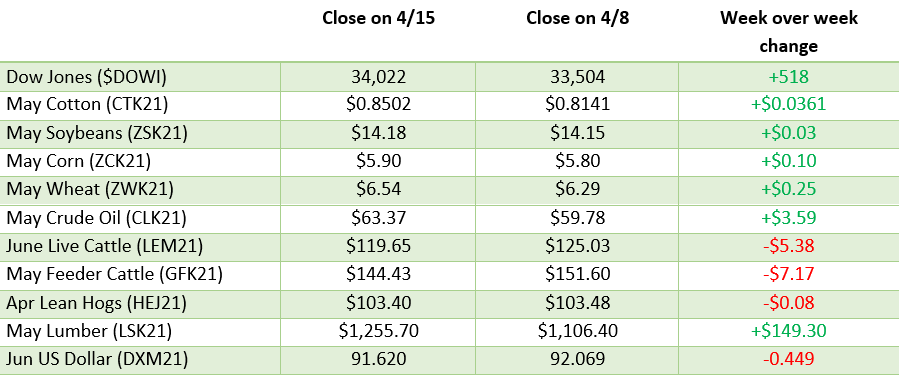

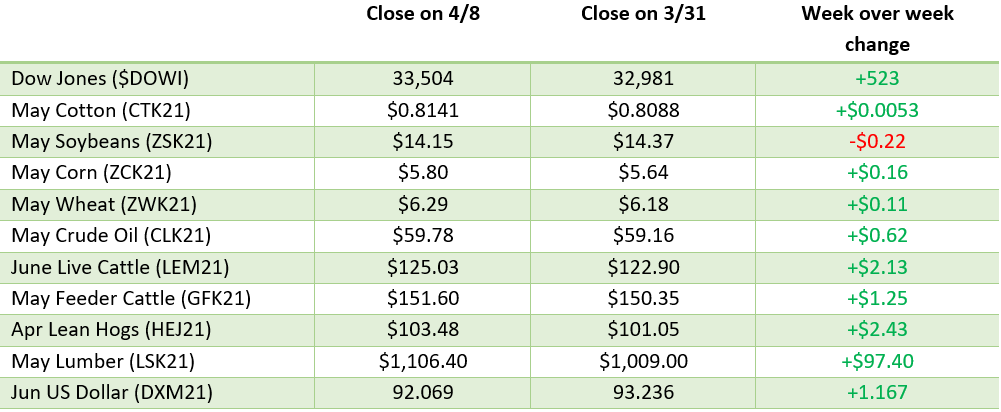

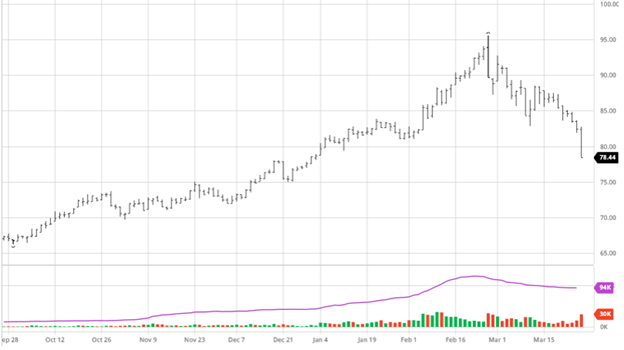

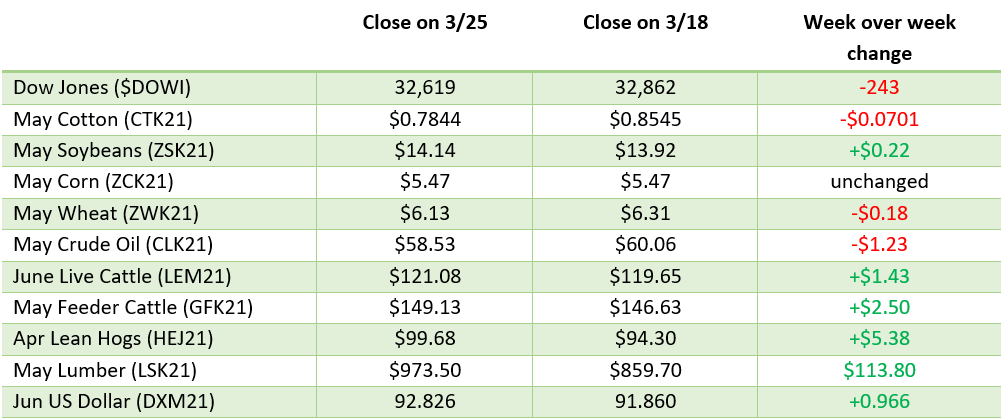

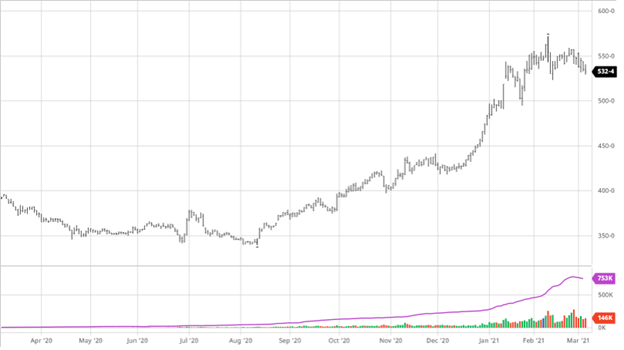

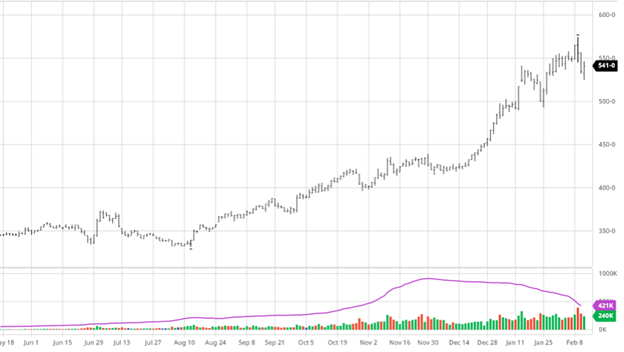

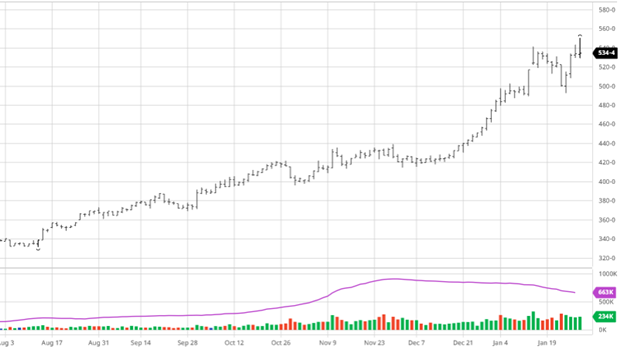

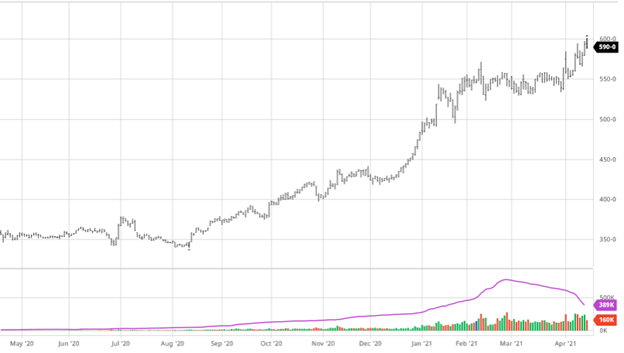

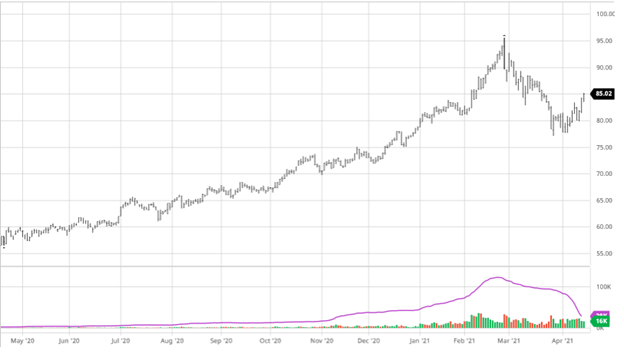

Corn had a good week as we reach new contract highs in May for old crop. As you can see in the 1 year chart below after trading in the $5.30-$5.60 range for a couple months corn has seen a strong response since the Projected Plantings report came out. The export numbers this week were not great, yet corn was still able to post a positive day following the report as the number was still 10 million bushels above the weekly total needed to meet USDA estimates. Analysts are expecting Brazil’s safrinha crop to potentially lose 5 million metric tonnes due to the late planting and stress from the drought conditions that have been present for a while. Ethanol stocks are the lowest mid-April they have been since 2014 showing that demand has ramped back up as re-openings continue. Some corn planting has started in areas across the country but this week’s cold weather will bring it to a stop as many areas will have to wait for it to warm back up to continue planting.

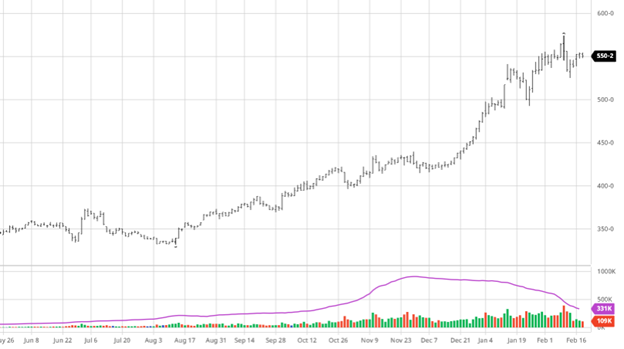

Soybeans saw small gains on the week, but for the most part it was a quiet week for beans after a slight dip then gains. The news in the market around soybeans has been limited which is why the corn and bean chart are starting to look different. The cold weather that will delay/pause planting in some areas will not have much, if any, effect on soybean planting as they usually begin later anyway. Beans are now well off their contract highs for old crop and until we get back to those levels do not expect any strengthening look from the charts. Soybean’s will continue to move with exports and if anything crazy happens in South America but will probably slowly follow corn just how corn followed soybeans until now for the short term.

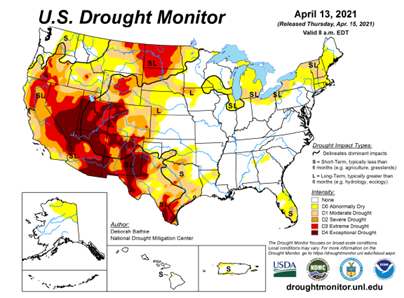

Cotton continues its rebound from the recent lows as world demand continues to increase and consumer spending rebounds. The dollar has also weakened recently supporting commodities as well. Retail sales for the month of March were reported this week climbing 9.8% as stimulus checks were spent and consumers get back out in the market. With cotton prices where they are compared to other crops many farmers are stuck with a difficult decision on which to plant. In some cases, farmers in areas such as west Texas, currently suffering from bad drought conditions, may elect to plant sorghum (milo) as a cheaper to produce alternative that has a much wider planting window. The drought conditions are a problem (see map below) in many areas, but when 40% of the cotton crop is expected to be planted in Texas the supply and demand story come the fall comes into play.

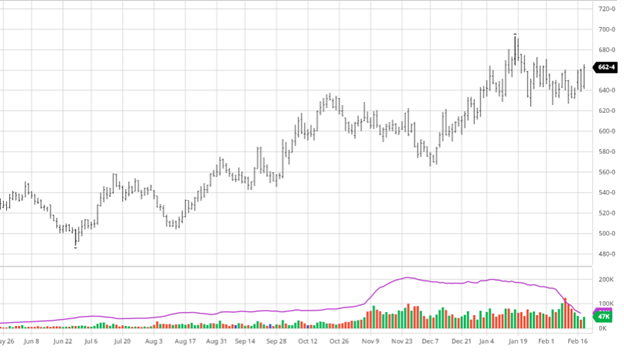

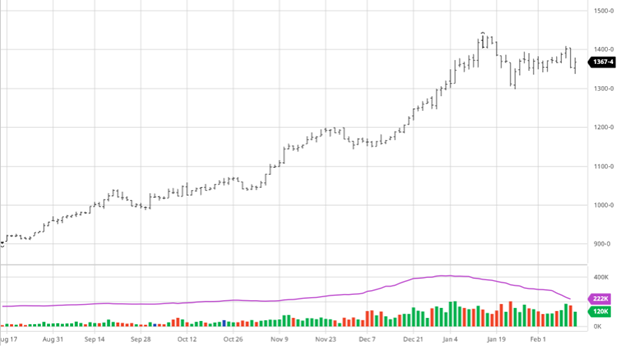

Dow Jones

The Dow gained on the week despite the news that the Johnson & Johnson vaccine distribution will be put on hold after 6 cases of a rare blood clot after giving out over 7 million doses. The reopening strength has still been playing in the markets as many consumers are out and about again after receiving stimulus checks.

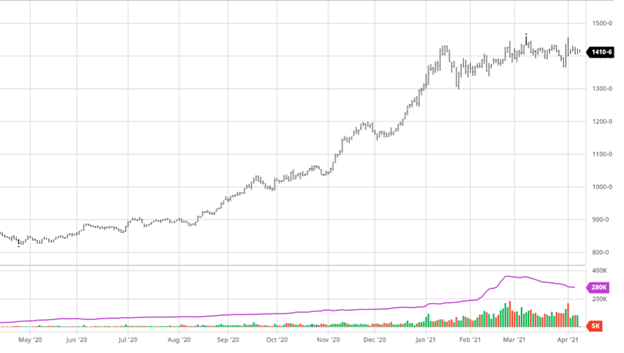

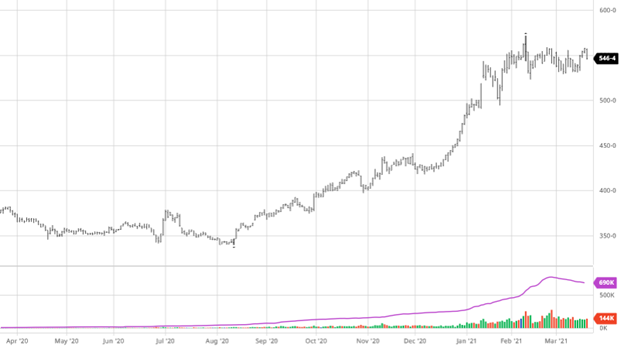

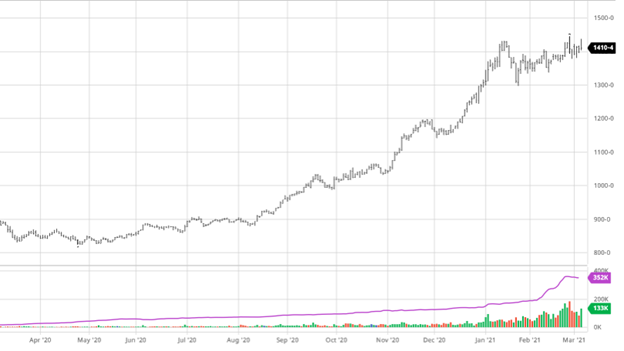

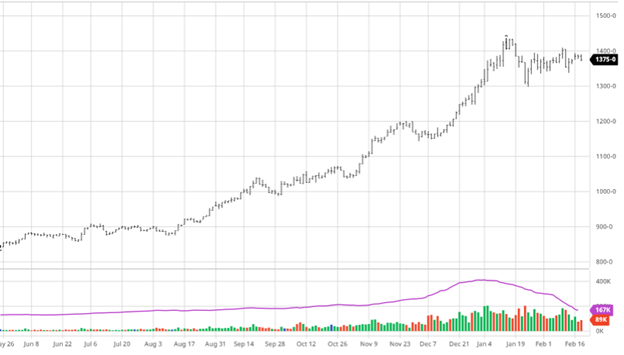

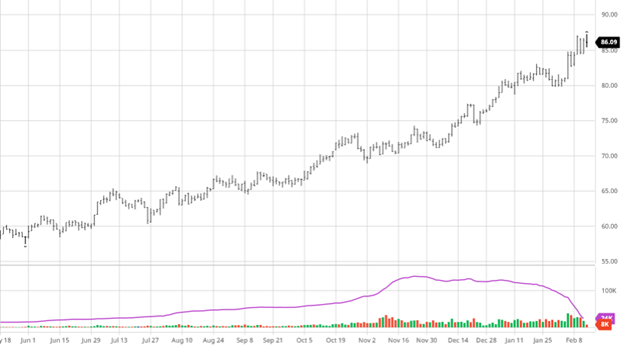

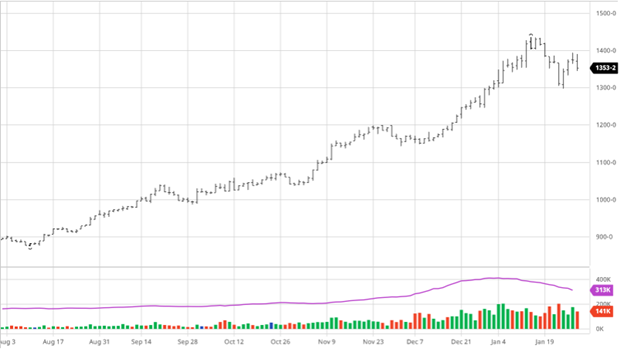

Lumber

In case you have not been paying attention to it, lumber prices have been high for a while now but continue to climb. In the cash market any wood that is for sale is bought immediately and this is also being reflected in the futures market with it now trading over $1,200. This plays out in the cost to build houses in a real estate market that has been hot the last year in the US despite the pandemic.

US Drought Monitor

The map below shows what areas of the US are currently suffering from drought conditions and as you can see it is widespread. As planting begins in many areas some areas will be delayed as they wait for a good rain to help them get in the field. The drought in Texas will have the biggest effect on Cotton as over 40% of the US cotton crop is expected to be planted there.

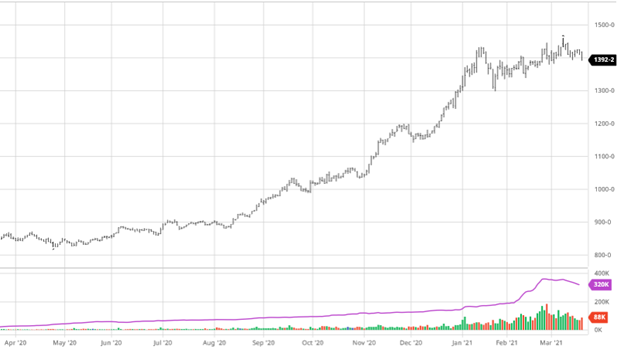

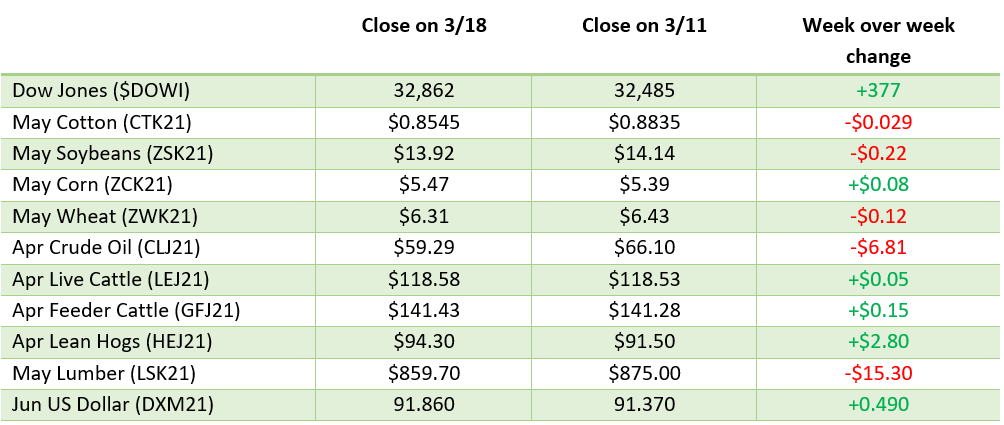

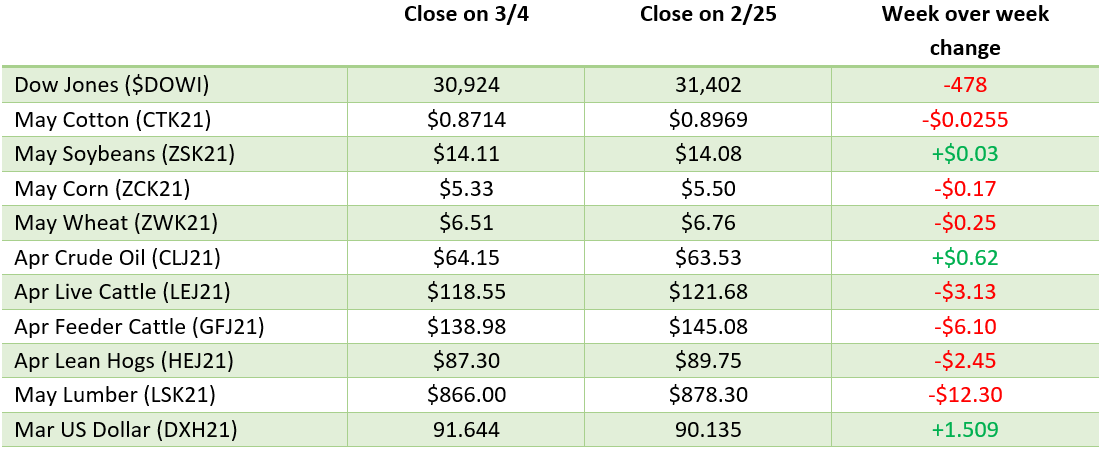

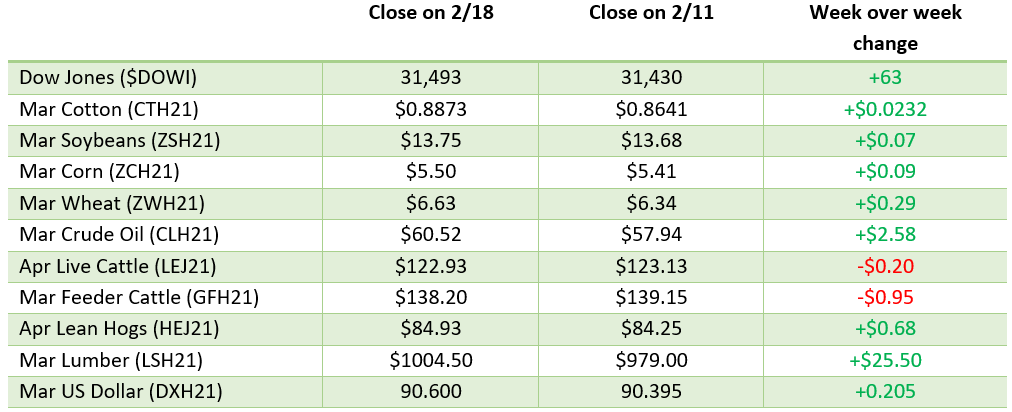

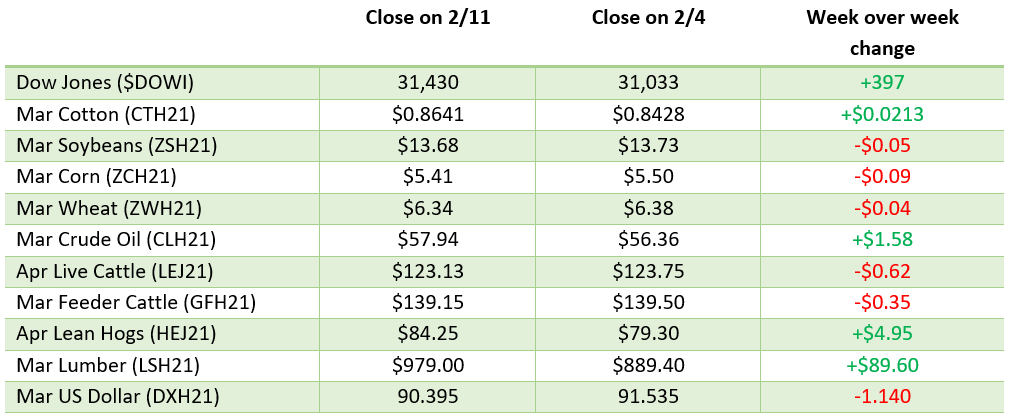

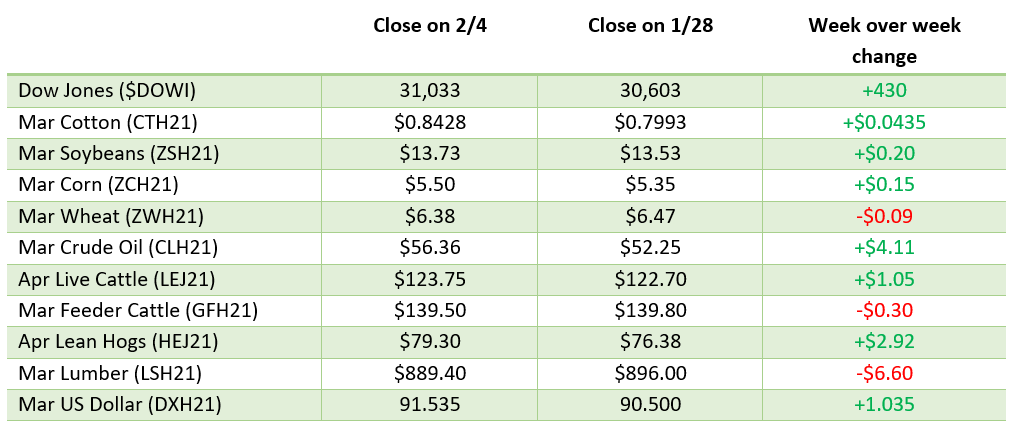

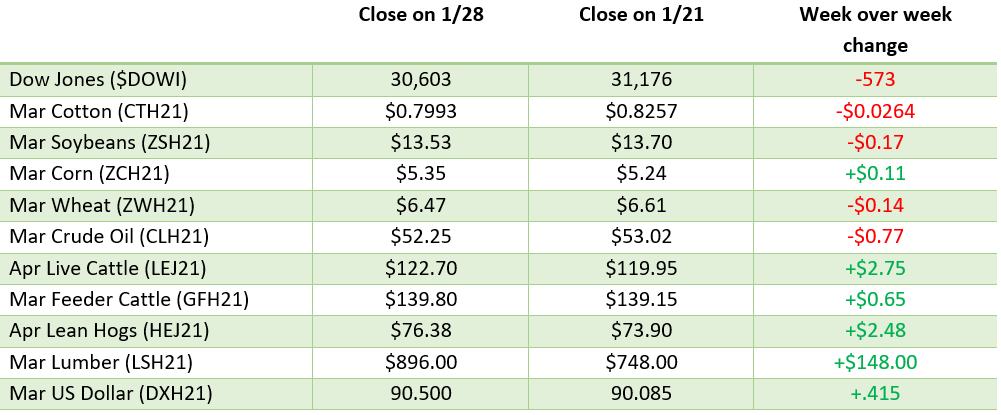

Weekly Prices