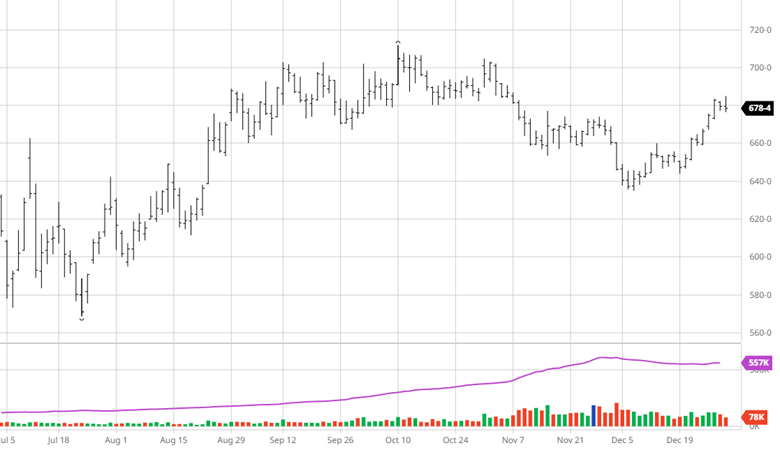

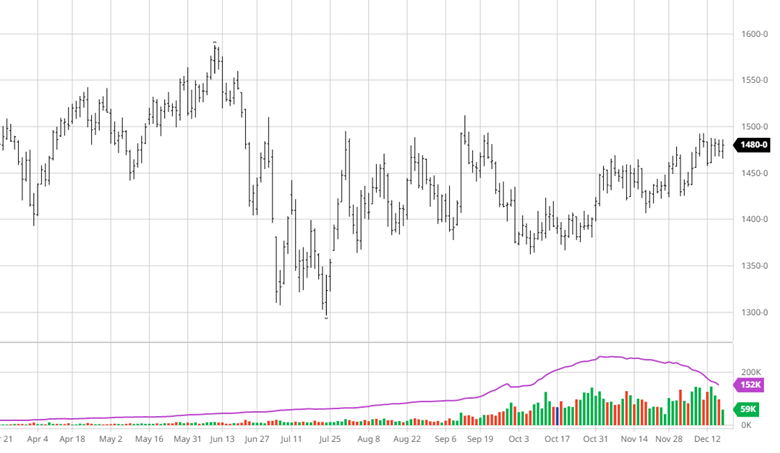

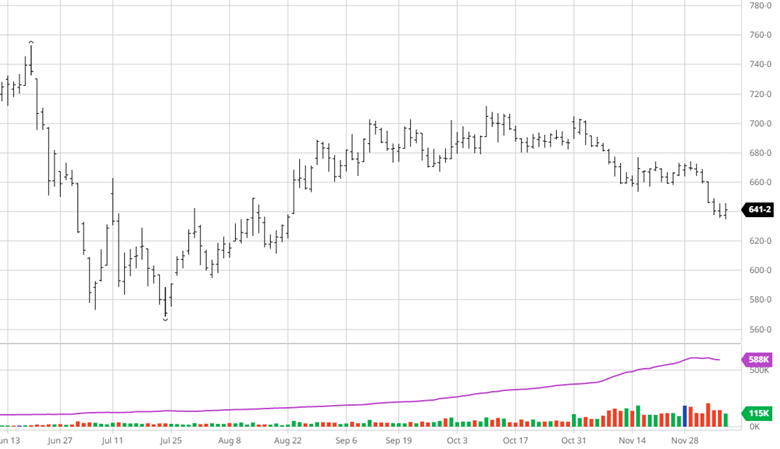

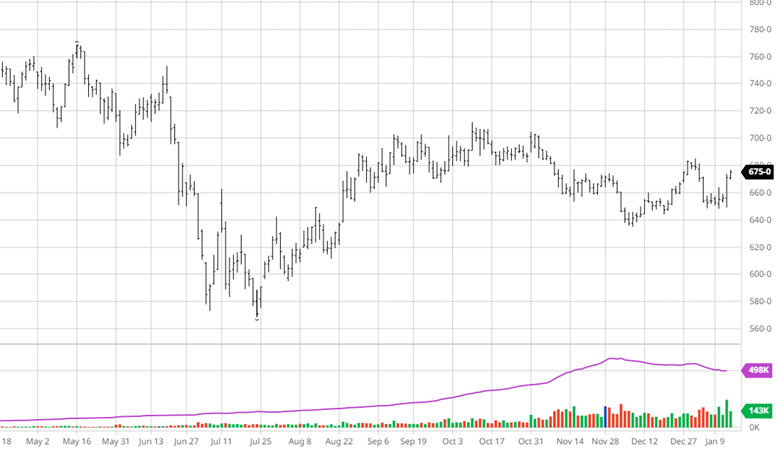

Corn finished the week strong following the January USDA report. The report had a mix of bullish and bearish news with the USDA raising the yield estimate to 173.3 bu/acre from 172.3 in November. At the same time they cut total production due to lowered harvested acreage while lowering US and world ending stocks. The USDA also lowered production estimates for South America by lowering Argentina yield 3 bu/acre and Brazil 1 bu/acre. Exports were also lowered as a bearish factor with lower usage. The news in the report was slightly bullish for corn and it needed it but there are still many factors around the world that can change. Argentina’s weather remains hot and dry for the next week and many private estimates believe the crop will continue to get lower.

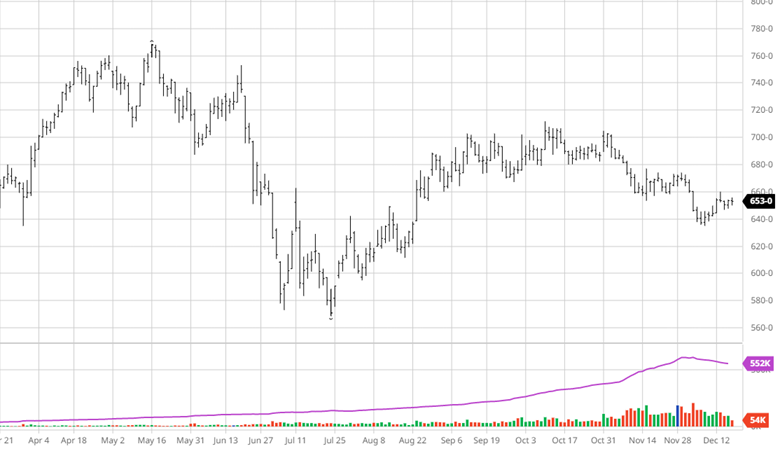

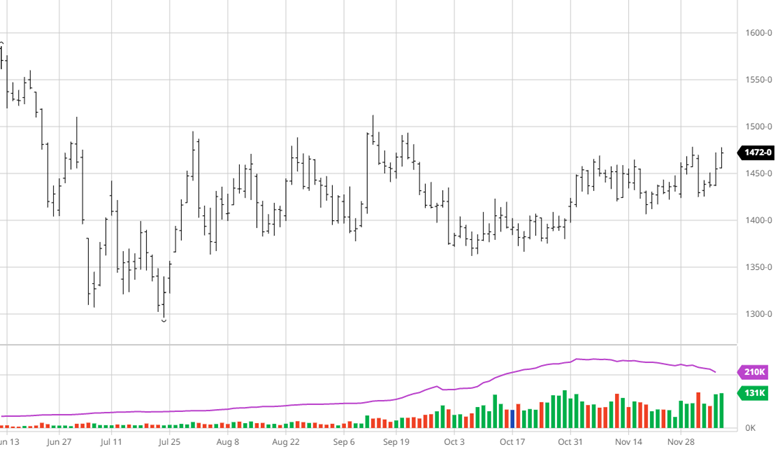

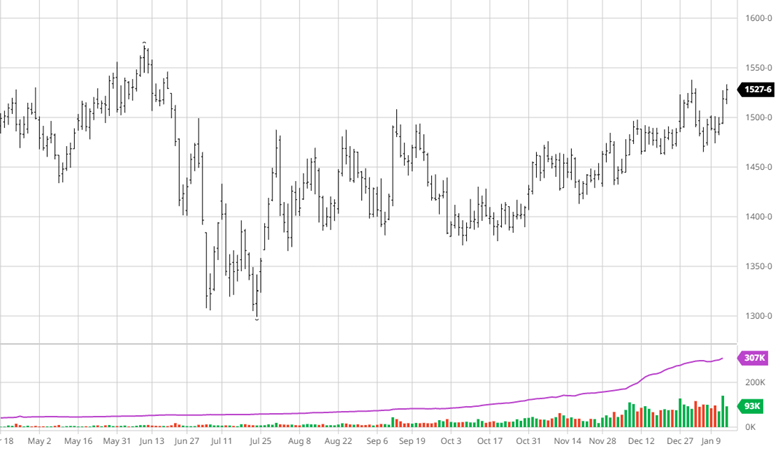

Soybeans participated in the post rally on bullish numbers from the USDA. The USDA lowered bean yield to 49.5 bu/acre, .7 bu/acre lower than November report. The lower yields and lower harvested acres lead to a lower US ending stocks of 210 million bushels. They also lowered Argentina’s bean yield by 4 bushels per acre and raised Brazil’s 1 bu/acre. Beans have been trading higher over the last couple of months and the report did not throw water on it. While any further rallies will be met with farmer selling, South American weather will be the main factor going forward.

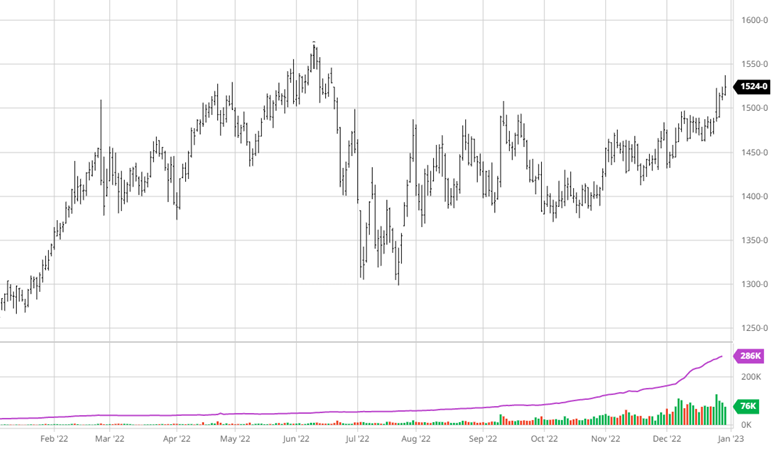

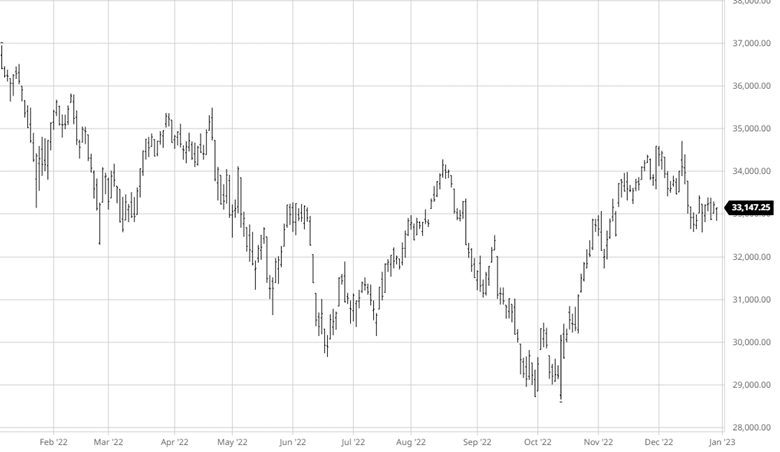

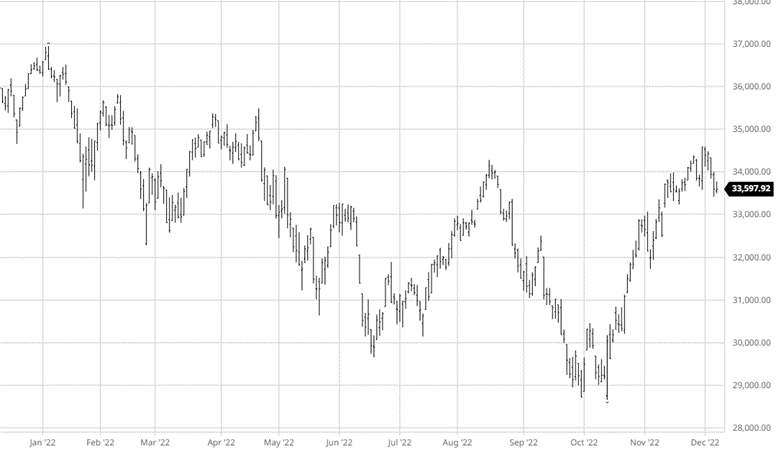

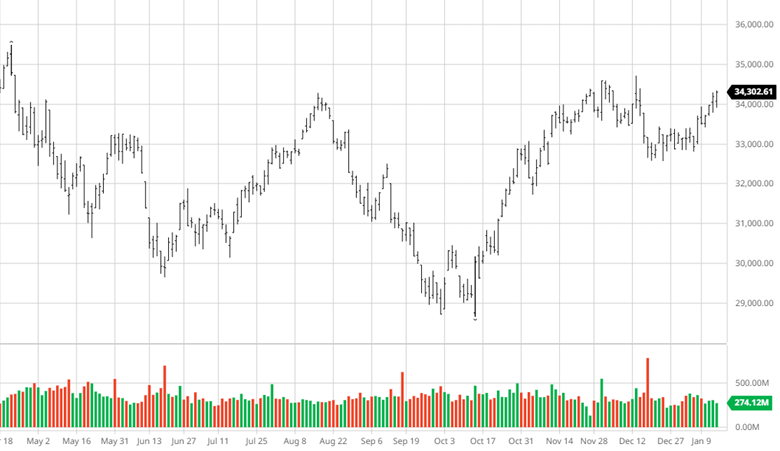

Equity Markets

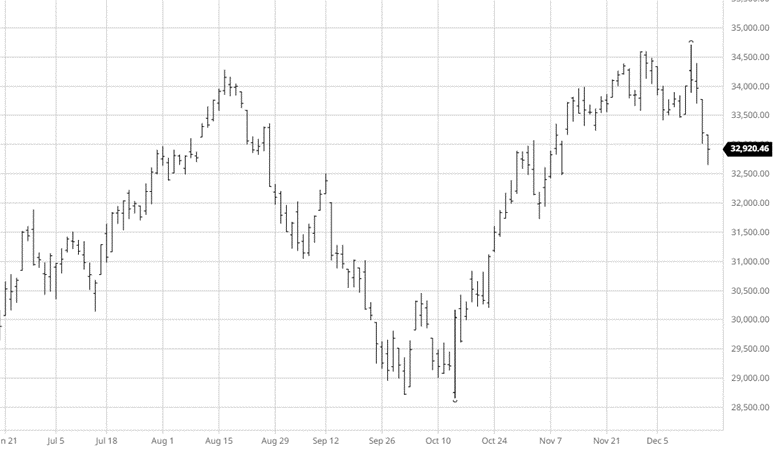

The Dow rallied this week along with other indexes as the market has started off the year on a positive note. CPI came in at 6.5% continuing its trend lower but still well above where the Fed wants it, expect them to continue to raise rates. Recession fears remain with many analysts still expecting one this year in the US and in Europe. Ultimately the market is still looking for a direction as it tries to figure out what comes next.

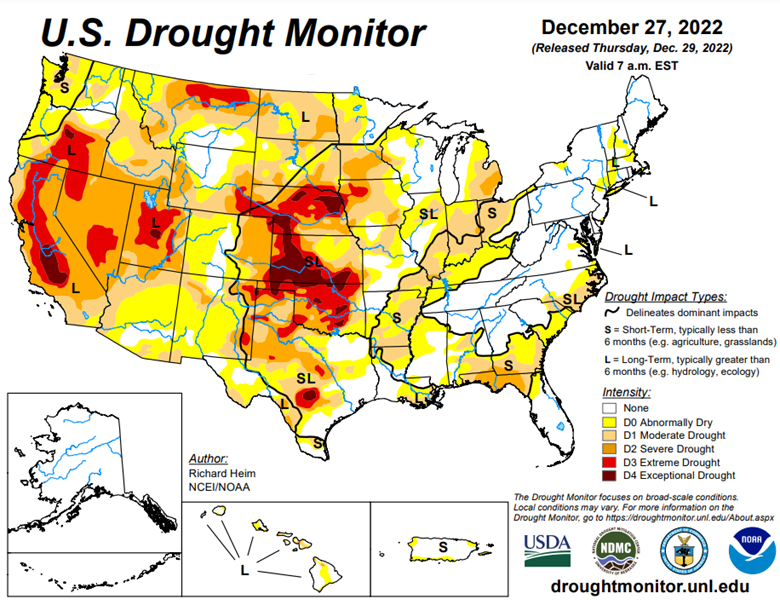

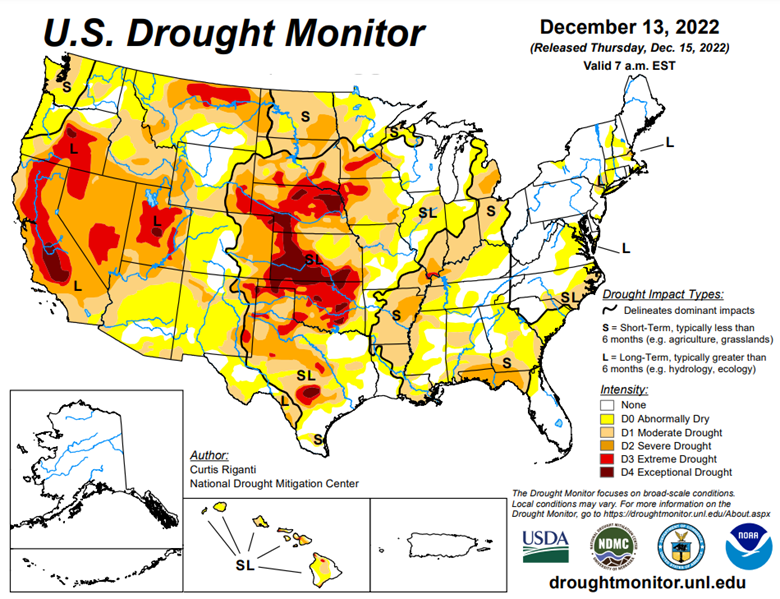

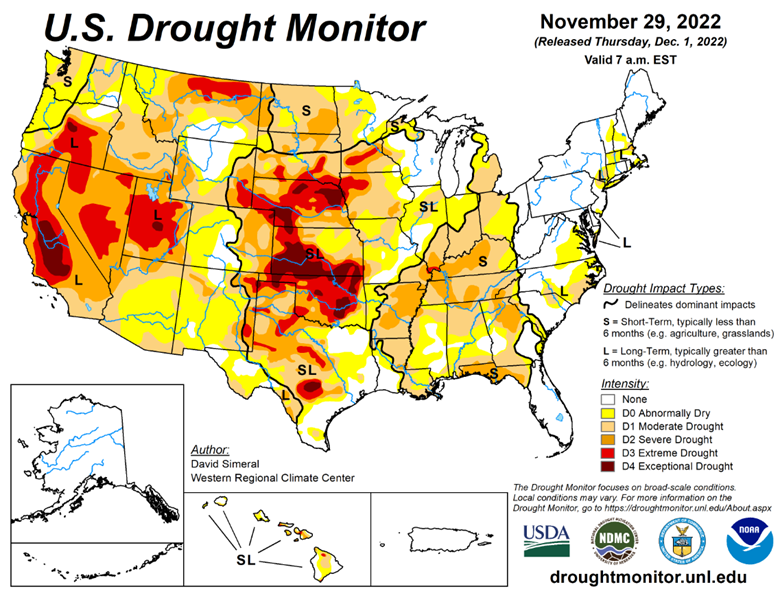

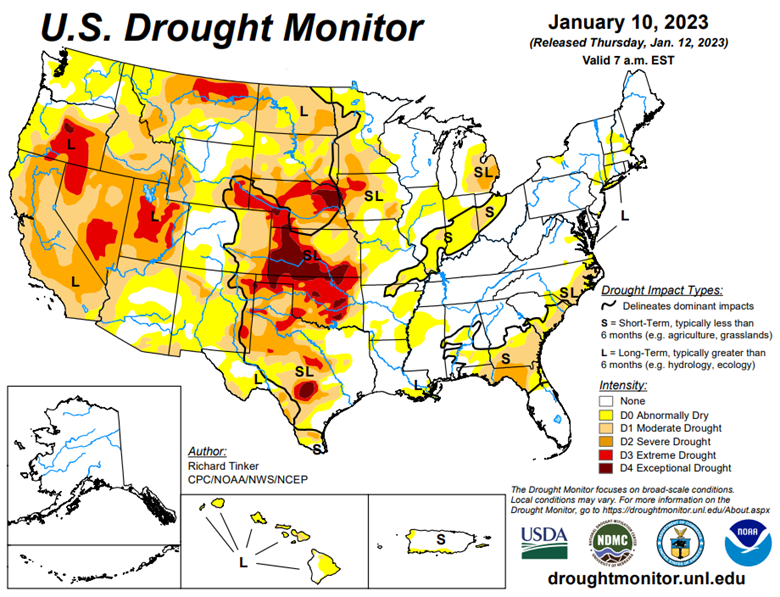

Drought Monitor

Podcast

With every new year, there are new opportunities, and there’s no better time to dive deeply into the stock market and tax-saving strategies for 2023 than now. In our latest episode of the Hedged Edge, we’re joined by Tim Webb, Chief Investment Officer and Managing Partner from our sister company, RCM Wealth Advisors. Tim is no stranger to advising institutions and agribusinesses where he has been implementing no-nonsense financial planning strategies and market investment disciplines to help Clients build and maintain wealth and reach financial goals since

Inside this jam-packed session, we’re taking a break from commodities, and talking about the world of equities, interest rates, tax savings, and business planning strategies. Plus, Jeff and Tim delve into a variety of topics like:

- The current state of the markets within the wealth management industry

- Is there a beacon of hope, or is it all doom and gloom for the markets?

- Other strategies to think about outside of the stock market and so much more!

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or [email protected].