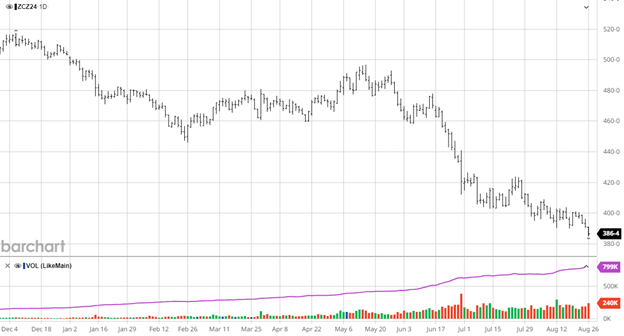

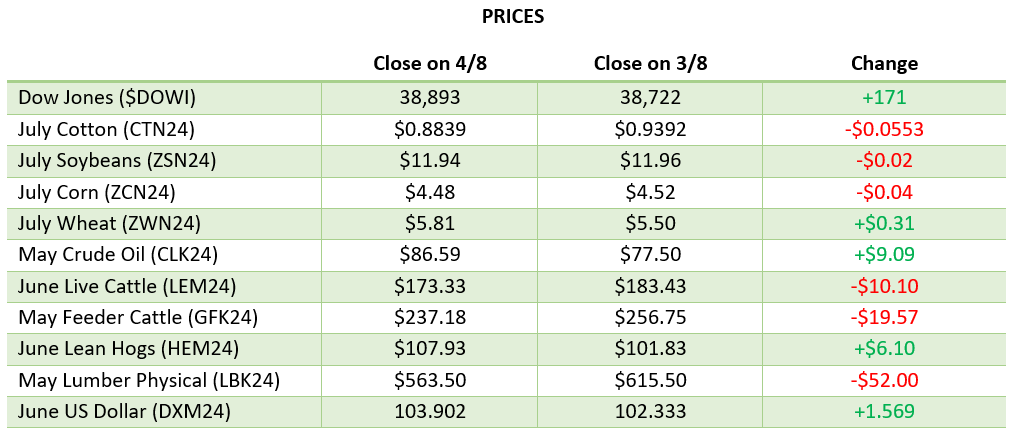

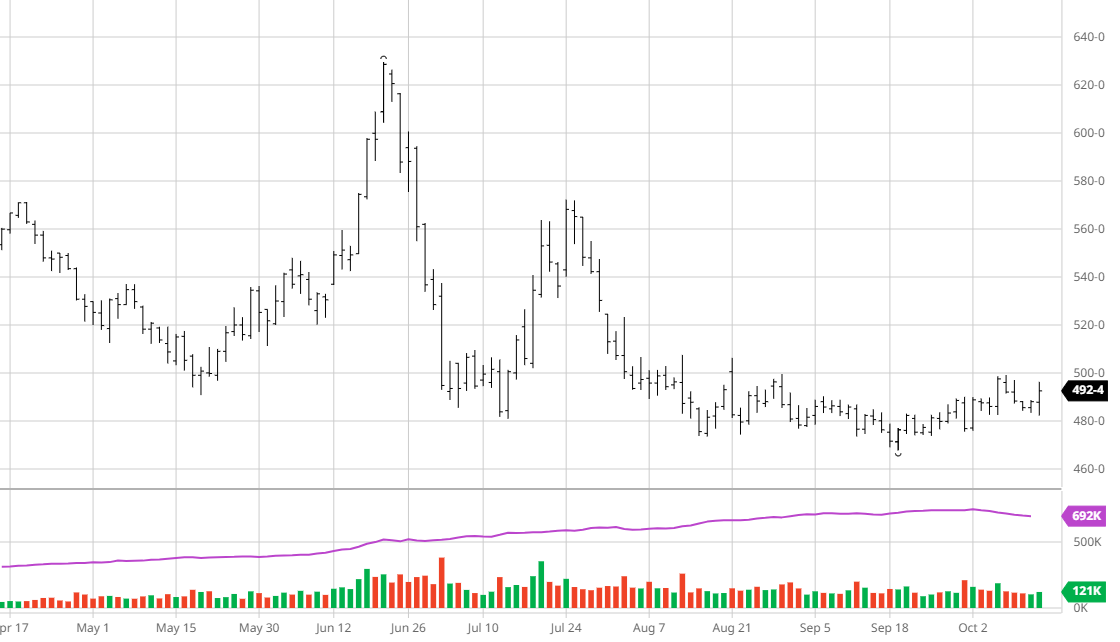

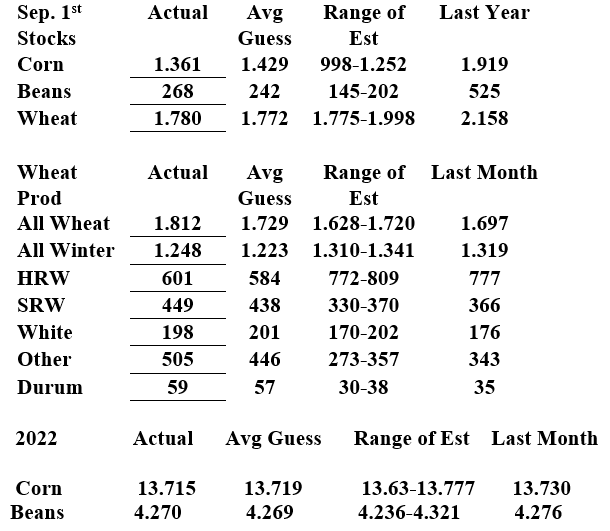

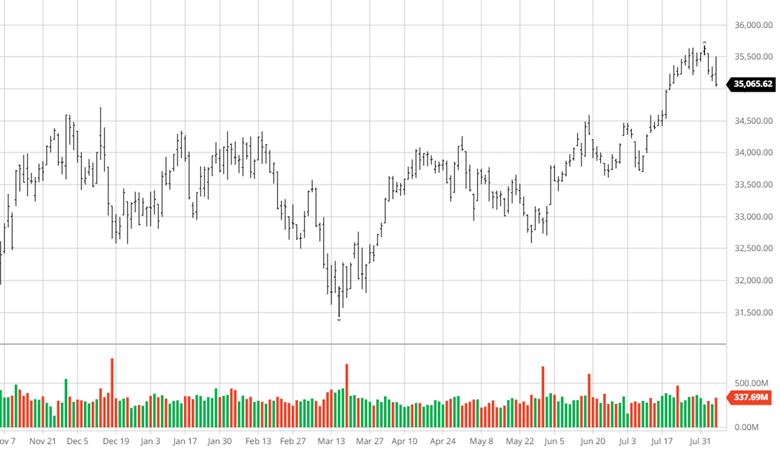

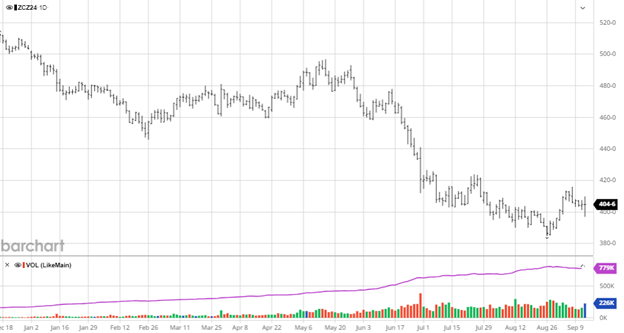

Corn has gotten back above $4.00 in a struggling market that needs good news to propel it back to the mid $4s. The USDA raised US corn yield to 183.6 bu/ac up from 183.1 bu/ac in last month’s report. In the USDA’s eyes the crop is getting bigger as struggling areas will be more than made up for by the best areas across the corn belt. Despite the higher US yield numbers, the corn trade following the report was welcome to see as it did not move much lower on larger numbers. If corn can bounce off or hold this $4 level then we can probably expect it to hang around here as planting gets rolling until we know what is actually in the field and if the numbers are closer to 180 or 183.6.

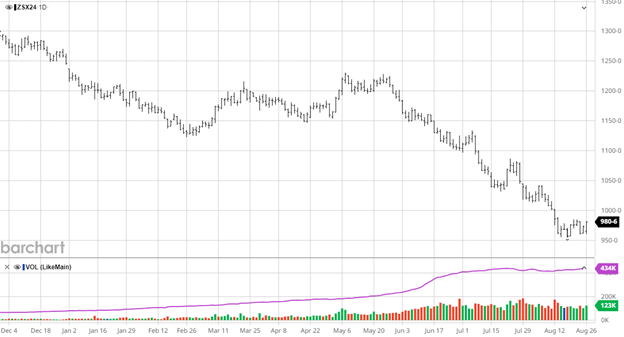

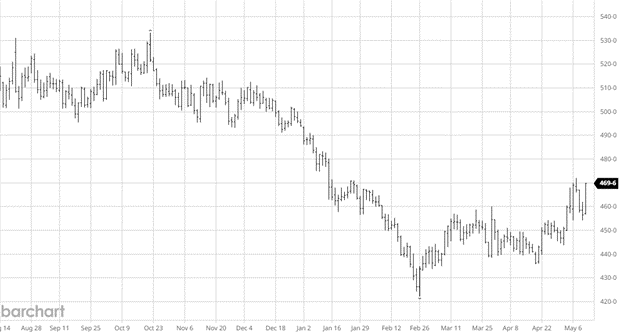

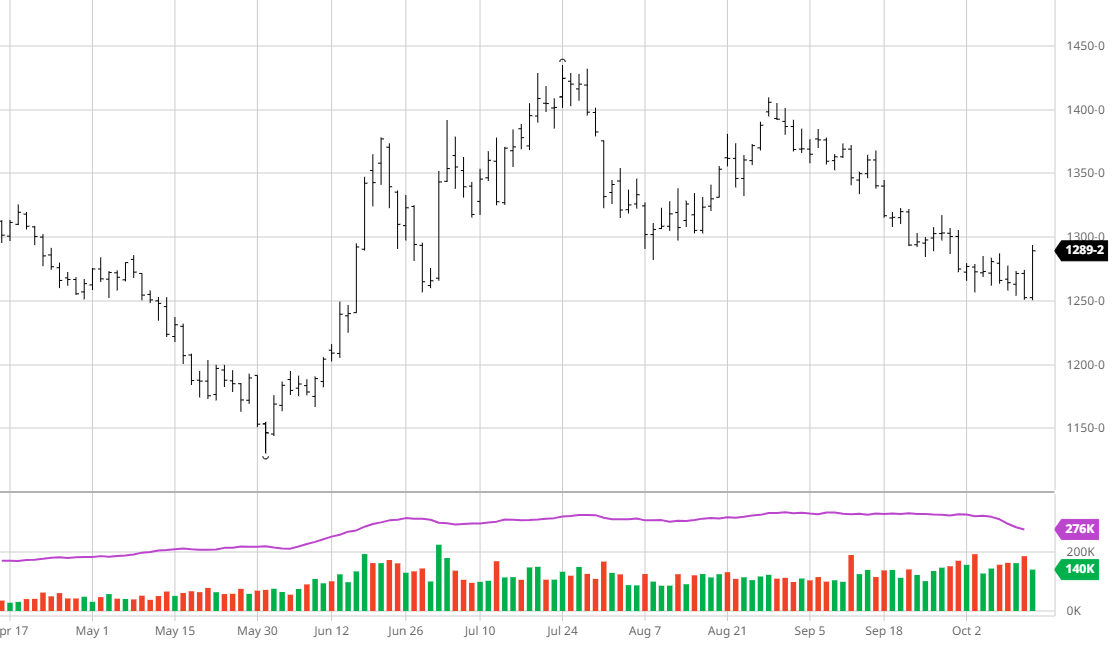

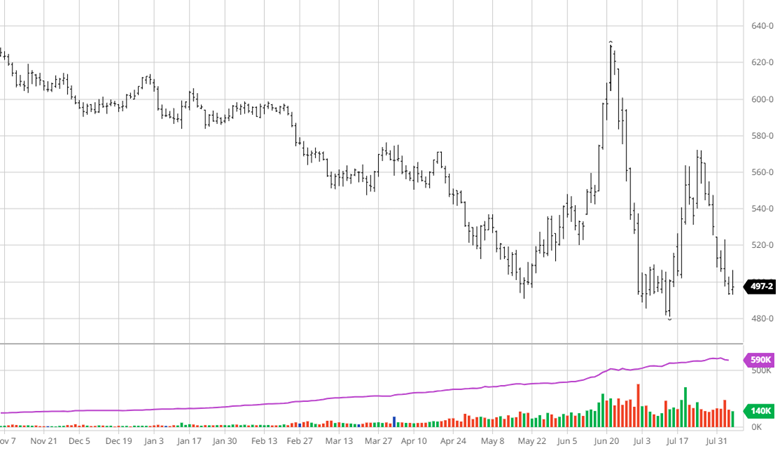

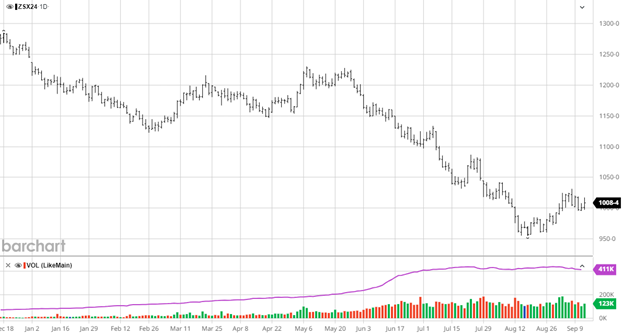

Soybeans have seen a nice 50+ cent rally off recent lows with dryness in areas causing a little concern with pod fill and some pickup in demand. The USDA kept yield the same at 53.2 bu/ac as they agree with Pro Farmer tour that a massive crop is out there. Like corn, this recent bounce off lows is encouraging but may setup a range bound trade until harvest gets rolling and we have a better idea on the true yield. The USDA did slightly lower US ending stocks in both 23/24 and 24/25. Continued exports and any issues to South American planting are needed to drive beans higher in the current market.

Soybeans have seen a nice 50+ cent rally off recent lows with dryness in areas causing a little concern with pod fill and some pickup in demand. The USDA kept yield the same at 53.2 bu/ac as they agree with Pro Farmer tour that a massive crop is out there. Like corn, this recent bounce off lows is encouraging but may setup a range bound trade until harvest gets rolling and we have a better idea on the true yield. The USDA did slightly lower US ending stocks in both 23/24 and 24/25. Continued exports and any issues to South American planting are needed to drive beans higher in the current market.

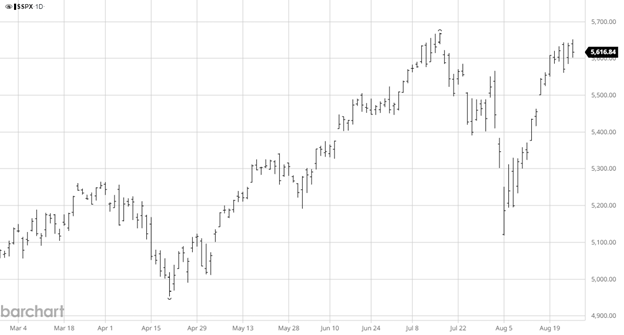

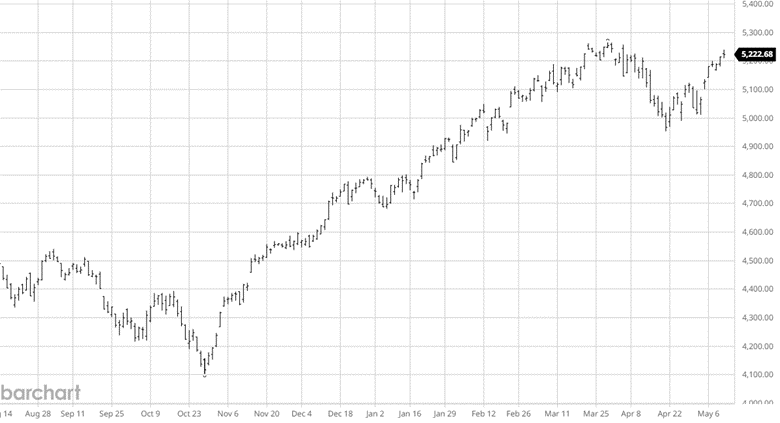

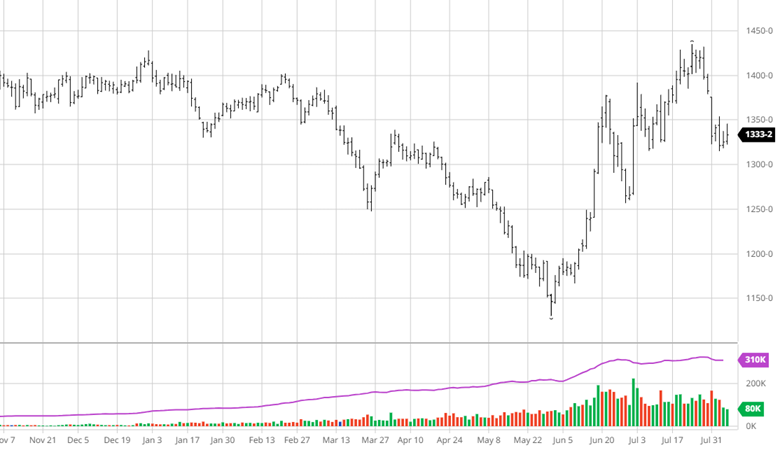

Equity Markets

The equity markets have been on a bit of a roller coaster lately with the tech/semiconductor trade having quite a bit of volatility while some rotation occurs with the Fed rate cuts expected to begin this month.

Other News

- The market is expecting a 25 basis point cut to the Fed Funds rate this month

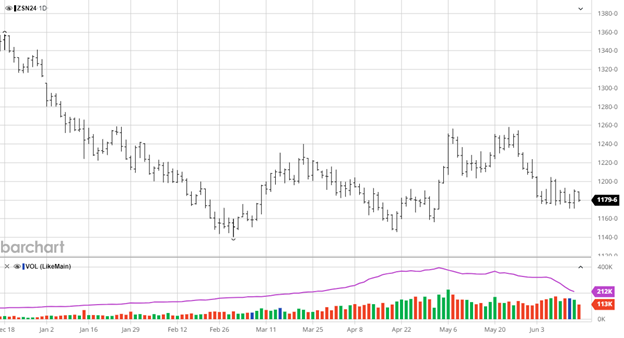

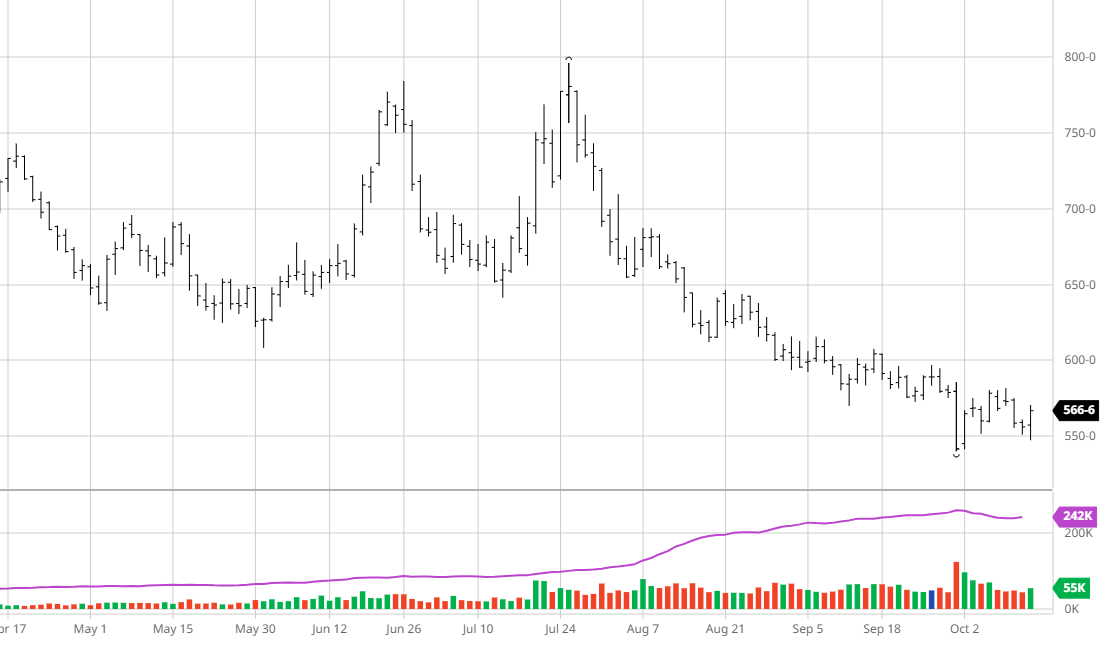

Wheat

- Wheat has been the one positive market lately, hitting new 2-month highs. The war in Ukraine and Russia continues to escalate and the market has responded accordingly. The USDA did not make any major changes in the report.

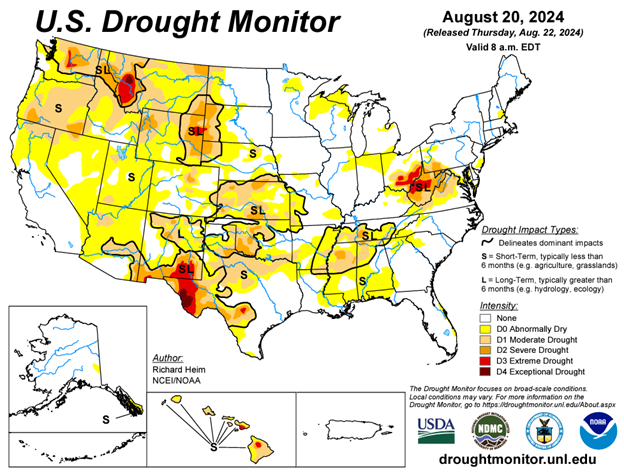

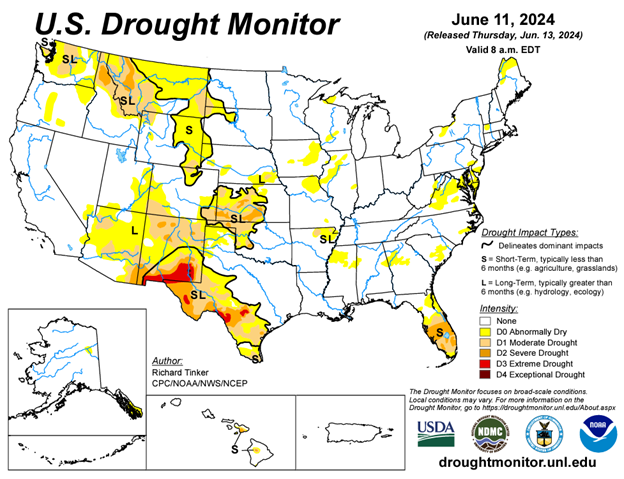

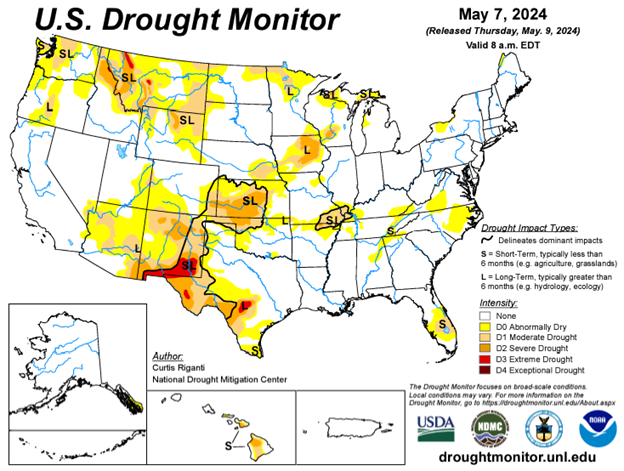

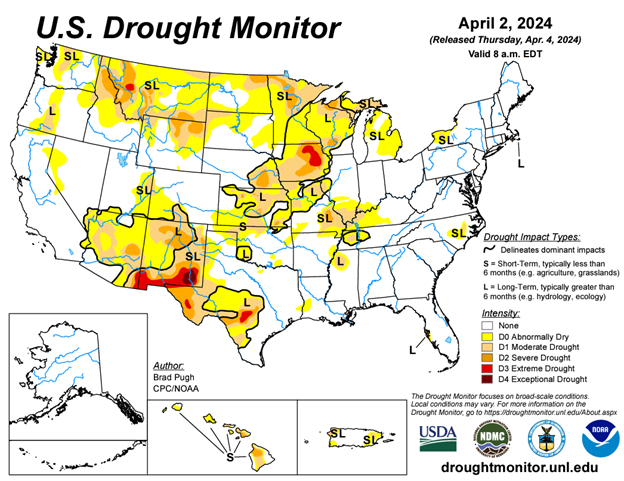

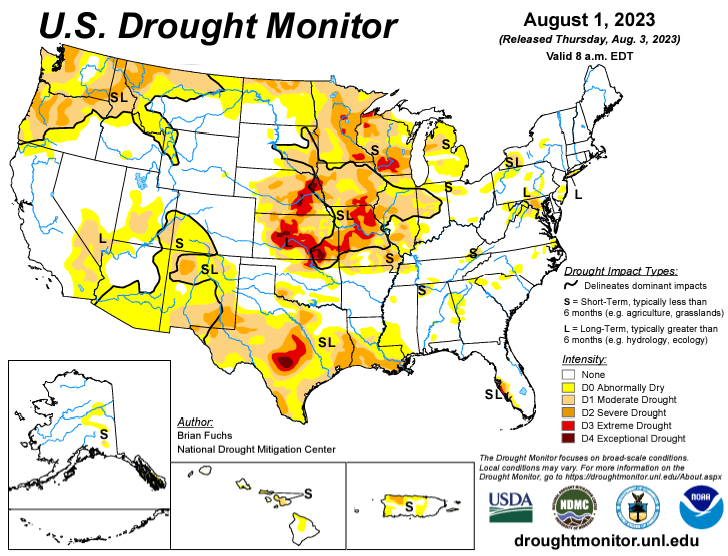

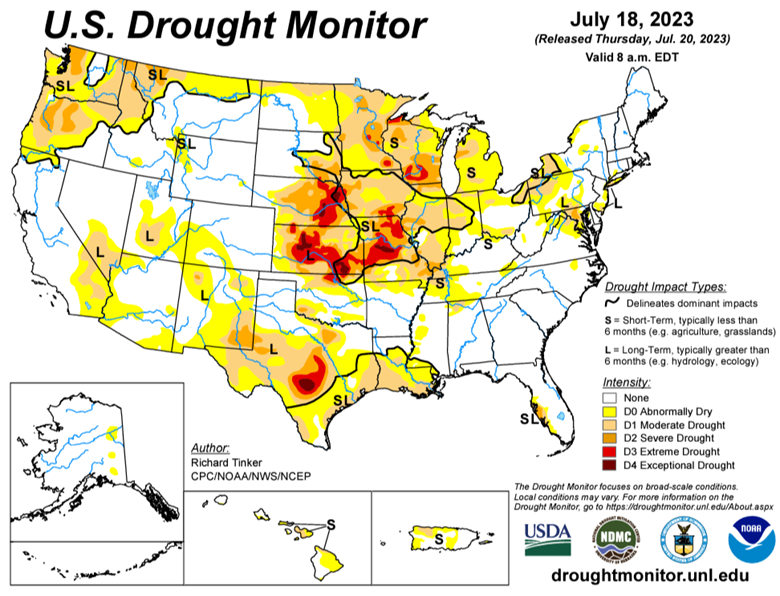

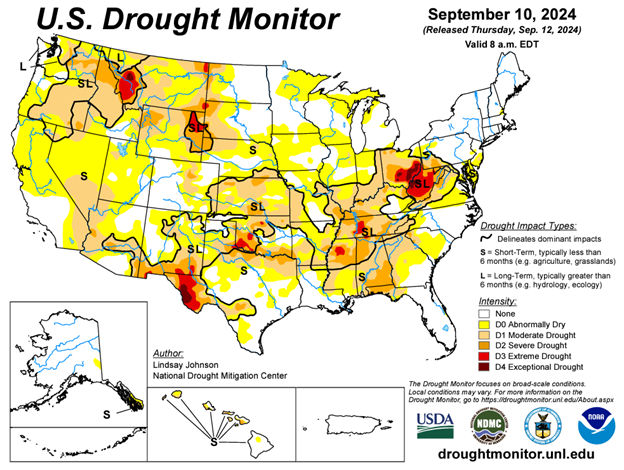

Drought Monitor

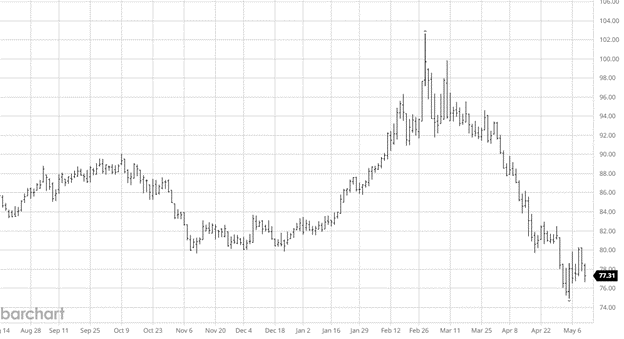

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].