Recap:

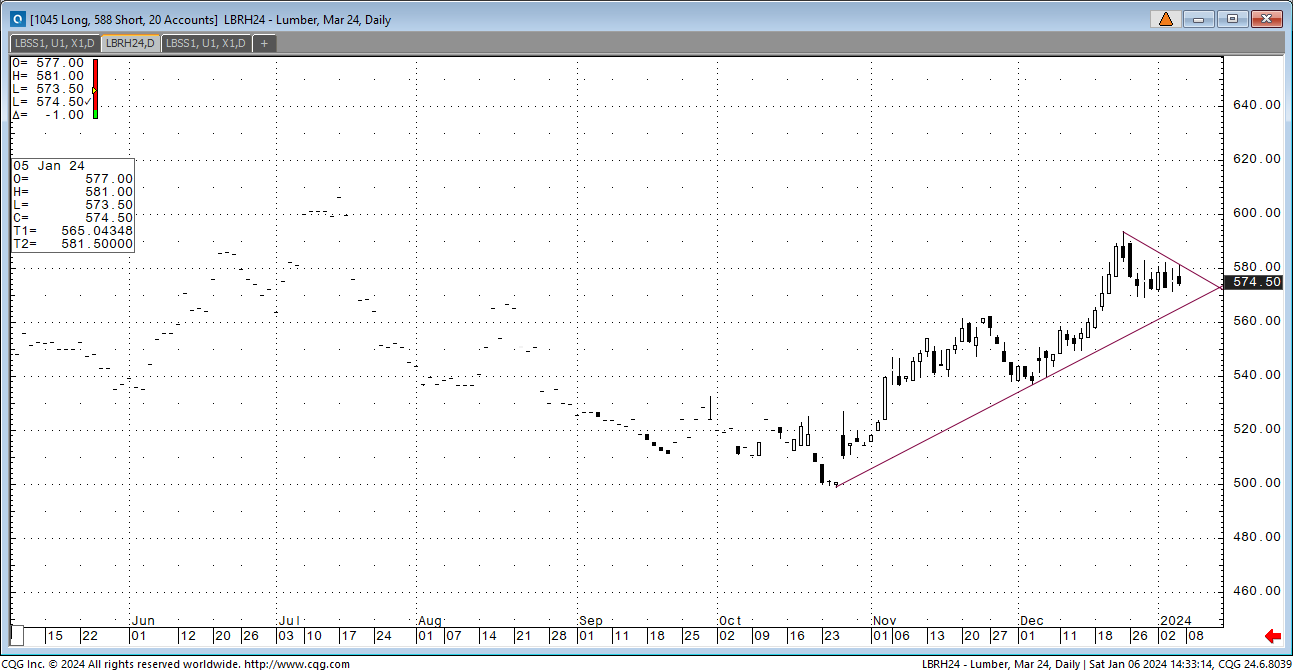

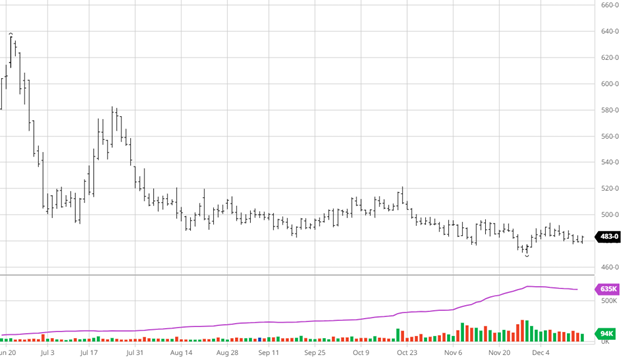

The futures market sprang to life on Friday, with May spiking to 620.50. It looks as if long-term buy stops were hit without any selling above. This market needed a little rattling. It wound itself tight into a small range while the cash market was busy daily. The premium did add to the buy side reluctance but a spike higher was brewing. Now what?

Weeks ago, we discussed the cash market needing to be the leader. Futures were already at a premium, and only the sell algo was trading. The cash side has been strong for a few weeks. The spring rally started early after the cash market suffered through January. That lag in business is showing up today. So, a combination of pent-up business and spring has helped keep the mills active.

This is not a supply-and-demand rally. The reduced supply has yet to be a factor in the trade. This is an accelerated fill-in. The buy side should see this as a warning to what a supply disruption could look like.

Technical:

The technical picture is limited to short-term data. The focus today is on the RSI in May, which is sitting at 75.10%—other than that, the switch from the old contract to new has nullified a lot of data points. If we add in the older data, the market tells us there is a $80 downside and $200 upside.

Note: A commodity producer will only lose money for so long before retooling the strategy.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636