Recap:

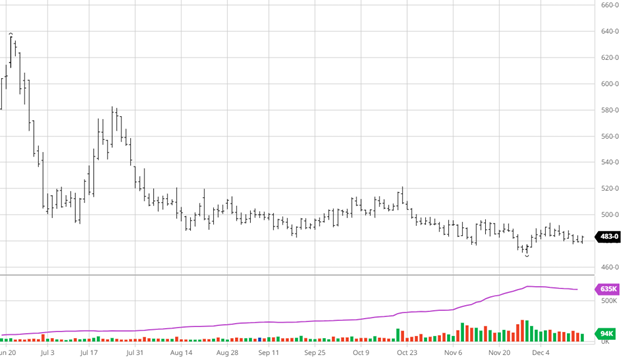

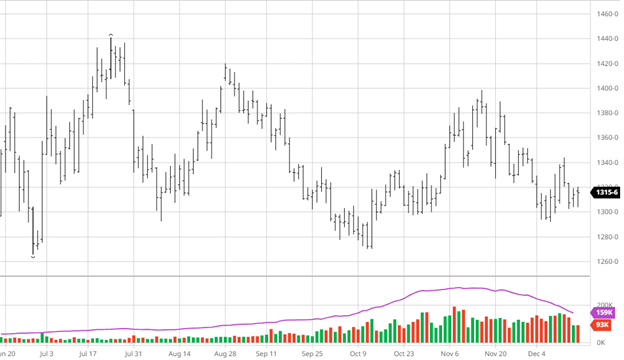

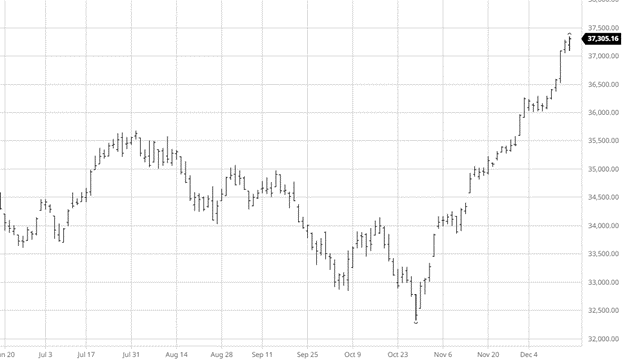

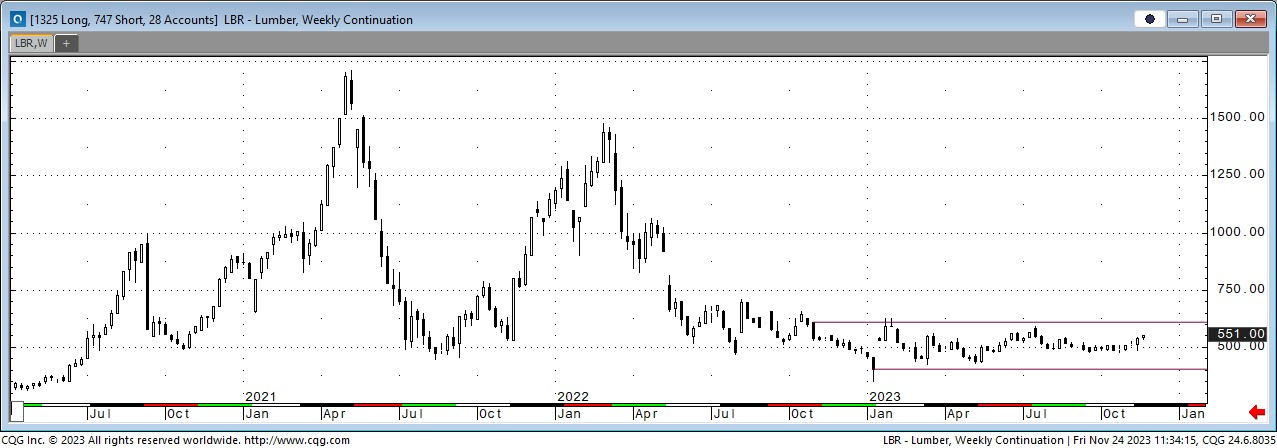

Can it be any more obvious? For many months, which are now turning into years, the marketplace has been perpetually short. Some by design and some by necessity. The market is always short. That had been a winning strategy. With a shift to tighter supply, pressure on the buy-side is coming into play today. Last week was a good example where an announcement of another mill closure set futures, not cash off. The industry adjusted by exiting futures positions, not buying cash. Where is the panic? The answer lies with the other obvious factor. As long as construction remains steady and mills produce, the industry can stay in this guarded mode. That is why the action last week was in the futures and not cash. The buy side will not go unless it is needed. Announcements won’t be a factor right after a buy round. They are a few weeks in.

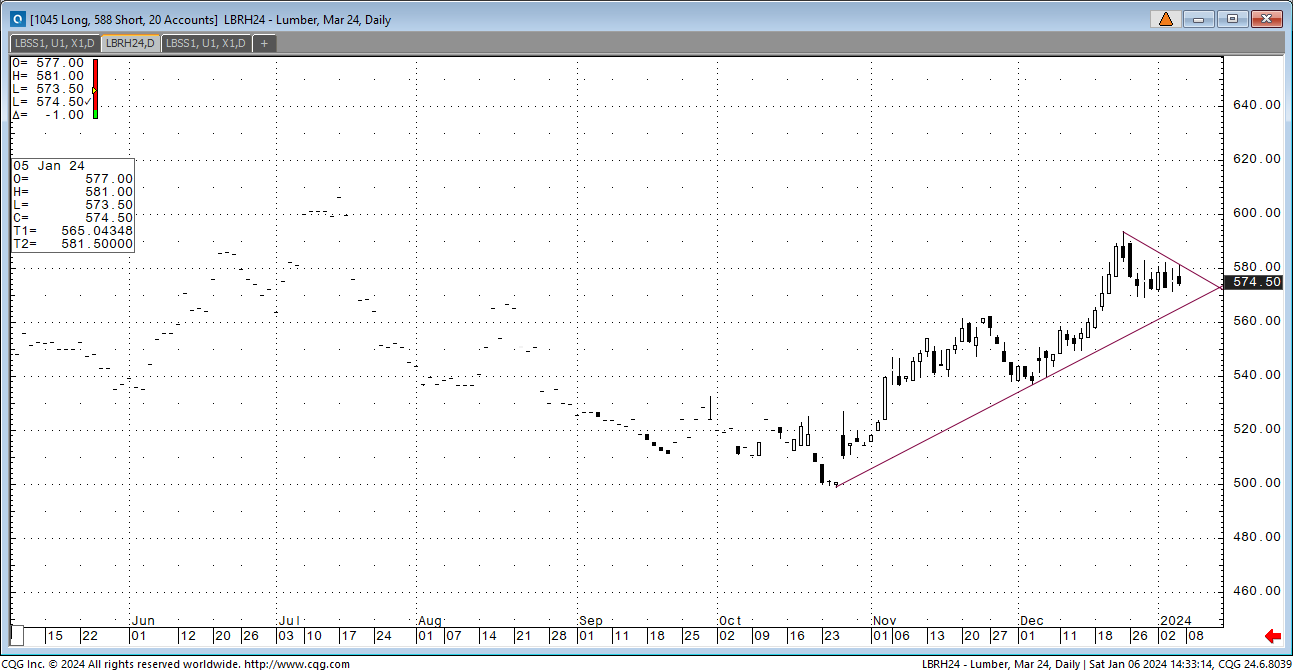

The futures market has changed directions. Instead of bleeding the market to the downside, it will bleed the market to the upside. This is not fund-related or algo-driven. This is a simple cycle change. The potential for sharp upside moves is real. The ability to hold those gains is not so much.

Technical:

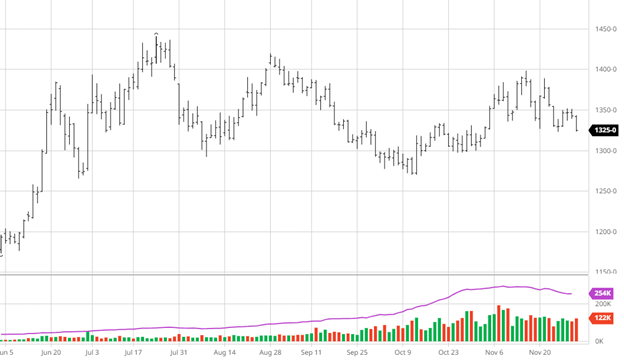

The elephant in the room is the gap below the market. I looked for it to get filled, only to see higher highs. The volume is too low to show a direction here. It is easy to hold the market up. A pullback into the gap is not a reversal. The technicals are positive. Basis trades are still in play.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636