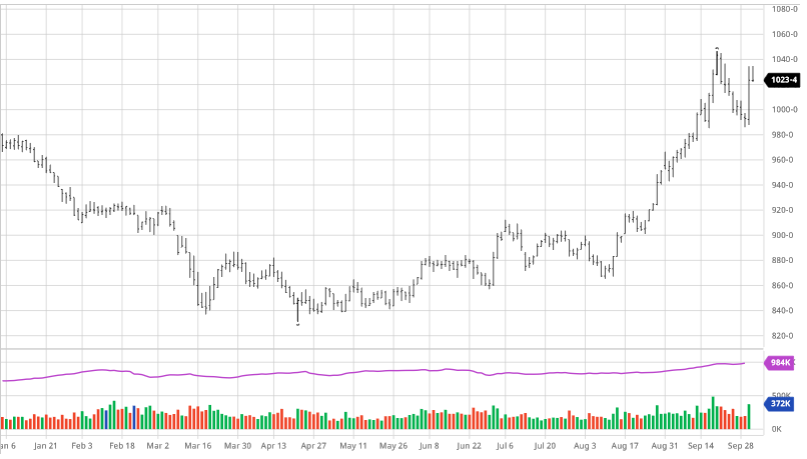

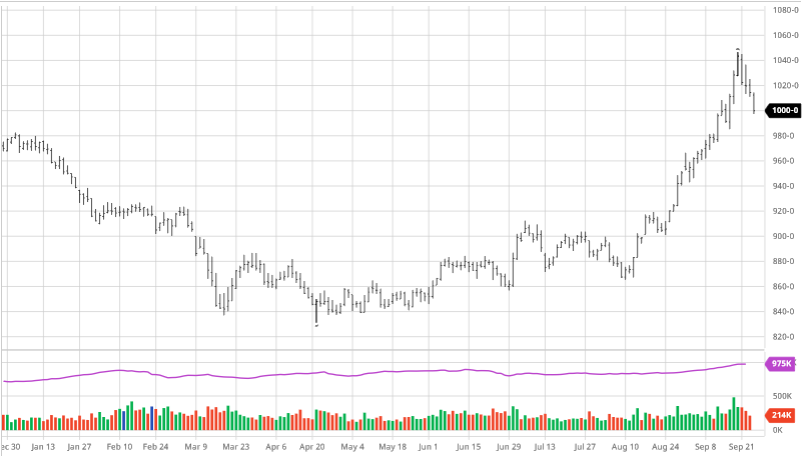

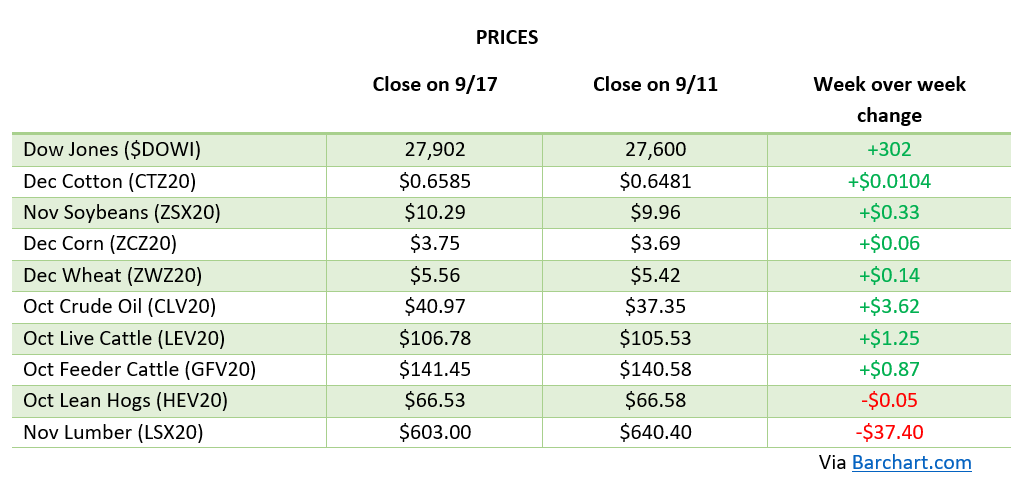

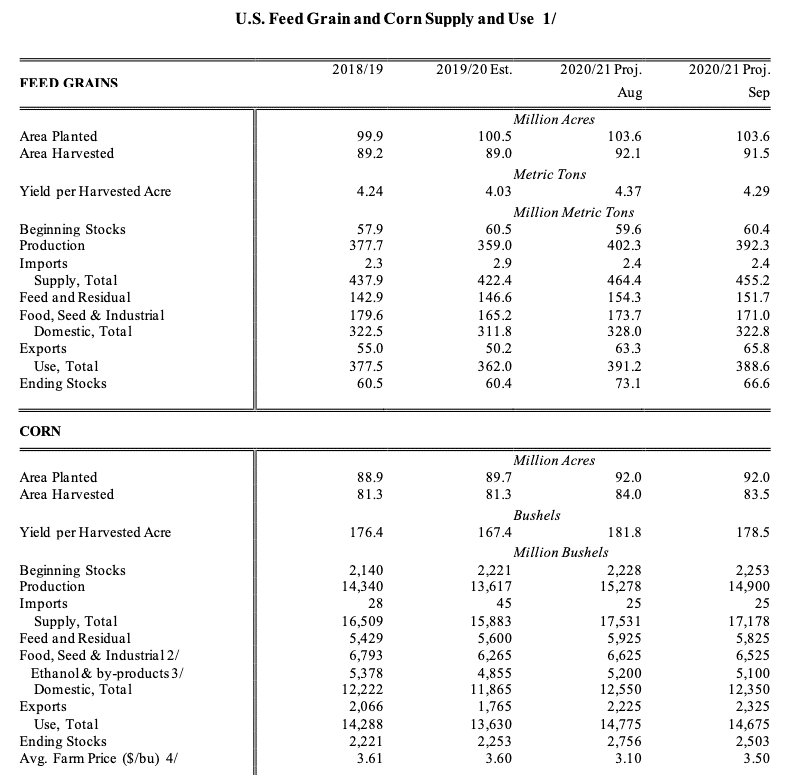

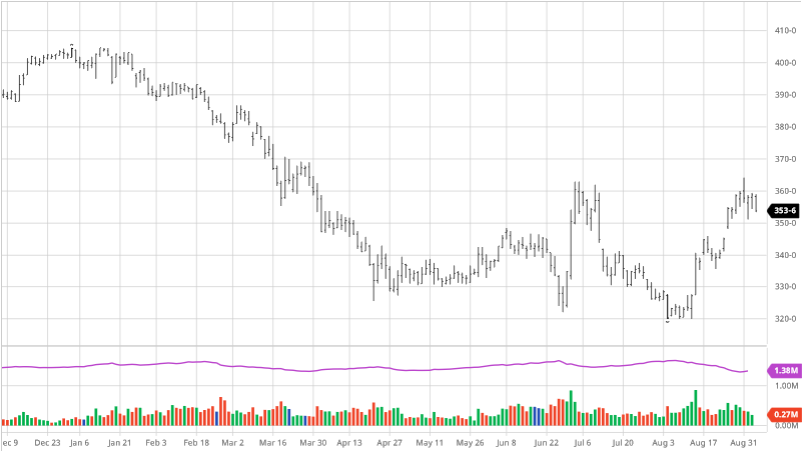

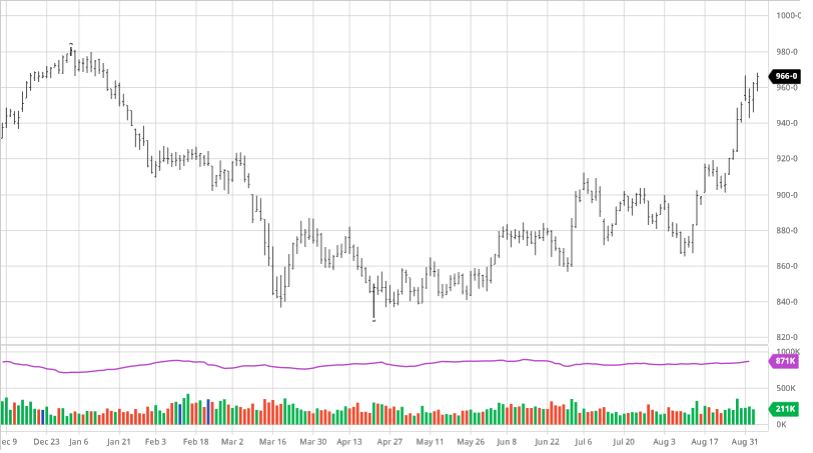

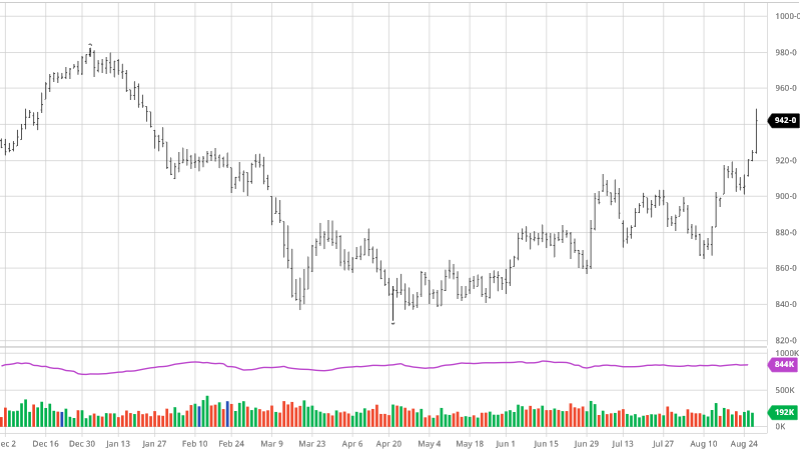

Corn saw a big boost as a result of the surprises in the USDA stocks report this week. Corn came in 255 million bushels below estimates at 1.995 MBU, which comes back to what everyone thought that the USDA overestimated the 2019 crop. This adjustment lowers the 2019 yield by about 3 BPA, which sounds much more accurate from what we heard from talking to farmers. Ultimately, this means world stocks are tightening as Chinese demand of US grains has picked up with Phase 1 trucking on. Post-report funds continued to get long, which helped the drive up as well. Exports continue at a great pace as harvest begins in many parts of the US. Continue to keep an eye on exports and weather as any major delays to harvest/crop moisture could prevent problems although the forecast is favorable into mid-October. The chart below shows the sharp bounce back up after a couple weeks of slow losses.

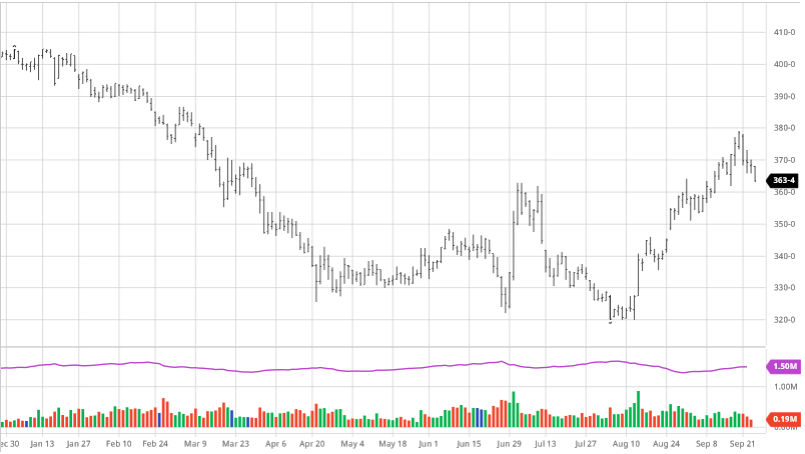

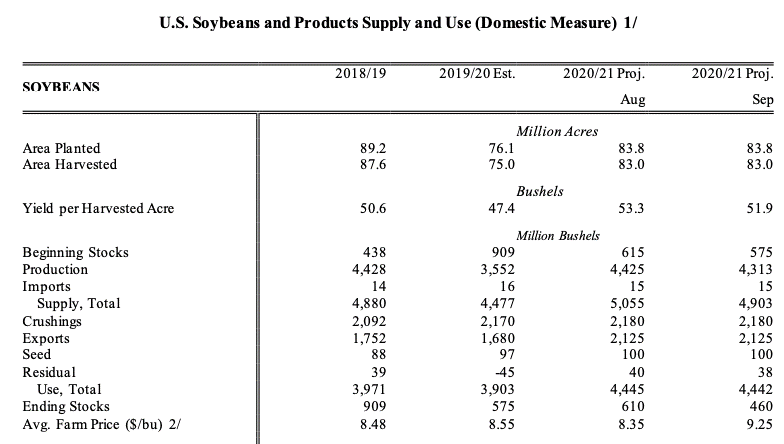

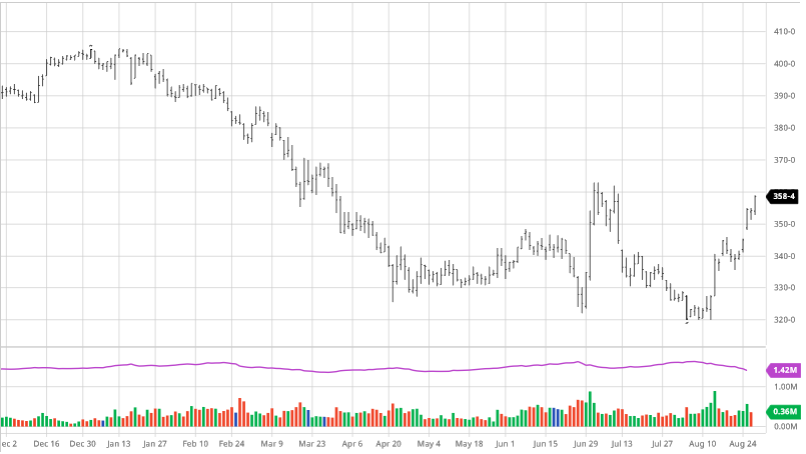

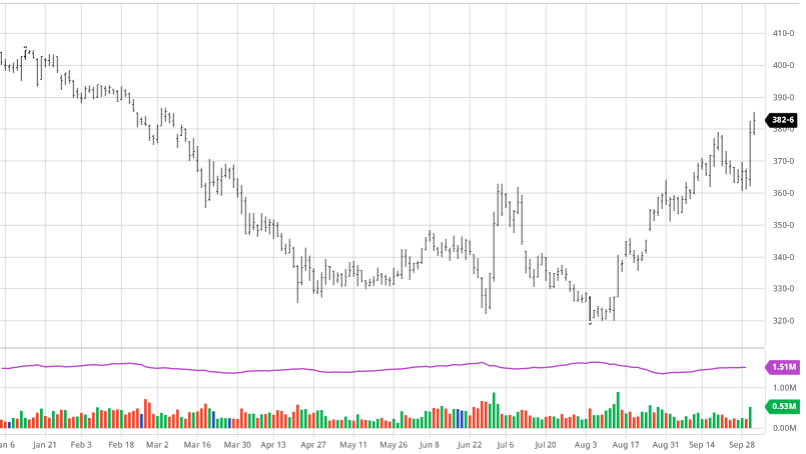

Soybeans had the biggest surprise of the report as ending stocks were down 42% from the September 2019 report. Beans came in at 523 million bushels, over 50 million below the average estimates. This low number on top of continued large buying from China saw a 25-cent rally after the report. Like corn, funds continued to get long post-report and are now long 1.07 billion bushels. As export numbers continue to be large and the USDA updated the stocks down, both were very bullish. Brazil’s growing season has gotten off to a good start as some areas are starting to look for rain. A good rain in Brazil would put a damper on the bulls, but with funds so long they will look to exports and harvest.

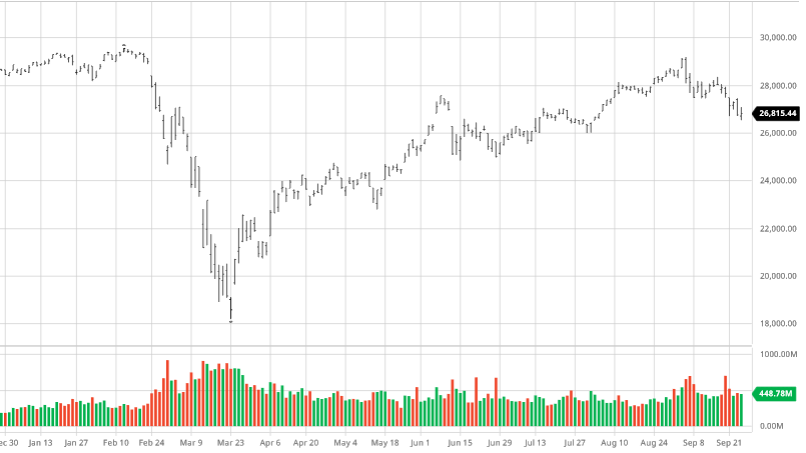

Dow Jones

The Dow bounced back this week despite a Presidential debate that left more questions than answers. Tech continued its bounce back after it took a tumble a few weeks ago as airlines and travel industry saw a boost as more potential aid could be heading there way along with a second stimulus package is in discussion. The unemployment report on Friday will be the main market mover. But with President Trump testing positive for Covid-19 more uncertainty and volatility will be added to the markets. Any updates on his condition with it will be watched closely as we will not see any campaigning from him over the next couple of weeks.

World Weather

Brazil and Argentina are off to a pretty normal start as planting went well. Central Brazil will see higher than normal temperatures accompanied by average to below average precipitation. Dry and warm outlook for central Brazil to start October and Argentina has a slightly dry outlook with normal temperatures.