AG MARKET UPDATE: AUGUST 12-19

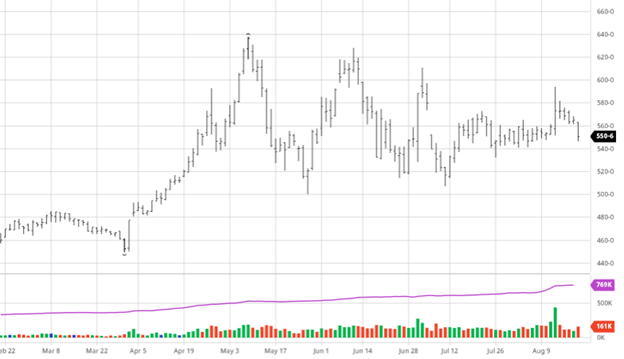

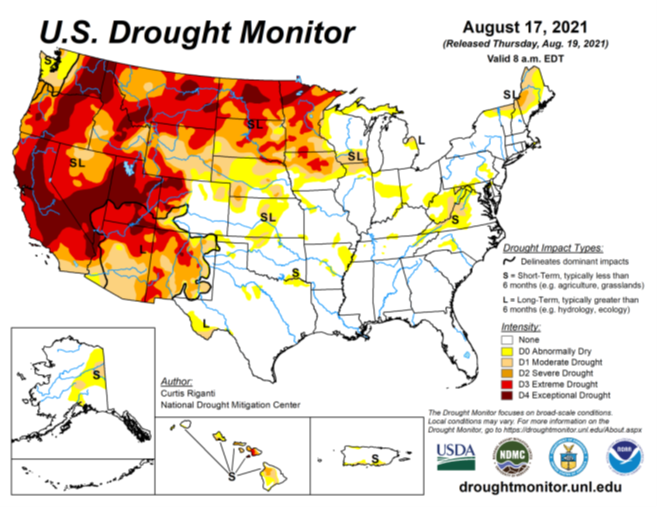

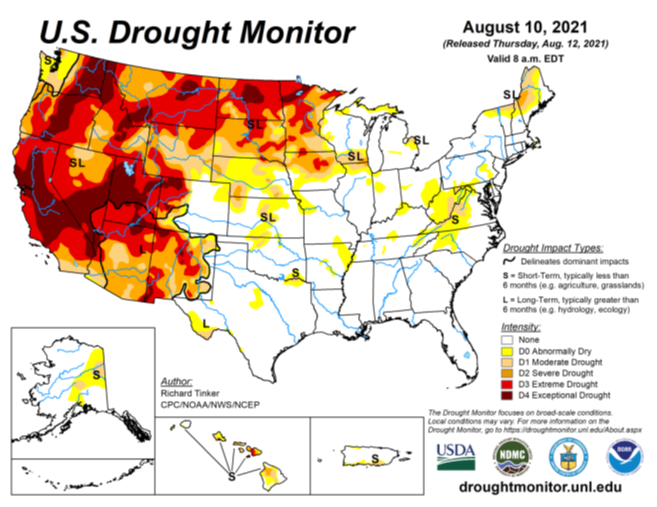

Corn fell on the week tied to better than expected rain totals and uninspiring demand news. Weather over this weekend is expected to provide relief in some areas before normal late summer weather returns to much of the corn belt. Exports were good but lagging this week and as we have seen recently we need consistent and strong buying, not just good. Thursday’s strong downturn was commodity wide as all grains and energies struggled. The western corn belt is expected to get rain this weekend – it needs it – as you can see in the drought monitor below. We are still within the pre-report trading range so how the market trades on Friday and rainfall over the weekend will be the market movers the next couple of trading days.

Via Barchart  Soybeans, like corn, fell on the week lead by the losses on Thursday. Bean oil and meal also struggled over the last few days as world demand remains in question going forward. The rains expected over this weekend should help the bean crop more so than corn in those areas so the actual rainfall received will be important come Sunday night. Like corn, exports were good but not great and we NEED great to get people excited. If we see China buying new crop beans (or corn) in the coming weeks that would be welcome support for the market that is needing direction. The Biden administration has yet to make up their mind on what they want to do with biofuel mandates presenting the markets with a big question mark that they must work with for now.

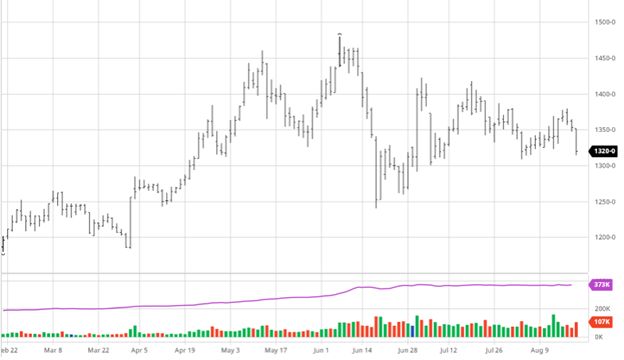

Soybeans, like corn, fell on the week lead by the losses on Thursday. Bean oil and meal also struggled over the last few days as world demand remains in question going forward. The rains expected over this weekend should help the bean crop more so than corn in those areas so the actual rainfall received will be important come Sunday night. Like corn, exports were good but not great and we NEED great to get people excited. If we see China buying new crop beans (or corn) in the coming weeks that would be welcome support for the market that is needing direction. The Biden administration has yet to make up their mind on what they want to do with biofuel mandates presenting the markets with a big question mark that they must work with for now.

Dow Jones

The Dow lost on the week as markets try to solve the mystery of the Fed and their tapering while also worried about the Delta variant. The consumer demand report and weakness in China consumer demand are hanging over the markets with a possible correction on the way according to some analysts.

US Dollar

The US Dollar hit a 10 month high adding to the bearish reaction across all commodities this week. A weaker USD helps US commodities be more competitive, but we are still a long way from where we were pre-pandemic.

Podcast

Check out our recent podcast where we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of the agriculture markets and to discuss the real-world application of the use of short-dated options to potentially fight the current blaze of volatility surrounding agriculture markets.

https://rcmagservices.com/the-hedged-edge/

US Drought Monitor

The maps below show the current drought conditions with rains expected over much of the corn belt over the weekend. Last week’s is also there for comparison week over week.

Via Barchart.com