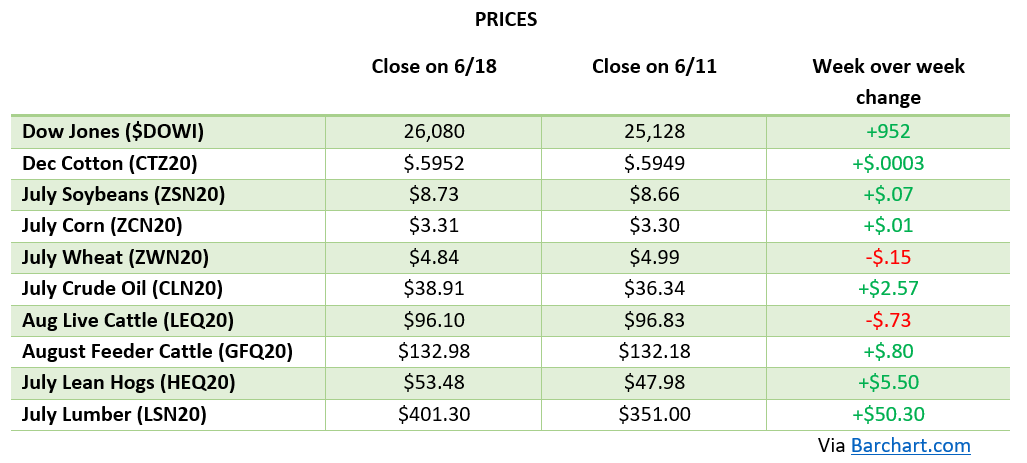

AG MARKETS UPDATE: JUNE 13 – 19

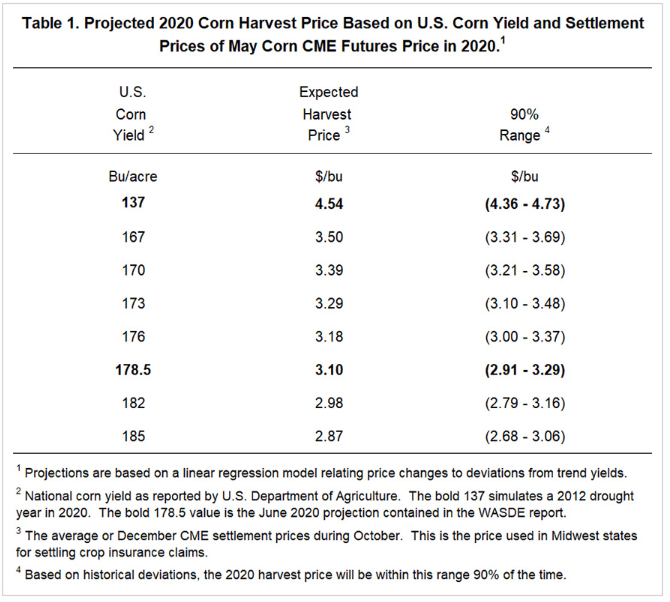

The July corn price has slowly climbed up since the start of May, more of a crawl than a climb, but front month prices have moved up. The next month of weather will be really important for this years corn crop and decide what level of potential yields we could see. The next week looks to dump a lot of rain in the western corn belt which has had some really dry areas, and moderate amounts of rain in Illinois over to Ohio and throughout the SE. The combination of good weather and a lack of any serious exports does not bode well for corn prices. Farmdocdaily has projected future corn prices which we see as a very real possibility. A trend line yield is not good for prices at harvest time. This would be a great time to look at doing some HTAs with your elevator or hedging in your brokerage account because a >170 yield come harvest will lead to poor prices on top of poor basis in some areas (trading futures and options on futures are not suitable for all investors). It is important to also consider what government payments you have received and see how they will effect your ultimate price.

Soybean prices gained a little bit this week but nothing too exciting. With another week of poor export sales, beans have been up on the week on rumors of Chinese buying despite no official confirmation from the USDA. Beans will move a little more independently as they will heavily rely on Chinese buying. The rumors of buying has gotten prices to this level, but big purchases and an effort to meet the Phase 1 trade deal would be very supportive for beans, even if the expected yield continues to be good. The June 30th Stocks and Acreage report will be very important to keep an eye on as well in the coming weeks to get a better idea of how big the corn and bean crops can actually be.

DOW Jones

The Dow Jones continues to try and erase the loss from last weeks major selloff. Continued new unemployment numbers came in Thursday with 1.5 million new unemployment claims. The economy is opening back up, but unemployment remains high as we continue to see the fallout of COVID-19 reach into the summer. Leveling positive rates and hospitalizations have many people wanting to move further on in their cities reopening plans but officials continue to warn about the possible second wave causing businesses to partially reopen (partial reopen=not as many jobs). Until there is a vaccine this will continue to be the major mover of the markets.

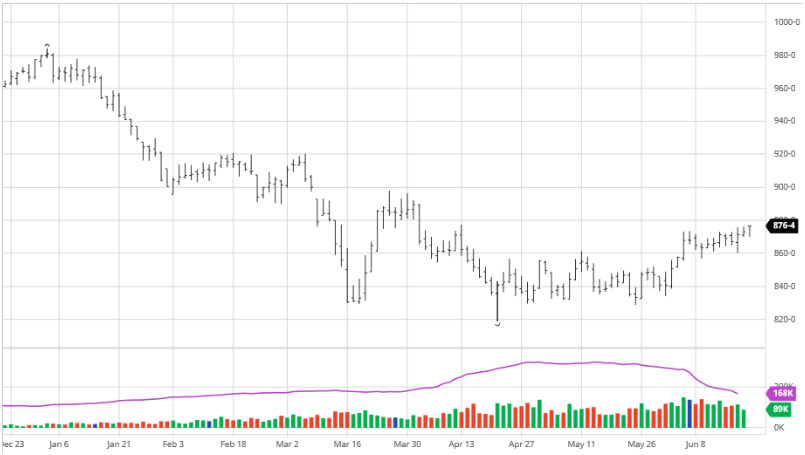

Lumber

Lumber has had a solid week in gains for the prices as a few factors hit the market. The cash market has picked up in the last week and mills have ramped up their production again. The market closed over the 100 DMA earlier this week breaking that technical resistance. Housing has begun to recover and a continued recovery would be welcome for demand.