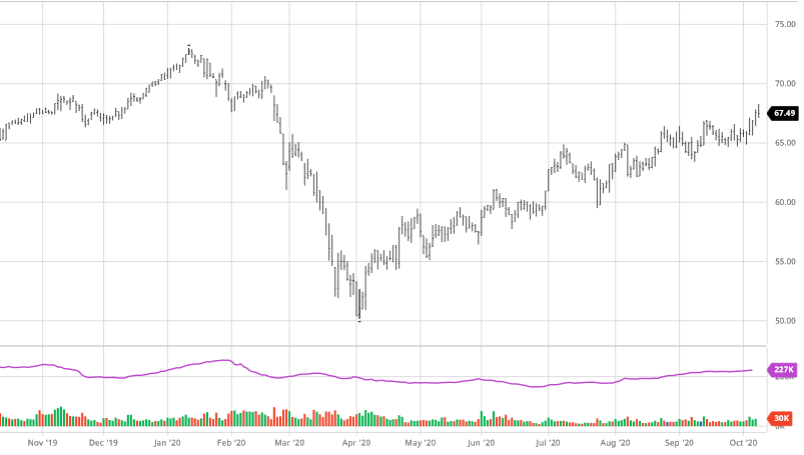

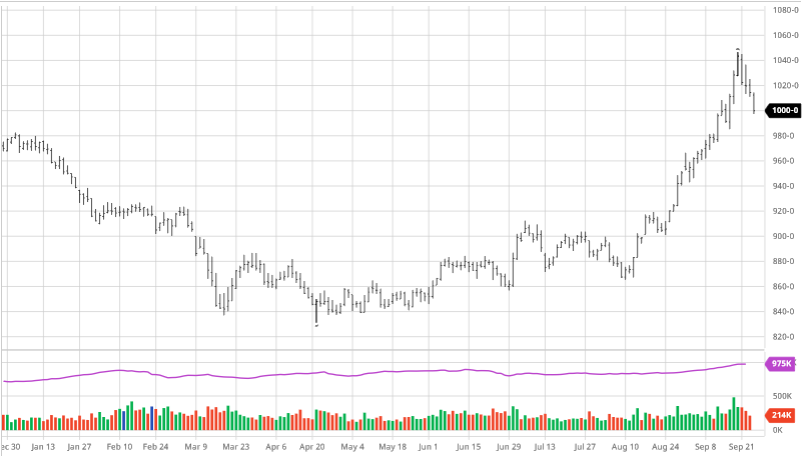

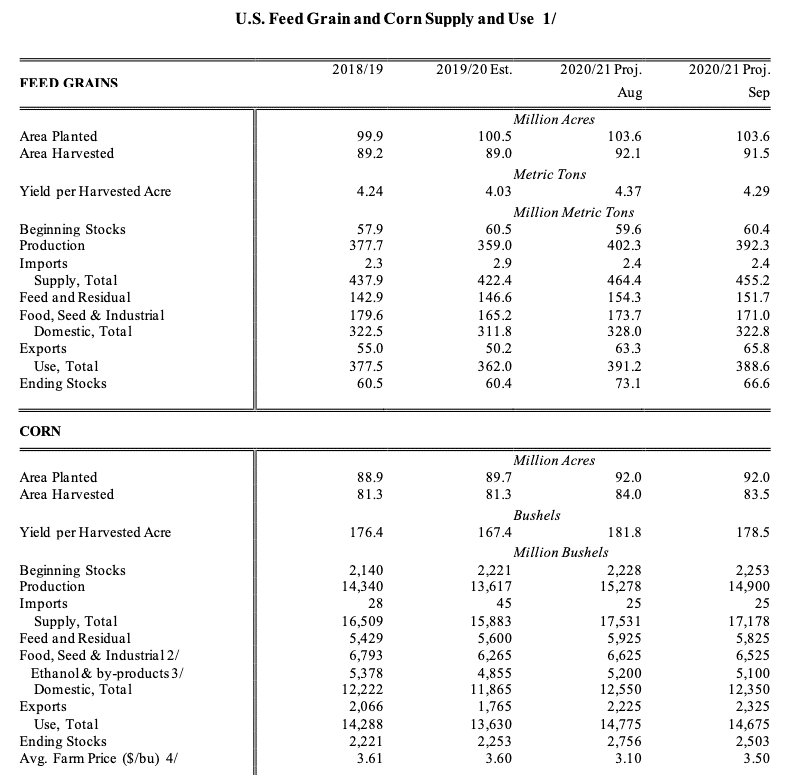

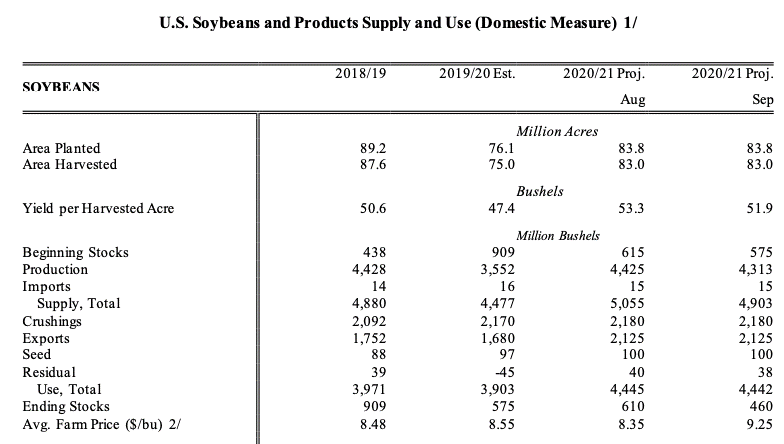

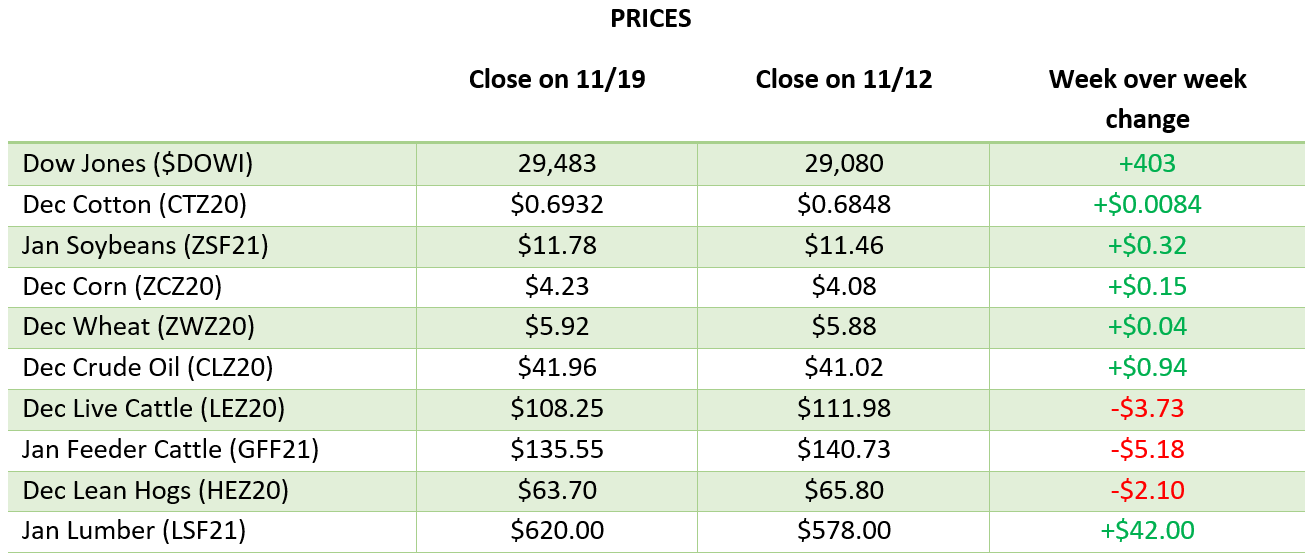

Corn followed beans higher this week as exports continued and Brazil’s weather is still questionable as their season starts. Corn harvest in the US is 26% complete as favorable weather looks to allow for harvest to continue across the country. As Chinese buying continued following holiday, markets are keeping an eye on their purchases as the Chinese government changed laws in what can be fed to hog herds as they continue to recover from ASF. By not allowing for swill (food waste and garbage) to be fed to hogs anymore the demand for corn and meal for feed looks to increase, but it is hard to tell how much swill feed will need to be replaced. Ethanol demand has remained lower than normal as the pandemic continues, but with lower demand has also lowered production. The lower production has lead to tightening in stocks to their lowest level in 8 years. If/when ethanol demand rebounds, look for a boost in corn purchases for ethanol use to replenish stocks and meet demand. Keep an eye on the USDA yield estimates on Friday.

Via Barchart

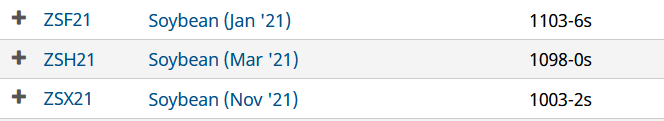

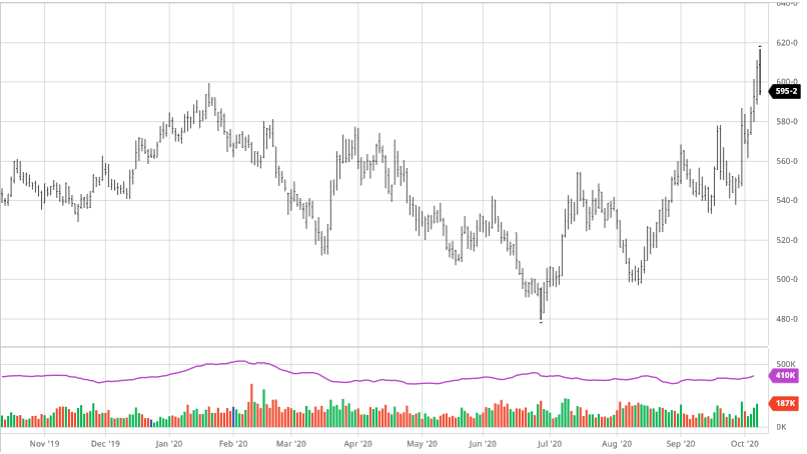

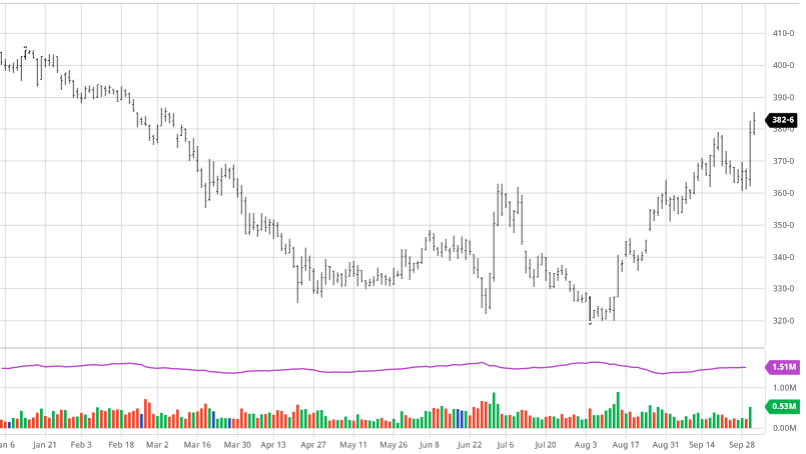

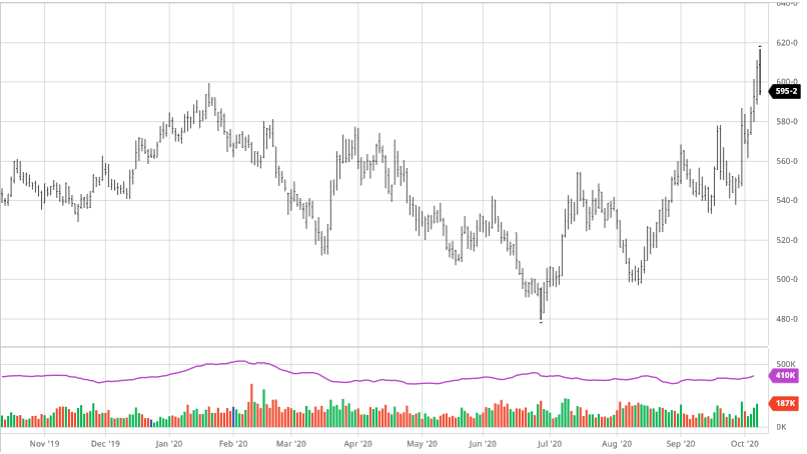

Soybeans kept the rally going this week on weather concerns in South America and exports continued in large amounts. South America remains in a dry pattern that could turn into a drought if they do not get the much needed and forecasted rain in the next couple of weeks to get the beans in the field in some major growing areas. Harvest continued across the US this week as harvest is seen 36% complete as favorable weather across much of the US has allowed farmers to get off to a great start. As China came back from holiday the buying continued as feed demand in China has started to pick up despite herd sizes only being about 65% of what they were before ASF. Fund buying has also continued this week as funds now are long 1.4 billion bushels (about 10% of the expected world production in 20/21) of beans. Prices will once again be paying attention to the USDA report on Friday but do not expect anything like the last report. As you go through harvest we suggest not storing any beans as the market is currently inverted (Nov prices being better than anything in ’21) showing the market wants your beans now. Not seeing a carry in the market makes it hard to hold the beans when selling the physical and getting long futures if you believe the markets are going higher is an option.

Via Barchart

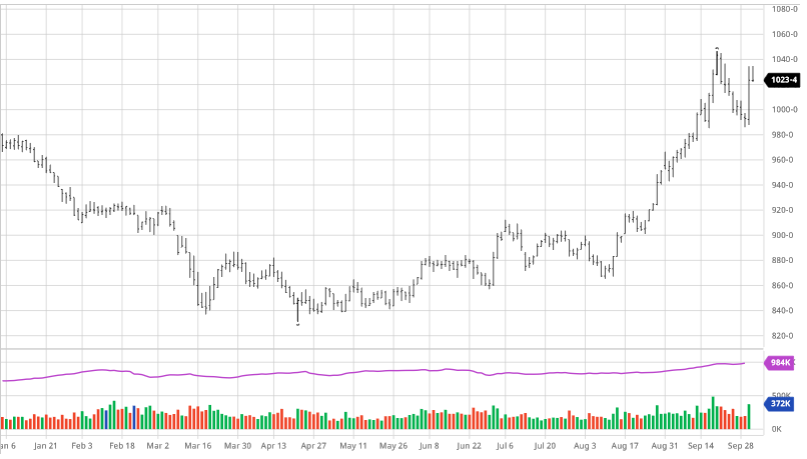

Funds continued to get long wheat this week, with some profit taking on Thursday, helping fuel the rally that other grains have seen. Weather problems in other areas of the world are helping markets move as parts of Russia remain dry and the Black Sea area has been dry but is forecasted to get much needed rain this week. Argentina like Brazil has been dry but looks to continue their dry pattern unlike Brazil. Stocks are expected to be lower in the report on Friday from the September report.

Via Barchart

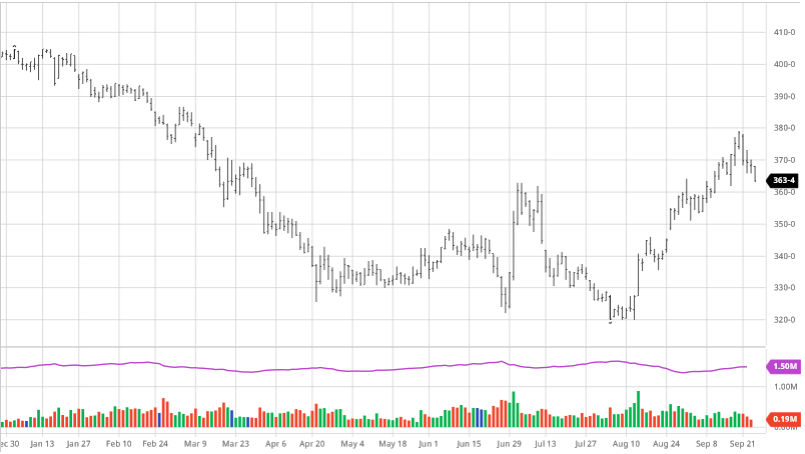

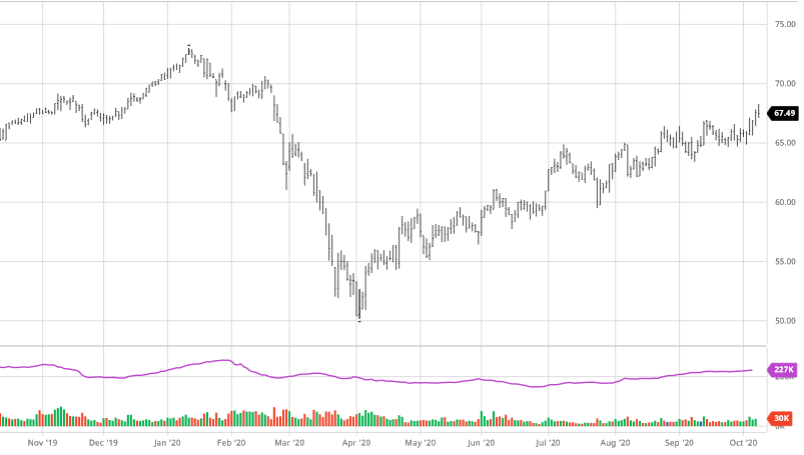

Cotton prices rallied this week as Hurricane Delta heads toward the Mississippi Delta. The fact that there is still plenty of time for another storm before harvest after Delta worries farmers that one storm may be fine but another would present major issues. Cotton has seen a steady rise in prices since the lows back in April. Exports were good this week as there were little cancellations and strong sales to Vietnam.

Via Barchart

Crude Oil

Crude saw a boost this week as Hurricane Delta has shut down production in many parts of the Gulf of Mexico. This is typical of prices whenever a hurricane is in the gulf as reactions to what may happen is usually worse than the outcome.

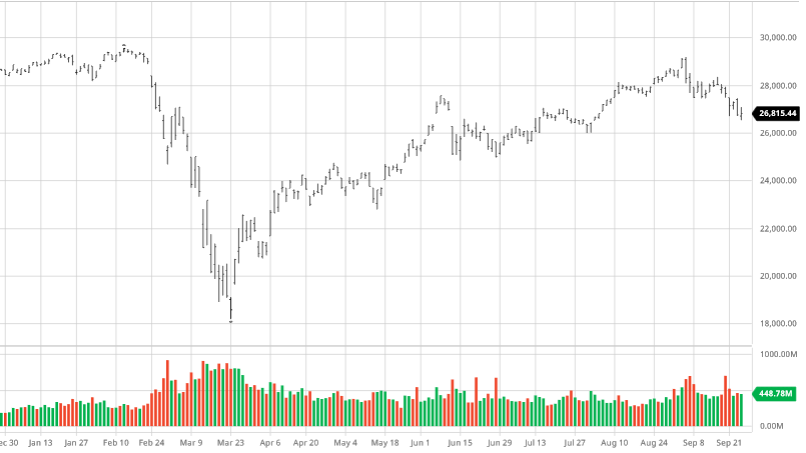

Dow Jones

The Dow continues its bounce back despite back and forth tweets from Trump and Pelosi regarding a new relief bill and what it should look like. Big tech stays in the news as Amazon and Facebook are continuously being looked at for anti-trust violations by a bipartisan group, not much is expected to come from this but worth noting.

World Weather

Brazil has been dry causing some delays in planting but some rain this week and cooler temperatures are in the forecast so markets will keep an eye on any changes there. Hurricane Delta barrels toward the US as farmers in the south look to try and get their crops out ahead of any rain that could cause damage, especially to cotton in the Delta.

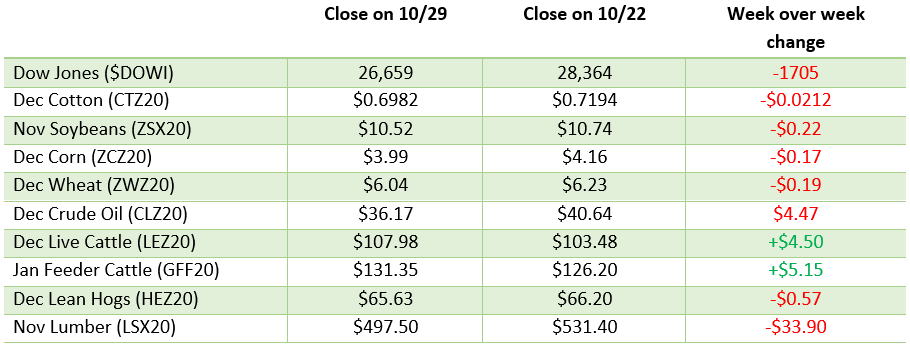

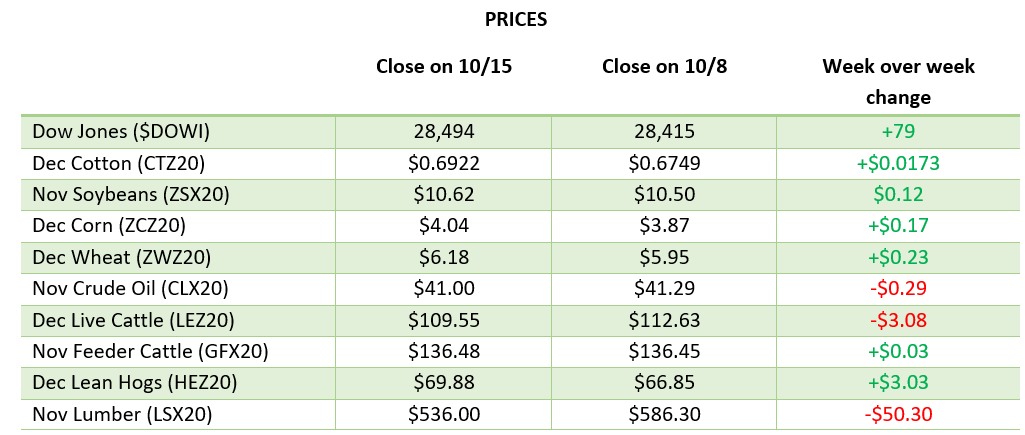

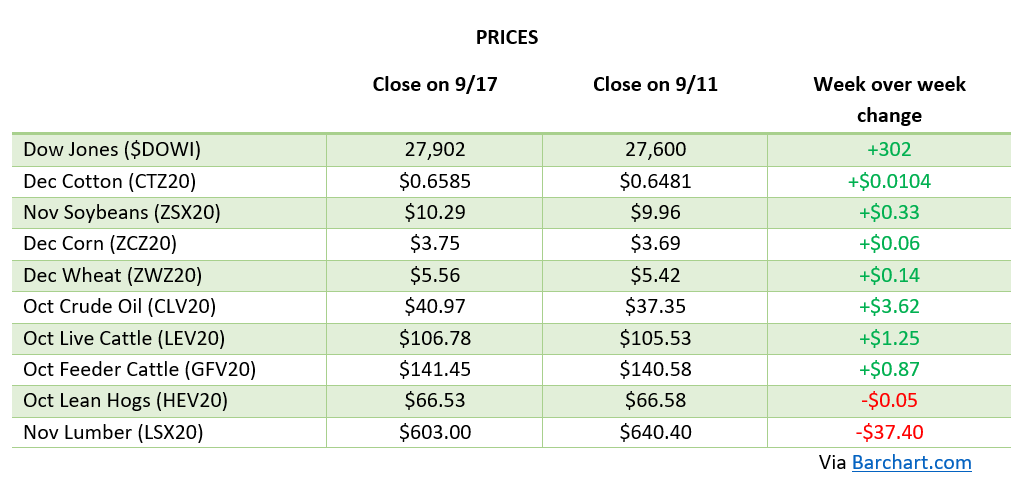

Via Barchart.com

Via

Via