Recap:

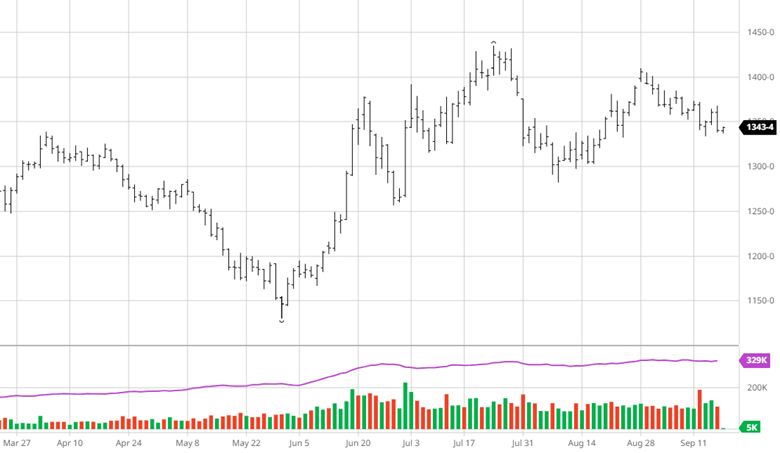

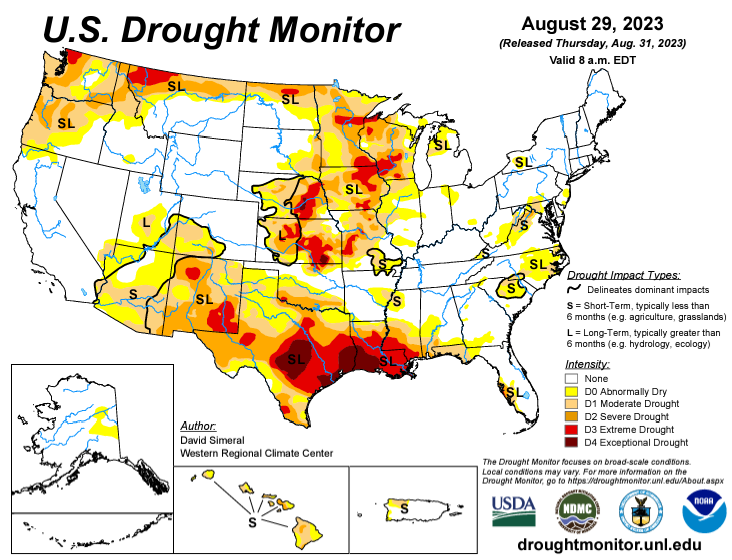

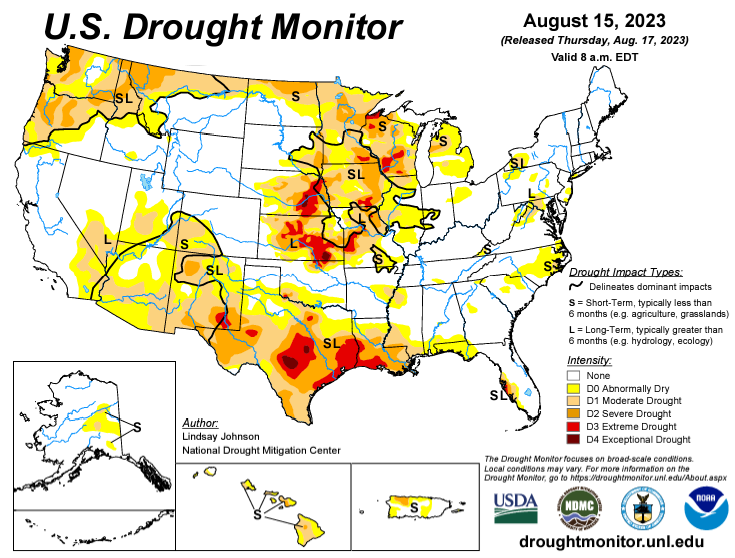

The housing market is entering into a “great pause.” That will show up as less buying, selling, and construction. The lumber side of this industry has already been in the great pause mode for most of 2023.

Housing has a typical pause nearing year-end, clearing the decks and creating a good spring. Some now are projecting the slowness to be carried through the spring. The futures market has been the best form of price discovery this year. The last few weeks have been a good example of that.

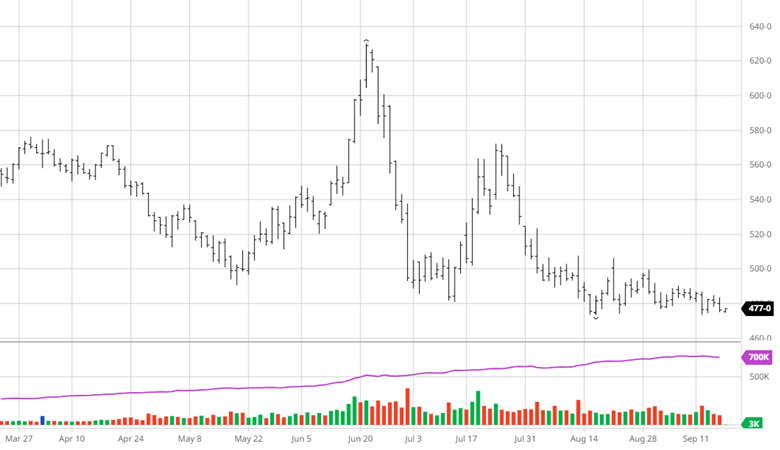

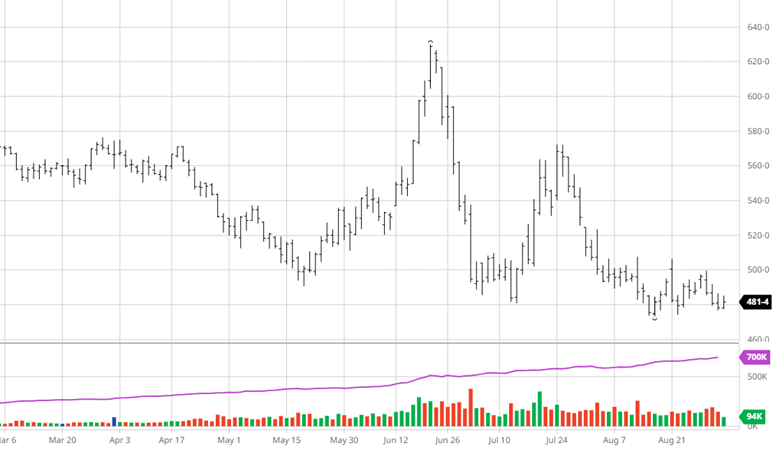

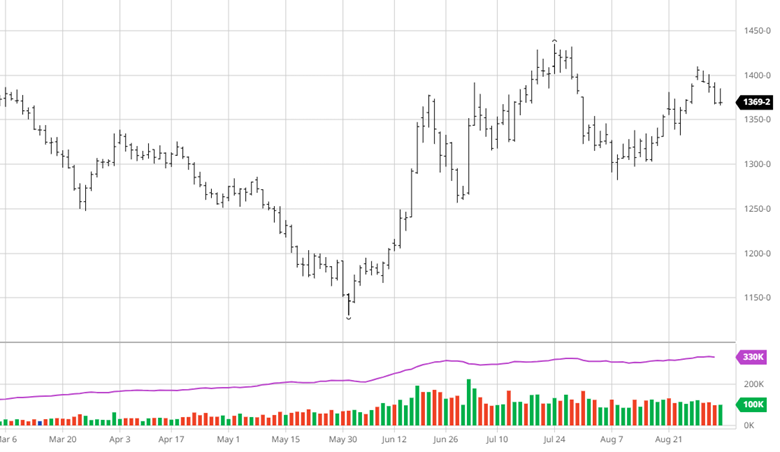

Futures rallied about $17 last week while the cash market collapsed. Futures had already made the low of $478 four weeks ago. The futures price is the “bid.” It is the market. That price is value. From here, we wait for cash to drift to the “bid.” If print followed the futures market, it would be much more efficient.

Last week, the futures trade indicated a bottom in the cash market at some point. The usual bottom is set when you can buy cash and sell futures. That is getting close but could lag. This is not a supply and demand issue. If the futures market at $506 is too high, then sell it. Forget the silliness of the roll or funds. $506 is a good hedge against that pine you just bought with a $2 handle.

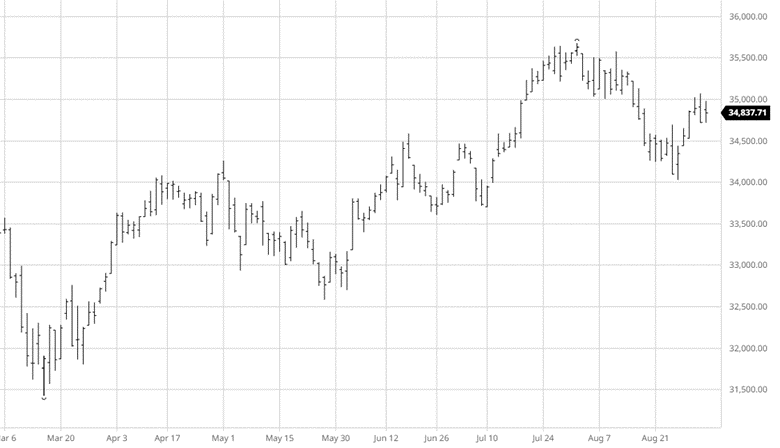

Macro:

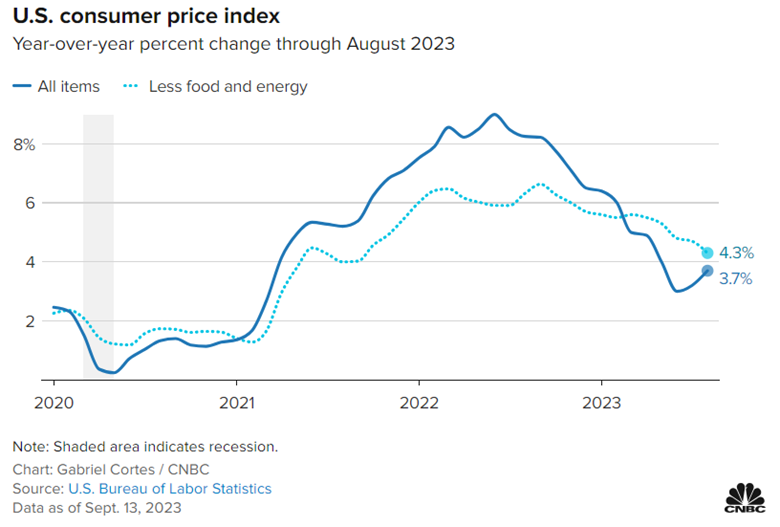

The housing sector is getting forced into a slowdown. This is not supply and demand. If rates were at 3%, we would be at 2 million starts. The underlying demand is there. The macro factors are too great today. The question becomes whether those factors increase or subside. Until that is answered, lumber inventories will be kept at a minimum and lumber contracts will be canceled. Cash is an investment that can be hedged today.

Technical:

Futures have a positive tone. The momentum indicators are positive. The RSI at 60% is neutral and finds buying on breaks. What it also has is major resistance every $6 higher. It has no room to run technically. Speculators can expect more upside from the roll while the industry has to form a plan to start hedging or creating a basis trade.

Daily Bulletin:

https://www.cmegroup.com/daily_bulletin/current/Section23_Lumber_Options.pdf

The Commitment of Traders:

https://www.cftc.gov/dea/futures/other_lf.htm

About the Leonard Report:

The Leonard Lumber Report is a column that focuses on the lumber futures market’s highs and lows and everything else in between. Our very own, Brian Leonard, risk analyst, will provide weekly commentary on the industry’s wood product sectors.

Brian Leonard

312-761-2636