AG MARKET UPDATE: OCTOBER 31 – NOVEMBER 6

Corn mounted a comeback to get back above $4.00 this week on export news along with South American dryness. Corn needs China to continue to be huge buyers as they try to follow soybeans higher. Corn exports this marketing year are running 179% ahead of this week last year and are already 56% of what the USDA forecasted. If the USDA raises export forecasts because they see this trend continuing, that would be bullish on the demand side as we head into 2021. Corn has not had the violent swings like soybeans but their charts look similar as exports have been their main mover. South American weather will be a market mover as we head into their growing season so keep an eye on their dryness because if it continues in future forecasts it will be bullish. The election does effect the commodities market, like every market, so there may still be some volatility as the election results slowly (very slowly) come in.

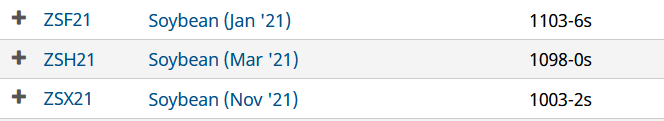

Soybeans have had a very strong week after slipping a bit to end October. With huge export numbers continuing and a dry La Nina pattern forming in South America, U.S. bean prices topped $11 for the first time in 4 years. The factors causing this run up have still been exports and South America worries, with exports being the main factor (for now). The continued forecast of dry weather in South America is starting to get long enough to cause some serious worries about the crop, especially if the forecast keeps the trend in some regions. The U.S. Dollar has also fallen over the last week helping U.S. commodities become more favorable to other countries. As the election may be up in the air for a while for both the presidency and senate all markets will remain volatile. We continue to suggest selling all your soybean crop and not carry any into 2021 to take advantage of this run as prices in March are lower than January futures.

Soybeans have had a very strong week after slipping a bit to end October. With huge export numbers continuing and a dry La Nina pattern forming in South America, U.S. bean prices topped $11 for the first time in 4 years. The factors causing this run up have still been exports and South America worries, with exports being the main factor (for now). The continued forecast of dry weather in South America is starting to get long enough to cause some serious worries about the crop, especially if the forecast keeps the trend in some regions. The U.S. Dollar has also fallen over the last week helping U.S. commodities become more favorable to other countries. As the election may be up in the air for a while for both the presidency and senate all markets will remain volatile. We continue to suggest selling all your soybean crop and not carry any into 2021 to take advantage of this run as prices in March are lower than January futures.

Dow Jones

The Dow took off this week despite all the volatility going on with the election and so many uncertainties days later. As quickly as it fell last week it has recovered just as fast this week. Still many questions remain about the election outcome, which the market will be watching closely, but markets are banking on the republicans maintaining control in the Senate which would hinder any large scale democratic changes for the time being.

Energies

The energy sector got a boost out of the election as they believe the Republicans can keep control of the senate, which would put a fork in the “Green New Deal” or any other major energy overhauls that could have been accomplished with a democratic sweep.