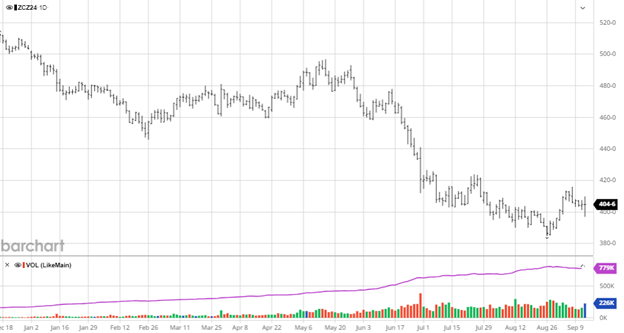

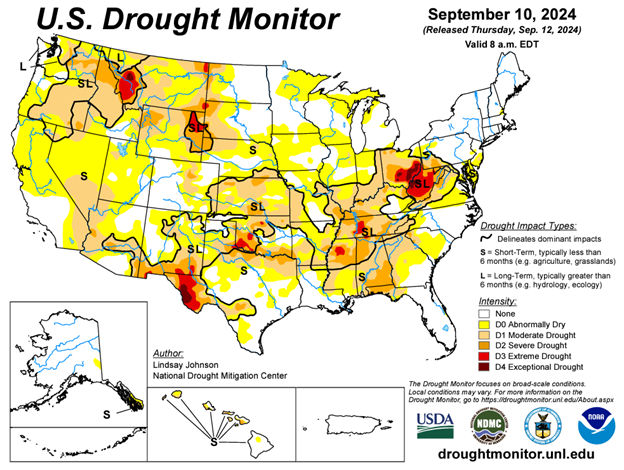

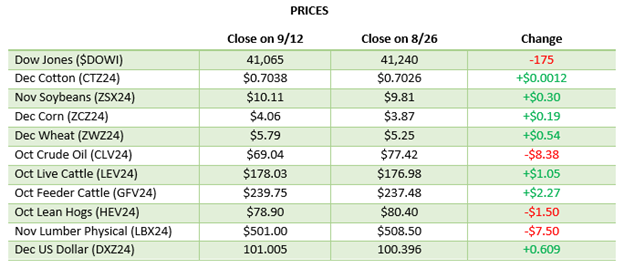

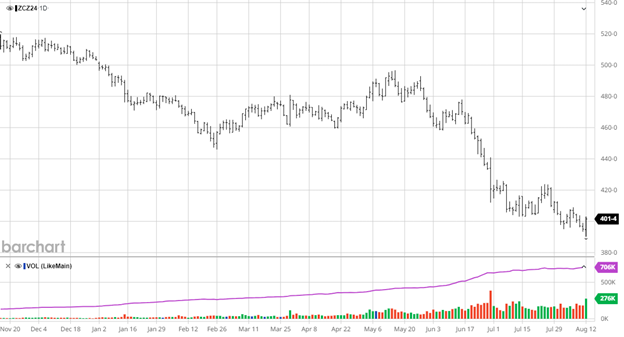

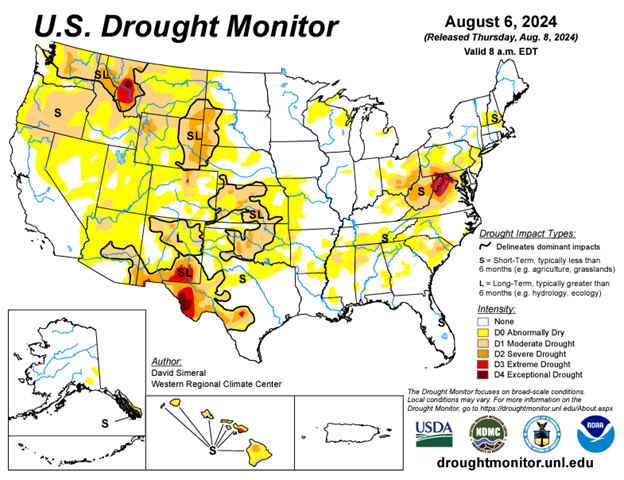

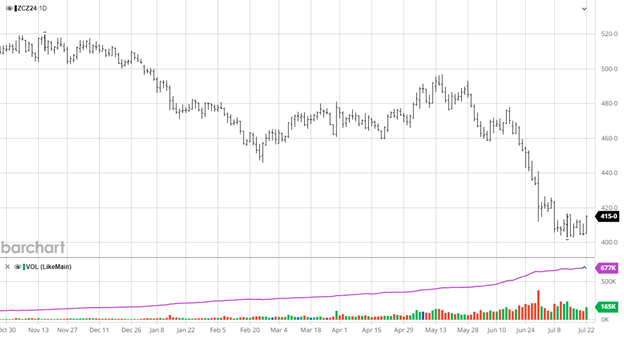

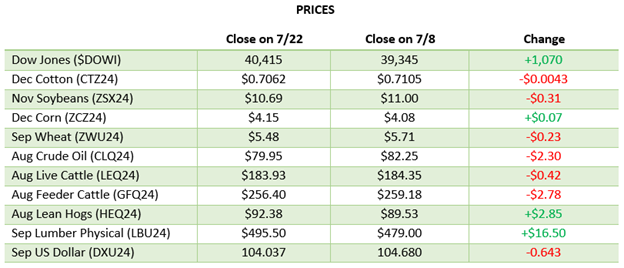

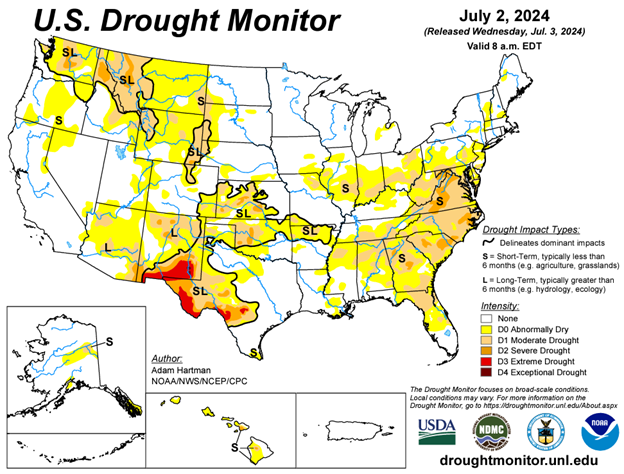

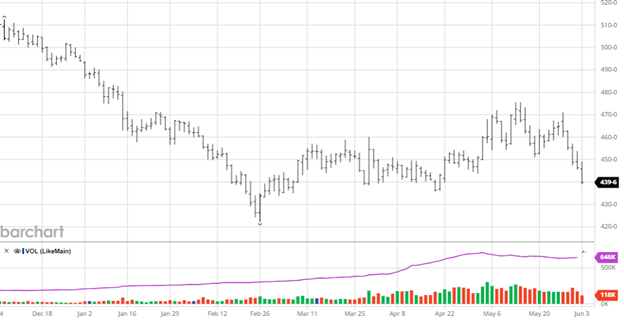

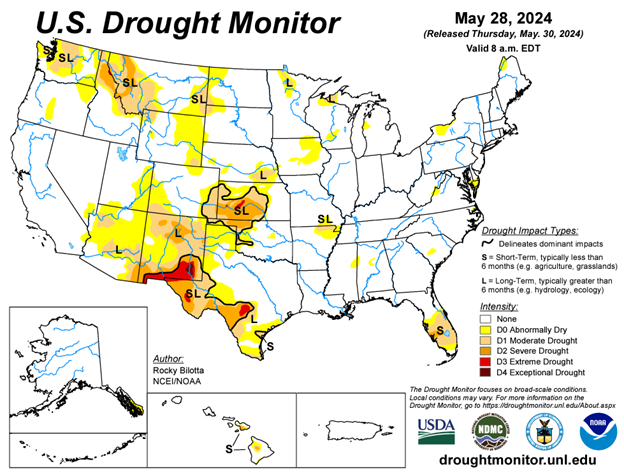

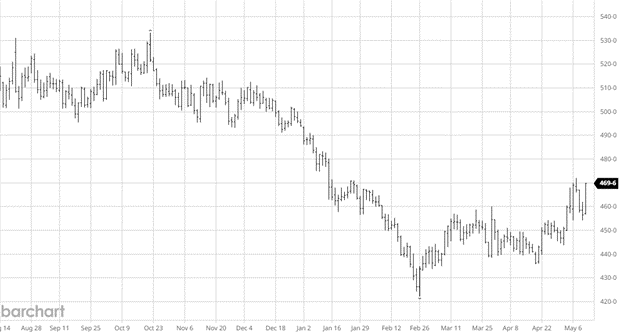

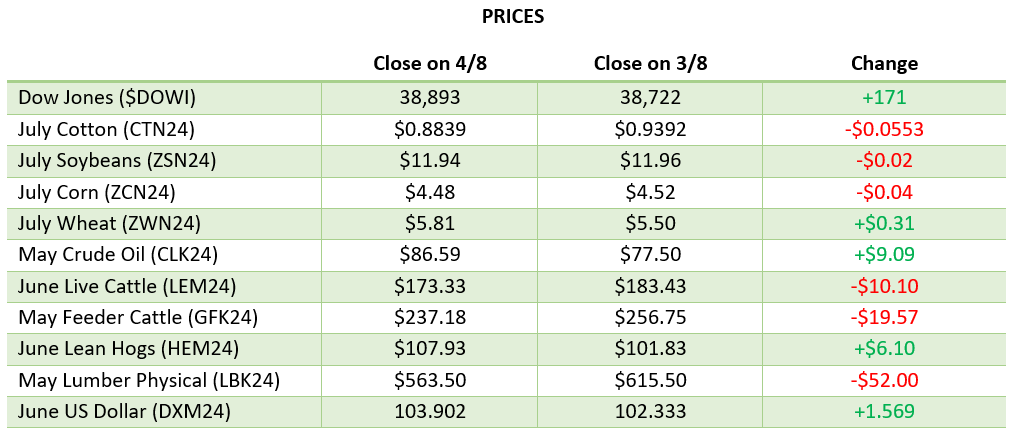

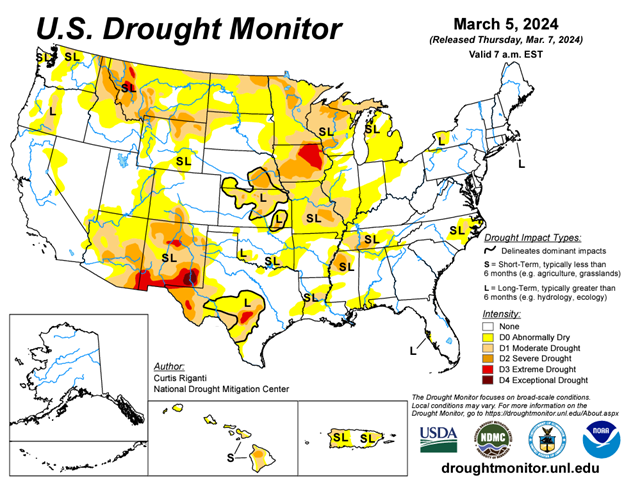

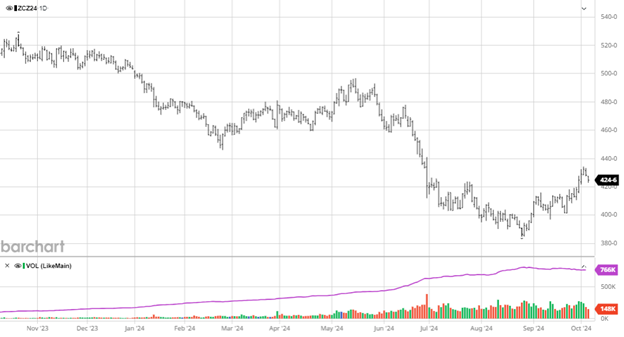

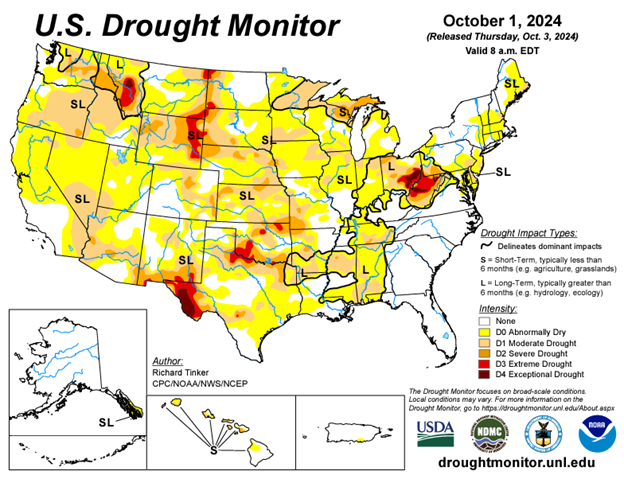

Corn’s rally back to $4.25 has been welcome heading into harvest as South America’s weather started off a little weary but have added rains to the upcoming forecast. The US drought to end growing season does not appear to have impacted the corn crop very much. Export demand has picked up putting us ahead of the USDA annual projections. The recent rally has taken corn above other major exporters which will likely lead to slowing exports unless South American weather becomes more of a concern. Harvest has gotten off to an average start with 21% harvested as dry weather shouldn’t cause any problems in the next week.

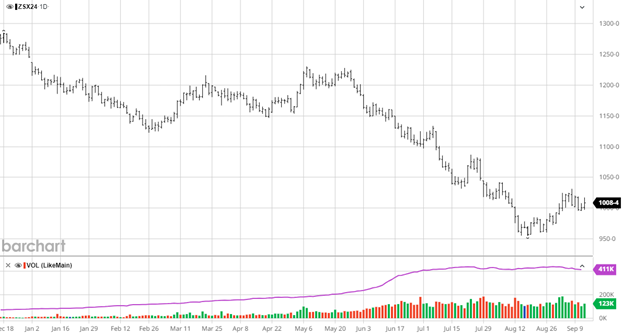

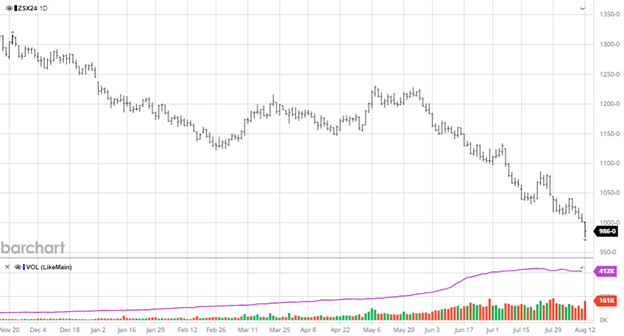

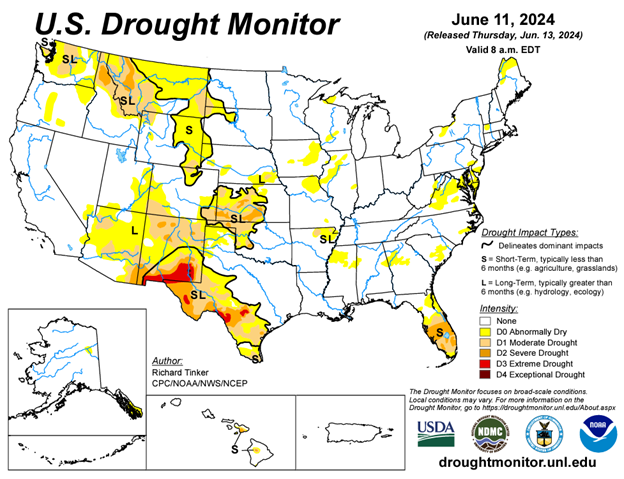

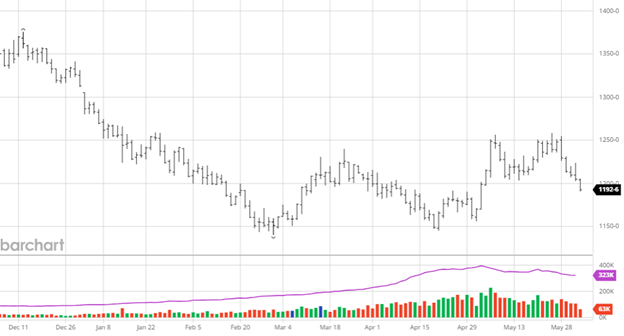

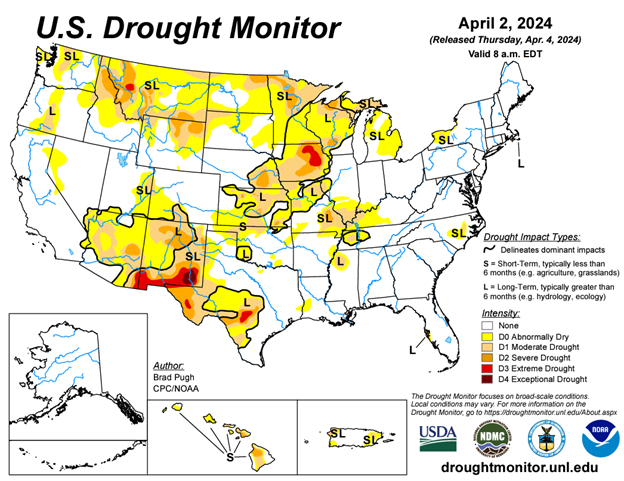

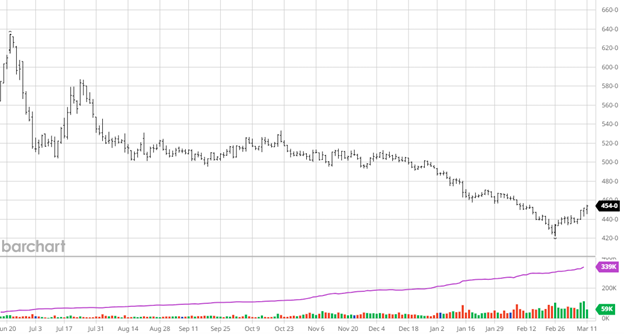

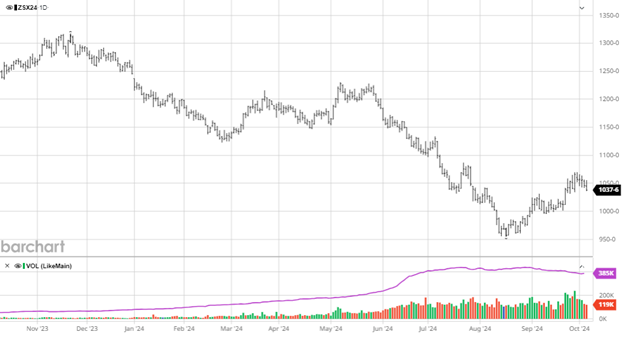

Soybeans faded to end the week as harvest progress and pressure lead to profit taking after the recent rally. The biggest news related to soybeans, non harvest related, is that congress seems to be working on bipartisan legislature to address the importing of used cooking oil while still collecting tax credits. The American farmer wants this loophole closed to force biofuel producers in the US to use domestic production. This will lead to millions of more bushels used at crush facilities in the US throughout the year with a major question of, what happens to the bean meal? The longer congress and the lobbying associations take on this legislature will lead to more frustration among farmers across the country so with it being an election year I would be careful with what gets “leaked” by parties involved. The end of year drought across much of the US likely led to a smaller crop as pods did not get the moisture needed for max fill. Bean harvest is slightly ahead of expectations at 26% to start the week of Sept 30.

Soybeans faded to end the week as harvest progress and pressure lead to profit taking after the recent rally. The biggest news related to soybeans, non harvest related, is that congress seems to be working on bipartisan legislature to address the importing of used cooking oil while still collecting tax credits. The American farmer wants this loophole closed to force biofuel producers in the US to use domestic production. This will lead to millions of more bushels used at crush facilities in the US throughout the year with a major question of, what happens to the bean meal? The longer congress and the lobbying associations take on this legislature will lead to more frustration among farmers across the country so with it being an election year I would be careful with what gets “leaked” by parties involved. The end of year drought across much of the US likely led to a smaller crop as pods did not get the moisture needed for max fill. Bean harvest is slightly ahead of expectations at 26% to start the week of Sept 30.

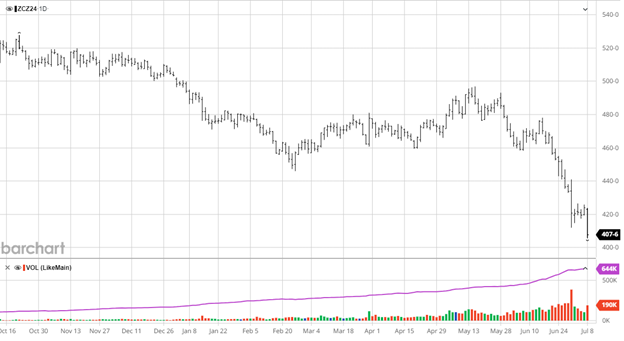

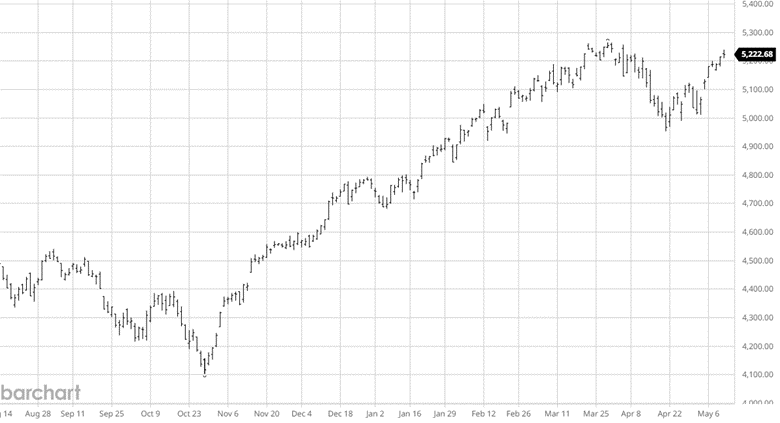

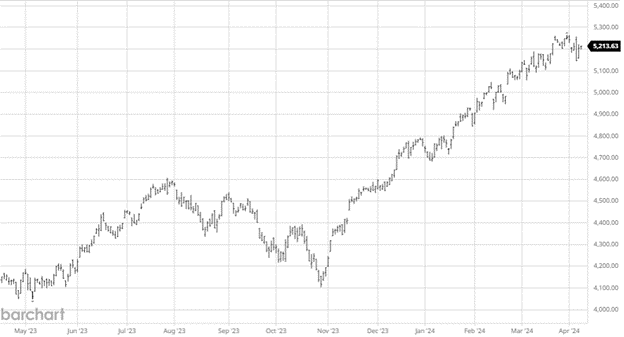

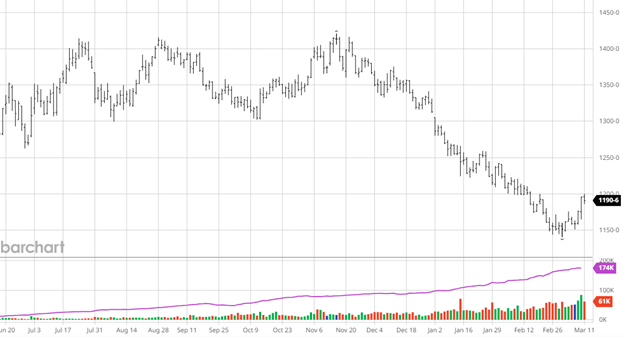

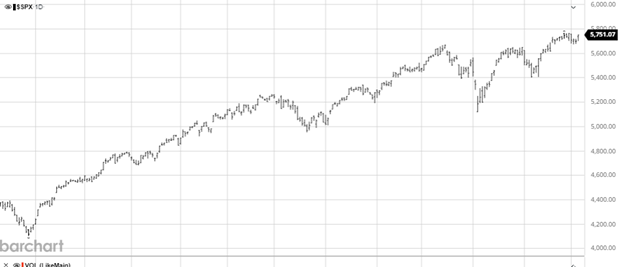

Equity Markets

The equity markets continue to roll hitting new all-time highs as Fed rate cuts and the likelihood of a soft landing becomes higher. The market has broadened out but the biggest names (Nvidia, Meta, etc) are still doing well. With rates lowering over the next year expect money that has been getting 5%+ in fixed income to begin to move back into the market. Chinese stimulus prompted a large rally in Chinese stocks this week as they try to get their economy going again.

Other News

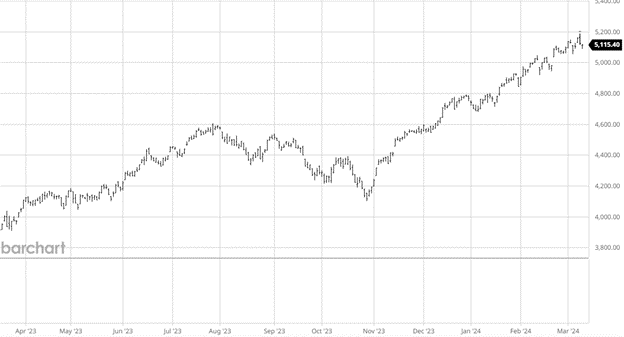

- The Fed announced a 50-basis point rate cut this month, cutting rates for the first time since the Pandemic. More rates are expected into the end of the year.

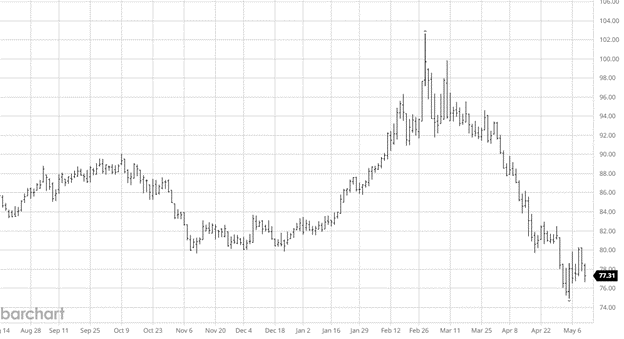

- Tensions in the Middle East escalated as Iran launched attacks on Israel. Israel is expected to respond but how and when remain unknown, with attacks on oil fields a possibility crude oil rallied over the week.

- Hurricane Helene caused massive devastation in the United States Southeast over the weekend causing loss of life and destruction of major infrastructure. The total amount of damage is still unknown, but it will take the mountain communities a long time to recover.

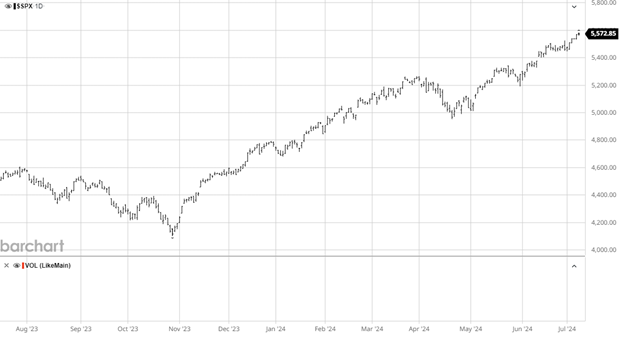

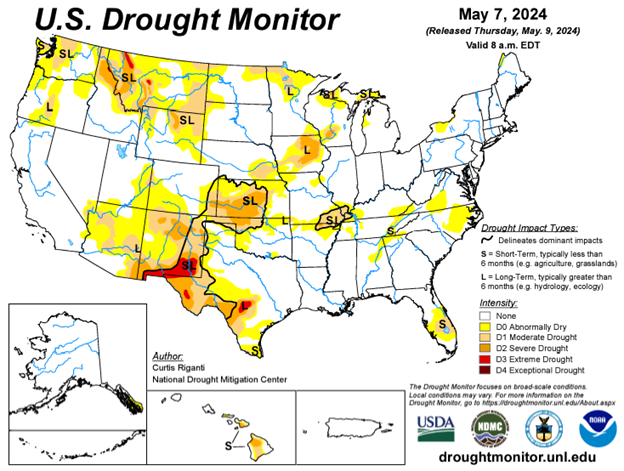

Drought Monitor

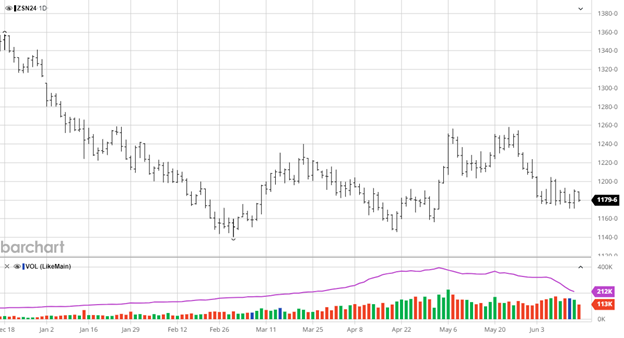

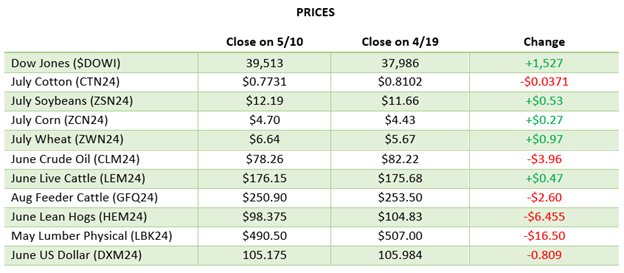

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].