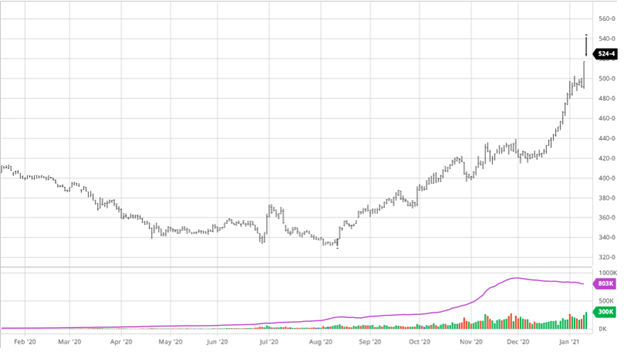

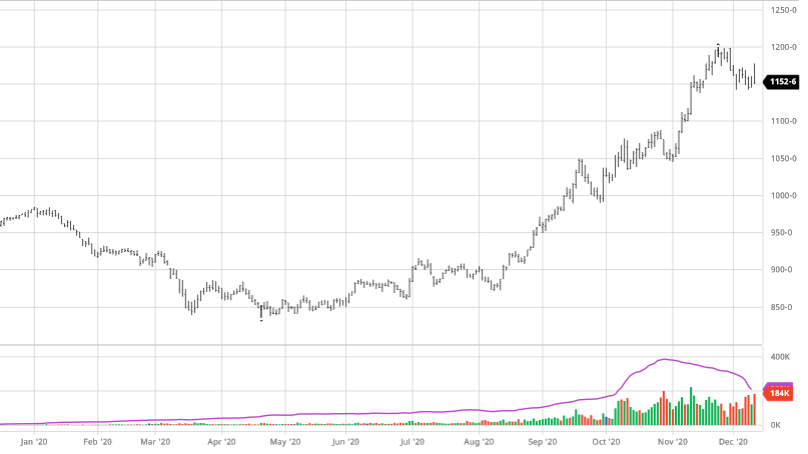

Corn had a huge boost this week as the USDA reported the US yield to be 172 bu/acre. This was a 3.8 bu/acre decrease from the Nov report that nobody was expecting. The average trade estimate heading into the report was 175.3 bu/acre, so this surprise played a large role in why corn was limit up following the report. This number is low when you think about the past several years of yields and the fact the USDA had estimated the crop to be 181.8 bu/acre in the August report. Now we had some weather events that caused damage to large areas of crops and a drier August, but not to the point that would cause a 9.8 bushel decrease. So, the drastic change over the last few months is a head scratcher, but the USDA does usually leave us with more questions than answers. The USDA also lowered both US and World ending stocks showing why corn has been going up over the past few months, less corn in the world than expected. US ending stocks were lowered from 1.702 billion bushels to 1.552 billion and world ending stocks were lowered from 288.96 billion bushels to 283.83 billion. Tightening ending stocks played a major role in the harvest to now rally in corn and will continue to play a role as all eyes will turn to South America and their corn crop. If their crop begins to struggle or comes out smaller than anticipated this will begin to push new crop ’21 prices up as farmers make their decisions on what to grow in 2021.

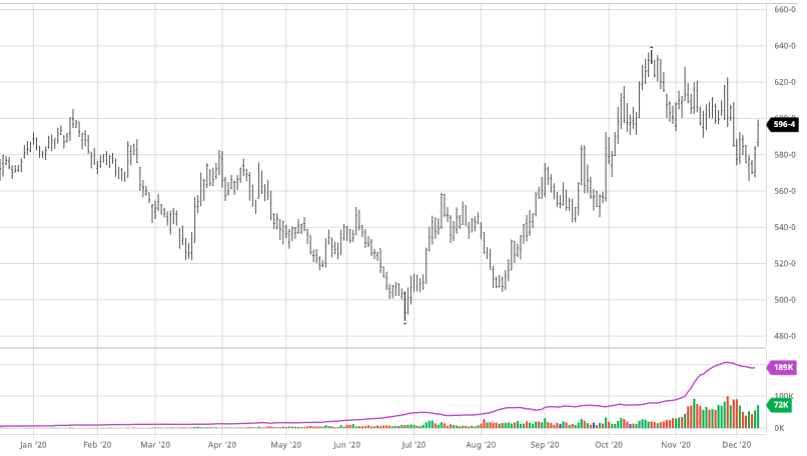

Soybeans continue to go higher as March beans topped $14 this week. Like corn, the report was bullish for soybeans. The USDA pegged yield at 50.2 bu/acre after dropping them ½ bu/acre from the December report. They also raised exports and use while cutting ending stocks adding to the bullish news. Soybean’s news the last few months has been bullish as South America oversold their last crop and are now importing US beans on top of the picked-up demand from China. The USDA also lowered the production for South America from 183 million metric tons to 180.6 MMT. With the current South America weather problems (dryness) this number could continue to go down which would keep the weather as one of the bullish factors pushing the market higher. With Chinese demand continuing along with the imports into South America until their harvest, we will continue to see demand support the market. As always with this time of year pay attention to South American production numbers/weather as changes in those will also have major impacts on our markets.

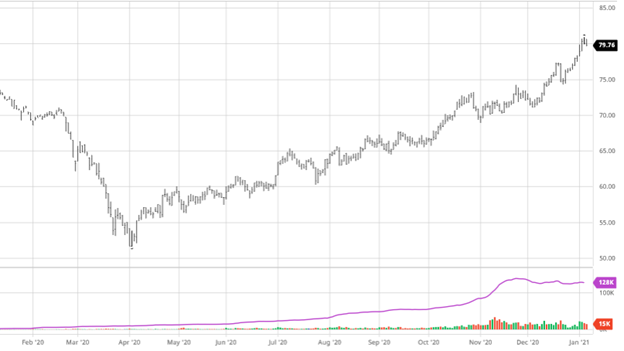

Wheat followed corn up after the report this week as there were no major changes to wheat. The news from the report was that the winter wheat seedings report increased for the first time in 8 years. All wheat acres were 31.991 million acres, up 1.576 million from last year. This was also slightly higher than the trade estimate. The Dec stocks number was not much of a surprise as it came in at 1.674 billion bushels. On the supply and demand side, supply was left unchanged while seed usage was raised slightly by 1 million bushels and feed usage raised by 25 million. This lead to a 26 million bushel reduction in the ending stocks , overall friendly for the market. As you can see in the chart below, despite the Nov dip the March chart is still bullish looking back to the contract lows in June.

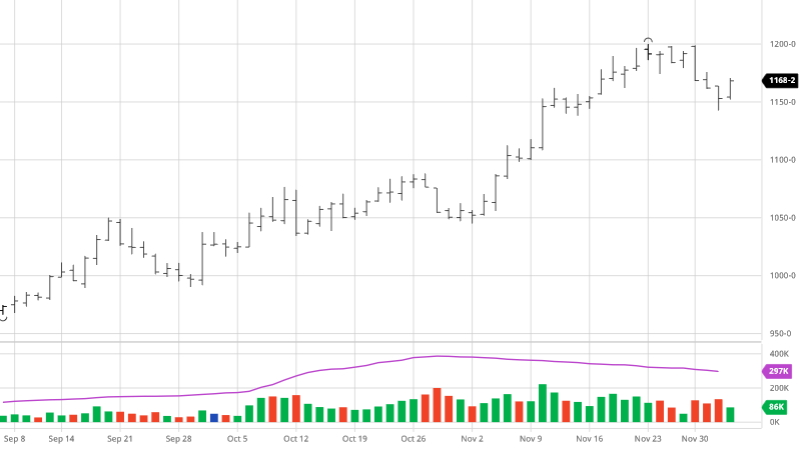

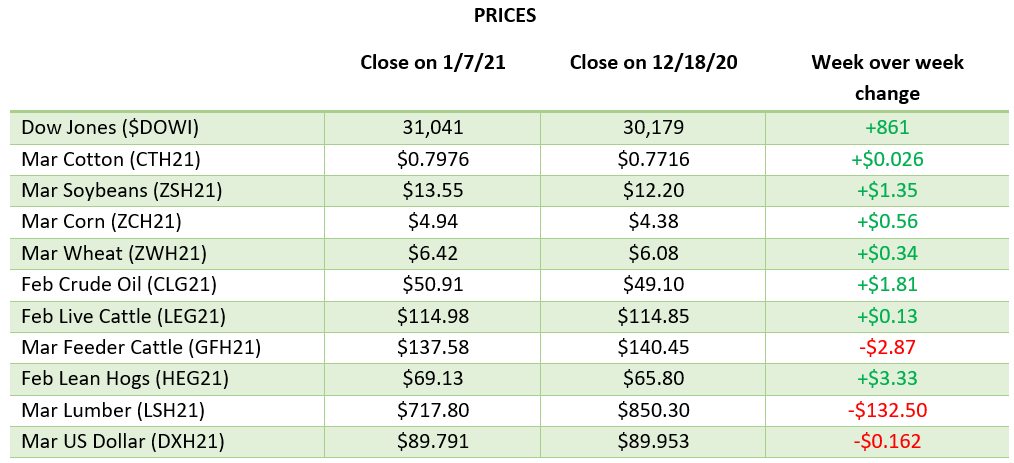

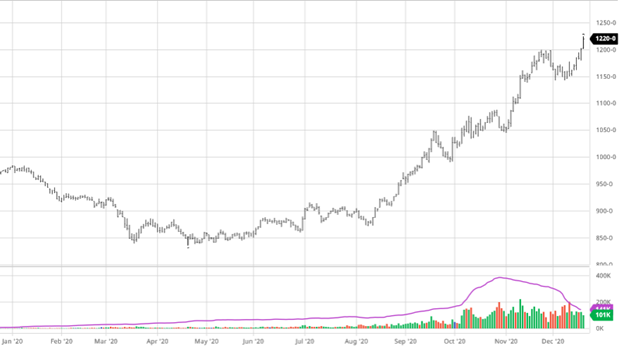

Dow Jones

The Dow has remained pretty flat over the last week as impeachment of President Trump hasn’t been a market mover with president elect Biden set to take office in one week. As vaccine rollouts continue to be slower than hoped for, states begin to ramp up their next phase to non-healthcare workers. Governor Cuomo has now come out against another round of lockdowns but we will see what the Biden administration has in store in the next two weeks.

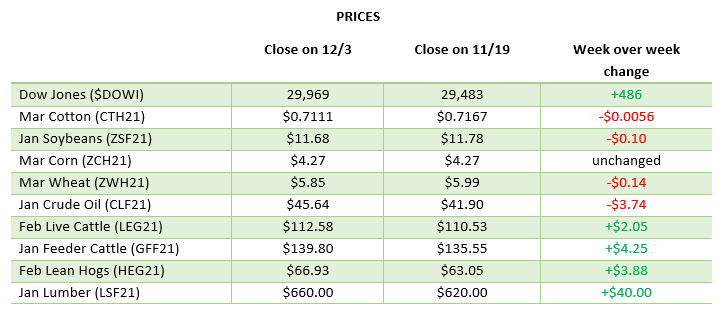

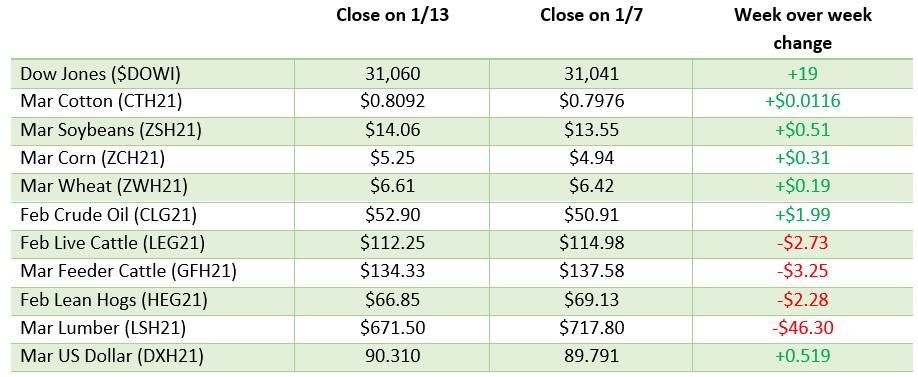

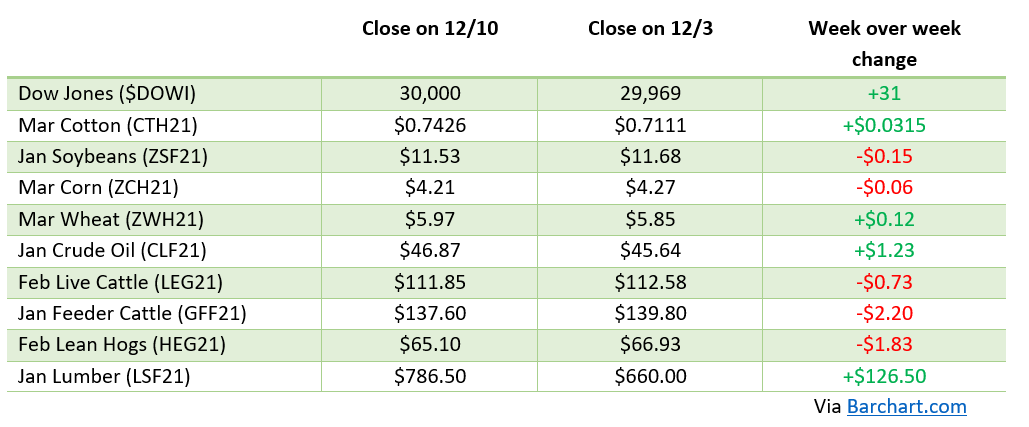

Weekly Prices

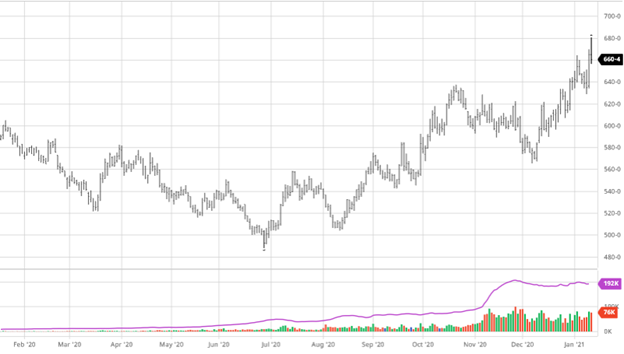

,

,