The 2020 June USDA Crop Report came out Thursday and contained little surprise for the corn market. The report did trim off some ending stocks from 19/20 as they adjusted for the corn that was lost in ND that was never harvested until this spring due to weather problems. Corn seems to have little news to drive it significantly higher in the near term as there is favorable weather in most areas that have corn already growing. We should keep our eye on the lack of rain in the 7-14 day window as an early lack of rain could effect pollination in areas. The USDA put 20/21 corn price at $3.20, the same as last month, and $3.60 for 19/20. The stocks numbers can be found on the chart at the bottom but, like we said, little surprise. Funds continue to hold large short positions.

Soybean prices stayed steady this week after gains over the past couple of weeks. Continued confirmed Chinese buying along with sales to “unknown buyers”, more than likely China, have given beans the support they need. The buying has slowed down some but as long as decent purchases keep coming from China that will support soybeans. Like corn, the USDA report was pretty much a non-event for beans despite some bullish news. The ending world stocks for both 19/20 and 20/21 were both lowered enough to see some slight gains in bean prices before coming back down to finish trading Thursday about unchanged. The rally over the past couple weeks helped keep the bullish news from moving the markets much as most of the news seemed to be factored into the price already.

Wheat has had a hard week, losing over 20 cents in the July contract. The USDA report was definitely bearish for wheat as the outlook for the southern hemisphere 20/21 growing season was bigger. USDA is forecasting a 11 mmt gain in Australia wheat crop and 1.5 mmt gain for Argentina. There are some trade concerns that the Russian wheat crop may be trimmed which would allow for more US wheat exports. The demand for US wheat looks to be strong for the remainder of this year but when the southern hemisphere starts harvest the smaller demand for US wheat should pull prices down. In the short run keep an eye on any weather problems and trouble in Russia as US spring wheat is off to a great start with 82% rated good to excellent.

DOW Jones

The Dow Jones had a major selloff Thursday as concern over COVID-19 begins to ramp back up. Cases/hospitalizations in some places have started to go back up the last week. This could be a result of the easing of restrictions but many states who have been open are not showing major changes despite a small up trend in cases. The government earlier this week also admitted they made a mistake, shocking I know, when calculating last week’s unemployment rate. They have admitted they were off by 3% stating it should have been at 16.3% instead of the reported 13.3% that lead to a market rally.

Crude Oil

Crude took a hit on Thursday with the market selloff, as it fell over $3 a barrel. This comes as a result of similar reasons for the fall in the DOW Jones as consumer’ optimism about COVID-19 may be put on hold for a little bit. If consumers do not plan on travelling as much this summer and fall anymore and people continue to not go in the office consumer consumption will stay low.

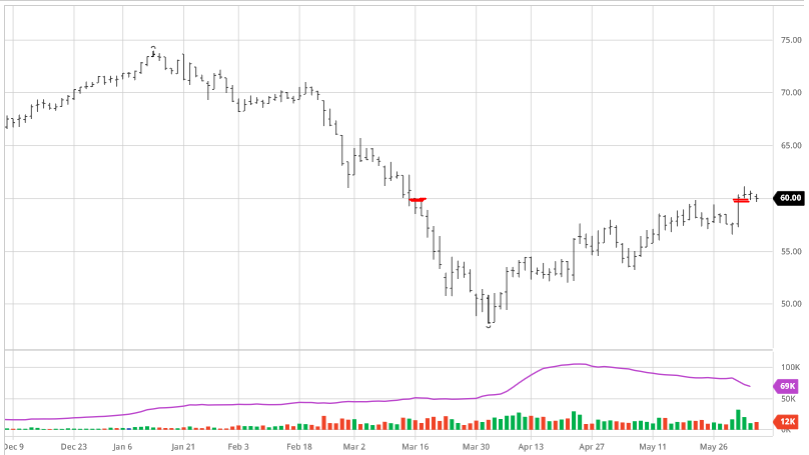

Cotton traded above $.60/pound this week for the first time in the July contract since March 16. Rising futures prices with smaller open interest usually leads to a price reversal, which this price move has seemed to follow. With more open interest in the December contract month, look for more volatility moving forward as speculators will look there. We are barely into the start of hurricane season and already on hurricane number 3 forming in the gulf. A long and consistent hurricane season could do a great deal of damage to the southeast Cotton crop. Cotton has always been sensitive to the U.S. dollar, so a weakening dollar the last couple of weeks has been supportive to prices.

Cotton traded above $.60/pound this week for the first time in the July contract since March 16. Rising futures prices with smaller open interest usually leads to a price reversal, which this price move has seemed to follow. With more open interest in the December contract month, look for more volatility moving forward as speculators will look there. We are barely into the start of hurricane season and already on hurricane number 3 forming in the gulf. A long and consistent hurricane season could do a great deal of damage to the southeast Cotton crop. Cotton has always been sensitive to the U.S. dollar, so a weakening dollar the last couple of weeks has been supportive to prices.