Ag Market Updates: March 13 – 19

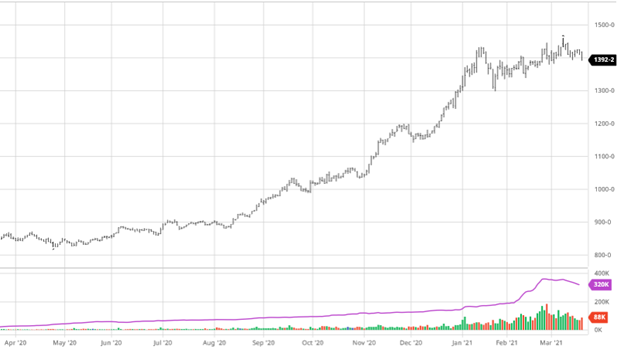

Corn had a good week overall, despite the struggle of Thursday’s trade, largely supported by another strong week of exports. Improved chances of rain in Argentina and rains in the US adding to early spring soil conditions kept the bulls from running away to the upside. The markets also continue to have ASF in China hanging over them, but the less we hear about that the better as “no news, is good news.” Ethanol production hit a 12-week high in this week’s report while stocks fell for the 5th straight week. With more people driving and good blend margins for producers the Ethanol machine (i.e corn buying) should continue. As you can see in the chart below we have been trading in the same range since the February USDA report bookended the near term high AND low. The Acreage Intentions report at the end of the month will be very important and likely the next major marketing moving event.

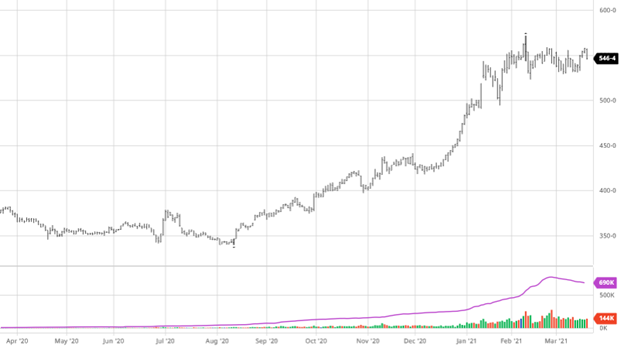

Soybeans struggled this week as much needed rain came in parts of the country as we approach planting season in the US. South America’s harvest has begun to pick up after it struggled the first few weeks. The increased harvest pace has helped replenish the world export pipeline. World demand continues to be strong, and the US will need to have a solid new crop production to be able to meet both the current and post COVID world demand heading into 2022. Looking ahead to the end of the month, both China and South American weather will continue to be the important movers leading up to the acreage report on March 31st. The chart below shows soybeans in a narrow near term technical range. Continued buying from both end users and the funds will be needed to keep the technical outlook from getting dicey, especially for new crop.

![]()

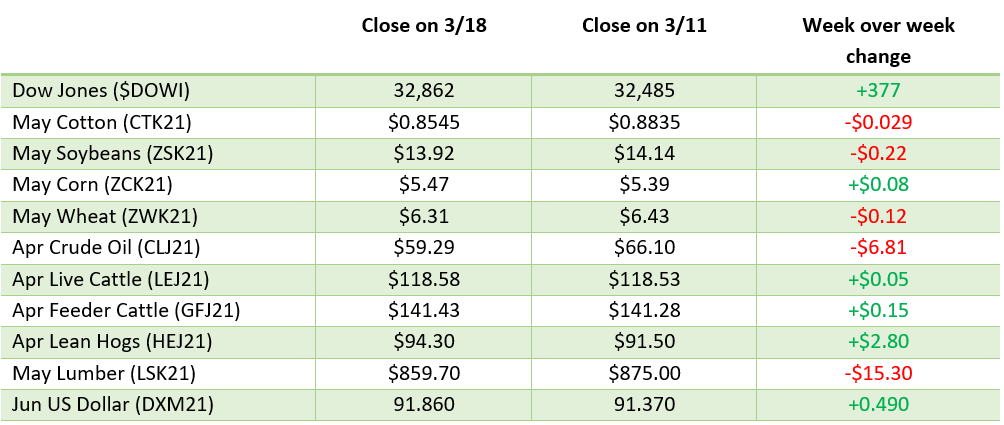

Dow Jones

The Dow had a strong week as vaccines continue to rollout in large amounts across the US. We are now well ahead of the 100 million vaccines in the first 100 days of the Biden administration. All eyes were on the FED earlier this week when they held interest rates at historic lows and indicated that no change in policy is likely until 2023. Combining low cost money and the $1.9 Trillion Covid Relief bill traders had no reason not to buy equities.

Energies

Energies took it on the chin this week as there were loses across the board in both energy stocks and energy commodities. Energies have had an incredible start the year, where a pullback wasn’t all that surprising. There is a question if OPEC will increase output to take advantage. Long term, as long as production doesn’t change drastically and vaccines continue to roll out experts are forecasting rising demand for energy across the board.

Weekly Prices

Via Barchart.com