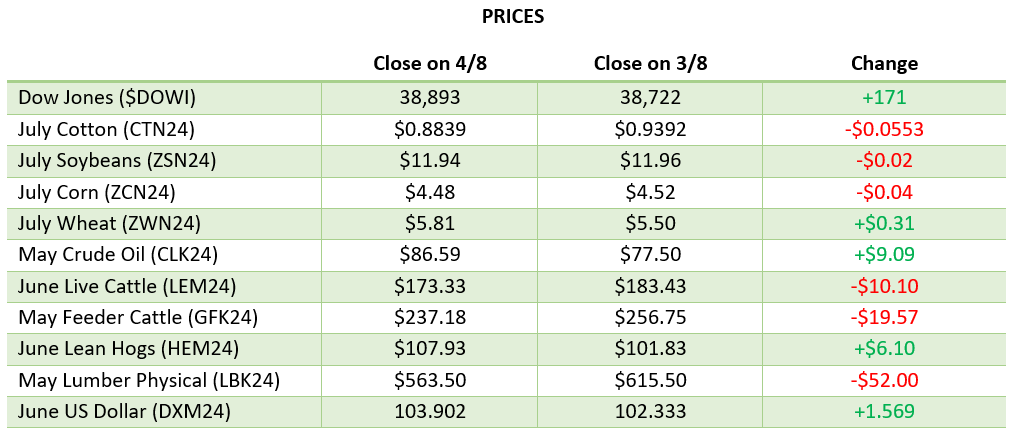

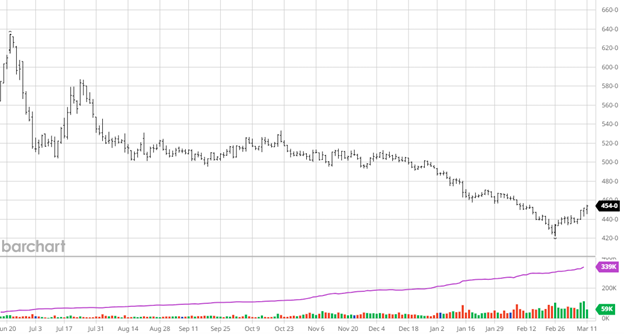

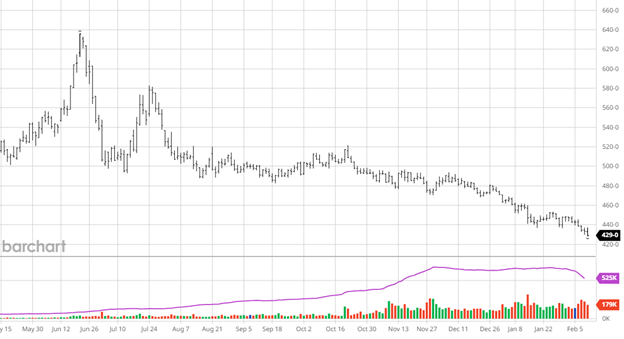

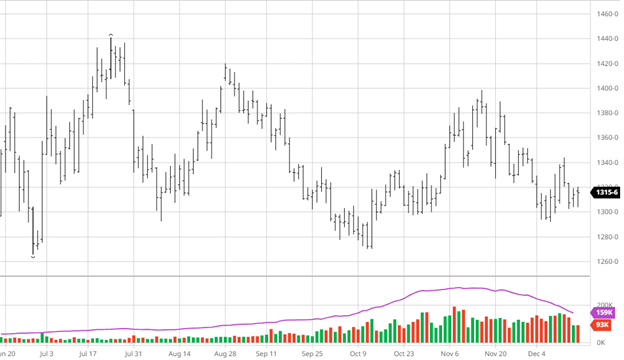

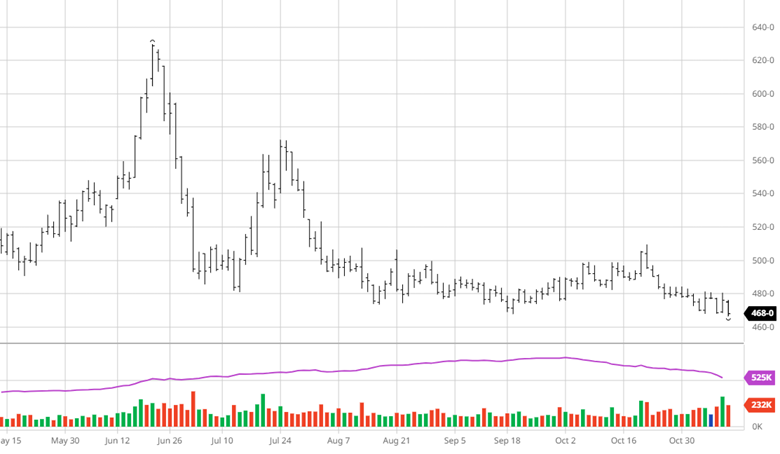

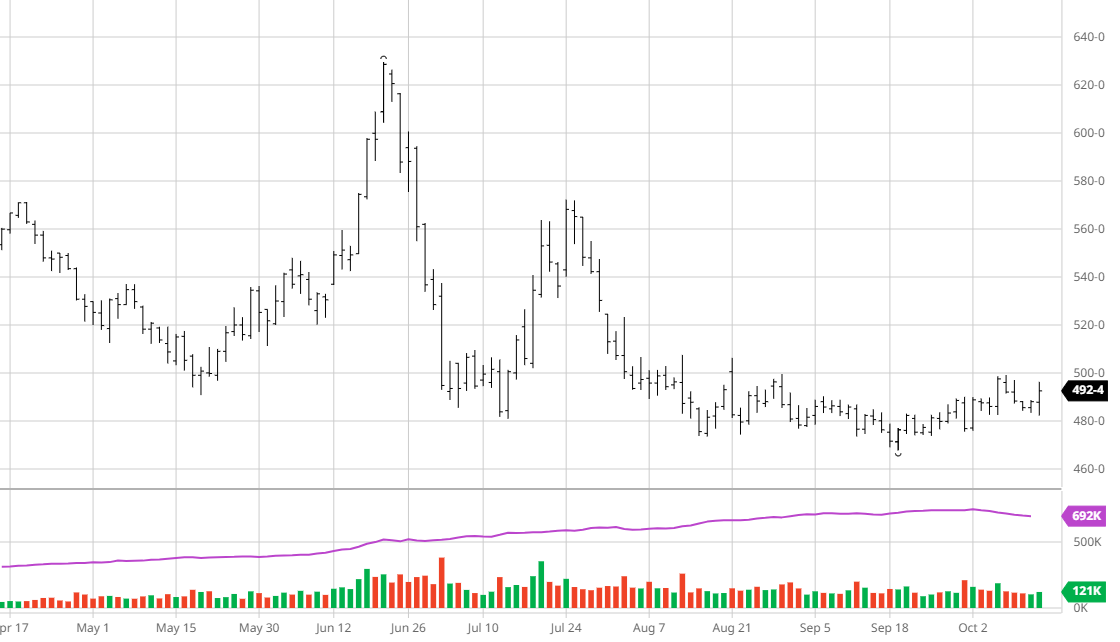

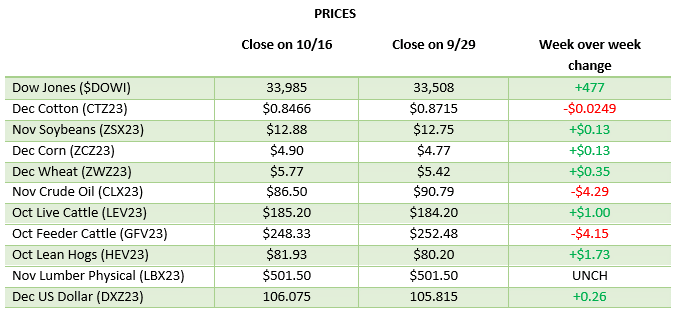

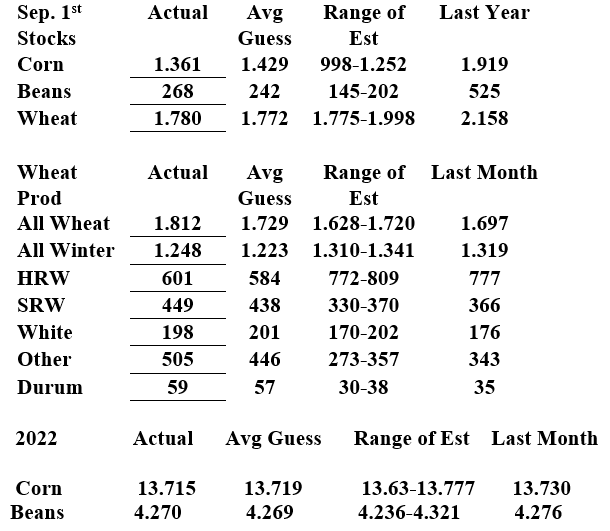

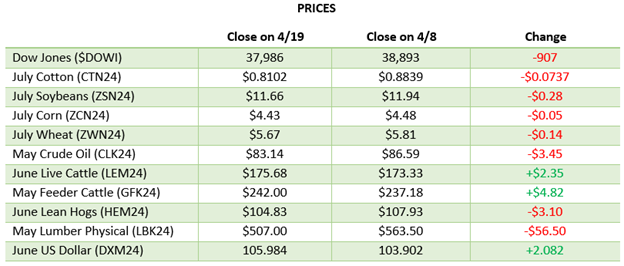

Corn continued its slow bleed lower over the last couple weeks with no major bullish news to turn this market around. US weather may slow planting down to end April a bit but not enough for markets to begin to worry anytime soon. Argentina’s rain will continue to slow harvest as the discrepancy between the USDA and South American reporting services remains a mystery. The bounce to end the week was due to escalation of the Israel and Hamas/Iran fighting in the middle east. According to Reuters the US EPA is expected to announce plans to temporarily waive restrictions on higher-ethanol gasoline blends this summer. This market is at the mercy of funds and weather which currently aren’t helping prices higher.

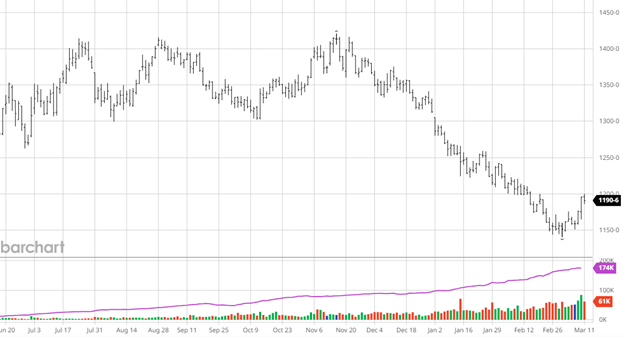

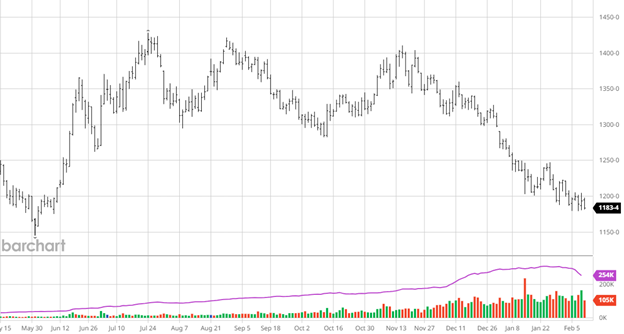

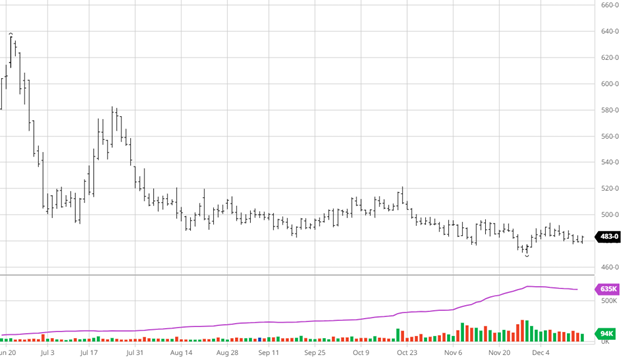

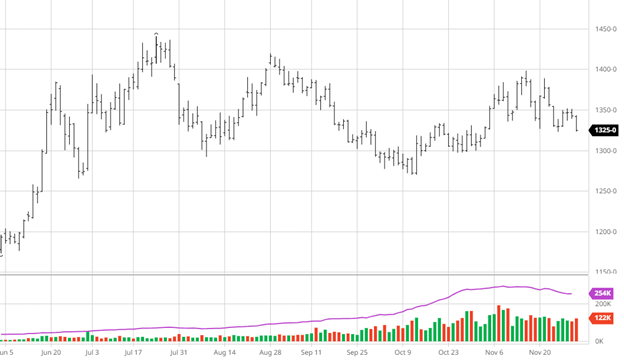

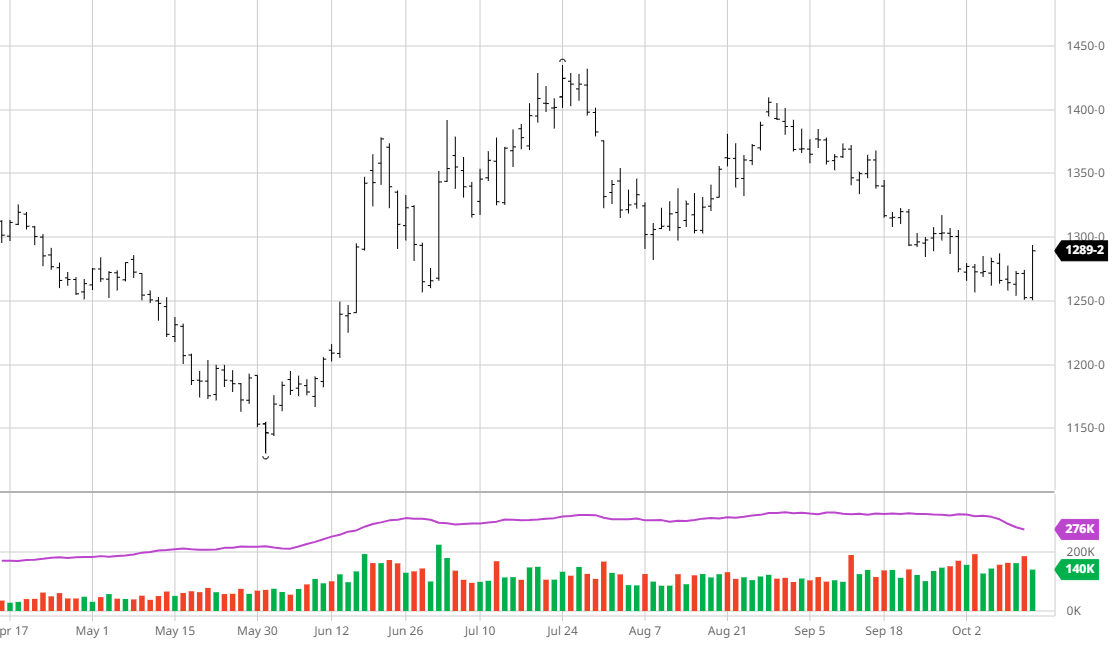

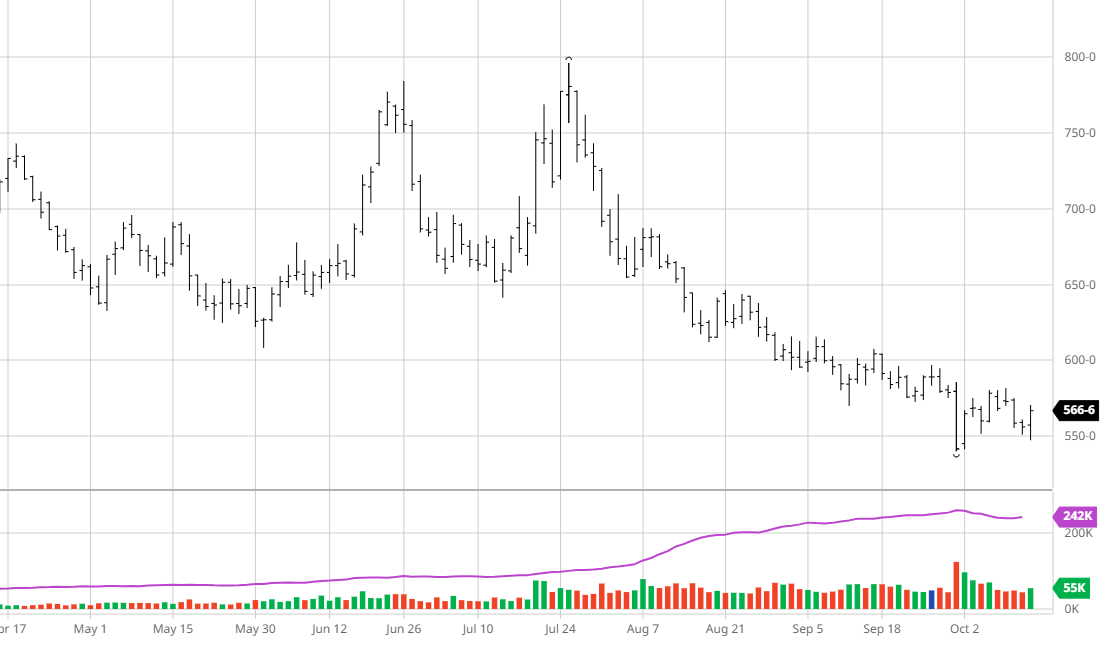

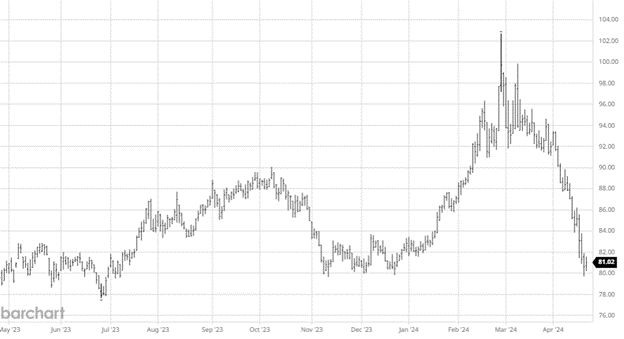

Beans continued lower as they lost another 20+ cents this week even with the big up day on Friday. Beans need any good news they can get as you can see from the chart below it has been a rough few months. Soybean oil has also had a rough go lately as bullish news is lacking in the soybean complex. The size of the bean harvest with the USDA and CONAB numbers still far apart will be the biggest factor moving forward as we need all the information we can get. We did get close to the technical support which is good to see a bounce there.

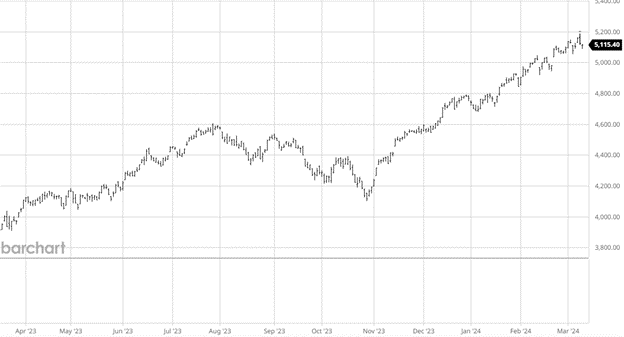

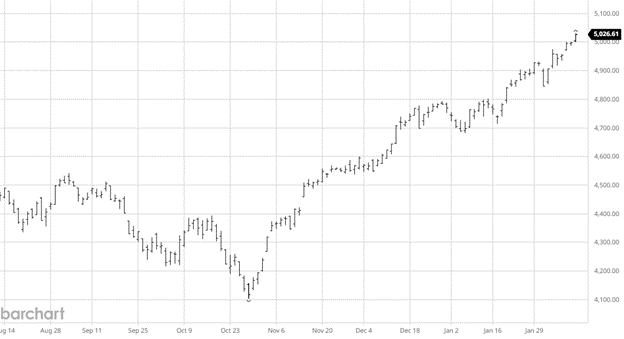

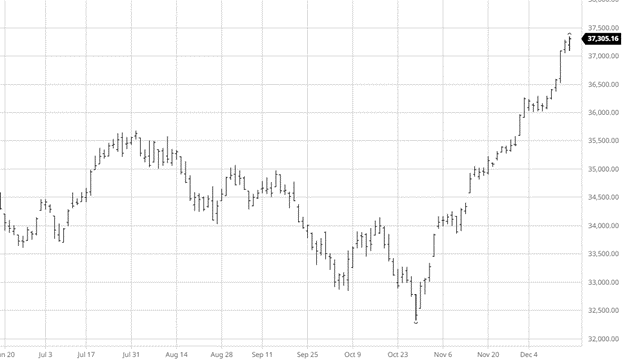

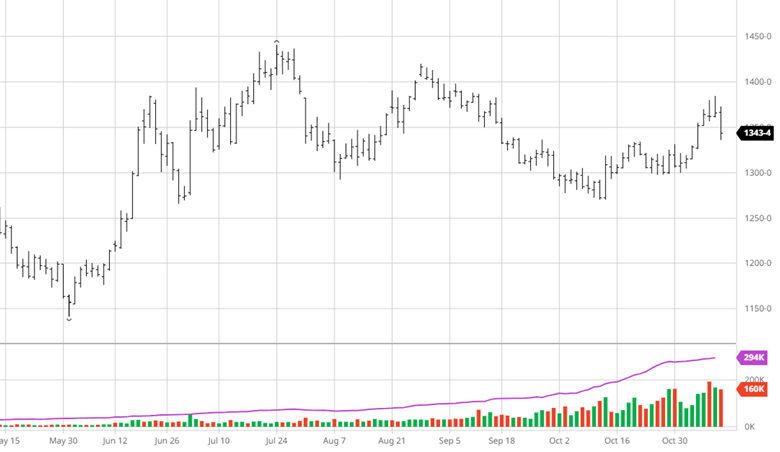

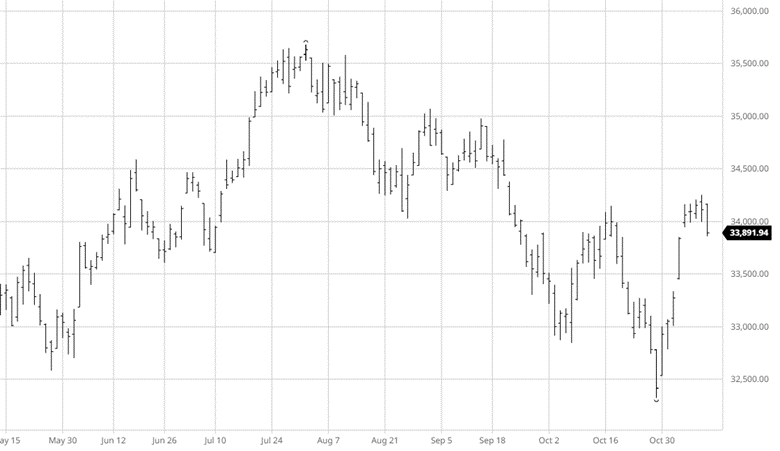

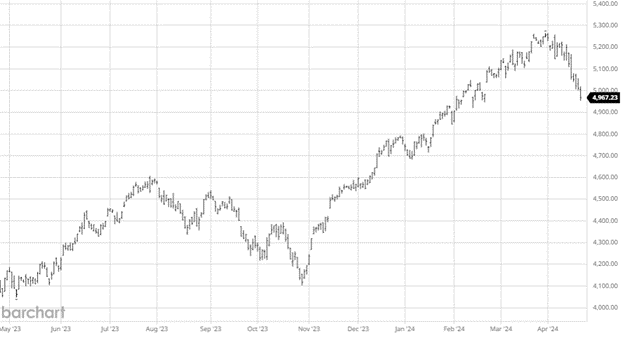

Equity Markets

The equity markets continued their recent struggles as tech and AI stocks have given back some recent gains. Pullbacks are healthy for markets, especially after the run we have had to start the last few months being so concentrated, but sticky inflation and war escalation provides some problems to monitor as earnings are set to ramp up next week.

Other News

- Israel retaliated against Iran overnight continuing the escalation of tensions and war in the middle east.

- The USD keeps moving higher as the June USD Index went over 106 earlier this week.

- Cotton has struggled of late as a lack of demand on the global scale and no weather issues yet in the US pulled it back from recent highs.

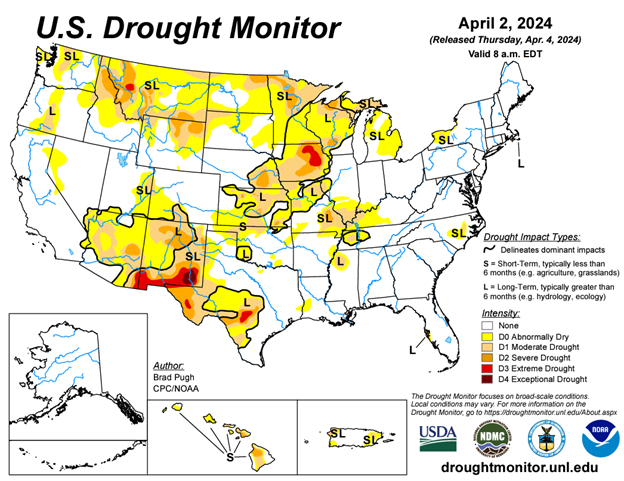

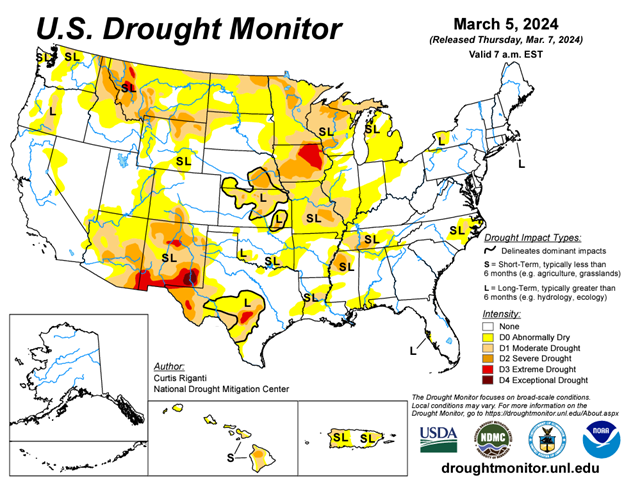

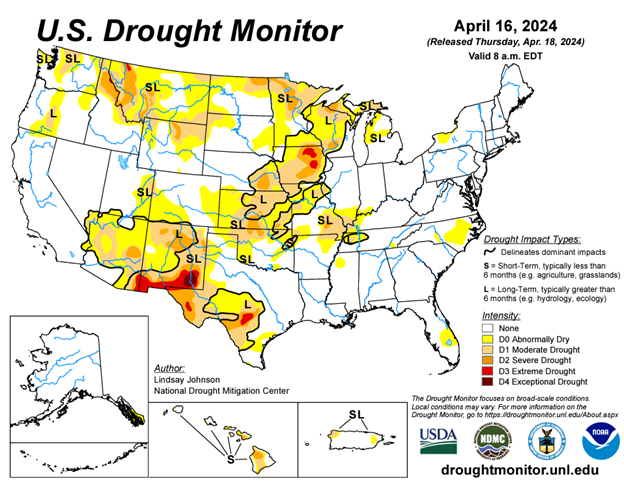

Drought Monitor

Here is the current drought monitor as we head toward planting with subsoil moisture a focus.

Via Barchart.com

Contact an Ag Specialist Today

Whether you’re a producer, end-user, commercial operator, RCM AG Services helps protect revenues and control costs through its suite of hedging tools and network of buyers/sellers — Contact Ag Specialist Brady Lawrence today at 312-858-4049 or blawrence@rcmam.com.