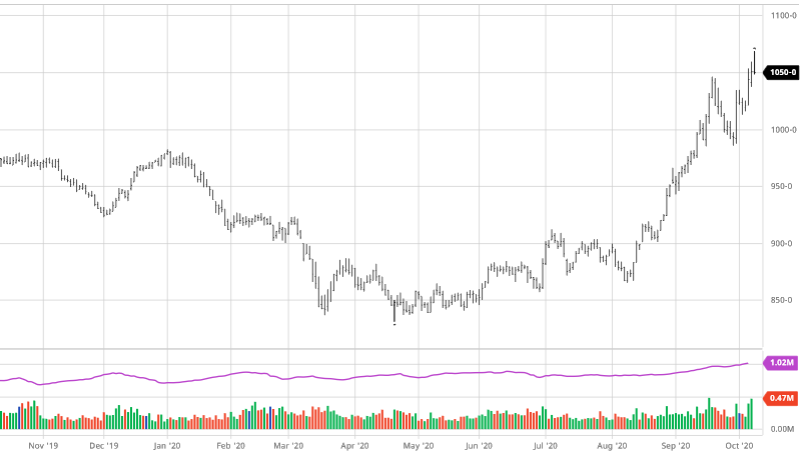

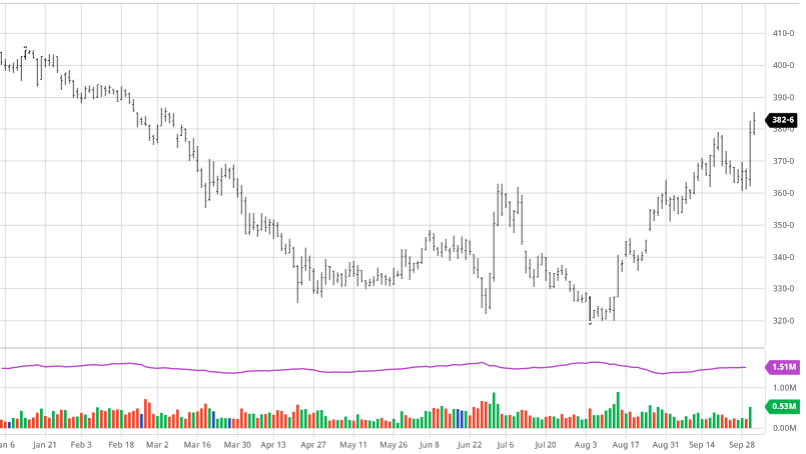

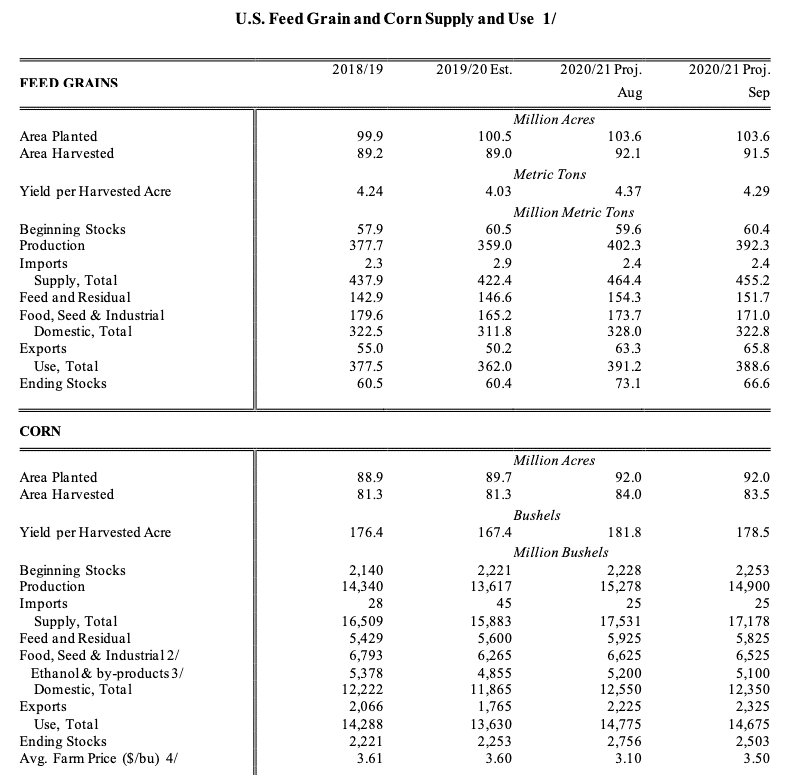

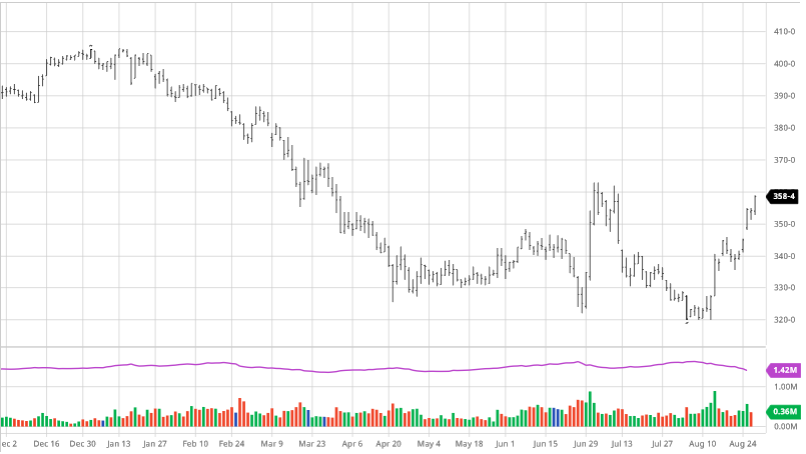

Corn is down on the week as funds took profit on their historically long positions as they have liquidated over 200 million bushels worth, still holding a large long position. The underlying fundamentals this week remained strong despite the big loses. Exports were strong again this week as China continues to buy & with bigger purchases from Mexico as farmers worry their crop may not be as large as expected. The forecast for Argentina has turned drier giving South America a concerning supply issue. As the La Nina weather pattern continues to strengthen, continued dryness looks to be in the future. The demand for ethanol going forward remains a big mystery as COVID cases continue to rise across the US and Europe. Ethanol production has not returned to pre-pandemic levels, but another shutdown could drive it back to spring levels. The fundamental outlook for corn continues to be bullish despite this week’s price movement.

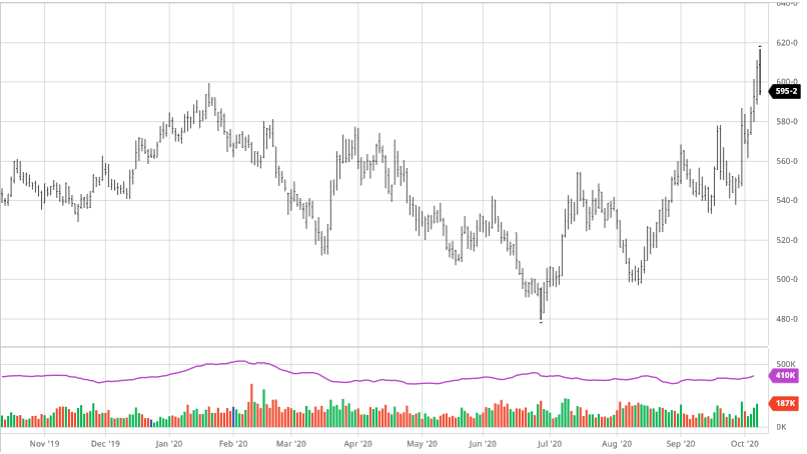

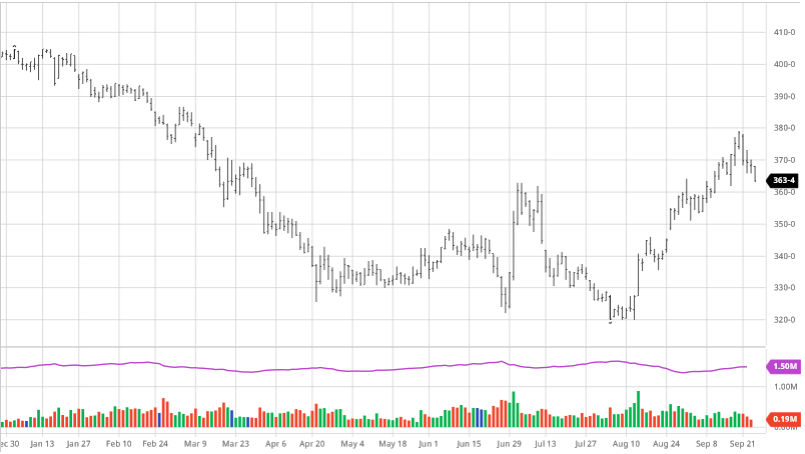

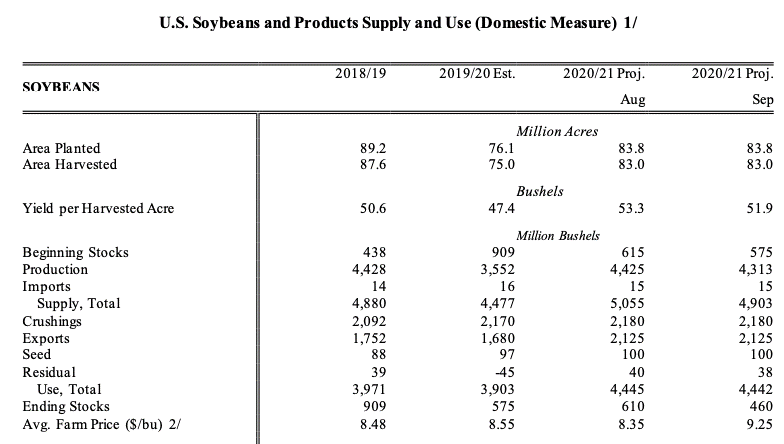

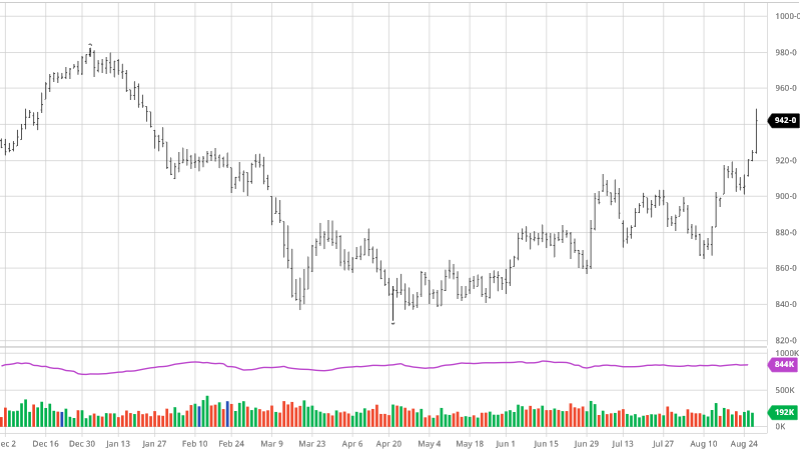

Soybeans were down on the week for similar reasons to corn. Exports were strong even though they were lower than last week’s report. Continued dryness in South America will be another bullish fundamental factor to keep an eye on as this may present continued selling opportunities after harvest if you stored any production as well as improvements to ’21 prices. The market selloff in all markets was the main problem as Covid-19 cases continue to rise around the world and uncertainty around next week’s election. Bean harvest was seen at 86% complete heading into this week. Even with snow in the Midwest, a warmer pattern looks to be on its way to allow farmers to get back in the fields and finish up harvest. Like corn, the underlying fundamentals remain bullish for soybeans if Chinese demand continues.

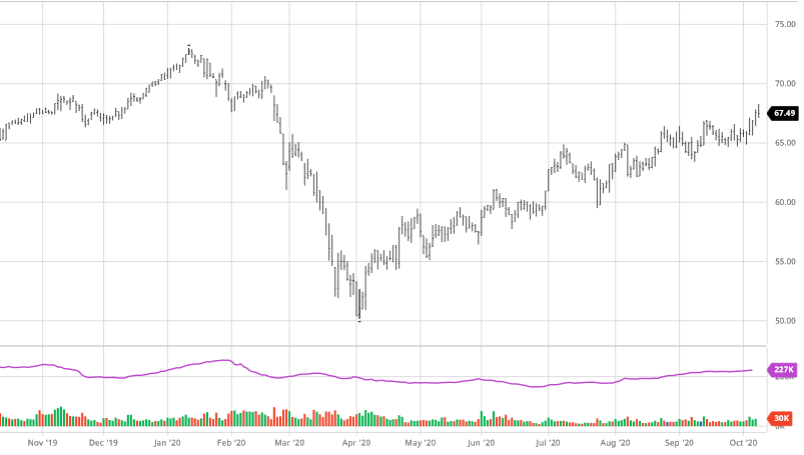

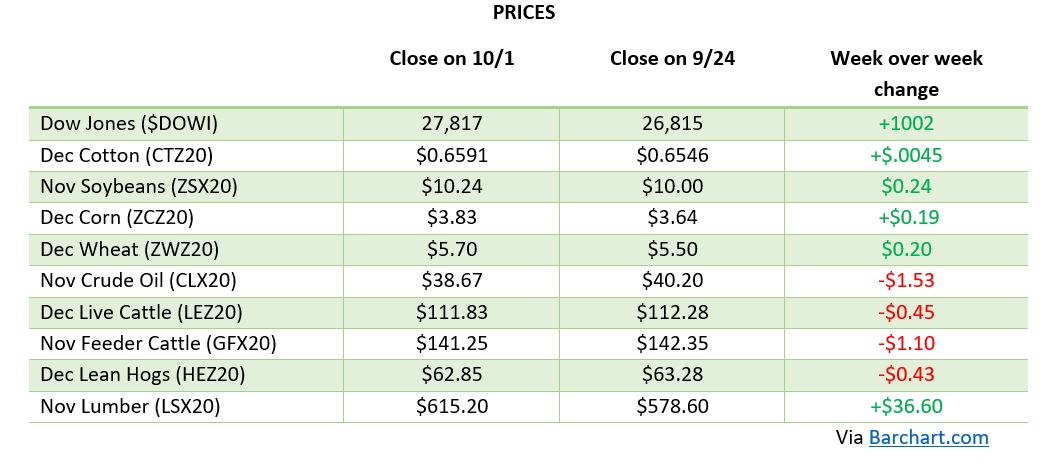

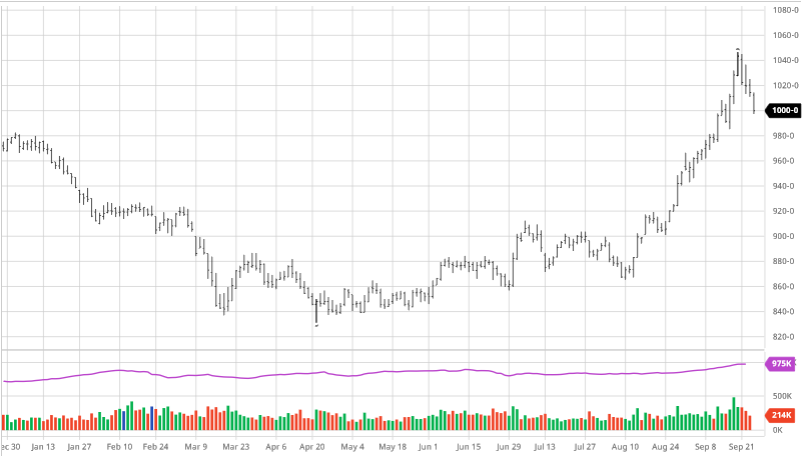

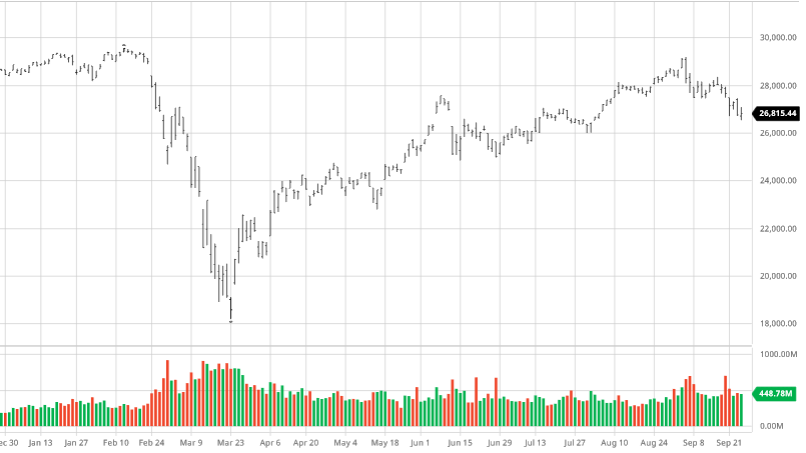

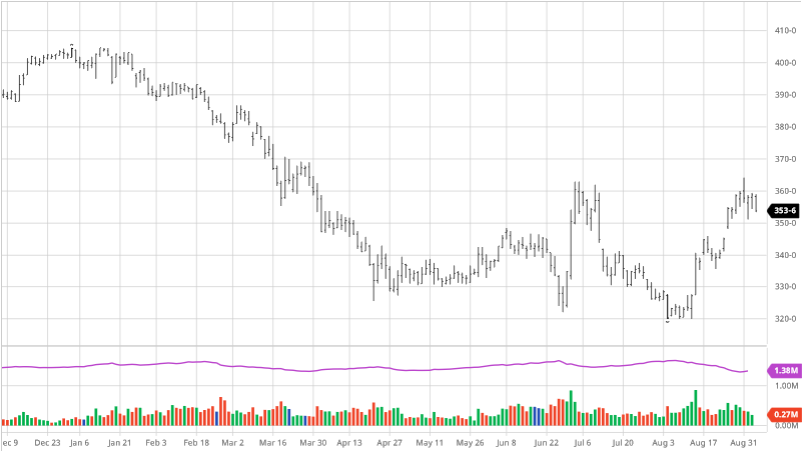

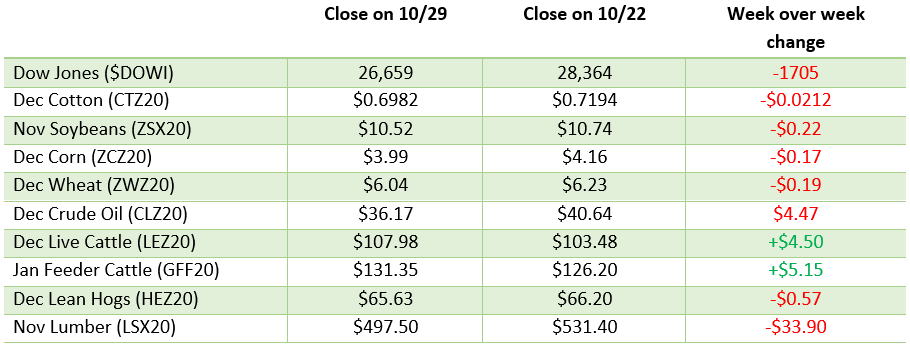

Dow Jones

The Dow was hit hard this week as Covid-19 cases around the world are on the rise bringing about fear of another economic shutdown to slow the spread. Along with rising cases, the potential of delayed results from the election and uncertainty about the outcome looms large. Several of the largest tech companies in the world reported earnings this week as well.

Presidential Election

President Trump and former Vice President Joe Biden’s months of campaigning and debating will come to an end next week (hopefully). With the potential of a democrat sweep, many experts are trying to predict the possible outcomes. But if we learned anything from 2016’s election, it is that the polls are hard to get an accurate read on. As the eyes of the world are on the US Nov 3rd , the futures markets are sure to be interesting to watch.

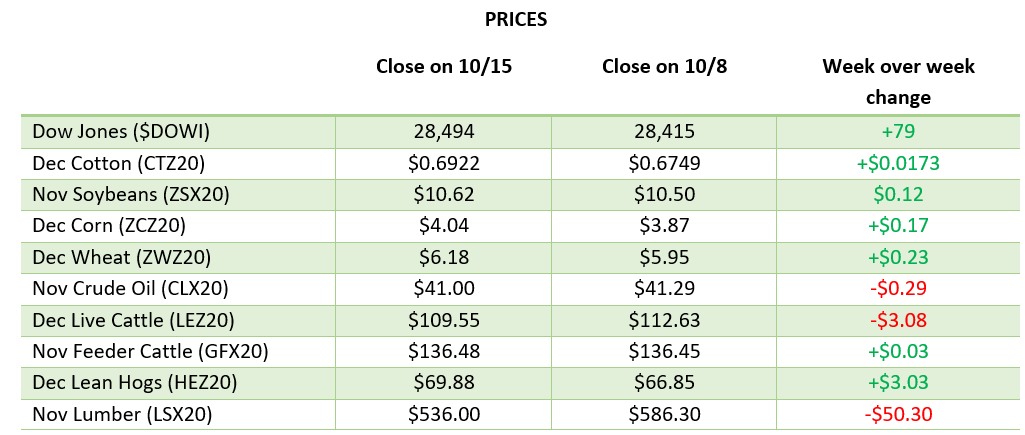

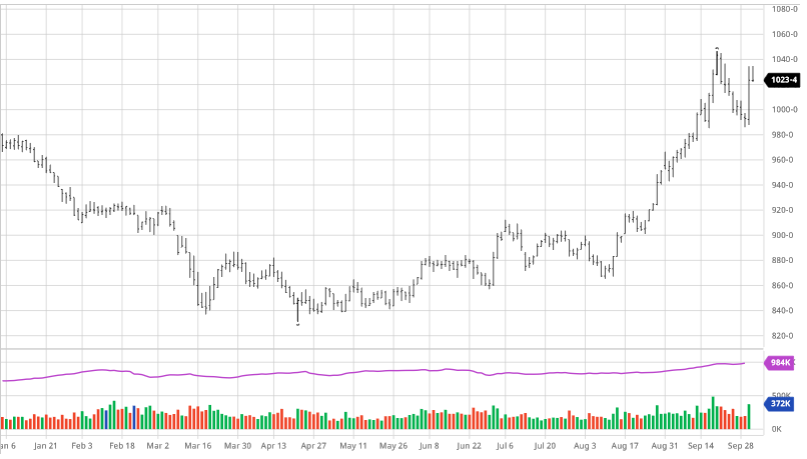

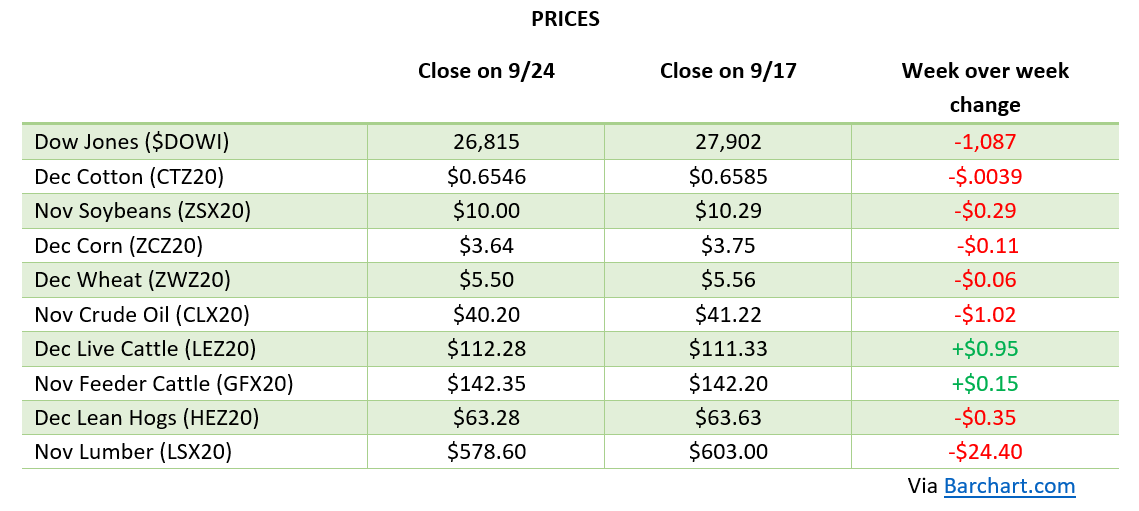

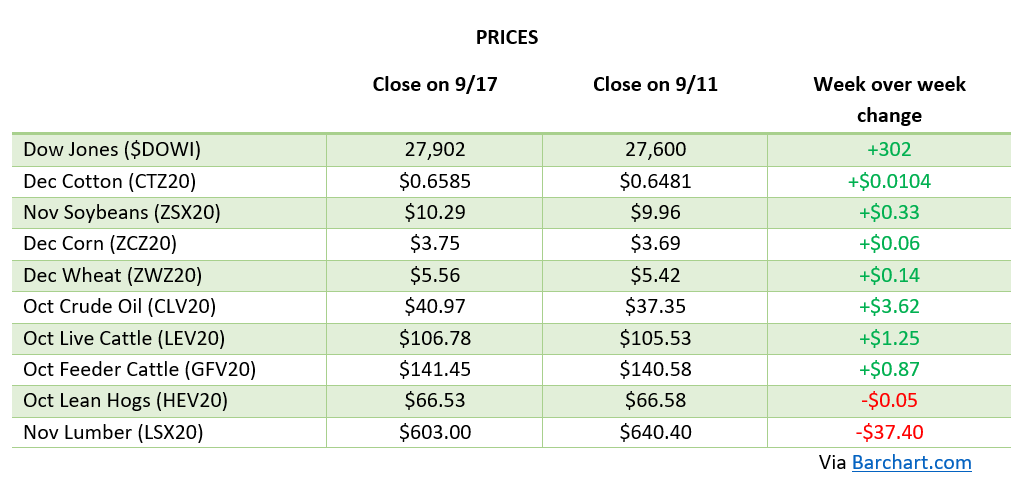

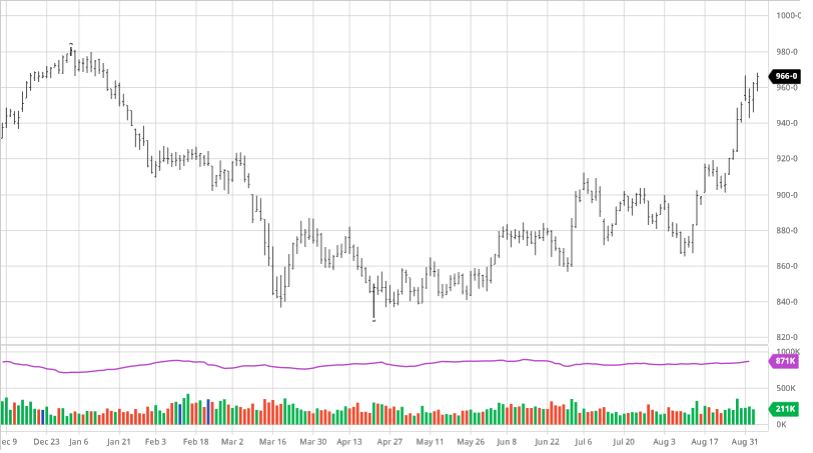

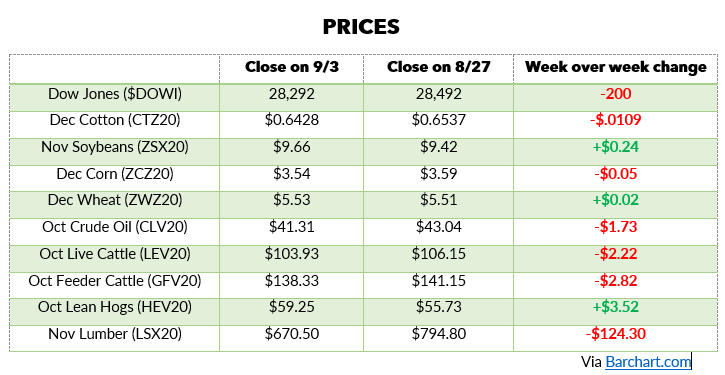

Weekly Prices

Via Barchart.com,