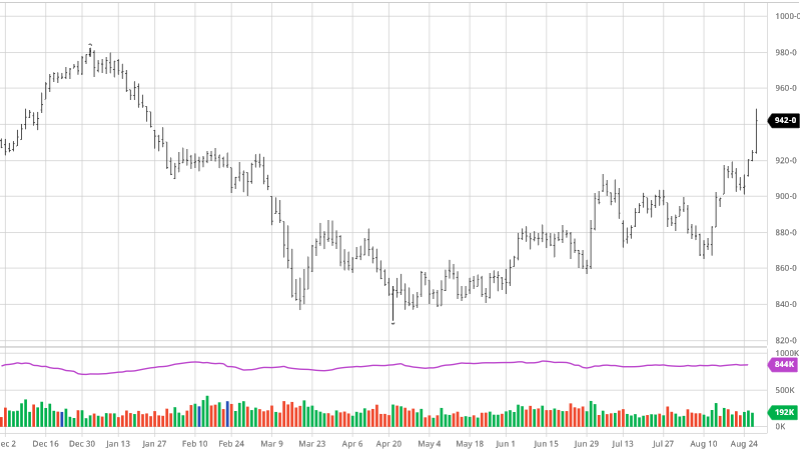

Corn saw solid gains on the week as large exports and continued weather problems were the market movers. The western corn belt looks to continue its dry run in the coming week with no widespread rain expected in areas that have been suffering from drought. This will put more strain on the crop as we head into harvest. The crop, especially in Iowa on top of the storm damage, has been fighting drought conditions most of the summer in the western corn belt so an already strained crop doesn’t look like it will get much help coming down the stretch. Large exports this week also helped give a boost as China is stepping up their purchases over the past month. Along with the rally in Dec ’20 prices the ’21 crop has gotten a boost as well to much more attractive levels than a few weeks ago. The chart below shows the rebound back to levels we last saw around the 4th of July. It is possible we have already put in a low heading into harvest as weather outlooks, crop conditions and exports have been favorable for prices as of late. Unfortunately favorable for prices does not usually mean favorable for the crop so hope exports continue because any good weather news to help the crops would be bearish for prices.

Corn saw solid gains on the week as large exports and continued weather problems were the market movers. The western corn belt looks to continue its dry run in the coming week with no widespread rain expected in areas that have been suffering from drought. This will put more strain on the crop as we head into harvest. The crop, especially in Iowa on top of the storm damage, has been fighting drought conditions most of the summer in the western corn belt so an already strained crop doesn’t look like it will get much help coming down the stretch. Large exports this week also helped give a boost as China is stepping up their purchases over the past month. Along with the rally in Dec ’20 prices the ’21 crop has gotten a boost as well to much more attractive levels than a few weeks ago. The chart below shows the rebound back to levels we last saw around the 4th of July. It is possible we have already put in a low heading into harvest as weather outlooks, crop conditions and exports have been favorable for prices as of late. Unfortunately favorable for prices does not usually mean favorable for the crop so hope exports continue because any good weather news to help the crops would be bearish for prices.

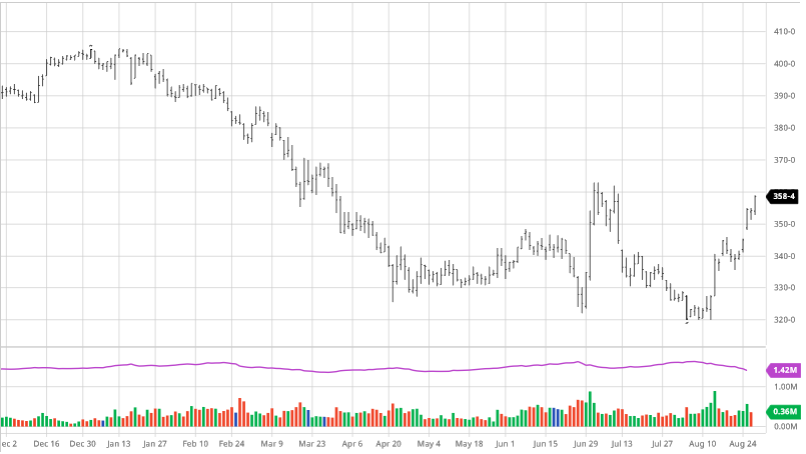

Soybeans saw a major bounce this week as weather concerns and Chinese buying drove the market. As soybean yields are still at a higher risk than corn at this point in the year the dry weather outlook could cause some damage to the crop. Like corn, the areas already in drought conditions will continue to hurt along with areas that have just started struggling look to continue into September. The continued exports to China are promising as consistent buying in bulk would be promising of long term Chinese demand. As everyone likes to see prices going higher for this year after a long year of Covid-19 and weather, do not forget to be thinking about the ’21 prices if the rally continues where you could sell forward some of your production for ‘21 or gain some premium for storing until next summer. If China continues making purchases and the weather remains grim look for this rally to continue or hold until there is news to stop it.

Hurricane Laura

Hurricane Laura slammed the gulf coast in eastern Texas and western Louisiana as a category 4 storm. The hurricane will bring 5-10 inches of rain and heavy winds to the western Mississippi Valley. As the storm is expected to turn northeast and dump rains on the southern Ohio Valley this weekend it will miss the areas that need the rain the most in the western corn belt. Seeing the destruction brought by the storm along the coast our thoughts and prayers are with everyone affected. (Check out some more thoughts on a hurricanes effect on futures markets from our sister company here)