meeting demands on time with high-quality products. In addition, logistics should also meet specific standards and operational objectives for efficiency in agriculture policies like:

- Protection of the environment

- Sustainable distribution practices

- Food safety and security

- Animal welfare (for transporting livestock)

With the growing population largely expected in developing countries, most of which have poor infrastructure, we can expect the need for massive investments into transportation and logistics operations in the years ahead (this is NOT a stock tip!).

COMMERCIAL AND END USERS

The penultimate step of the process is grain reaching a commercial elevator before going on to the end-user to be converted to a final product. Some producers deliver straight to the end-user in areas where that is an option.

Traditionally, commercial elevators accept farmers’ grain and then ship it to the end-user, either by rail, barge, or other means.

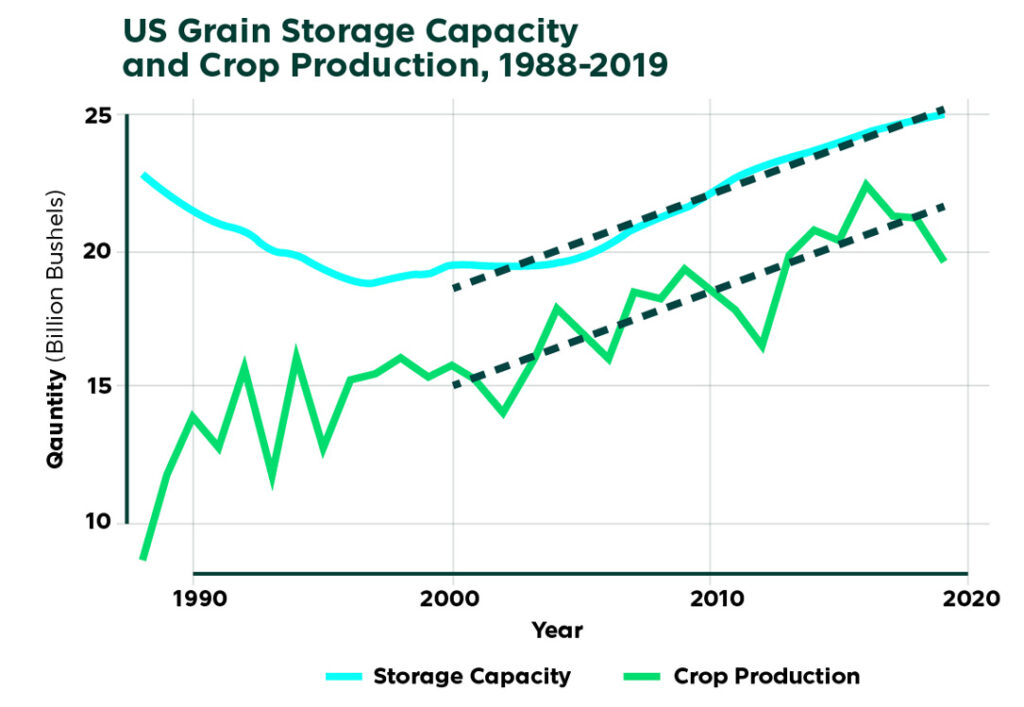

With the continued upward trends of production, it is no surprise, that grain storage capacity has consistently grown. In fact, it is on pace with increases in crop production over the last 20 years and by all accounts is likely to continue to grow.

Source: Farmdocdaily

Along with the enormous capacity, commercials and end users also carry a tremendous amount of of price / volatility risk requiring a proactive and disciplined risk management approach to maximize the margins of their operation and keep the system moving forward.

In 2018, $139.6 billion worth of American agricultural products were exported worldwide, with elevators playing a significant role in that process. The commercials and end-users are essential for getting the product from the farm into your home on the table.

FEEDING THE WORLD IN THE FUTURE

Bringing awareness to how the agriculture industry is vital to feeding the rapidly growing world is pivotal as we continue to face unprecedented challenges in global food security. However, there is a silver lining. We already know what must be done; it is figuring out how to do it that could be problematic. The world must unite and understand that each of these areas highlighted in the infographic is very complex, employs millions of people worldwide, and is vital to the growth of the agriculture industry as well as producing the necessary food for the future.

Download the Infographic

CONTACT AN AG SPECIALIST TODAY

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact us today to speak with an ag specialist at 888-875-2110!