Planting is close to done in most parts of the country with over 90% of corn in the ground. Now the focus will turn to weather as early growing season is an important time. With a tropical depression in the gulf, it makes it difficult to predict future weather patterns as they are constantly changing. One model predicts for a drought type pattern in the southern plains and western corn belt as the tropical storm Cristobal pulls a lot of energy, so we’ll see how that pans out. Corn prices have been steady the past few weeks with few purchases to get excited about and no early problems to the U.S. corn crop. As long as yield estimates for U.S. corn stays high, there does not seem to be many reasons for a rally unless there is a weather event or we start to see large purchases. Ethanol production has remained steady as reserves are starting to go down, which will hopefully lead to more plants opening back up. The chart below is for July corn and you can see the change in the 20 day moving average as it has begun to tick up.

Soybean prices got a boost this week as Chinese buying continued, despite the government telling companies to quit buying many U.S. Ag products in retaliation to Trump’s comments and policies about Hong Kong last week. Despite what people thought would initially hurt Chinese purchases, tensions seem to be cooling between the two countries (for now). A huge week of soybean meal exports helped fund short covering that gave beans a big boost on Thursday. Continued buying from China would be very supportive for beans, but a decline could see a retreat after recent strength. Look for bean planting to continue its good progress over the next week.

Soybean prices got a boost this week as Chinese buying continued, despite the government telling companies to quit buying many U.S. Ag products in retaliation to Trump’s comments and policies about Hong Kong last week. Despite what people thought would initially hurt Chinese purchases, tensions seem to be cooling between the two countries (for now). A huge week of soybean meal exports helped fund short covering that gave beans a big boost on Thursday. Continued buying from China would be very supportive for beans, but a decline could see a retreat after recent strength. Look for bean planting to continue its good progress over the next week.

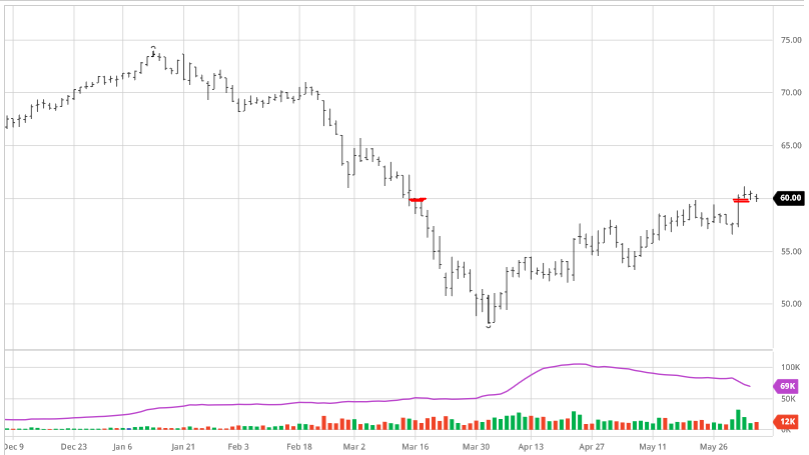

Cotton traded above $.60/pound this week for the first time in the July contract since March 16. Rising futures prices with smaller open interest usually leads to a price reversal, which this price move has seemed to follow. With more open interest in the December contract month, look for more volatility moving forward as speculators will look there. We are barely into the start of hurricane season and already on hurricane number 3 forming in the gulf. A long and consistent hurricane season could do a great deal of damage to the southeast Cotton crop. Cotton has always been sensitive to the U.S. dollar, so a weakening dollar the last couple of weeks has been supportive to prices.

Cotton traded above $.60/pound this week for the first time in the July contract since March 16. Rising futures prices with smaller open interest usually leads to a price reversal, which this price move has seemed to follow. With more open interest in the December contract month, look for more volatility moving forward as speculators will look there. We are barely into the start of hurricane season and already on hurricane number 3 forming in the gulf. A long and consistent hurricane season could do a great deal of damage to the southeast Cotton crop. Cotton has always been sensitive to the U.S. dollar, so a weakening dollar the last couple of weeks has been supportive to prices.

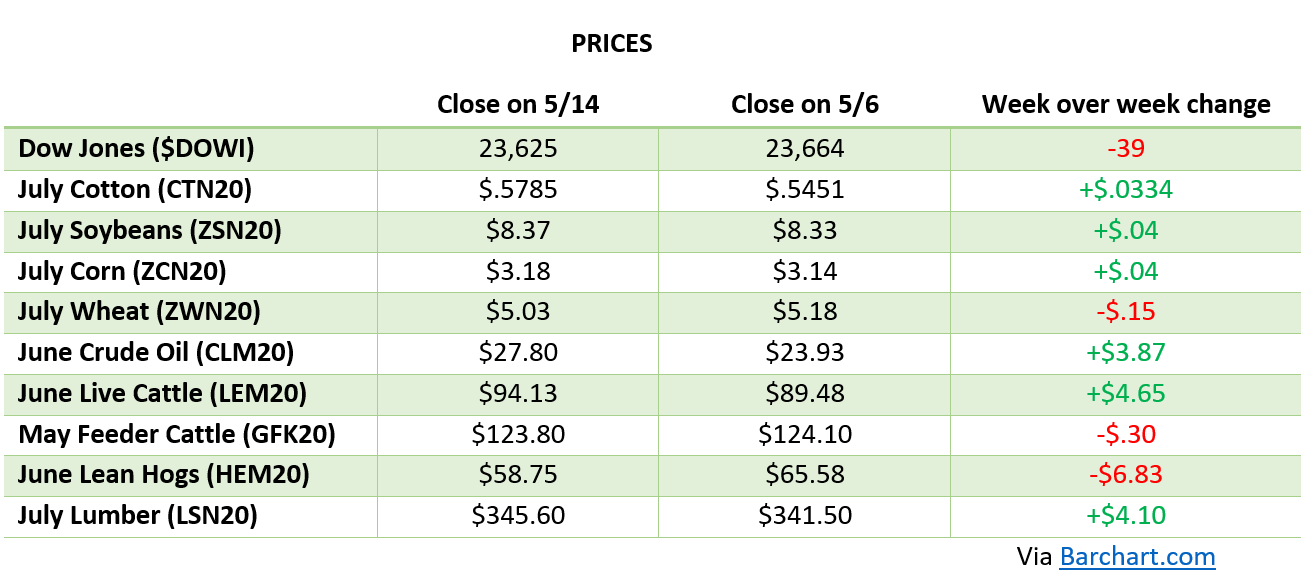

DOW Jones

The Dow Jones continues its climb as it topped 26,000 this week. The markets have recovered quicker than many expected to get to this point. As states across the country have opened back up investors have an optimistic outlook for the rest of 2020. Continuing progress on the Covid-19 vaccine and no spikes in positive test results are all good things for the market and overall economy of the US. This will help people get back to work quickly and hopefully minimize the damage of the long shutdowns.

Crude Oil

Crude continues its climb back to normal prices as OPEC is in discussions to continue production cuts for June. Even though the world is opening back up and oil demand will ramp up, drilling needs to happen at the same rate to not create an oversupply. This agreement being extended would be supportive for crude.