Ag Markets Update: July 11 – 17

Despite one of the largest single export sales to China ever, prices for the week fell. After some welcome rains in the past week in areas that were dry, favorable outlook during pollination has the potential to help make this crop large. Ultimately, as yield potential continues to look high, big bumps in corn are looking slim unless there is a surprise in forecast changes or export sales. The crop conditions continue to look strong as you can see in the chart below. We are not near/at record conditions, but still have very strong numbers at this point in the year. A dip in condition would factor into price movement as well, but don’t don’t plan on that for a big boost towards the end of the month.

Despite one of the largest single export sales to China ever, prices for the week fell. After some welcome rains in the past week in areas that were dry, favorable outlook during pollination has the potential to help make this crop large. Ultimately, as yield potential continues to look high, big bumps in corn are looking slim unless there is a surprise in forecast changes or export sales. The crop conditions continue to look strong as you can see in the chart below. We are not near/at record conditions, but still have very strong numbers at this point in the year. A dip in condition would factor into price movement as well, but don’t don’t plan on that for a big boost towards the end of the month.

Soybeans had a flat week price-wise as steady sales continued to China and forecasts didn’t change too drastically. We started out the week with some prices drops, but a solid midweek bounce helped get back to flat as we head into the weekend. Look for any big forecast changes or unexpected purchases to be the only thing to move bean prices in the near future. As world demand has seen an uptick, the U.S. may find more buyers as South America has been so busy selling up to this point, they may have trouble fulfilling any additional large exports.

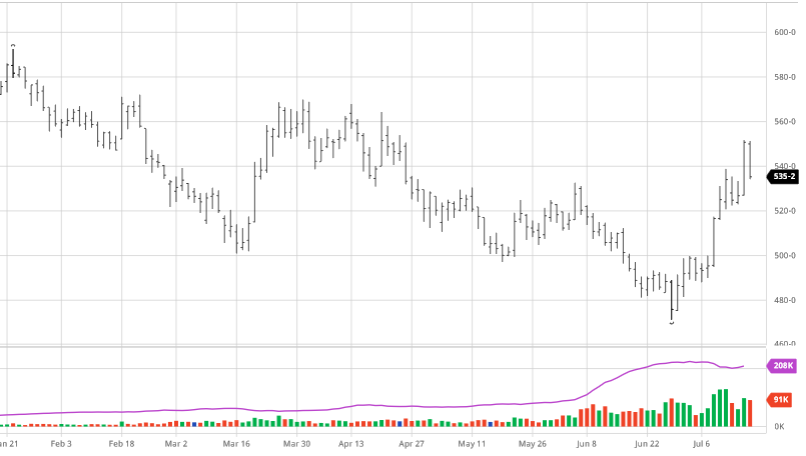

Large purchases from China gave Wheat a big boost halfway into the week. Wheat did have to give a good chunk of that boost back the following day due to a lack of confirmation on purchases, but any Chinese purchases at this point are beneficial to the markets as other Wheat growing countries are seeing lower yield numbers. As you can see below, markets are well off the lows that we set a few weeks back as Wheat has made a solid rebound. Just like with Soybeans, more confirmed purchases, or any purchases for that matter, would be beneficial to U.S. Wheat.

Large purchases from China gave Wheat a big boost halfway into the week. Wheat did have to give a good chunk of that boost back the following day due to a lack of confirmation on purchases, but any Chinese purchases at this point are beneficial to the markets as other Wheat growing countries are seeing lower yield numbers. As you can see below, markets are well off the lows that we set a few weeks back as Wheat has made a solid rebound. Just like with Soybeans, more confirmed purchases, or any purchases for that matter, would be beneficial to U.S. Wheat.

Dow Jones

Dow Jones

The Dow saw positive numbers overall for the week with a few days of solid gains and small losses. Americans continue to keep their eyes on places that are reopening and spikes in major metropolitan areas. Retail spending was up +7.5% last month, but some experts think we may see that shrink as some states have rolled back their opening phases where cases have spiked. President Trump wants schools to open this fall as he sees that as a way to get more people back to work, so the rolling out of back-to-school plans be an important factor on the economy heading into election times.