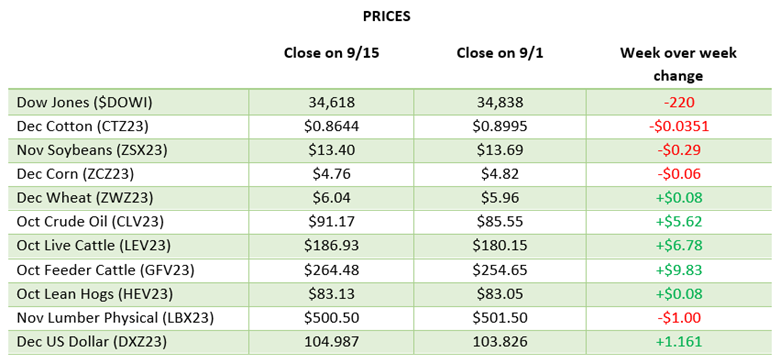

“Everyone is worried about everything.” That was a quote from a Morgan Stanley person regarding the overall economy Friday. Worry is the emotion driving our industry today. I’ll attempt to temper that despair. Let’s face it: the market has been flat for almost 18 months. The profit margins have shrunk to pre-2000 levels. Every dollar earned is hard work. Welcome back. Could this type of market be with us for another 18 months? I hope not, but it will be here for a while more. The greatest attribute of the lumber industry is the trader’s ability to make lemonade out of lemons. That is where the marketplace sits today.

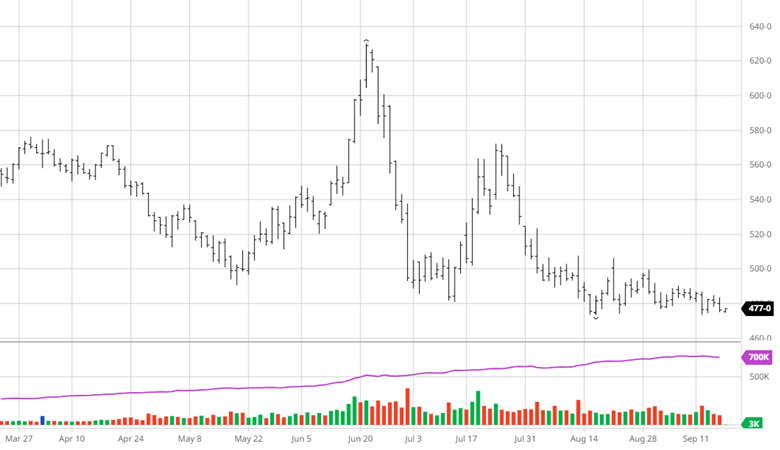

Inventory is viewed as a negative again. I hear repeatedly that buying a car is like trying to catch a falling knife. If you have contracts, you get to start with a loser and work your way down. The VMI programs are beginning to feel excessive to most participants. A black cloud hangs over the market for many, but not all. The futures market sits at $500 month after month, which tells me that we have a trading level for this demand. The problem is that the trade faces a flood of negative news daily, which is hard to navigate.

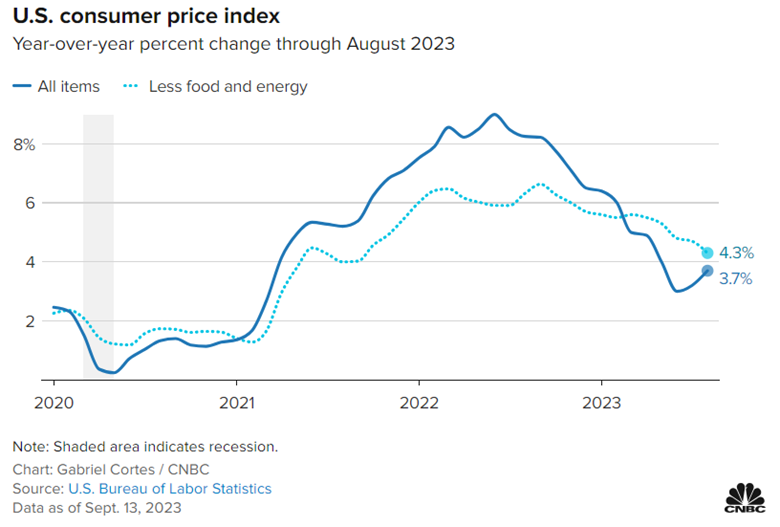

The trade needs to get past the news at this point. As I said last week, we lost our starting QB (rates) and now have the backup in. Those who have consistently bought three months out since September of 2022 have done very well. The fact that they return to the market each time tells me that construction remains steady. The fact that many long futures remain tied to forward pricing also tells me that business is going on. And finally, the fact that the commodity funds continue to sell and do not reap any benefits tells me we are balanced. Single and multifamily construction had been carried forward. We will see a slowdown. The futures market indicates that housing is slowing but not on a cliff. Is it a further slowing or a cliff? With rates close to 8%, some see a cliff, but I’m not so sure with the 50-year average at 7.45%. Higher rates have not caused the demand destruction most had expected. It has slowed things but not stopped it. The higher rates are a function of flooding the system with capital. That money is here to stay. I don’t think people have that understanding yet. Here is a simple example. The President spent millions of dollars building more of the wall yesterday. That was millions of dollars sitting since 2019 needing to be spent. Billions of dollars allocated since 2020 have not yet hit, and it is estimated to be 3 to 5 years before it is all in. That massive excess my friends take projecting in this environment from an Econ 101 drill to an Econ 401 estimate. Throw an excellent employment environment and growing family units into the mix, and I would say this isn’t a cliff.

This market also has an internal issue. There are only so many dollars available in this industry. You can’t project an increase in profits when there are more players to bid on fewer cars. This doesn’t mean business is bad but indicates a too-crowded space. It also doesn’t indicate that inventory is a negative. On the contrary, it is becoming an investment again as most push back. The market needs time to evolve. The chances of demand or supply making an impact any time soon are slight. Hedging after a pop or locking in a basis trade will remain popular for the following year. At this point, no one wants to do all the work to lock in a $20 winner. The facts are it may be coming back to the historic norm.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

bleonard@rcmam.com

312-761-2636