AG MARKET UPDATE: AUGUST 5 – 12

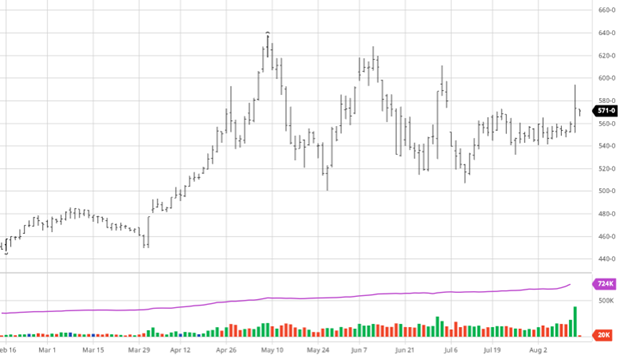

Corn saw large gains following the USDA report on Thursday before finishing the day well off the highs. The USDA cut expected yield to 174.60 bu/acre from 179.5 in the July report. The USDA also lowered Brazil’s crop yield by 6 million tons to 87 million and some estimates believe it will still be lower than that. The combination of these two yield cuts cut the world ending stocks for the 21/22 year by over 6.5 million tons which shows a slightly lower demand as well.

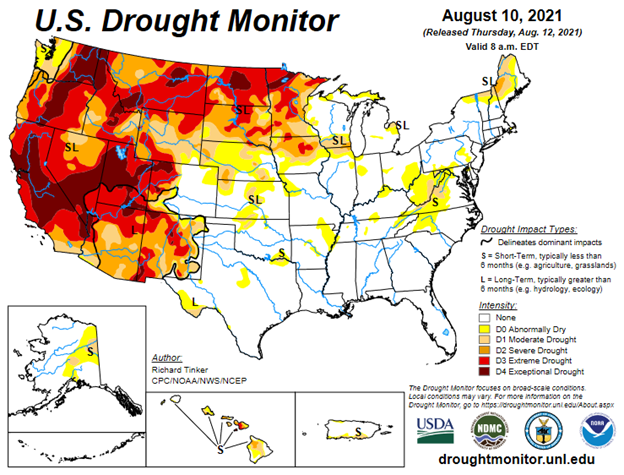

The report this year cut yield expectations much earlier than in the past which is what surprised the market as we usually get adjustments after the fact. Brazil will probably see another cut in their production down the road where the USDA left the possibility of raising the US production in the future by making such a drastic cut. The drought monitor at the bottom shows current conditions and although it is slightly improved from last week but as you have seen the plains have had a brutal stretch.

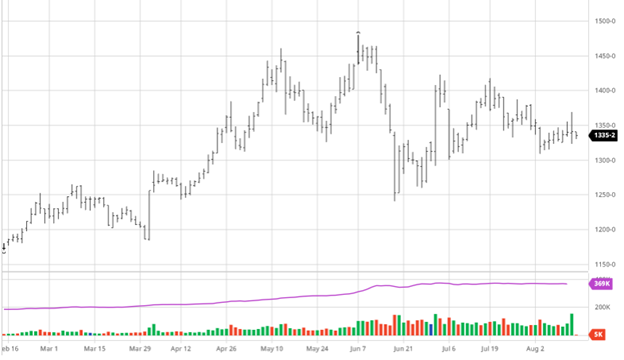

Soybeans had more of a mixed report but still gained following the report while finishing well off their highs. The USDA pegged the bean crop at 50 bushel per acre but cut demand by raising world ending stocks. As the demand from China has slowed from the torrid pace to start the year that fueled the run up in price the demand has been quiet recently. With improving weather conditions coming down the stretch the US bean crop is in good shape with the possibility to improve. The world supply is snug but not critically tight so there is more wiggle room for beans than corn currently.

Dow Jones

The Dow gained on the week as strong earnings continue to come through with the normal names leading the way. The Biden administration’s Infrastructure plan will become more a story as more exact details come out but will provide areas of growth.

Podcast

Check out our recent podcast where we’ve brought on one of our real-life firefighters from RCM Ag – Jody Lawrence along with Tim Andriesen from the CME Group to provide us with some inside baseball knowledge of the current state of the agriculture markets and to discuss the real-world application of the use of short-dated options to potentially fight the current blaze of volatility surrounding agriculture markets.

https://rcmagservices.com/the-hedged-edge/

US Drought Monitor

The maps below show the continued drought conditions in the northern Midwest that reaches into the Canadian planes while it has also improved since last week.

Via Barchart.com